In this Dr Tee 1hr video education (Top 5 Factors of Global and Singapore REITs Investing), you will learn:

1) Singapore Stock Market Outlook

– Short term, medium term & long term

2) LOFTP Investing Strategies for REITs Investing

– Level Analysis (L1 Stock, L1 Sector, L3 Country, L4 World)

– Optimism Analysis (0-100%)

– Fundamental Analysis (Strong / Weak)

– Technical Analysis (Follow-trend / Counter-trend)

– Personal Analysis (Short Term Trading / Long Term Investing)

3) 4 Case Studies of Global and Singapore REITs Giant Stocks

– Singapore Giant Reit: CapitaLand Integrated Commercial Trust, CICT (SGX: C38U)

– Singapore Giant Reit: Parkway Life REIT (SGX: C2PU)

– Hong Kong Giant Reit: Link REIT (HKEX: 823)

– US Giant Reit: Equity Lifestyle Properties (NYSE: ELS)

4) 4 REITS Investing Strategies

– Dividend Investing (Buy Low & Hold, Long Term)

– Growth Investing (Buy Low & Hold, Long Term)

– Cyclic Investing (Buy Low & Sell High, Mid / Long Term)

– Momentum Trading (Buy High Sell Higher, Short Term)

5) Q&A with Practical Demo on Global REITs

– Short term & medium term trend-following TA strategies on entry / exit

– Summary on actions in REITs investing

Here is Dr Tee Free 1-hr Video Course. Enjoy and give your comments for improvement. You may subscribe to Dr Tee Youtube channel (Ein Tee) for future Dr Tee video talks.

Dr Tee Video Course: https://youtu.be/3-5r03LsCPA

For readers who are interested to take actions in 42 Singapore REITs and 16 Business Trusts, may read earlier article by Dr Tee (published in June 2020, one of the best time to invest in REITs during pandemic stock crisis):

https://www.ein55.com/2020/06/42-singapore-reits-16-business-trusts/

Past readers could have profited with over 50% rally in share price if have taken actions during pandemic on similar giant REITs such as Parkway Life REIT, CICT and many others REITs. No one could change the past but you could still change the future if taking action to learn now!

