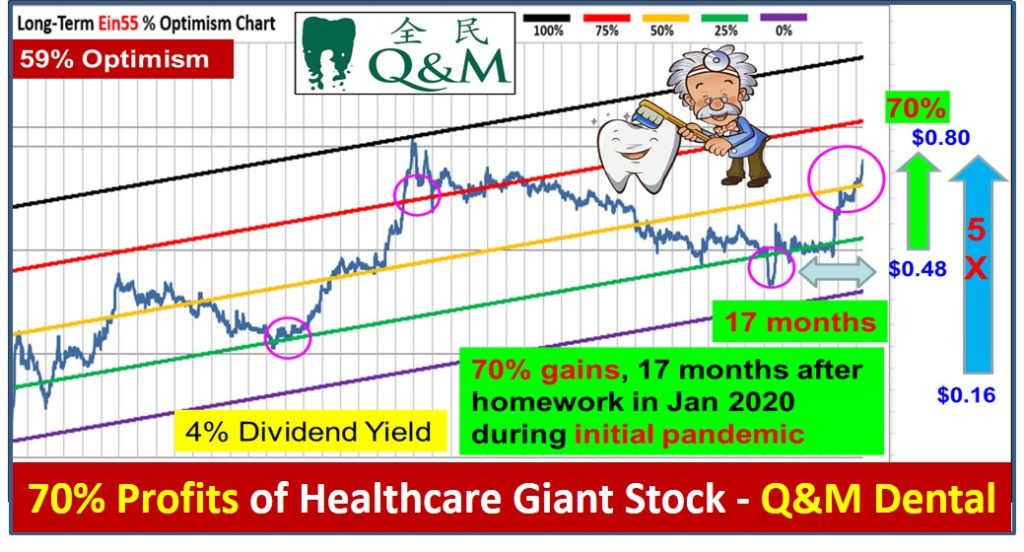

Over the past 1 year of pandemic, Dr Tee has shared with Ein55 graduates, forum readers and public webinars audience on this giant healthcare stock, Q&M Dental Group (SGX: QC7) with at least 3 articles and multiple comments regularly, witnessing surging of share prices from low Ein55 Optimism of $0.40+ share price to breaking above $0.50+/share resistance, predicting the fair value with Ein55 Intrinsic Value of $0.70/share, today is already $0.80/share (about 70% to 100% profits if an investor could buy & hold for over 1 year), moving towards next target of greedy price of high Ein55 Optimism at about $1/share.

Let’s learn from Dr Tee on this journey of making money and how to take action from now, assuming today is the first time you read Dr Tee educational article on global giant stocks.

Since Year 2015, Q&M Dental has been declining in share prices, mainly due to slower business growth (still profitable) and bearish market sentiment with little knowledge of this largest dental service provider in Singapore which also has dental clinics in Malaysia and China. Over the past 6 years, the share price has dropped from peak of about $0.90/share to about low of $0.35 during pandemic. For a giant stock, how it falls down (by 3 times) would imply how it may recover one day with similar scale (assuming by 3 times would be $0.35/share x 3, to about $1/share, aligning with Ein55 Optimism at high level).

Q&M Dental suffered in business temporarily in first half of pandemic but recovering quickly after Circuit Breaker was over as few people could resist tooth pains for months. Q&M Dental subsidiary, Acumen Research Lab is an HPB authorized COVID19 test service provider, providing fuel for share prices to grow with additional future earnings.

Some Ein55 graduates even invested below $0.40 – $0.50/share with contrarian dividend strategy during the worst time of pandemic. Dividend yield can be 10% with 4.3 cents/share dividend over the past 1 year if one could invest at $0.43 share price which was common in Year 2020. At current price of $0.80, beyond Ein55 Intrinsic Value of about $0.70, the dividend yield is moderate at 4%, comparable with Singapore REITs, therefore still a dividend giant stock. The gain so far with this strategy (Buy at low Ein55 Optimism of about $0.40) is about 2 times or 100% profits, able to hold as understanding Q&M Dental has economic moat, even under worst time of pandemic. Next few years would be the harvest time to enjoy the fruits, an investor has option to Sell High (following Ein55 Optimism). Due to cyclical nature of this giant stock, Buy Low Sell High strategy is more suitable than Buy Low & Hold very long term (usually for growth investing) unless the business fundamental of Q&M Dental is growing more consistently in future.

For a giant stock, regardless short term trading (price action with trend-following strategies), medium term trading (Buy Low Sell High) or long term investing (Buy Low & Hold for both dividend and price growth), all could make money, but need to take one of the actions. If there is no action, a reader always feel regret or sour feeling when reading successes of other investors, despite Q&M Dental was shared by Dr Tee before in at least 3 articles as a highly potential giant stock:

Dr Tee Article 1 posted on 24 Apr 2020 (Q&M price = $0.52)

https://www.ein55.com/2020/04/healthcare-giant-stock-qm-dental/

Dr Tee Article 2 posted on 4 Sep 2020 (Q&M price = $0.46)

https://www.ein55.com/2020/09/11-singapore-healthcare-covid-19-stocks/

Dr Tee Article 3 posted on 31 May 2021 (Q&M price = $0.68)

https://www.ein55.com/2021/05/seasonality-effect-with-ex-dividend-months-on-singapore-stock-market-2009-2021/

Another related sibling Singapore healthcare giant stock to take note is Raffles Medical Group (SGX: BSL), usually share price correlation is about 2X of Q&M which is already $0.80, implying minimum potential of Raffles Medical is about $0.80 x2 = $1.60 (currently at $1.18, still moderate low optimism, having more potential than Q&M Dental currently). For Ein55 graduates who have mastered 55 Ein55 investing styles, would know the actual potential of Raffles Medical. Don’t regret again if Dr Tee may share on this giant stock next time.

Most people regret of missing an opportunity, did not know that they don’t miss it at all, even reading today here (eg. applying short term momentum trading on Q&M Dental to Buy High Sell Highe). The key is to confirm whether it is a giant stock, then next step is to apply the right LOFTP (Level / Optimism / Fundamental / Technical / Personal Analysis) strategy on short term trading and / or long term investing based on current market condition, aligning with own unique personality.

There are many other global giant stocks prepared to surge with pandemic recovery, are you ready to become their business partners as a stock investor?

===================================

There are over 2000 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Frasers Logistics & Commercial Trust (SGX: BUOU), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Integrated Commercial Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com

View quick preview video below, Dr Tee will introduce 10 key stock investment strategies (股票投资十招) to be learned in 4hr free stock webinar:

Register Here (Dr Tee Free 4hr Stock Webinar): www.ein55.com