During crisis, a consumer may not able to afford luxury products but still need to eat and drink to survive. Therefore, an investor may consider 48 Food & Beverage (F&B) stocks in Singapore, especially those defensive growth stocks.

In this article, you will learn from Dr Tee on 9 Singapore F&B Giant Stocks which are efficient in making money with food as essential products (consumer staples) but having mixed impacts during COVID-19 stock crisis. Bonus for readers who could read the entire article: a strategy to eat and drink for free for lifetime.

1) Supermarket F&B Stocks

– Sheng Siong (SGX: OV8)

– Dairy Farm International (SGX: D01)

2) Restaurant F&B Stocks

– Japan Foods Holding (SGX: 5OI)

– Old Chang Kee (SGX: 5ML)

3) Consumer F&B Stocks

– QAF (SGX: Q01)

– Thai Beverage (SGX: Y92)

4) Mixed Industry F&B Stocks

– Amara Holdings (SGX: A34)

– SATS (SGX: S58)

– Wilmar International (SGX: F34)

There are 48 Food & Beverage Stocks in Singapore, making money from the most essential products of people (民以食为天):

Abterra (SGX: L5I), Acma (SGX: AYV), Amara Holdings (SGX: A34), Bonvests Holdings (SGX: B28), ChasWood Resources (SGX: 5TW), China Fishery (SGX: B0Z), China Kangda Food (SGX: P74), Dairy Farm International (SGX: D01), Del Monte Pacific (SGX: D03), Delfi (SGX: P34), Dukang (SGX: BKV), Envictus (SGX: BQD), Food Empire Holdings (SGX: F03), Fraser and Neave F&N (SGX: F99), Hosen Group (SGX: 5EV), Japan Foods Holding (SGX: 5OI), Japfa (SGX: UD2), JB Foods (SGX: BEW), Jumbo Group (SGX: 42R), Katrina Group (SGX: 1A0), Khong Guan (SGX: K03), Kimly (SGX: 1D0), Koufu (SGX: VL6), Luzhou Bio-Chem (SGX: L46), Mewah International (SGX: MV4), Neo (SGX: 5UJ), No Signboard Holdings (SGX: 1G6), Old Chang Kee (SGX: 5ML), OneApex (SGX: 5SY), Pacific Andes (SGX: P11), Pavillon (SGX: 596), QAF (SGX: Q01), Sakae (SGX: 5DO), SATS (SGX: S58), Sheng Siong (SGX: OV8), Shopper360 (SGX: 1F0), Sino Grandness (SGX: T4B), Soup Restaurant (SGX: 5KI), ST Group Food (SGX: DRX), SunMoon Food (SGX: AAJ), Thai Beverage (SGX: Y92), Tung Lok Restaurants (SGX: 540), United Food (SGX: AZR), Wilmar International (SGX: F34), Yamada Green Resources (SGX: BJV), Yeo Hiap Seng (SGX: Y03), Zhongxin Fruit (SGX: 5EG).

From the table sorted below for 48 Singapore F&B stocks, only 2/3 are profitable (32 / 48 stocks were making money in businesses last year). Therefore, careful choices of giant F&B stocks are critical, many are at lower optimism share prices due to either stock market fear or actual business is affected during COVID-19 pandemic.

Nearly half of F&B stocks (22 / 48) have Price-to-Book ratio ($ / NAV = PB) < 1 with discount over asset but only 1 stock (Amara) has high quality asset related to properties which will be discussed further. Buy undervalue stocks require patience, Buy Low may not able to Sell High in future if there is no alignment with one’s unique personality and other consideration of investment. Buy low-quality asset simply at low price (very low PB << 1) may have high risk of bankruptcy if the company could not be profitable.