===================================

There are over 2000 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

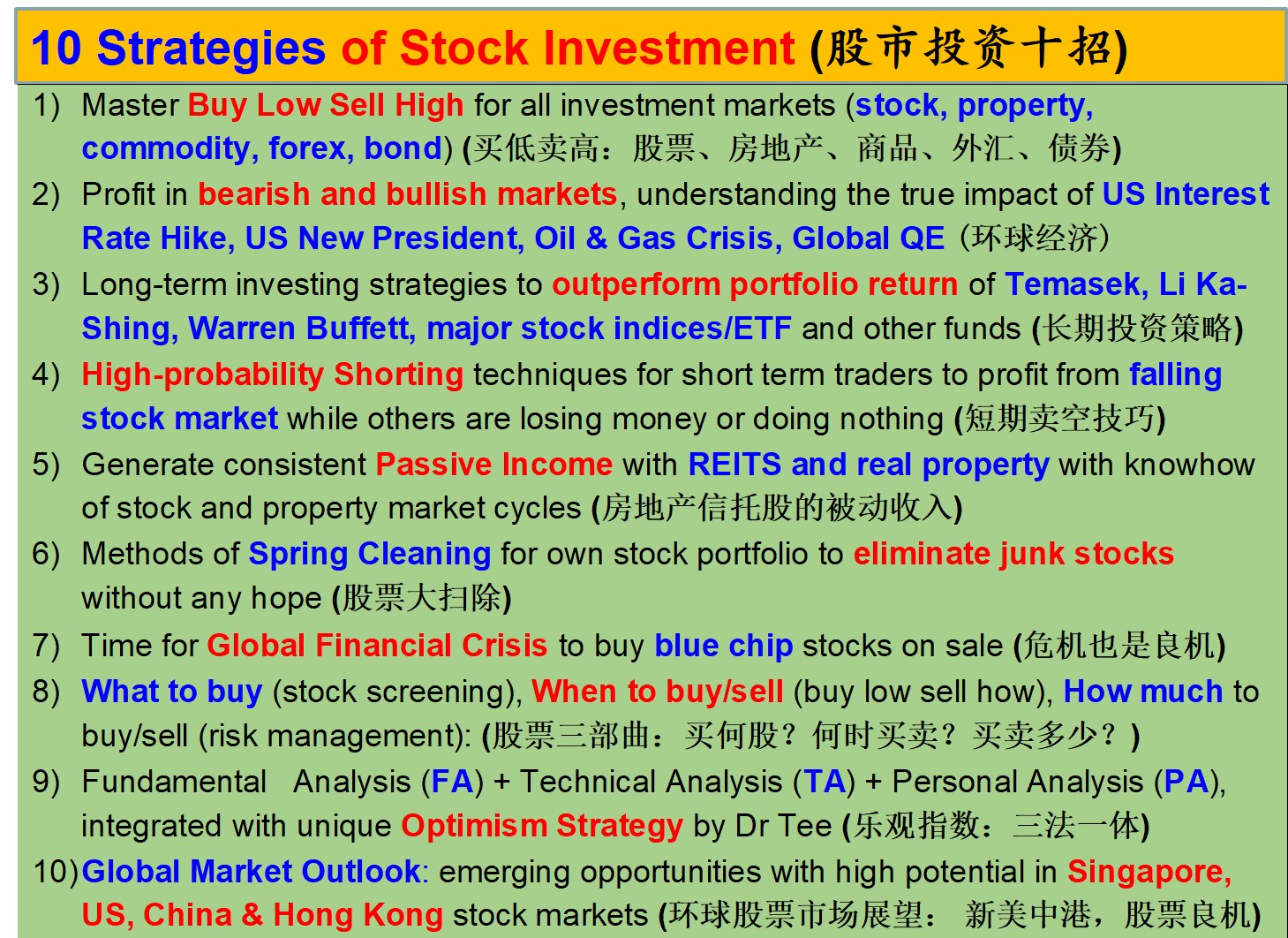

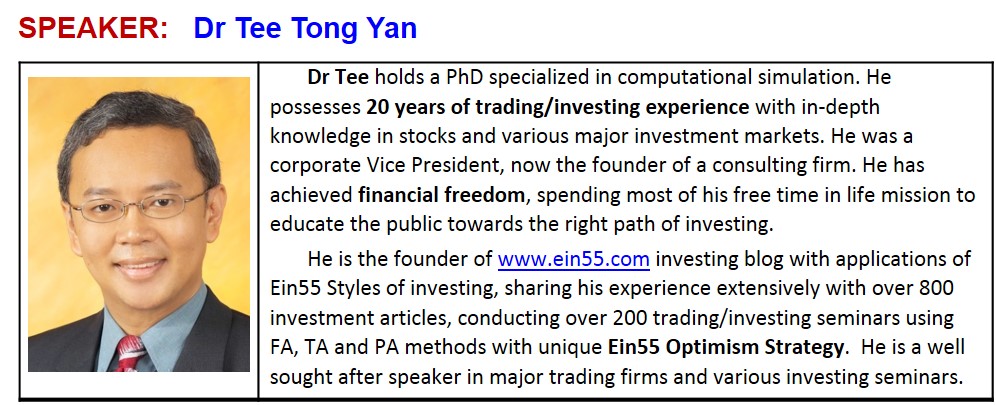

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Frasers Logistics & Commercial Trust (SGX: BUOU), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Integrated Commercial Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com

View quick preview video below, Dr Tee will introduce 10 key stock investment strategies (股票投资十招) to be learned in 4hr free stock webinar:

Register Here (Dr Tee Free 4hr Stock Webinar): www.ein55.com