In recent Ein55 Charity Course on Global Discounted NAV (DNAV) Stocks, we have raised fund of $24,488 to help needy families in Singapore. Under the spirit of charity, Dr Tee decides to share 134 Singapore Property Stocks and 3 global DNAV stocks in 3 countries with readers (detailed strategies including Ein55 Optimism levels, Ein55 intrinsic values and DNAV will be shared):

1) Singapore DNAV Stock – Hongkong Land (SGX: H78)

2) Malaysia DNAV Stock – Paramount (Bursa: 1724)

3) Hong Kong / China DNAV Stock – Yuexiu Property (HKEx: 123)

Dr Tee, Ein55 Mentors & Graduates have together organized 11 charity investment courses (REITs in Nov 2015, May 2017 and May 2019, High Dividend Stocks in Mar 2016, Oct 2017 and Nov 2019, Global Growth Stocks in Apr 2018 and Nov 2020, and Discounted NAV Stocks in Sep 2016, Nov 2018 and May 2021) in the past 6 years, donating net income of around $222,000 to Tzu Chi 慈济 Singapore.

We hope to inspire more Ein55 Graduates to reach out the society, helping others who are in need. More importantly, they have also learned the secrets of making money through investment. When more Ein55 Graduates are successful financially, they could also contribute back to the society to help more people in future (为善最乐).

Discounted Net Asset Value (DNAV) Strategy is valuation of company business, firstly based on the Net Asset Value (NAV) listed in current Balance Sheet. Then, we determine the net cash that would be received if all assets were sold and liabilities paid off. Various discounts will be applied based on different quality of asset classes. It is safer to buy stock with share price below the Discounted NAV (much more conservative than price below NAV or Price-to-Book ratio, PB < 1). Unlike PB method mainly applied for asset rich company (eg. property stocks), DNAV method can be applied in non-property or not cash-rich stocks. However, Ein55 Optimism strategies have to be integrated to avoid value trap, i.e. Buy Low Get Lower for undervalue stocks.

The best time to buy global DNAV stocks and 134 Singapore property stocks is always during global stock crisis (eg. Year 2020-2021 during pandemic, 2008—2009 during subprime crisis, etc), not only able to maximize the dividend yield (due to lower entry share price), also could have higher potential of capital gains (when market cycle moves from fear in low optimism to greed in high optimism). Singapore property stock investing is not based on undervalue strategy (Buy Undervalue Sell Overprice) alone, may be integrated with dividend investing, growth investing, swing trading, momentum trading, cyclic investing, defensive investing and other Ein55 strategies.

There are 134 Singapore property stocks (not all are giant stocks with Dr Tee criteria), based on the last price traded (7 May 2021), sorted by 3 key Fundamental Criteria:

1) ROE (a criteria for growth stocks, eg. ROE > 5%),

2) Dividend Yield, DY (a criteria for dividend stocks, eg. DY > 3%),

3) Price-to-Book (PB) ratio, Price/NAV (a criteria for undervalue stocks, eg. PB < 1).

From the table sorted below, over 75% (101/134 stocks) are undervalue (Price to Book ratio, PB < 1), mainly due to COVID-19 stock crisis, affecting property construction business with bearish share prices but property asset valuation remains stable. There are only 20% (27/134 stocks) have growing businesses (over 5% ROE, Return on Equity) while over 50% (72/134 stocks) were making losses during pandemic in Year 2020. There are nearly 50% (62/134 stocks) were paying dividend but only 22 stocks (16%) having dividend yield over 3%, potential for dividend investing.

