With strong recovery of China / Hong Kong stocks after ending of zero COVID policy and strong rebound of US technology stocks with consistently lower inflation rates, some giant stocks surge to new historical high in share prices. This is a good problem to have for stock investor or trader when there are high capital gains (eg. more than 2 times).

Knowing What to Buy and When to Buy help to start the investing journey at the right time and right direction. However, knowing When to Sell (take profits) or How Long to Hold with alignment to own personality is the ultimate plan.

Let’s learn from Dr Tee on 3 Exit Strategies When a crisis stock becomes highly profitable (丰收季节). A recent Dr Tee Graduate success of a giant stock, Tianjin Pharmaceutical Da Ren Tang (SGX: T14 / China Shanghai: 600329) is applied as an example.

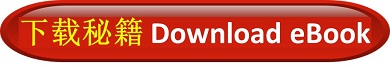

Congratulations to readers who may have taken action on Tianjin Da Ren Tang (strong fundamental China healthcare giant stock, dual listing in SGX and China) mentioned in Dr Tee articles on 2 Oct 2020 ($0.79 share price, Cyclic & Dividend investing), 31 Aug 2021 ($1.32 share price, Growth / Dividend investing) and 17 Feb 2023 ($1.30 share price, Growth / Momentum trading), as well as recent public webinar on 25 Mar 2023 ($1.39 share price, Momentum trading). Current share price (17 Apr 2023) is $2.26, exceeding the Ein55 intrinsic value of $1.50 mentioned, aiming for >$2.50 high Ein55 Optimism price with more greed recently.

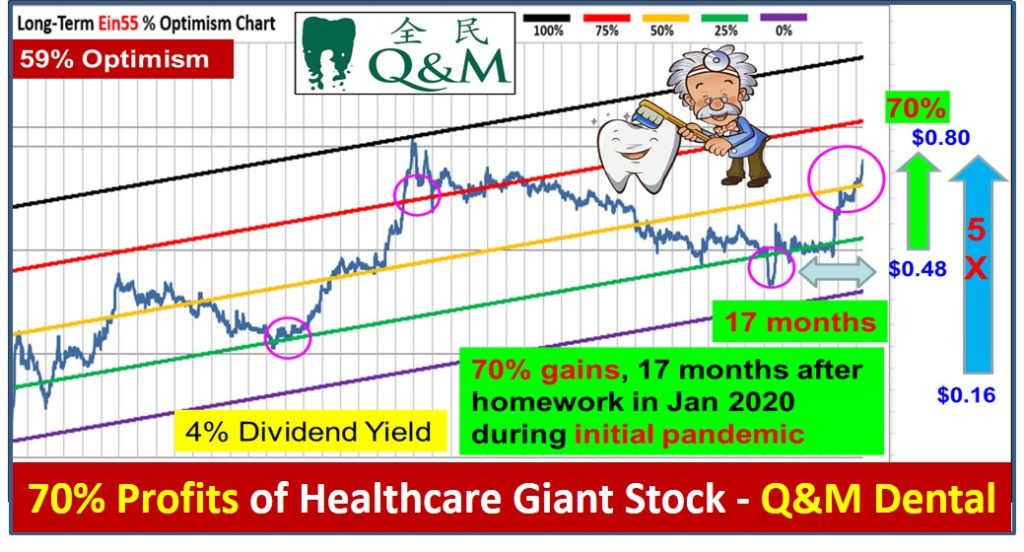

Dr Tee graduates were assigned homework on this stock in May 2020 ($0.68 share price, low Ein55 Optimism level for Cyclic + Growth + Dividend + Undervalue investing, see chart below) and again in July 2021 ($1.20 share price), not only share price has climbed up with over 3X capital gains ($0.68 to $2.26), also enjoying an enormous dividend yield = (dividend / price) = ($0.17/$0.68) = 25%, after dividend payments have grown 4X over the 3 years, supported by strong earnings (>70% business is Traditional Chinese Medicine, remaining is western medicine, etc).

