After major correction of technology stocks in Year 2022, the technology sector recovers strongly in 2023 with the support of Artificial Intelligence (AI), initiated by popularity of ChatGPT, following by the healthy competitions and future AI plans of many technology giant stocks, pushing up the stock prices of technology stocks and even entire US stock indices (S&P500 and Nasdaq), nearer to the last peak in late 2021.

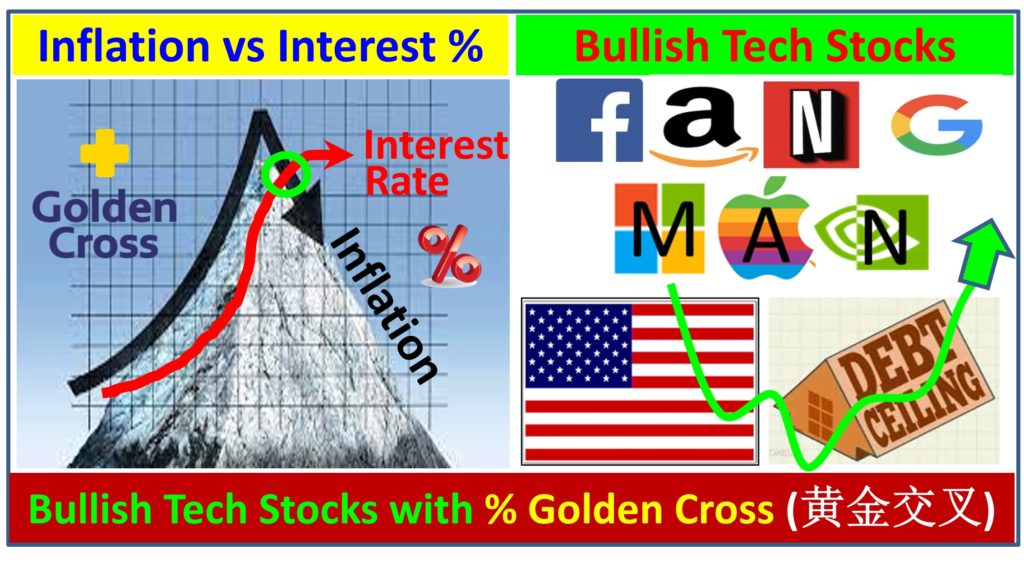

As mentioned in earlier Dr Tee articles, Golden Cross of inflation (now 3%) below interest rate (now 5%) help to support recovery of technology stocks which are sensitive to interest rate (likely will reach its peak soon). Since stock market is usually 6-12 months ahead of economy and businesses, a smart investor may take calculated risk with early actions (eg. big winner for those who took actions 6 months ago on technology stocks when inflation starts to fall from its peak).

Investing and trading in stocks may also apply AI (eg. following certain rules) but key difference is to personalize the strategies, eg holding for short term (momentum trading), mid term (cyclic trading) or long term (growth investing).

Dr Tee has shortlisted 8 AI stocks with potential for trading and investing, each stock requires unique positioning due to different types of LOFTP (Level / Optimism / Fundamental / Technical / Personal Analysis):

1) Nvidia (Nasdaq: NVDA)

Nvidia is a bigger winner in AI game as development generative AI requires strong demand of GPU chips, which is dominated by Nvidia. It projects significant increase in near future revenue which supports the share price to break above last high of $335 in Year 2021, exceeding by 50% to $460 so far.

Even before recent AI stock rally, Nvidia already has sustainable strong business fundamental. However, due to stock price is far above fair value with high Ein55 Optimism, it is more suitable for short term momentum trading, following the uptrend prices (eg. entering when breaking a new high, but it is crucial to set stoploss when price trend is reversed more than risk tolerance level).

2) Microsoft (Nasdaq: MSFT)

Microsoft is another direct AI winner because it is major investor for ChatGPT, even incorporating into BING search engine (challenging Google Search) and Windows 11 platform with Microsoft Office products. As a result, Microsoft share price has recovered back to its 2021 peak of $344, may achieve another new historical high if AI momentum continues.

Microsoft is veteran technology giant stock with over 50 years history since 1970s (comparable with Apple), products are diversified beyond traditional PC into cloud and gaming, etc. Strong business fundamental but it has price exceeding fair value with high Ein55 Optimism, more suitable for mid term cyclic investing (Buy Low Sell High) or short term momentum trading (Buy High Sell Higher).

3) Alphabet / Google (Nasdaq: GOOGL/GOOG)

Alphabet has been early AI developer (eg. DeepMind with AlphaGo could win human No 1 Go player in the world) but slow in commercializing the AI products, still focusing more on Google search engine which 85% market share (compared with BING only has 8%) for advertisement revenue (Youtube contributes to about 10% of Alphabet revenue). ChatGPT quick success has helped Google to introduce comparable BARD chat quickly to supplement Google search. It is not too late for BARD to catch up because they have strong foundation in development with wide Google network as potential customers, just need to focus on marketing and commercialization in future, helping to retain or grow the online advertisement revenue.