| No | 134 SG Property Stocks | ROE (%) | PB | DY (%) |

| 1 | 3Cnergy (SGX: 502) | – | 1.1 | – |

| 2 | A-Smart Holdings (SGX: BQC) | 0.852 | 1.8 | – |

| 3 | AEI Corporation (SGX: AWG) | – | 2.6 | – |

| 4 | Aims Property Securities Fund (SGX: BVP) | – | 0.4 | 1.9 |

| 5 | Asia-Pacific Strategic Investments (SGX: 5RA) | – | 0.8 | – |

| 6 | APAC Realty (SGX: CLN) | 10.62 | 1.1 | 5.1 |

| 7 | Abterra (SGX: L5I) | 50.49 | 2.1 | – |

| 8 | Acromec (SGX: 43F) | – | 1.9 | – |

| 9 | Alset International (SGX: 40V) | 53.45 | 1.1 | – |

| 10 | Amara Holdings (SGX: A34) | – | 0.5 | – |

| 11 | Amcorp Global (SGX: S9B) | – | 0.6 | – |

| 12 | AnnAik (SGX: A52) | 0.294 | 0.3 | 1.8 |

| 13 | Astaka Holdings (SGX: 42S) | – | 5.5 | – |

| 14 | BBR Holdings (SGX: KJ5) | – | 0.5 | – |

| 15 | BRC Asia (SGX: BEC) | 7.693 | 1.3 | 1.3 |

| 16 | Blackgold Natural Resources (SGX: 41H) | – | – | – |

| 17 | Boldtek Holdings (SGX: 5VI) | – | 0.7 | – |

| 18 | Bonvests (SGX: B28) | – | 0.5 | 0.3 |

| 19 | Boustead Singapore (SGX: F9D) | 9.01 | 1.4 | 2.9 |

| 20 | Boustead Projects (SGX: AVM) | 7.469 | 1.1 | 0.8 |

| 21 | Bukit Sembawang Estates (SGX: B61) | 5.748 | 0.9 | 0.9 |

| 22 | Bund Center Investment (SGX: BTE) | 2.197 | 0.9 | 7.3 |

| 23 | CSC Holdings (SGX: C06) | 4.531 | 0.4 | – |

| 24 | CapitaLand (SGX: C31) | – | 0.8 | 2.5 |

| 25 | CASA Holdings (SGX: C04) | 2.638 | 0.3 | 5.6 |

| 26 | Chemical Industries (Far East) (SGX: C05) | 2.782 | 0.4 | 2.1 |

| 27 | China International Holdings (SGX: BEH) | 14.62 | 0.3 | 9.1 |

| 28 | China Yuanbang Property Holdings (SGX: BCD) | 5.991 | 0.1 | – |

| 29 | Chip Eng Seng Corporation (SGX: C29) | – | 0.4 | 4.4 |

| 30 | City Developments (SGX: C09) | – | 0.9 | 1.0 |

| 31 | DISA (SGX: 532) | – | 4.3 | – |

| 32 | Debao Property Development (SGX: BTF) | – | 0.1 | – |

| 33 | ETC Singapore (SGX: 1C0) | – | 0.3 | – |

| 34 | Edition (SGX: 5HG) | – | 1.6 | – |

| 35 | Engro Corporation (SGX: S44) | 8.563 | 0.6 | 2.0 |

| 36 | Fraser and Neave – F & N (SGX: F99) | 5.026 | 0.7 | 3.5 |

| 37 | Far East Orchard (SGX: O10) | 0.124 | 0.4 | 2.6 |

| 38 | Figtree Holdings (SGX: 5F4) | – | 0.5 | 2.9 |

| 39 | First Sponsor Group (SGX: ADN) | 5.996 | 0.8 | 2.2 |

| 40 | Fragrance Group (SGX: F31) | 0.133 | 0.6 | – |

| 41 | Frasers Property (SGX: TQ5) | 1.477 | 0.5 | 0.9 |

| 42 | GYP Properties (SGX: AWS) | – | 0.4 | – |

| 43 | Gallant Venture (SGX: 5IG) | – | 0.9 | – |

| 44 | Golden Energy and Resources (SGX: AUE) | 2.101 | 0.7 | – |

| 45 | Goodland Group (SGX: 5PC) | – | 0.3 | 1.0 |

| 46 | GuocoLand (SGX: F17) | 2.234 | 0.5 | 3.6 |

| 47 | HL Global Enterprises (SGX: AVX) | 0.263 | 0.4 | – |

| 48 | Hatten Land (SGX: PH0) | – | 0.9 | – |

| 49 | Heeton Holdings (SGX: 5DP) | – | 0.2 | – |

| 50 | Hiap Hoe (SGX: 5JK) | – | 0.4 | 0.8 |

| 51 | Hiap Seng Engineering (SGX: 510) | – | – | – |

