The best way to make money is to let money make more money. In this article, you will learn 30 Singapore Banking & Finance Stocks which are efficient in making money with money for investors, focusing in 6 groups of stocks (with strategies for 3 major bank stocks: DBS, OCBC and UOB):

1) Bank Stocks

2) Finance Stocks

3) Insurance Stocks

4) Stock Broker Stocks

5) Pawnbroker Stocks

6) Investment and Other Stocks

There are only 30 Banking & Finance stocks in Singapore, relatively less than other sectors as Singapore has tighter regulation in finance sector for services such as lending money (limited licenses available):

AMTD IB OV (SGX: HKB), B&M Hldg (SGX: CJN), DBS Bank (SGX: D05), Edition (SGX: 5HG), G K Goh (SGX: G41), Global Investment (SGX: B73), Great Eastern (SGX: G07), Hong Leong Finance (SGX: S41), Hotung Investment (SGX: BLS), IFAST Corporation (SGX: AIY), IFS Capital (SGX: I49), Intraco (SGX: I06), Maxi-Cash Finance (SGX: 5UF), MoneyMax Finance (SGX: 5WJ), Net Pacific Finance (SGX: 5QY), OCBC Bank (SGX: O39), Pacific Century (SGX: P15), Prudential USD (SGX: K6S), Singapore Exchange (SGX: S68), SHS (SGX: 566), Sing Investments & Finance (SGX: S35), Singapore Reinsurance (SGX: S49), Singapura Finance (SGX: S23), TIH (SGX: T55), Uni-Asia Group (SGX: CHJ), UOB Bank (SGX: U11), UOB-KAY HIAN HOLDINGS (SGX: U10), UOI (SGX: U13), ValueMax (SGX: T6I), Vibrant Group (SGX: BIP).

From the table sorted for 30 Singapore banking & finance stocks, mostly are profitable (26 / 30 stocks were making money in businesses last year) but still undervalue (22 / 30 stocks have Price to Book ratio, PB < 1, some have higher quality asset such as cash, properties and equities, potential target for future acquisition).

There are 7 stocks having PB < 0.5 with 50% discount over asset but an investor must double check on quality of assets and whether the business could be sustainable to make money. If not, undervalue stock may continue to be undervalue for a long period of time, may not suitable for long term stock investing nor short term stock trading.