Unlike other business (eg. technology / glove) which may have huge earnings surge during the first 2 years of pandemic (then suffer when both earnings and share prices are corrected post pandemic as the high business growth is not sustainable), Tianjin Da Ren Tang has been consistent and sustainable in business growth before / during / post pandemic. With ending of zero COVID policy in China, Tianjin Da Ren Tang enjoys the free ride together to higher Ein55 Optimism level, exceeding intrinsic value (about $1.50) and driven by market greed recently towards high Ein55 Optimism >$2.50.

The stock formerly was named Tianjin Zhongxin, after change in major shareholder, later renamed to Tianjin Da Ren Tang, partly to reflect its true historical value for the past century (eg. comparable with the same TCM school of more famous Beijing Tong Ren Tang). Tianjin Da Ren Tang is relatively less well known to global investors (unlike other Top 10 largest TCM or healthcare stocks in China) which makes it significantly undervalue, especially for dual listed stock in SGX vs China (eg. on 4 Nov 2022, share price was US$1/share in SGX but RMB 28.26 / 6.87 = US$ 4.11), about 4X price difference in the past, but Tianjin Da Ren Tang in SGX catches up recently to narrow down the gap with China listed stock to (40.08 / 6.87) / 2.26 = 2.6 times on 17 Apr 2023.

Even so, it is still over 2X difference between SGX and Shanghai listed stock, therefore there have been some speculations that SGX listed stock (about 1/3 total shares) may be acquired one day. In fact, when there was a change in major shareholder a few years ago, due to regulation, a low-ball offer (less than US$1) was proposed but this was just for formality, “acquisition” was not successful. In fact, Tianjin shares in SG are mostly owned by retail investors, major shareholders (who own 2/3 shares in China) would need to buy up significantly (relative to 2.6X difference of China stock) if the stock may be acquired to delist one day.

By right, both 1/3 SGX stock and 2/3 China Shanghai stock should have close to 1:1 share price since stock value is the same. Therefore, the earlier 4X undervalue of SGX listed of Tianjin Da Ren Tang has make it an excellent dividend stock, especially its dividend is doubled during recent announcement on 31 Mar 2023, together with 2X in earlier 2 years, total of 4X dividend growth in 4 years, resulting in an unbelievable 25% dividend yield for medium term investors who could take action 3 years ago ($0.68 in May 2020 for Dr Tee graduates).

While celebrating the success for Tianjin Da Ren Tang with 3X Capital Gains and 25% Dividend Yield, an investor or trader may worry when to exit. If sell too early, one may regret as stock may goes up further to higher Ein55 Optimism level driven by greed and social media publicity. If sell too late, the rally may be over, corrected back to square one, less profitable. Therefore, even making profits could be a headache, although it is a good problem to have.

Let’s apply 3 Exit Strategies of Dr Tee with LOFTP (Level / Optimism / Fundamental / Technical / Personal) Strategies to take profits. This is not limited to Tianjin Da Ren Tang (one has to make own decision aligning to own personality), may be applied to any giant stock with profits gained so far.

1) Contrarian Sell (Counter-trend)

Similar to “Buy Low” at Low Optimism with bearish prices, a contrarian investor may sell at High Optimism (eg. >$2.50 for Tianjin Da Ren Tang) with bullish uptrend prices (counter trend). Contrarian is against the majority, eg Buy when others were fearful 3 years ago during pandemic and Sell when others are greedy one day (eg. current market).

However, this strategy requires to know where is Low or High (eg. need knowledge of Ein55 Optimism with intrinsic value of a stock), else Buy Low may get lower (worst may go bankrupt for a junk stock with weak business), Sell High may get higher (>2-10X). A useful finetuning strategy is selling progressively (eg. sell 10% share whenever price is up by 10%, selling 100% when it is up by 100% or 2X). This is similar to an investor who “Average Down” (entry in batches) to Buy Low a few years ago. The weakness of this method is potential profits could be limited with progressive sell, balanced by the benefits of multiple more predictable exit points.

A special smart strategy is to sell 50% shares whenever stock price is 2X (eg. Tianjin Da Ren Tang from $0.68 to $1.36, or from $1 to $2, exit price depending on entry prices X2). This way, the initial capital of an investor is recovered (assuming commission and dividends are neglected), this would give confidence to an investor to take higher risk to hold longer time for the remaining 50% shares, aiming for even higher prices as psychologically, the investor knows that one will not make a loss anymore when 50% profits are taken with 2X prices, even a company may go bankrupt in future.

