Many investors and traders like US technology stocks which could move up and down like a roller coaster with high potential gains in a shorter time. Similar to driving a car, despite there are many potential risks, a trained driver or stock trader could adopt best practices with experience for a smooth ride.

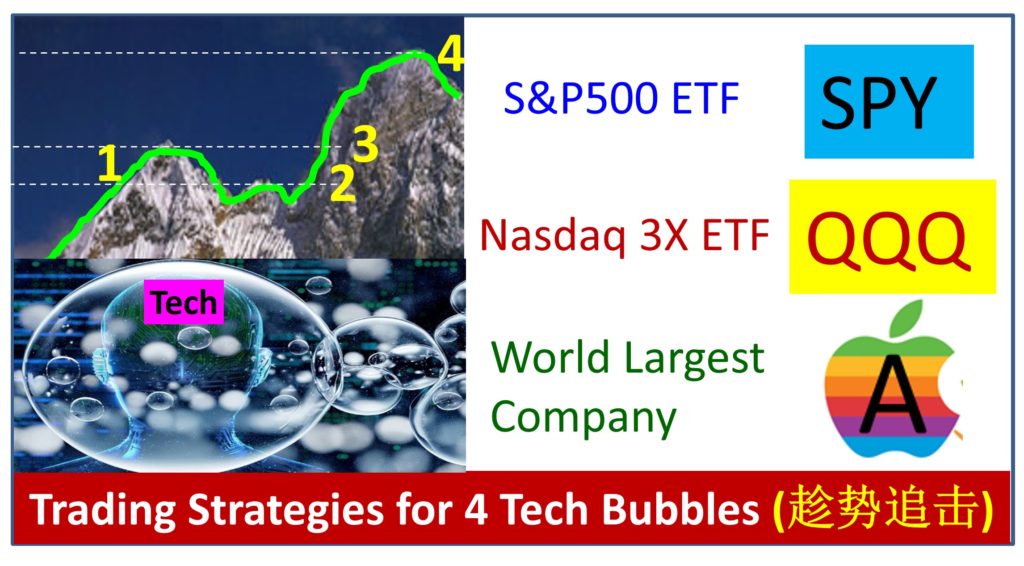

In general, there are 4 stages of technology stocks bubbles (see image above):

Stage 1

The first peak when technology stocks achieve high Ein55 Optimism > 75%, eg. during Year 2000 dotcom bubble and Year 2021 COVID online bubble.

Technology sector may not go through the entire 4 stages of bubbles. For example, for Year 2000 dotcom bubble, stock market crashed after Stage 1. For Stage 1, similar to surfing with a strong wave, trend-following position trading strategy with S.E.T. (Stop Loss / Entry / Target Prices) plan is key, buying with uptrend (eg. higher low higher high, breaking above critical resistance), sell / short selling with downtrend (eg. lower high lower low, breaking below critical support).

Stage 2

If it is a correction (eg. high inflation and interest rate hike in Year 2022), technology stocks would start to recover, eg Year 2023 has been recovering well with AI as the main driver.

Stage 2 has weaker trend than Stage 1, focusing more on recovery wave, usually stock prices need to break above certain patterns (eg. resistance of a double bottom neckline, etc) to sustain its recovery. Short term to mid term cyclic trading may be considered. If Stage 2 could not exceed the last high of Stage 1, then it may form a risky pattern (eg. Head & Shoulders, etc), therefore it is safer to trader than to invest in technology stocks with higher optimism level.

Stage 3

It is possible (although seldom) for technology stocks to achieve another new high than the peak of Stage 1 bubble. If inflation could fall down consistently below 3% while global economy is intact, US technology stocks may continue to recover. However, it may take time, especially No 2 economy, China is getting weaker, would affect global / US economy indirectly. Inflation may be stagnant around 3% +/- 1% for mid term until an economic crisis, only then it may fall down further.

Strategy for Stage 3 is focusing on shorter term trading with positioning sizing, leveraging on market momentum to trade uptrend.

Stage 4

This is the ultimate bubble (may or may not come), much higher peak than Stage 1 with high Ein55 Optimism >75%, mainly driven by stock market greed. The strategy is similar to Stage 1 but closer monitoring (daily) is required.

Besides uptrend trading, an experienced trader may also consider to short sell the market when it is falling down below critical support from high optimism level, potentially gaining from the crash of stock market which may be induced by the next black swan.

===================================

Technology giant stocks are mostly major component stocks of indices, therefore the movement of NASDAQ index (mostly technology stocks, popular ETF is QQQ, 3X of Nasdaq) is also aligned with S&P500 index (500 largest US stocks, popular ETF is SPY). When market is bearish, there are also inverse ETFs for traders who don’t know how to short sell but more suitable for shorter term trading.

In additional to indices, a trader may also consider technology giant stocks, eg. leader (world largest company) is Apple (Nasdaq: AAPL), already passing Stages 1 & 2, approaching Stage 3 (but fail to create new resistance above $200).

The current bull run for technology stocks is still intact. However, during each correction, a trader may need to exit first, reenter when trend is reversed to uptrend or when a new high is created.

At the same time, for longer term investors who have invested in technology giant stocks or indices (eg. S&P500 or Nasdaq), may also consider to switch to short term investing (choosing stocks like an investor, buy/sell like a trader) during uncertain high optimism level, no need to take any major risk against potential black swans (eg. China economy slowdown, escalation of Russian-Ukraine war, etc) which stock market may fall more than 50% when the bubble is burst.

In summary, a smart investor or trader would leverage on technology stock bubbles (Stages 1-4) but adjusting the strategy accordingly (eg. shorter term trading with higher optimism level). Stock bubble could be the best friend for trader (trend-following trading with greed) and investor (crisis investing after the market crash with fear).

===================================

There are over 2000 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Frasers Logistics & Commercial Trust (SGX: BUOU), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Integrated Commercial Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com

View quick preview video below, Dr Tee will introduce 10 key stock investment strategies (股票投资十招) to be learned in 4hr free stock webinar:

Register Here (Dr Tee Free 4hr Stock Webinar): www.ein55.com