| No | Name | Ticker | PB = Price /NAV | ROE (%) |

| 1 | SGX | S68 | 8.06 | 35.9 |

| 2 | AMTD IB OV | HKB | 3.37 | 13.7 |

| 3 | DBS | D05 | 1.12 | 12.3 |

| 4 | ValueMax | T6I | 0.77 | 11.7 |

| 5 | Great Eastern | G07 | 1.11 | 11.7 |

| 6 | TIH | T55 | 0.48 | 11.3 |

| 7 | UOB | U11 | 0.94 | 11.0 |

| 8 | MoneyMax Finance | 5WJ | 0.74 | 10.8 |

| 9 | Maxi-Cash Finance | 5UF | 0.98 | 10.7 |

| 10 | IFAST | AIY | 3.33 | 10.6 |

| 11 | OCBC Bank | O39 | 0.88 | 10.3 |

| 12 | UOI | U13 | 1.05 | 9.7 |

| 13 | Global Investment | B73 | 0.71 | 6.2 |

| 14 | Hong Leong Finance | S41 | 0.58 | 5.4 |

| 15 | Sing Investments & Finance | S35 | 0.50 | 5.4 |

| 16 | IFS Capital | I49 | 0.42 | 5.2 |

| 17 | Hotung Investment | BLS | 0.55 | 5.0 |

| 18 | Uni-Asia Group | CHJ | 0.24 | 4.7 |

| 19 | UOB Kay Hian | U10 | 0.64 | 4.6 |

| 20 | Prudential USD | K6S | 2.59 | 4.0 |

| 21 | Vibrant Group | BIP | 0.34 | 3.8 |

| 22 | Singapore Reinsurance | S49 | 0.65 | 3.6 |

| 23 | Pacific Century | P15 | 0.74 | 3.0 |

| 24 | Singapura Finance | S23 | 0.50 | 2.9 |

| 25 | G K Goh | G41 | 0.62 | 1.9 |

| 26 | Intraco | I06 | 0.31 | 1.5 |

| 27 | B&M Hldg | CJN | 2.57 | -9.0 |

| 28 | Net Pacific Finance | 5QY | 0.68 | -9.7 |

| 29 | SHS | 566 | 0.67 | -13.6 |

| 30 | Edition | 5HG | 0.85 | -33.7 |

Based on Dr Tee criteria, from the 30 Singapore Banking & Finance stocks above, only 8 are giant stocks, some are marginal giant stocks (despite business fundamentals are reasonably good). A few Banking & Finance giant stocks were discussed with more details in Dr Tee earlier articles (see www.ein55.com/blog), eg. DBS (SGX: D05) and Singapore Exchange (SGX: S68).

Focus of this article is discussion on 6 main groups of Banking & Finance stocks in Singapore, understanding the risks and opportunities:

1) Bank Stocks

After decades of merging and acquisition, there are only 3 major local banks in Singapore: DBS (SGX: D05), OCBC (SGX: O39), UOB (SGX: U11), all are STI component stocks. Naturally, these 3 blue chip stocks become the first choice for investment in bank stocks. DBS, OCBC and UOB contribute in total to 1/3 of STI Index weightage, therefore could easily move up or down the entire Singapore stock market whenever there is major move in bank sector.

Here is a list of 30 STI component stocks sorted by size of market cap (significant contribution by 3 major bank stocks):

DBS Bank (SGX: D05), Singtel (SGX: Z74), OCBC Bank (SGX: O39), UOB Bank (SGX: U11), Wilmar International (SGX: F34), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Thai Beverage (SGX: Y92), CapitaLand (SGX: C31), Ascendas Reit (SGX: A17U), Singapore Airlines (SGX: C6L), ST Engineering (SGX: S63), Keppel Corp (SGX: BN4), Singapore Exchange (SGX: S68), Hongkong Land (SGX: H78), Genting Singapore (SGX: G13), Mapletree Logistics Trust (SGX: M44U), Jardine Cycle & Carriage (SGX: C07), Mapletree Industrial Trust (SGX: ME8U), City Development (SGX: C09), CapitaLand Mall Trust (SGX: C38U), CapitaLand Commercial Trust (SGX: C61U), Mapletree Commercial Trust (SGX: N2IU), Dairy Farm International (SGX: D01), UOL (SGX: U14), Venture Corporation (SGX: V03), YZJ Shipbldg SGD (SGX: BS6), Sembcorp Industries (SGX: U96), SATS (SGX: S58), ComfortDelGro (SGX: C52).

Most bank stocks are cyclic in nature, including Singapore and global bank stocks in US, Malaysia, Hong Kong, etc. Therefore, market cycle investing strategy is required with alignment to Optimism Strategies to Buy Low Sell High, as well as good understanding the global stock market and economic cycle. Bank sector is the key pillar of economy (business needs money to operate), therefore investment in giant bank stocks in a country with growing economy would enjoy the capital gains of prosperity (狮城财神).