Assuming there is a good problem to have, share price goes up by another 2X after selling 50%, then an investor may sell 50% of remaining 50% = 25% when share price is 4X (eg. Tianjin Da Ren Tang from $0.68 to $2.72). Continue to sell 50% each time on remaining shares if any stock may become rocket high next time (eg. buy IFAST stock last time during pandemic at $1, sell 50% when come to $2, sell 25% when come to $4, sell 12.25% when come to $8, only left 12.25% shares today, else IFAST stock is corrected to below $5 currently if buy & hold till today).

2) Follow-trend Sell

Many retail investors and traders are more suitable for trend-following trading, eg. Buy a stock (low or fair or high price) with support of stronger uptrend prices. Similarly, they feel “safer” or more comfortable to sell when trend is reversed from uptrend to downtrend. This requires knowledge of share price reversal, eg. application of Technical Analysis, however one may regret after selling as the signal could be too fast, eg. taking 10% profits but stock may continue to go up over 2X, unless the traders continue to buy back again in future to follow the uptrend.

A more practical trend-following is to define own personality first, eg. short term, medium term or long term. This way, one may identify the right indicator to sell (aligned to earlier buy signal). A simple but smart strategy is to apply a trailing stop with X% correction during uptrend price, short term trader may sell when it corrects down by 5-10% one day (eg. Sell if Tianjin Da Ren Tang drops by 10% or around $0.22), medium term trader may wait for 10-20% (eg. Sell if Tianjin Da Ren Tang drops by 20% or around $0.44), long term investor may even able to tolerate >20-30% (acceptable since they have hold with over 2-3X capital gains).

Alternatively, a trader may finetune with any systematic trading system (eg. moving averages crossover, MACD, stochastic, breakout of support/resistance, etc), daily, weekly or monthly, following own personality (buy & sell every few weeks, months or years). Success trend-following is when the system matches own personality, else it would be a failure (eg. feeling of selling too early or too late).

Personality is usually ignored by investors / traders, especially for beginners, who simply busy looking for the “secret method” to make money in stocks. Ein55 Optimism has considered effects of personality in both Buy / Sell signals, integrating with LOFTP strategies.

3) No Sell (Hold)

In fact, the last exit option is not to exit at all, which may be holding for long term or lifetime, especially when business is intact, still growing consistently each year. It means an investor may ignore the share prices volatility or even stock crisis, mainly monitoring the business performance (eg. earnings, revenue, cashflow and many other key fundamental indicators from 3 financial statements).

By the way, Tianjin Da Ren Tang is a very cyclic stock (eg. price could drop over 60% during past stock crisis, partly due to cyclic China and SG stock markets), may not be suitable for Buy and Hold strategy, unless it may evolve from cyclic to growth and dividend investing over time. With recent strong dividend growth (despite recent 2X dividend growth may not be sustainable as this is not supported by 2X earnings, only up by >10% earnings, share prices is mainly driven up due to large gap between SG and China listed stock, as well as market greed), it starts to evolve gradually.

For Buy & Hold long term or lifetime, an investor may need 10-20 giant stocks in a portfolio (eg. 50% dividend stocks + 50% growth stocks) for diversification. Stock price (usually cyclic) may not always reflect business fundamental (even it continues to grow). If 25% dividend yield may be sustainable (may not be unless Tianjin Da Ren Tang continues to grow >10% in earnings each year), then an investor has an option to hold a stock as it only takes 4 years of dividend x 25% yearly to recover the initial capital with holding of stocks. Current dividend yield for Tianjin Da Ren Tang is 8% (still high relative to other dividend stocks) based on current share price >$2.

===================================

There are over 2000 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Frasers Logistics & Commercial Trust (SGX: BUOU), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Integrated Commercial Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com

View quick preview video below, Dr Tee will introduce 10 key stock investment strategies (股票投资十招) to be learned in 4hr free stock webinar:

Register Here (Dr Tee Free 4hr Stock Webinar): www.ein55.com