Relative to other technology / AI giant stocks, Alphabet / Google is relatively slow in stock price recovery (still below its peak of $150 in Year 2021), current price of $124 is near to its fair value, therefore still possible to be considered for long term investor for growth investing (Buy fair price and Hold). At the same time, Alphabet / Google may also be suitable for mid term cyclic investing (Buy Low Sell High) or short term momentum trading (Buy High Sell Higher). It is a rare giant stock which may be considered for both long term investors and short/mid term traders. However, since few technology giant stocks could last for decades, it is crucial to monitor its technology advantages over competitors (eg. ChatGPT vs BARD, Google vs BING, etc) for long term investors.

4) Meta / Facebook (Nasdaq: META)

Meta share price was seriously corrected in Year 2022 from about $380 to $90, partly due to venture into unprofitable Metaverse and headwind of technology sector then. Meta is early winner for technology stock recovery in 2023 (another is Netflix), growing with very strong momentum (comparable with Nvidia and Microsoft performances), current price of $313 is still below its 2021 peak of $380.

Even without AI (new plan) or Metaverse (old plan), advertisement revenue for existing Facebook and Instagram could already support and grow the business. The new Threads app is a strong challenger to Twitter, could be future revenue generator, making its social media network even wider (a strong economic moat). Meta share price is still below its fair value of about $360, may be considered for long term growth investor and also short term momentum trader.

5) Amazon (Nasdaq: AMZN)

Amazon share price was halved in Year 2022 from about $187 to $85, partly due to high growth during pandemic is not sustainable during post pandemic, business also becomes cyclic, affecting share price stability. Amazon has cloud businesses, AI concept has helped to recover its share prices together with other technology giant stocks, current price of $134 is still below its 2021 peak of $187.

Amazon is a trillion-dollar market cap giant stock (after Apple and Microsoft, ahead of Google and Nvidia), business becomes more sustainable as pre-pandemic. Current share is still below fair value of about $200, therefore may be considered for long term growth investing, mid term cyclic trading or even short term momentum trading.

6) AMD (Nasdaq: AMD)

AMD share price dropped to 1/3 from about $155 to $55 in Year 2022 technology sector crisis, partly due to high growth of chips demand during pandemic is not sustainable during post pandemic, business even suffered losses in the last quarter. Over the last few decades of competition, AMD is stronger and larger than Intel, supporting AMD share price growing by 80 times over the past 10 years. Despite AMD AI chip is still behind leader Nvidia, its latest chips are widely used by cloud platforms (eg. Amazon). AMD price has recovered strongly, current price of $115 is still below its 2021 peak of $155.

AMD is a young technology giant stock which would benefit from future AI sector expansion. Current share is still below fair value of about $200, therefore may be considered for long term growth investing, mid term cyclic trading or even short term momentum trading.

7) TSMC (NYSE: TSM / Taiwan TPE: 2330)

TSMC share price was corrected by more than half from about $140 to $63 in Year 2022 technology sector crisis, partly due to high growth of chips demand during pandemic is not sustainable during post pandemic, but business remains profitable with more sustainable growth rate. TSMC is the world leader for high end chip manufacturing (eg. 3nm), far ahead of competitors Samsung and Intel. With help of Warren Buffett (despite he sold it eventually due to worry of geo-political crisis) and technology sector rally, TSMC price has recovered strongly, current price of $105 is still below its 2022 peak of $140.

Semiconductor sector is cyclic in nature, similar for TSMC share price, more suitable to Buy Low Sell High for cyclic investor. Current share price is higher than fair price of about $80, therefore more suitable for mid term cyclic investing (not long term due to higher Ein55 Optimism) or even short term trading (since momentum is relatively weaker, may consider to Buy Low Sell High with short term swing trading).

8) ASML (Nasdaq: ASML)

Semiconductor sector is very specialized and inter-dependent, eg. design by Nvidia, manufacturing by TSMC but leading equipment supplier is ASML, etc. ASML business and even share price performances are comparable to TSMC since both are closely related.

ASML share price was corrected by more than half from about $868 to $379 in Year 2022 technology sector crisis, partly due to high growth of chips demand during pandemic is not sustainable during post pandemic, but business remains profitable with more sustainable growth rate. ASML is the world leader for high end chip equipment (eg. lithography for 3nm), far ahead of other competitors. US/China trade war may affect its future business expansion in China due to new export ban for high tech semiconductor equipment. Together with technology sector rally, ASML price has doubled from valley, current price of $750 is getting nearer to its 2022 peak of $868.

Semiconductor sector is cyclic in nature, similar for ASML share price, more suitable to Buy Low Sell High for cyclic investor. Current share price is higher than fair price of about $470, therefore more suitable for mid term cyclic investing (not long term due to higher Ein55 Optimism) or even short term trading (since momentum is relatively weaker, may consider to Buy Low Sell High with short term swing trading).

===================================

There are over 2000 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Frasers Logistics & Commercial Trust (SGX: BUOU), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Integrated Commercial Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com

View quick preview video below, Dr Tee will introduce 10 key stock investment strategies (股票投资十招) to be learned in 4hr free stock webinar:

Register Here (Dr Tee Free 4hr Stock Webinar): www.ein55.com