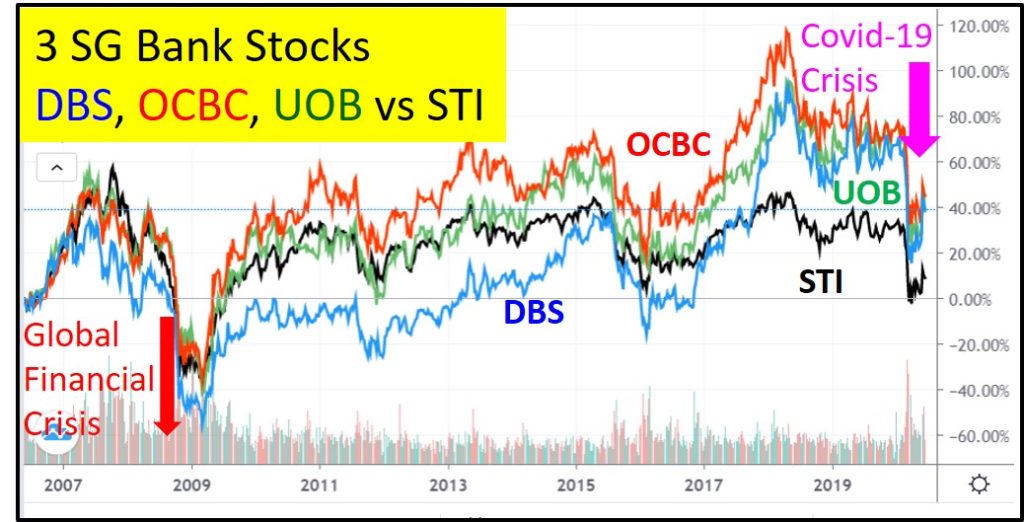

So, which of the 3 major Singapore bank stocks are better? Well, the choice is dependent on stock trading or investment strategy which is personality dependent. The historical stock price chart of DBS, OCBC and UOB with STI (could be considered with STI ETF) shows that these 4 counters are aligned in general directions in longer term.

In longer term, the differences of DBS, OCBC and UOB are mainly on pattern of stocks. DBS is the largest Singapore bank, also the most cyclic among 3 bank stocks, usually correcting more than STI during global financial crisis (eg. Year 2008-2009, falling below $10/share) and outperforming STI, OCBC and UOB during the bullish phase of economy. DBS is more suitable for cycling investing (Buy Low Sell High) and possibly momentum trading (Buy High Sell Higher) when stock market is bullish.

OCBC is the second largest Singapore bank, more defensive with less volatility in prices. OCBC is more suitable for dividend stock investor who prefers to Buy Low and Hold for a long term. So, each global stock crisis (following optimism strategies) could be an opportunity to add more position.

UOB is the smallest bank in Singapore, performance is also in between DBS and OCBC. In general, an investor may choose between DBS and OCBC and their business sizes are larger than UOB. In fact, for short term to mid term trading (months), differences of 3 major bank stocks are limited, any of the 3 bank stocks may be considered but trading rules should be followed (eg. setting S.E.T. in trading plan with Stop Loss / Entry / Target Prices) for Swing Trading or Momentum Trading.

There is no need to invest in all the 3 major bank stocks for diversification as in general, they are all relatively safer than most of the banks in the world due to tight MAS regulations for Singapore banks. Investing in a particular bank stock could be better than investing in STI ETF because bank stocks could have higher dividend yield (5-6%, depending on entry share prices) and growth are stronger than STI (which are diversified over 30 stocks, which some are weaker than DBS, OCBC and UOB).

In general, being a bank has a strong economic moat, especially in Singapore as there are limited licenses issued by government. A smart investor could become a “banker” through investing in any of these 3 major Singapore banks. Each of them has strong sponsor with decades of history in businesses, eg. DBS by Temasek, OCBC by Lee Family, UOB by Wee Cho Yaw.

So, it is possible to invest for lifetime (Buy Low & Hold for life) or even pass to next generation (eg. OCBC has nearly 100 years of history for several generations). Disruptive technology (eg. online payment or virtual bank) would have less impact on traditional bank stocks as bank sector is tightly regulated by local government due to sensitive asset of money. Bank stocks usually are more suitable as positioning as defender in a stock portfolio, more gradual growth with consistent passive income.

Due to low global bank interest rates (nearly 0 for US), the interest income would be less with lower Net Interest Margin (NIM). However, banks could still be profitable with interest income, just the return would be lower. Banks also have other businesses such as investment, credit card, insurance, wealth management, etc, which could provide non-interest income but usually would also be affected in a bearish economy. Therefore, entry with low-optimism stock price far below the fair value (following Dr Tee Optimism Strategies) is key for success in bank stocks investing.