| No | Stock Name | Code | PB = Price /NAV | ROE (%) |

| 1 | ABR Holdings (SGX: 533) | 533 | 1.46 | 2.1 |

| 2 | Abterra (SGX: L5I) | L5I | 2.81 | – |

| 3 | Acma (SGX: AYV) | AYV | 0.31 | – |

| 4 | Amara Holdings (SGX: A34) | A34 | 0.51 | 7.0 |

| 5 | Bonvests Holdings (SGX: B28) | B28 | 0.39 | 0.4 |

| 6 | ChasWood Resources (SGX: 5TW) | 5TW | -0.11 | – |

| 7 | China Fishery (SGX: B0Z) | B0Z | 0.15 | 5.1 |

| 8 | China Kangda Food (SGX: P74) | P74 | 0.12 | 0.7 |

| 9 | Dairy Farm International (SGX: D01) | D01 | 4.78 | 26.8 |

| 10 | Del Monte Pacific (SGX: D03) | D03 | 0.36 | – |

| 11 | Delfi (SGX: P34) | P34 | 1.41 | 12.4 |

| 12 | Dukang (SGX: BKV) | BKV | 0.04 | – |

| 13 | Envictus (SGX: BQD) | BQD | 0.32 | – |

| 14 | Food Empire Holdings (SGX: F03) | F03 | 1.11 | 12.6 |

| 15 | Fraser and Neave F&N (SGX: F99) | F99 | 0.60 | 5.2 |

| 16 | Hosen Group (SGX: 5EV) | 5EV | 0.48 | – |

| 17 | Japan Foods Holding (SGX: 5OI) | 5OI | 1.97 | 3.2 |

| 18 | Japfa (SGX: UD2) | UD2 | 0.87 | 13.6 |

| 19 | JB Foods (SGX: BEW) | BEW | 0.81 | 18.5 |

| 20 | Jumbo Group (SGX: 42R) | 42R | 3.19 | 17.0 |

| 21 | Katrina Group (SGX: 1A0) | 1A0 | 10.80 | – |

| 22 | Khong Guan (SGX: K03) | K03 | 0.62 | – |

| 23 | Kimly (SGX: 1D0) | 1D0 | 3.28 | 22.8 |

| 24 | Koufu (SGX: VL6) | VL6 | 3.81 | 27.1 |

| 25 | Luzhou Bio-Chem (SGX: L46) | L46 | -0.75 | – |