| 52 | Ho Bee Land (SGX: H13) | 3.782 | 0.5 | 2.9 |

| 53 | Hock Lian Seng Holdings (SGX: J2T) | 2.08 | 0.6 | 1.0 |

| 54 | Hong Fok Corporation (SGX: H30) | – | 0.3 | 1.2 |

| 55 | Hong Lai Huat Group (SGX: CTO) | – | 0.3 | – |

| 56 | Hong Leong Asia (SGX: H22) | 5.312 | 0.8 | 1.0 |

| 57 | Hongkong Land Holdings (SGX: H78) | – | 0.3 | 4.5 |

| 58 | Hor Kew Corp (SGX: BBP) | 0.861 | 0.2 | – |

| 59 | Huationg Global (SGX: 41B) | – | 0.2 | – |

| 60 | Hwa Hong Corporation (SGX: H19) | 2.221 | 1.0 | 3.3 |

| 61 | IPC Corporation (SGX: AZA) | – | 0.2 | – |

| 62 | ISOTeam (SGX: 5WF) | – | 1.1 | – |

| 63 | Imperium Crown (SGX: 5HT) | – | 0.2 | – |

| 64 | Jasper Investments (SGX: FQ7) | – | – | – |

| 65 | KOP (SGX: 5I1) | – | 0.4 | – |

| 66 | KSH Holdings (SGX: ER0) | 4.757 | 0.6 | 6.0 |

| 67 | Keong Hong Holdings (SGX: 5TT) | – | 0.4 | – |

| 68 | Keppel Corp (SGX: BN4) | – | 0.9 | 1.9 |

| 69 | Keppel Reit (SGX: K71U) | – | 0.9 | 4.4 |

| 70 | King Wan Corporation (SGX: 554) | 0.753 | 0.2 | – |

| 71 | Koh Brothers Group (SGX: K75) | – | 0.2 | – |

| 72 | Koon Holdings (SGX: 5DL) | – | – | – |

| 73 | KORI Holdings (SGX: 5VC) | 0.852 | 0.3 | – |

| 74 | LHN (SGX: 41O) | 19.85 | 0.9 | 4.7 |

| 75 | Ley Choon Group (SGX: Q0X) | – | 1.1 | – |

| 76 | Lian Beng Group (SGX: L03) | 4.06 | 0.3 | 2.0 |

| 77 | Low Keng Huat (Singapore) (SGX: F1E) | 7.007 | 0.5 | 5.1 |

| 78 | Lum Chang Holdings (SGX: L19) | – | 0.6 | 3.3 |

| 79 | Luminor Financial Holdings (SGX: 5UA) | – | 0.5 | – |

| 80 | MYP (SGX: F86) | – | 0.4 | – |

| 81 | Metro Holdings (SGX: M01) | 2.15 | 0.4 | 2.7 |

| 82 | OIO Holdings (SGX: KUX) | – | – | – |

| 83 | OKH Global (SGX: S3N) | – | 0.3 | – |

| 84 | OKP (SGX: 5CF) | 2.696 | 0.5 | 3.8 |

| 85 | OneApex (SGX: 5SY) | – | 1.1 | – |

| 86 | Oxley Holdings (SGX: 5UX) | – | 1.0 | 3.3 |

| 87 | PSL Holdings (SGX: BLL) | – | 0.3 | – |

| 88 | Pacific Century Regional Development (SGX: P15) | – | 1.0 | 8.7 |

| 89 | Pacific Star Development (SGX: 1C5) | – | – | – |

| 90 | Pan Hong (SGX: P36) | 15.44 | 0.5 | 2.4 |

| 91 | Pavillon Holdings (SGX: 596) | – | 0.4 | – |

| 92 | Pollux Properties (SGX: 5AE) | 0.096 | 0.6 | – |

| 93 | PropNex (SGX: OYY) | 34.4 | 4.9 | 4.9 |

| 94 | Raffles Infrastructure Holdings (SGX: LUY) | 13.35 | 0.5 | – |

| 95 | Regal International Group (SGX: UV1) | 15.28 | 4.3 | – |

| 96 | Renaissance United (SGX: I11) | – | 0.3 | – |

| 97 | Rich Capital Holdings (SGX: 5G4) | – | 1.4 | – |

| 98 | Roxy-Pacific Holdings (SGX: E8Z) | – | 1.0 | – |

| 99 | Ryobi Kiso (SGX: BDN) | – | 2.2 | – |

| 100 | SHS Holdings (SGX: 566) | – | 0.8 | – |

| 101 | SLB Development (SGX: 1J0) | 6.838 | 0.63 | – |

| 102 | SP Corporation (SGX: AWE) | 2.459 | 0.38 | – |

| 103 | Sasseur Reit (SGX: CRPU) | 4.254 | 1.01 | 7.06 |

| 104 | Second Chance Properties (SGX: 528) | 1.786 | 0.78 | 1.61 |

| 105 | Sin Heng Heavy Machinery (SGX: BKA) | 1.063 | 0.33 | 1.54 |