2) Finance Stocks

Finance companies could provide similar services as banks (eg. loan & deposit) but with much smaller scale. There are a few Finance Stocks in Singapore: Singapura Finance (SGX: S23), Sing Investments & Finance (SGX: S35) and Hong Leong Finance (SGX: S41). These 3 finance stocks have reasonably good business fundamental but these 3 Singapore Finance Stocks may not be in the same grade for investing as 3 major Singapore bank stocks.

Finance stocks have relatively weaker business fundamental than bank stocks. Stock investment is always relative comparison, looking for the best, not just good or acceptable. In addition, Singapura Finance, Sing Investments & Finance and Hong Leong Finance are less well known, therefore lower confidence by customers (to deposit money) and investors (to invest in finance stocks).

Hong Leong Finance has a strong sponsor of Kwek Leng Beng (Hong Leong Group Singapore / City Development – SGX: C09). However, its cousin (Kwek Leng Chan of Hong Leng Group Malaysia) stock of Hong Leong Bank (Bursa: 5819) would be a much better choice between 2 stocks as 1 is finance stock, 1 is bank stock with strong business fundamental. Details of Quek / Kwek family of stocks are described by Dr Tee in earlier article (https://www.ein55.com/2020/05/15-hong-leong-group-and-kwek-family-stocks/).

In short, a stock investor may ignore weaker Finance Stocks, aiming for stronger Bank Stocks directly, considering both the stock and business performance, especially for lifetime investing. For shorter term trading, it is possible to consider Finance Stocks if there are positive signals in this group.

3) Insurance Stocks

There are a few Insurance Stocks in Singapore: Great Eastern (SGX: G07), Prudential (SGX: K6S), UOI (SGX: U13), Singapore Reinsurance (SGX: S49) and other stocks which provide partial services on insurance. These 4 Singapore insurance stocks have good business fundamental but only 2 are considered giant stocks (based on Dr Tee criteria) worth longer term investing.

Usually insurance companies are also suitable partner for banks, eg. Great Eastern is under OCBC, UOI is with UOB, LPI (Bursa: 8621) is with Public Bank (Bursa: 1295), etc. This way, similar pool of clients in both banks and insurance groups may be approached with higher chance of success. A stock investor may choose to invest directly in subsidiary (insurance stock) or indirectly through parent stock (bank which has partial business in insurance), if both are giant stocks, the choice is dependent on own personality and pattern of stock.

Confidence in business stability is important for an insurance client (to ensure compensation would be received if any misfortune based on agreement). Therefore, a reputable insurance brand with decades of business history (supported by strong sponsor) is crucial.

There are only 2 business sectors almost guaranteed to make money in long term: Insurance and Casino (eg. Genting Singapore, SGX: G13) as they apply probability in business to make money. It is possible for unexpected hurricanes to destroy houses, US insurance companies (including Warren Buffett’s Berkshire, NYSE: BRK) could suffer losses in 1 particular year. However, past statistics (eg. accident rates in driving, Covid-19 risks, etc) would help to naturally adjust the future premium. If there is a need, resinsurance company could help to share the risks of primary insurance company. Similarly, a stock investor should apply probability investing in making decision of What Stocks to Buy, When to Buy / Sell.

However, insurance business requires customer interactions, eg. meet-up before a policy may be eventually signed. During Covid-19 with global lockdown, both banks (eg. wealth management) and insurance companies suffer due to less chances to meet-up with customers. Due to less income from Great Eastern (subsidiary), parent company OCBC reported 40% less income in Q1/2020. However, insurance sector could recover with restart of economy which allows social interaction for businesses.

4) Stock Broker Stocks

There are a few Stock Brokerage related Stocks in Singapore: Singapore Exchange, SGX (SGX: S68), UOB Kay Hian (SGX: U10) and IFAST (SGX: AIY) are listed in SGX. CGS-CIMB is a joint venture with 2 overseas parent stocks from China and Malaysia: China Galaxy Securities, CGS (HKEx: 6881) and CIMB (Bursa: 1023). Maybank Kim Eng has a parent company in Malaysia, Maybank (Bursa: 1155).

