Parents are our best role models for life including investing. Dr Tee will share in this article, both valuable life principles learned from his father (who passed away recently) and also a lifetime investing strategy with 100% success rate practiced by his parents, applicable in both stock and property markets.

Bonus is Dr Tee Grandparents Crisis Investing Strategy for reader who could patiently read the entire article. This investing strategy is proven over 3 generations of Dr Tee family over the past 100 years.

Many people hope to learn a “sure-win” investing strategy. For most practical considerations, there is a certain probability of success for each stock trading or investing strategy but rarely could achieve 100% success rate.

Dr Tee parents have a remarkable achievement to have 100% winning record in both stock and property investment consistently over the past few decades. This lifetime investing strategy may not be suitable for everyone, requiring alignment of similar personality as Dr Tee parents. Let’s learn the details here.

Some people may change mind easily, even for a good investment (stock or property), if the market prices fall down significantly, some may end up sell low with losses under tremendous fear. Alternatively, some people could hold an investment for long term, even over a lifetime but due to declining businesses, suffering permanent losses over time.

Dr Tee parents’ “Sure-Win” Strategy is simple but only if one could align with similar personality (work hard + take right investment action). Here are the 3 main steps:

1) What to Invest

For stock investment, Dr Tee parents prefer giant stocks from country stock index component, especially those with strong business fundamental stocks with good track record (both capital gains and dividend payout) over the past decades.

Property (house or land with high quality asset) by default is a giant, therefore also a key option for their investment. Their main source of investment knowledge was through reading local newspaper investment articles and discussion with friends having similar interest.

This “100% winning” strategy requires support of a portfolio of giant stocks (reviewing giant stocks status yearly for possible change in business fundamental). Many giant stocks could be found in a country stock index. For example, these are 30 STI component stocks, could be a possible starting point for lifetime investing for an investor in Singapore:

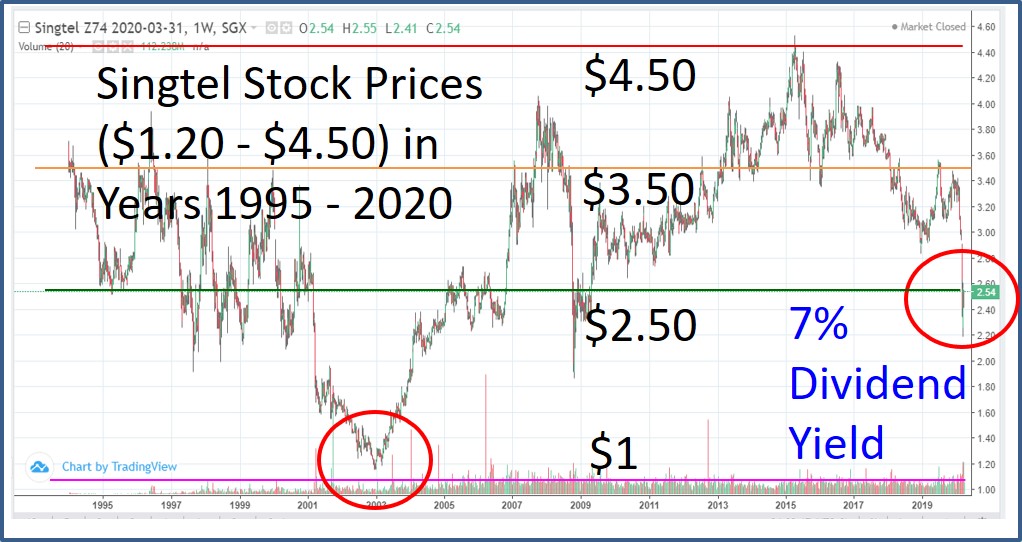

DBS Bank (SGX: D05), Singtel (SGX: Z74), OCBC Bank (SGX: O39), UOB Bank (SGX: U11), Wilmar International (SGX: F34), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Thai Beverage (SGX: Y92), CapitaLand (SGX: C31), Ascendas Reit (SGX: A17U), Singapore Airlines (SGX: C6L), ST Engineering (SGX: S63), Keppel Corp (SGX: BN4), Singapore Exchange (SGX: S68), Hongkong Land (SGX: H78), Genting Singapore (SGX: G13), Mapletree Logistics Trust (SGX: M44U), Jardine Cycle & Carriage (SGX: C07), Mapletree Industrial Trust (SGX: ME8U), City Development (SGX: C09), CapitaLand Mall Trust (SGX: C38U), CapitaLand Commercial Trust (SGX: C61U), Mapletree Commercial Trust (SGX: N2IU), Dairy Farm International (SGX: D01), UOL (SGX: U14), Venture Corporation (SGX: V03), YZJ Shipbldg SGD (SGX: BS6), Sembcorp Industries (SGX: U96), SATS (SGX: S58), ComfortDelGro (SGX: C52).

For different country, an investor may start with local stock indices with component stocks, eg. 30 KLCI stocks, 50 HSI stocks, 30 Dow Jones stocks, S&P 500 stocks, 50 SSEC stocks, Top 10 largest NASDAQ stocks, etc. Subsequently, analyze business fundamental and other critical criteria for giant stocks. Here is a list of 30 Malaysia Bursa KLCI Index component stocks which may be considered for Malaysia stock investors:

CIMB (Bursa: 1023) CIMB GROUP HOLDINGS BERHAD, DIALOG (Bursa: 7277) DIALOG GROUP BERHAD, DIGI (Bursa: 6947) DIGI.COM BERHAD, GENM (Bursa: 4715) GENTING MALAYSIA BERHAD, GENTING (Bursa: 3182) GENTING BERHAD, HAPSENG (Bursa: 3034) HAP SENG CONSOLIDATED BERHAD, HARTA (Bursa: 5168) HARTALEGA HOLDINGS BERHAD, HLBANK (Bursa: 5819) HONG LEONG BANK BERHAD, HLFG (Bursa: 1082) HONG LEONG FINANCIAL GROUP BERHAD, IHH (Bursa: 5225) IHH HEALTHCARE BERHAD, IOICORP (1961) IOI CORPORATION BERHAD, KLCC (Bursa: 5235SS) KLCC PROPERTY HOLDINGS BERHAD, KLK (Bursa: 2445) KUALA LUMPUR KEPONG BERHAD, MAXIS (Bursa: 6012) MAXIS BERHAD, MAYBANK (Bursa: 1155) MALAYAN BANKING BERHAD, MISC (Bursa: 3816) MISC BERHAD, NESTLE (Bursa: 4707) NESTLE MALAYSIA BERHAD, PBBANK (Bursa: 1295) PUBLIC BANK BERHAD, PCHEM (Bursa: 5183) PETRONAS CHEMICALS GROUP BERHAD, PETDAG (Bursa: 5681) PETRONAS DAGANGAN BHD, PETGAS (Bursa: 6033) PETRONAS GAS BERHAD, PMETAL (Bursa: 8869) PRESS METAL ALUMINIUM HOLDINGS BERHAD, PPB (Bursa: 4065) PPB GROUP BERHAD, RHBBANK (Bursa: 1066) RHB BANK BERHAD, SIME (Bursa: 4197) SIME DARBY BERHAD, SIMEPLT (Bursa: 5285) SIME DARBY PLANTATION BERHAD, TENAGA (Bursa: 5347) TENAGA NASIONAL BHD, TM (Bursa: 4863) TELEKOM MALAYSIA BERHAD, TOPGLOV (Bursa: 7113) TOP GLOVE CORPORATION BHD.

2) When to Invest

Dr Tee parents only have middle-class income from active jobs, which salary in cash would depreciate over time. When they got married about 60 years ago in Muar (a small town in Johor of Malaysia), both were having little starting capital. Since young, over 4 decades of working hard, they would gradually convert the cash saving into another form of “fixed deposit” through purchases of stocks (both private and public listed companies) and properties (houses and plantations), which could generate passive incomes (eg. stock dividends and property rentals, much higher than bank interest rates) and consistent growth with enormous capital gains.