| 26 | Mewah International (SGX: MV4) | MV4 | 0.47 | 2.2 |

| 27 | Neo (SGX: 5UJ) | 5UJ | 1.81 | 15.2 |

| 28 | No Signboard Holdings (SGX: 1G6) | 1G6 | 1.34 | – |

| 29 | Old Chang Kee (SGX: 5ML) | 5ML | 3.15 | 3.2 |

| 30 | OneApex (SGX: 5SY) | 5SY | 1.16 | – |

| 31 | Pacific Andes (SGX: P11) | P11 | 0.09 | 8.5 |

| 32 | Pavillon (SGX: 596) | 596 | 0.25 | 1.1 |

| 33 | QAF (SGX: Q01) | Q01 | 1.06 | 5.4 |

| 34 | Sakae (SGX: 5DO) | 5DO | 0.17 | – |

| 35 | SATS (SGX: S58) | S58 | 2.01 | 10.4 |

| 36 | Sheng Siong (SGX: OV8) | OV8 | 6.39 | 24.176 |

| 37 | Shopper360 (SGX: 1F0) | 1F0 | 0.6144 | 5.642 |

| 38 | Sino Grandness (SGX: T4B) | T4B | 0.04 | 6.4 |

| 39 | Soup Restaurant (SGX: 5KI) | 5KI | 2.92 | 7.692 |

| 40 | ST Group Food (SGX: DRX) | DRX | 1.13 | 15.6 |

| 41 | SunMoon Food (SGX: AAJ) | AAJ | 4.55 | – |

| 42 | Thai Beverage (SGX: Y92) | Y92 | 2.58 | 20.087 |

| 43 | Tung Lok Restaurants (SGX: 540) | 540 | 2.63 | – |

| 44 | United Food (SGX: AZR) | AZR | 0.13 | – |

| 45 | Wilmar International (SGX: F34) | F34 | 1.01 | 7.716 |

| 46 | Yamada Green Resources (SGX: BJV) | BJV | 0.99 | 2.253 |

| 47 | Yeo Hiap Seng (SGX: Y03) | Y03 | 0.75 | 2.873 |

| 48 | Zhongxin Fruit (SGX: 5EG) | 5EG | 1.01 | 3.926 |

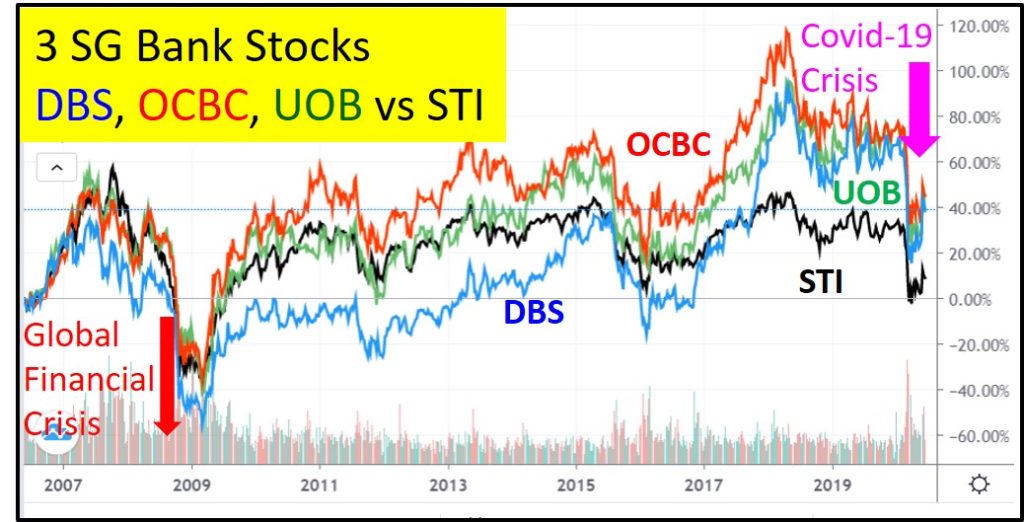

There are only 3 F&B related stocks (Dairy Farm, Thai Beverage, Wilmar) which are also listed in 30 STI component stocks:

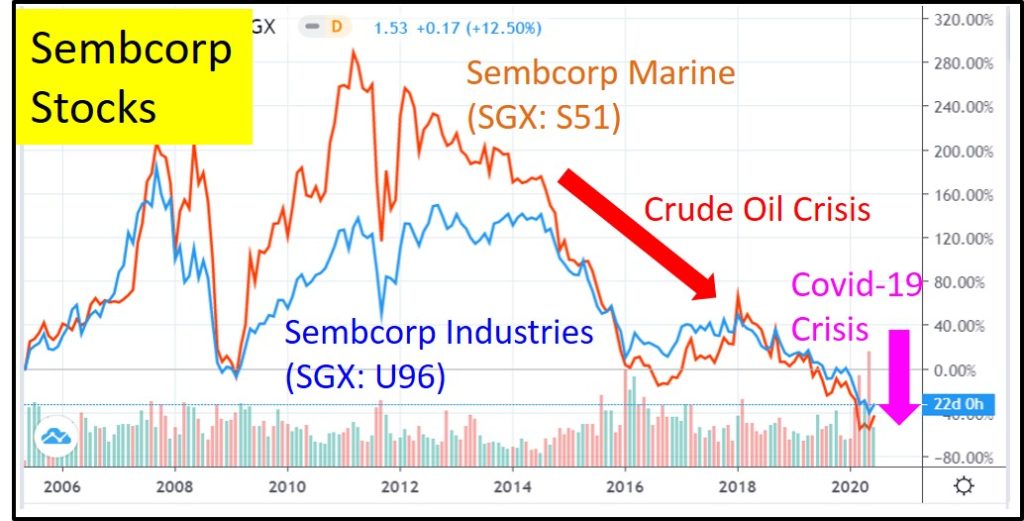

DBS Bank (SGX: D05), Singtel (SGX: Z74), OCBC Bank (SGX: O39), UOB Bank (SGX: U11), Wilmar International (SGX: F34), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Thai Beverage (SGX: Y92), CapitaLand (SGX: C31), Ascendas Reit (SGX: A17U), Singapore Airlines (SGX: C6L), ST Engineering (SGX: S63), Keppel Corp (SGX: BN4), Singapore Exchange (SGX: S68), HongkongLand (SGX: H78), Genting Singapore (SGX: G13), Mapletree Logistics Trust (SGX: M44U), Jardine Cycle & Carriage (SGX: C07), Mapletree Industrial Trust (SGX: ME8U), City Development (SGX: C09) , CapitaLand Mall Trust (SGX: C38U), CapitaLand Commercial Trust (SGX: C61U), Mapletree Commercial Trust (SGX: N2IU), Dairy Farm International (SGX: D01), UOL (SGX: U14), Venture Corporation (SGX: V03), YZJ Shipbldg SGD (SGX: BS6), Sembcorp Industries (SGX: U96), SATS (SGX: S58), ComfortDelGro (SGX: C52).

F&B stocks may not be defensive as not all the products are popular (eg. taste of food) and some may not have the right marketing (even restaurant with tasty food and/or low prices may not able to last if few people know). Therefore, selection of F&B giant stocks is different from selection of “Best Food” in Singapore or each country. In fact, it is possible for average taste or even “junk” food for some people (eg. fast food McDonald’s, NYSE: MCD) to be a global giant stock.

Here, let’s focus on 9 Singapore F&B giant stocks over 4 main categories:

1) Supermarket F&B Stocks

– Sheng Siong (SGX: OV8)

– Dairy Farm International (SGX: D01)

Both Sheng Siong and Dairy Farm make more profits in supermarket business during COVID-19 pandemic as most people would stay longer at home (cook more often at home) and need more consumer staples (using more essential products in daily life). However, share prices performances of both supermarket giant stocks are distinctly different with Sheng Siong at high optimism and Dairy Farm at low optimism.

Sheng Siong is mainly on supermarket business, therefore it is clear on positive impact of COVID-19 crisis, share prices dropped to low optimism in Mar 2020 during the most fearful time of pandemic, then quickly recovered and speculated to historical high prices, together with other COVID-19 related stocks, eg, glove / healthcare stocks: Medtecs International Corporation (SGX: 546), UG Healthcare Corporation (SGX: 41A), Top Glove Corporation (SGX: BVA), Riverstone Holdings (SGX: AP4). These COVID-19 beneficiary stocks including Sheng Siong have been falling down from high optimism with fading of fear of COVID-19, therefore both stock traders (trend-following) and investors (price over value) have to take note, not to “Buy High Sell Low” eventually. Sheng Siong may be considered when short term momentum is back (depending on the prices) or when there is global financial crisis in future (with low optimism prices again)

Dairy Farm has more diversified businesses within the Asia Pacific, besides Cold Storage, also has 7-Eleven, IKEA, restaurants, etc, which have different impacts during pandemic. Despite overall business is still profitable, the profitability is declining over the past 5 years, even before COVID-19. In addition, Dairy Farm belongs to Jardine Group, bearish share prices at low optimism is aligned for all Jardine related stocks, eg: Jardine Matheson Holding – JMH (SGX: J36), Jardine Strategic Holding – JSH (SGX: J37), Jardine Cycle & Carriage – JCC (SGX: C07), Hongkong Land (SGX: H78), Mandarin Oriental Hotel (SGX: M04), etc. When market sentiment of Jardine Group related stocks is negative, they would take longer time to recover in stock crisis. Dairy Farm may be considered for crisis investing with protection of consistent dividends (about 5% dividend yield) but an investor needs to have longer term holding power and able to control fear with falling prices in short term to medium terms.

2) Restaurant F&B Stocks

– Japan Foods Holding (SGX: 5OI)

– Old Chang Kee (SGX: 5ML)

Japan Foods and Old Chang Kee behave as if twin, IPO time was also close in years 2009 and 2008 respectively. Both stocks suffered during COVID-19 due to lockdown with less customers come to the food outlets. However, the main issue is even before COVID-19, since year 2013 till now, earnings of both stocks have been dropping, result in bearish share prices with low optimism prices. Therefore, they are lower quality crisis stocks as business is affected (lower profitability for 7 years), hard for the share prices to recover significantly in short to medium terms.