These 6 Stock Brokerage related stocks and parent stocks have good business fundamental but only 3 of them are giant stocks (including Singapore Exchange, SGX, details were given in earlier Dr Tee article: https://www.ein55.com/2020/05/5-global-stock-exchanges-stocks/).

Due to relatively low stock volume in Singapore stock market (except during bullish market or stock crisis time), stock broker stocks with only stock trading business has limited profits when stock market is “quiet” with little price volatility (eg. STI has been ranging around 3000 +/- 300 points over the past 10 years). Only when stock market is very bullish (eg. crazy bull in Years 2000 and 2007) or during global stock crisis (eg. dumping of stocks in Years 2008-2009 and Mar 2020), then stock volume would be relatively higher.

At the same time, Singapore Exchange has more products (stocks and derivatives) for local and overseas customers with profitable monopoly business (unless stock brokers have to compete for similar business of stock trading, lowering commission to gain business but lower profit margin). Singapore has relatively smaller market with less number of traders and investors with more stable (“quiet” market), therefore stock brokerage could become part of a parent company business, may not be the main business to remain profitable. For example, UOB Kay Hian is with UOB group, could also be integrated with UOI (insurance) business with sharing of similar pool of potential clients. So, an investor may invest directly in more profitable parent stock if subsidiary stock (eg. stock brokerage) is playing supporting role with less income.

IFAST is a relatively young stock with strong business fundamental. In fact, stock brokerage business is considered bonus for IFAST as its main business is on fund management which itself could grow naturally (high recurring incomes) yearly with compounding effect. Similarly, the integrated business of fund, stock, insurance, bond, etc, giving an edge to IFAST business. IFAST has high potential with overseas business expansion and even bidding for virtual bank license in Singapore (but intense competition). The main weakness of IFAST is that it is a younger player, therefore relatively less well known among the investors, resulting in “undervalue” share prices, not aligned with its business performance.

5) Pawnbroker Stocks

Interestingly, there are only 3 stocks in Singapore having the name “Max” and all are Pawnbroker Stocks: ValueMax (SGX: T6I), Maxi-Cash Finance (SGX: 5UF), MoneyMax Finance (SGX: 5WJ). Pawnbroker is a special “Finance” stock as it provides easy way of loan, especially to needy people who may not get the loan easily from banks.

A pawnbroker stock has pawnshops that offer secured loans to people, with valuables (eg. gold, silver, jewelry, coins, luxury handbags, etc) used as collateral. If an item is pawned for a loan, within a certain contractual period of time, the pawner may redeem it for the amount of the loan plus some agreed-upon amount for interest. If the loan is not paid (or extended, if applicable) within the time period, the pawned item will be offered for sale to other customers by the pawnbroker.