Besides regular conversion of cash into saving (spending very little on themselves, saving every dollar possible for family with 4 children), later into stocks or properties, Dr Tee parents would invest more during financial crisis, especially when they observed the stock index (eg. KLCI Index as they live in Malaysia) was at relatively low level or when there was special sales of house or land below the market prices.

Dr Tee parents worked very hard (like a habit) for whole life, even after they have retired, could not rest well for 1 day, must find something to do each day in kampung. To them, this is their ideal lifestyle to keep busy (but not stressful) each day. Dr Tee wished they could be more relaxed but looking back now, this could be blessing in disguise as some retirees who relaxed too much, may age even faster.

3) When to Sell

Most of the time, Dr Tee parents would not sell stocks or properties, keeping them long term over lifetime, collecting both passive incomes (which can be used for family expenses or reinvest again) and capital gains. Sometimes when stock index or investment is at high optimism level, they would sell but most of the time, they would simply ignore them, keeping as “fixed deposit” which could compound each year for decades through stocks and properties. Apply this simple method of investing (buy stocks as if property for many generations to stay) on giant stocks, naturally the success rate is 100% over the decades, overcoming all the stock “crisis” eventually.

In a certain period of time for about 10 years, due to high cost to support 4 children (Dr Tee and 3 siblings) university education in US (ringgit was weak vs USD), they decided to sell significant private shares of palm oil plantation (with many times of capital gains). This was rare for them to sell properties or stocks to convert back into cash but children (especially education) are their most important goal in life. They strongly believe that knowledge is the best investment to generate more wealth (eg. with a better job) to support a better future life.

Dr Tee parents were working very hard, saving almost every dollar they could during this period, spending very little on themselves, saving and then investing mainly to provide additional financial shield for children. History seems to repeat itself, it is turn for Dr Tee to do similar planning for family with children. However, Dr Tee could still have reasonable spending (disagree with parents who almost did not spent much on themselves) as children should also work hard to enjoy fruits of life with own creation of wealth. This way, the “shield” contributed by each generation could be compounded to protect against a major future crisis. If not, wealth could not last through 3 generations with spending alone.

Financial literacy could be the best gift for any young generation. Dr Tee is amazed that a few Ein55 graduates are as young as 14 years old (learning together with parents), could understand and apply value investing principles. With compounding return of many decades to come, knowing what giant stocks to invest, these young learners main goals would be to work hard and save more for capital to start the first investment of life one day.

This “Buy Low and Hold” strategy for long term or even lifetime suit Dr Tee parents personalities. Some people may not have patience to hold or wish to sell earlier for capital gains to enjoy life, therefore missing the natural compounding growth of giant stock or property, hedging against inflation. To maximize the compounding over lifetime, one has to start investment younger. Assuming 50 years of lifetime investing (eg. 30 to 80 years old) with average of 10% growth rate, capital gains could be as high as 1.1^50 = 117 times. Even with a minimal 5% growth rate over 20 years (eg. 40 to 60 years old when retiring), capital gains could be 1.05^20 = 2.65 times.

So, this “sure-win” strategy could be very simple (tested over 100 years with 3 generations) but could be very tough as some people may not able to make sacrifice in life (eg. not willing to invest in oneself to enhance knowledge in own profession or investment), simply wait for gift to drop from heaven (most of the time are speculative news, ending up with big losses). So, heaven is fair, usually reward those who work hard and follow the right path of investing, even if one forgets about making money one day (eg. Buy Stocks / Properties and Forget), hidden fortune would appear naturally one day when needed.

So, the secrets of making money in investment is not to think of making money, just do the right proven actions, eg: investing over a portfolio of 10-20 giant stocks, buying more during financial crisis, holding long term, then the compounded return would come naturally one day.

My Father Story

Similar to investment, life also has its own cycle. My father (Mr Tee Ching Sin, 郑清森) passed away peacefully recently due to natural aging. Over the past 10 years, this has been my biggest worry to receive unexpected call from parents in Malaysia which could be potential sad news. The day still comes with expected call when I was halfway conducting a Zoom coaching class, need to hold my tears to complete the program as this is a commitment, a value shared by my father.