Although operational cashflow have been improving over the past 2 years, this could be due to impact of IFRS-16 (new accounting principle) which categories operational leases (eg. rental of food outlets) as liability (therefore debt has been increasing over the past 2 years), may not be entirely improvement in business cashflow. It is important for an investor review with longer term perspective (over 10 years) and bigger picture (income statement, balance sheet, cashflow statement) with integration with share price performance. When businesses of both stocks have significant breakthrough, the bearish trend in share prices and earnings may be reversed. Until then, they may only be considered for trading with trend-following.

3) Consumer F&B Stocks

– QAF (SGX: Q01)

– Thai Beverage (SGX: Y92)

QAF is famous of bakery brands such as Gardenia and Bonjour breads available in Asia Pacific. The defensive business (eg. breakfast) has doubled during pandemic but share prices are not speculated as high as Sheng Siong, only at mid optimism level but it is a stronger F&B stock relative to peers. QAF may also be considered as dividend stock with consistent dividend payout (about 5% dividend yield). See strategy in later article on how to eat Gardenia bread for free for lifetime (one may upgrade to better free food with improvement in investment).

Thai Beverage is an outstanding F&B giant stock, strong in businesses (eg. beers and spirit drinks in Thailand, Myanmar and regional markets) and low optimism in share prices. The business is not much affected during COVID-19 but share prices dropped to very low optimism due to market fear, which is a higher quality crisis stock. Positioning of Thai Beverage requires alignment with other stocks of Charoen Sirivadhanabhakdi (Top 10 richest person in Thailand), eg. Fraser and Neave – F&N (SGX: F99), Frasers Property (SGX: TQ5), Frasers Centrepoint Trust, FCT (SGX: J69U), Frasers Logistics & Commercial Trust (SGX: BUOU), Frasers Hospitality Trust (SGX: ACV).

4) Mixed Industry F&B Stocks

– Amara Holdings (SGX: A34)

– SATS (SGX: S58)

– Wilmar International (SGX: F34)

Some stocks only have partial F&B businesses, eg. Amara, SATS and Wilmar. Therefore, analysis of these stocks require integration with other sectors with different business segments.

Amara is mainly on hotel related businesses, F&B is only a smaller segment of business (restaurants), businesses are badly affected during COVID-19. SATS has both F&B and airlines gateway businesses, the earnings from F&B has helped the company minimize the negative impact of COVID-19 to airlines sector.