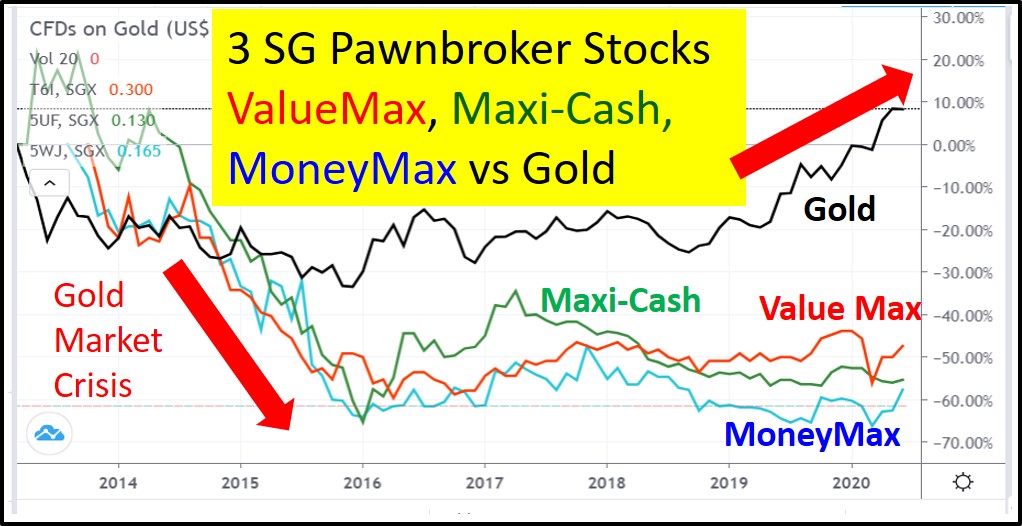

Since gold or related jewelry is a common valuable as collateral for loan, the “value” of pawnbroker stock would partly related to gold prices. After reaching high optimism, gold market started to from about US$1900/oz in Year 2012 to US$1000+/oz in Year 2016, then recovering gradually to current price of US$1700+/oz in Year 2020. The chart below shows the correlation of falling in gold price and stock prices of ValueMax, Maxi-Cash and MoneyMax which has weaker business fundamental during this period of time (clients or pawners may choose not to redeem the gold as prices have been falling in these 4 years from 2012 o 2016), holding to assets which are declining in values.

However, gold started to become bullish from Years 2016 to 2020, business fundamentals of all 3 pawnbrokers (ValueMax, Maxi-Cash and MoneyMax) have improved significantly. However, the rising of gold price with strong business fundamental do not help much on their share prices, simply changing from downtrend to sideways. In fact, all 3 pawnbroker stocks also pay dividend like bank stocks, having high dividend yield now: 5% for ValueMax, 10% for Maxi-Cash and 65 for MoneyMax. However, the catch is an investor would suffer high capital losses due to “undervalue” or downtrend prices (correcting over 50% since IPO, even continue to underperform after business fundamental is improving). Despite the business fundamental is good, pawnbrokers stocks are not suitable for dividend investing due to inconsistent share prices.

The divergence between business and pawnbroker stocks prices may partly due to uncertain gold prices (which crashed before in the past) and also there are better choices for investment in Singapore bank stocks which are more predictable and “safer”. Lack of confidence and little knowledge in pawnshop business may deter potential investors from supporting their share prices.

So, these 3 pawnbroker stocks may not be suitable for investing due to misalignment between business and stock performance. Even during the bullish period of gold, pawners may choose to redeem the collateral (if containing gold), then pawnbrokers would just gain the interests. The 3 pawnbrokers stocks have many branches with relatively high level of debt over asset (a form of leveraging), therefore this business model is not as safe as bank or even traditional finance stocks.

6) Investment and Other Stocks

The remaining Singapore Banking and Finance stocks are mostly related to investment holding, fund management or other diversified businesses. These are some of the investment holding stocks: Hotung Investment (SGX: BLS), G K Goh (SGX: G41), Global Investment (SGX: B73), TIH (SGX: T55) and IFS Capital (SGX: I49). However, most of these stocks have weaker business fundamental, especially if the investment portfolio of companies may not perform during global stock crisis.

Hotung is an undervalue stock (Price-to-Book ratio, PB = 0.55) with stable profitable business (venture capital). It may be considered mainly for medium term dividend investing (about 7% dividend yield) but growth is limited if holding for long term. The company has no debt but undervalue business behave as those undervalue property stocks, safe but slow.

=====================================

If you feel there are too few Banking & Finance Stocks in Singapore (only 8 are giant stocks), then you may consider over 1500 global giant stocks in the world, some are much stronger bank stocks than DBS, OCBC and UOB. Learn to form a Dream Team stock portfolio with 10-20 global giant stocks from over 3 sectors and 3 countries, aligning the strategies with own personalities.

Drop by Dr Tee free 4hr investment course to learn how to position in global giant stocks with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Learn further from Dr Tee valuable 7hr Online Course, both English (How to Discover Giant Stocks) and Chinese (价值投资法: 探测强巨股) options, specially for learners who prefer to master stock investment strategies of over 100 global giant stocks at the comfort of home.

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 9000 members.