| 106 | Sinarmas Land (SGX: A26) | 3.545 | 0.43 | 0.32 |

| 107 | SingHaiyi (SGX: 5H0) | – | 0.46 | – |

| 108 | SingHaiyi Group (SGX: 5IC) | 5.319 | 0.49 | 2.63 |

| 109 | Singapore Land Group (SGX: U06) | 1.23 | 0.53 | 1.28 |

| 110 | Sinjia Land (SGX: 5HH) | – | 0.95 | – |

| 111 | Soilbuild Construction (SGX: S7P) | – | 0.75 | – |

| 112 | Straits Trading (SGX: S20) | 3.347 | 0.71 | 2.22 |

| 113 | Sysma Holdings (SGX: 5UO) | 2.121 | 0.59 | – |

| 114 | TA Corporation (SGX: PA3) | – | 0.38 | – |

| 115 | T T J Holdings (SGX: K1Q) | – | 0.421 | 2.614 |

| 116 | Tai Sin Electric (SGX: 500) | 5.364 | 0.816 | 4.348 |

| 117 | Thakral Corporation (SGX: AWI) | 4.418 | 0.407 | 6.522 |

| 118 | Thomson Medical Group (SGX: A50) | – | 4.946 | – |

| 119 | Tiong Seng Holdings (SGX: BFI) | – | 0.299 | 1.562 |

| 120 | Top Global (SGX: BHO) | – | 0.531 | – |

| 121 | Tosei Corporation (SGX: S2D) | 6.109 | 0.583 | 2.585 |

| 122 | Tritech Group (SGX: 5G9) | – | 1.063 | – |

| 123 | United Overseas Australia – UOA (SGX: EH5) | 6.401 | 0.729 | 2.678 |

| 124 | UOL Group (SGX: U14) | 0.134 | 0.656 | 2.3 |

| 125 | USP Group (SGX: BRS) | – | 0.204 | – |

| 126 | Vibrant Group (SGX: BIP) | 2.456 | 0.307 | – |

| 127 | Wee Hur Holdings (SGX: E3B) | 6.81 | 0.451 | 2.439 |

| 128 | Wing Tai Holdings (SGX: W05) | 0.088 | 0.454 | 1.593 |

| 129 | Yanlord Land Group (SGX: Z25) | 8.306 | 0.428 | 4.857 |

| 130 | Yeo Hiap Seng (SGX: Y03) | – | 0.892 | 2.21 |

| 131 | Ying Li International Real Estate (SGX: 5DM) | – | 0.391 | – |

| 132 | Yoma Strategic Holdings (SGX: Z59) | – | 0.405 | – |

| 133 | Yongmao Holdings (SGX: BKX) | 7.682 | 0.359 | 0.309 |

| 134 | Yongnam Holdings (SGX: AXB) | – | 0.308 | – |

However, not all the 134 Singapore property stocks listed are giant stocks. A growing business in the past may not be sustainable during COVID-19 period and an undervalue stock may remain lagging in share prices for many years, could end up as a crisis stock. Fundamental Analysis alone is not sufficient, a low PB or low PE or high dividend yield stock may be a value trap as this may be the result of lower share price with weakening businesses. Therefore, deeper analysis is required with LOFTP (Level, Optimism, Fundamental, Technical, Personal Analysis) Strategies.

Let’s learn these 3 global Discounted NAV giant stocks in 3 countries, understanding the business nature, investment clock and unique strategy.

1) Singapore DNAV Stock – Hongkong Land (SGX: H78)

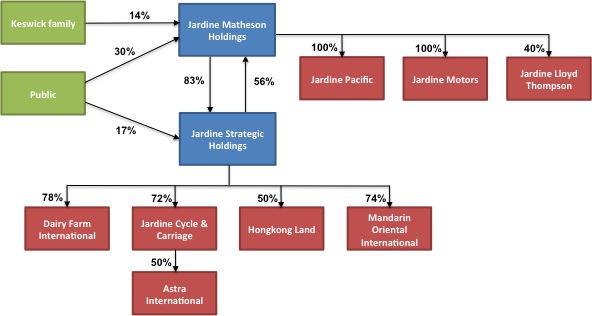

Hongkong Land is part of Jardine Group with over 100 years of history. It has property businesses mainly in Hong Kong, China and Singapore with 61% in investment properties (main source of rental income) and 39% in development properties. The West Bund project in Xuhui Shanghai of China would be major revenue contributor in the next few years.