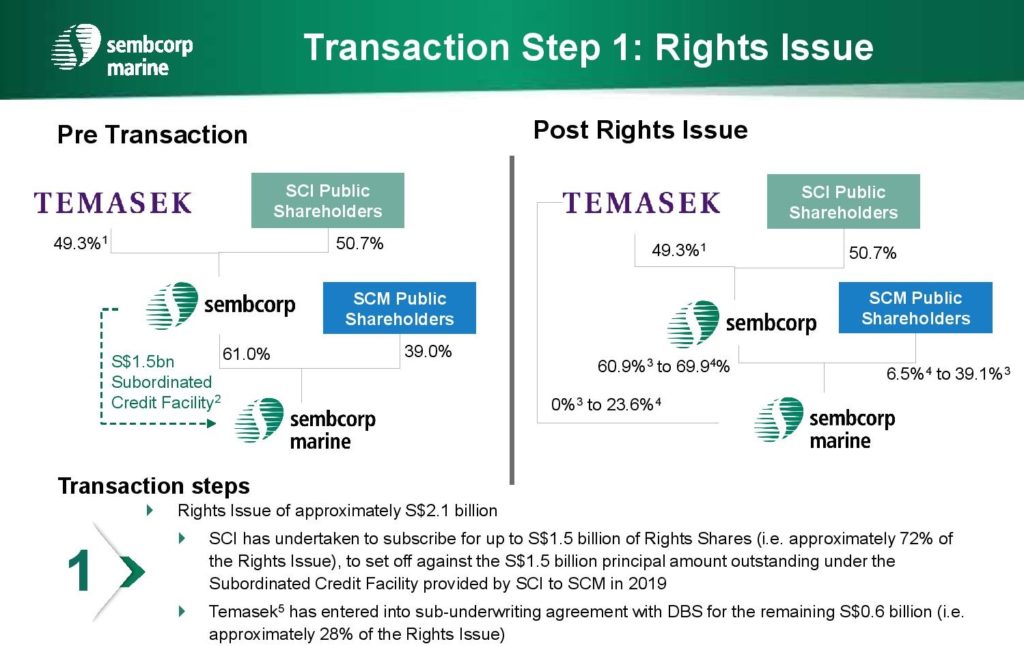

Both Amara and SATS suffer low optimism in share prices but each has its own defense system. Amara has undervalue hotel properties which could still generate cash with fading of COVID-19 but it needs to go through a long winter time until vaccine could be developed for COVID-19. SATS may expand F&B business during the downturn of airlines sector. Therefore, SATS is relatively a better airlines related stock than Singapore Airlines, SIA (SGX: C6L), which has full risk exposure to COVID-19 crisis, even the recent rights and bond issues may not be sufficient, therefore need to reduce the staff size to save cash.

Cash is King for investor, also true for stocks in crisis. SATS has strong sponsor of Temasek with diversification of business in F&B, therefore chances of recovery is higher than the peers in airlines sector. Some companies went bankrupt during global financial crisis mainly due to shortage in cash while making losses, hard to get new loan (high risk of default) with weak sponsor. So, when investing in crisis stock with weaker business fundamental, an investor who wants to take calculated risks, need to consider the cash burning rate of company vs the potential duration of crisis (eg. assuming another 12 months for COVID-19 to last).

Wilmar is a commodity giant stock, mainly in palm oil which products include cooking oil in F&B sector. Subsidiary company of Wilmar, Yihai Kerry Arawana (YKA), is a major producer of cooking oil in China, will be listed in China stock market. The future stock potential of Yihai Kerry Arawana has helped Wilmar to outperform other palm oil stocks, recovering from low to mid optimism level. Palm oil prices have been recovering, combining with positive news of spin-off of Yihai Kerry Arawana, supporting Wilmar share prices. Wilmar is a cyclic giant stock, more suitable to invest during uptrend stock market from lower to mid optimism level. Demand of palm oil would be higher with fading of COVID-19. Possible speculation of IPO (common in China stock market) of Yihai Kerry Arawana may also support the share price of parent stock, Wilmar.

===================================

If one could invest $2000 in QAF stock, would get about $100 dividend with consistent 5% dividend yield (higher if investing during crisis), enough to pay for $2 or 1 loaf of white bread per week (assume eat bread for 50 weeks in 1 year) which have about 14 slices (assuming eating 2 slices per day x 7 days per week), could enjoy free white bread for lifetime if QAF continues the business model this way. An investor may apply this strategy to eat in restaurant (eg. McDonald’s burger) for free for lifetime (if investing in a restaurant stock with consistent dividend or growth in share prices) or enjoy any drink (Coca-Cola – NYSE: KO, Thai Beverage beer, Starbucks coffee – NASDAQ: SBUX, etc), 1 cup per day, free for lifetime. Similarly, a consumer could enjoy free healthcare service (hospital or dental stocks), free handbag or watch (luxury products stocks), free house rental (property stocks but need higher capital), etc.

In fact, most consumers pay for lifetime for the same products (foods & beverages) again and again, contributing to the growth of F&B giant stocks with recurring incomes. When a consumer could reverse the role to an investor (as if a business partner of F&B outlet of interest), a consumer could make profit and enjoy free foods and drinks for life, with condition that it has to be a F&B giant stock, to be certified each year with Dr Tee selection criteria. For investors who are foods or drinks lover, may consider to invest in Top 10 global F&B giant stocks, diversifing investment over 10 different types of low-risk foods and beverages.

F&B giant stocks usually are cash cow with profitable businesses, therefore when share prices are undervalue at low optimism, may become target of acquisition, eg. past Singapore F&B giant stocks of Super Group (SGX: S10) and BreadTalk Group (SGX: CTN). Singapore has less F&B giant stocks but there are some global F&B giant stocks which have strong dominance in certain F&B businesses, able to make money consistently each day for decades.

===================================

There are over 1500 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar.

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Mall Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com