Hongkong Land is still at low Ein55 Optimism (<25%) but recovering well from low in pandemic, aiming for Ein55 intrinsic value of about $9/share. This stock has Discounted NAV of $15/share (close to NAV, implying very high quality of its asset), providing high safety of margin for long term investors with stable dividend payment (about 4-5% dividend yield, depending on entry price). Assuming extreme devaluation of Hong Kong property market by 50%, Hongkong Land would still have $7.50/share value for very conservative investors. The “loss” of Hongkong Land in Year 2020 is mainly accounting loss due to devaluation of property but cashflow is still strong to support the dividend payment, behaving as if a REIT.

Recent acquisition of parent company, JSH (SGX: J37) by JMH (SGX: J36), has helped to support the prices of other stocks in Jardine group including Hongkong Land. Jardine Group may have more corporate actions in future to release the hidden value of subsidiary stocks including Hongkong Land, Jardine Cycle & Carriage – JCC (SGX: C07), Dairy Farm International (SGX: D01) and Mandarin Oriental Hotel (SGX: M04). However, the recovery pattern of share prices for undervalue stock can be different from growth stocks. Hongkong Land is more suitable for long term investors with patient, positioning as a mid-fielder stock, good balance between capital gains and dividend as passive income.

Readers may read earlier articles (during pandemic with low optimism prices) by Dr Tee for more details on Jardine Group of stocks including Hongkong Land:

https://www.ein55.com/tag/jardine/

2) Malaysia DNAV Stock – Paramount (Bursa: 1724)

Paramount is a Malaysia property development stock with 50 years of history in businesses. After divestment of education segment business, Paramount has drawn up a new 5-year (2020 – 2024) strategic roadmap to focus on Property development and concentrate on landed developments and integrated developments in Malaysia. In the next 5 years, Paramount plans to venture into overseas property development projects, expecting to contribute approximately 10% of the Group’s revenue. It enjoys recurring income from investment property and minority interest in education business.

Paramount is still at low Ein55 Optimism (<25%) but recovering well from low in pandemic, aiming for Ein55 intrinsic value of about $1.20/share. This stock has Discounted NAV of $2.17/share (20% lower than NAV, partly due to lower value of non-property business), providing high safety of margin for long term investors with stable dividend payment (about 4-5% dividend yield, depending on entry price). Assuming extreme devaluation of Malaysia property market by 50%, Paramount would still have $1.08/share value for very conservative investors.

Malaysia property stock investing is complicated by worse pandemic condition, political instability and weaker consumer purchasing power. Paramount is more suitable for long term investors with patient, positioning as a mid-fielder stock, good balance between capital gains and dividend as passive income.

Readers may read earlier article (during pandemic with low optimism prices) by Dr Tee for more details on other Malaysia stock affected by pandemic:

https://www.ein55.com/tag/malaysia-stocks/

3) Hong Kong / China DNAV Stock – Yuexiu Property (HKEx: 123)

Yuexiu Property is a China property developer company (state-owned enterprise), originated in Guangzhou, expanding property businesses to other 19 cities in China. In 2019, Guangzhou Metro (another state-owned enterprise) becomes the second largest investor of Yuexiu Property, deepening the strategic collaboration between 2 giants (transportation and property).

Yuexiu Property is at moderate low Ein55 Optimism of about 40%, near to Ein55 intrinsic value of $2.20. This stock has Discounted NAV of $1.27/share (much lower than its NAV), higher than its current share price, therefore no safety of margin for very conservative investors. Yuexiu Property may still be considered for growth investing with dividend payment (about 6-7% dividend yield, depending on entry price). Trend-following strategy with S.E.T. (Stop Loss, Entry, Target Prices) trading plan may be integrated into stock investing without DNAV protection.

Yuexiu Property belongs to Yuexiu Group, which also owns 2 other subsidiary stocks, Yuexiu Reit (HKEx: 405) and Yuexiu Transport Infrastructure (HKEx: 1052) which may also be considered for dividend stock investing. Major shareholder and sponsor is Guangzhou local government, providing strong support to Yuexiu Group of stocks.

Readers may read earlier articles by Dr Tee for more details on other global and local property stocks including but not limited to Yuexiu Property:

https://www.ein55.com/category/property-market/

===================================

There are over 1500 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Mall Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com