When I observed my parents have been getting older each year, I started to slow down the pace of my work or interest in investment education (used to work 365 days a year, 7 days a week, working nearly all the time), visiting them more often in Malaysia over the past few years. Each time when I said farewell to them when returning to Singapore, I was thinking could this be the last time we meet in life.

More importantly, my father has taught me many positive values in life (not just making money with investment), setting an excellent example with his whole life. Despite he has left the world, sometimes I could still “hear” his voices which is embedded in the subconscious mind (similar to Artificial Intelligence, AI). This is how a “spirit” or family value could be transmitted between the generations.

Similarly, I often use “Dr Tee” as third person narration when teaching investment knowledge to students or writing articles (eg. Dr Tee aims for “giant stocks”, investing when giant is falling during crisis, etc), hopefully this could help to form positive habits of investment in a faster way with AI into their minds when they hear “Dr Tee voices” in their subconscious mind one day.

This article is a special tribute to my father, a short summary of his successful life, not only with “sure-win” investing strategy and hardwork over lifetime, but also for his selflessness to think of family first. It is a regret that there is travelling restriction to Malaysia during pandemic (requires 14 days quarantine), together with 2 other siblings living outside Malaysia, we join the online ceremony to pay the last respect to our father.

My father dedicated his whole life for family but reward little to himself. During his funeral ceremony today, I have shared my feeling remotely in Chinese (you may use google translator if needed) to him:

爸爸,您是我们心目中,敬重的父亲。

您的3个孩子,姐姐,二哥和我,身在海外,因为疫情的情况下,国家限制旅游,不能回来尽孝,我们庆幸过去与您保持密切联系,亲情永在,不限一时。

爸,身为您的儿女与亲友们,舍不得与您告别。

纵然您已离开尘世,浩瀚宇宙中遨游,您不朽的精神,将永远留在我们心里。

爸爸,多谢您一生无私的付出,栽培了我们四个孩子,海外留学,开阔视野。教育是您留给我们最珍贵的资产,我们也继承了您的精神与理念,与后代分享。

年轻时,为了给家庭增强经济后盾,您毅然放下教鞭,从事繁重的经商活动,过度劳累,透支身心。晚年时,纵然行动不便,您意志顽强,坚持独立活动,心灵手巧,甚至到人生最后一刻。

言传不如身教,您是我们的人生楷模。我们从中观察,学习宽容待人,刻苦节俭,不畏失败,活出自我。孩儿东渊记得,曾经问您为何不多花一分钱在自己身上,却慷慨帮助孩子们与他人。您说人生已无遗憾,家人安康就是最大的满足。

爸爸,请您放心,我们会照顾好妈妈。 您的一生是成功的, 无憾无悔,不枉此生。我们衷心感激您为家庭的无偿付出。

爸爸,愿您一路走好,我们爱您,永远怀念您。

Suddenly, I remember this old song by Taiwanese singer (高凌風 – 牽不住你的手, “Could Not Hold Your Hands”), now finally I could understand the meaning as he wrote this song when losing his father many years ago: https://www.youtube.com/watch?v=xQmQllux1bo

I was hoping to hold my father hands for the last time. I tried to appeal to Malaysia High Commission in Singapore by queuing up before 8am (hope to enter Malaysia without quarantine if pass COVID test in 1-2 days) but standard answer was to fill in online form (which has no option of funeral, mainly ask to sign to agree to pay for 14 days quarantine in hotel after entry to Malaysia with on-site test) and wait for reply which response time is not guaranteed. I sadly called ICA of Singapore for help (hoping there is some special agreement between 2 countries on travelling for special case of funeral, not just on businesses), standard answer is entry to Malaysia depends on Malaysia policy. So, the recent bi-lateral “Reciprocal Green Lane” may not have considered hundreds of thousands of citizens with close elderly family members in both countries (Singapore and Malaysia were 1 country before, hard to separate families apart with a political border). COVID-19 crisis is not only a health and financial crisis, may also be a family crisis.

I am relieved that online technology (Whatsapp Group Video) has helped to lessen this potential biggest regret in my life. My siblings and I who are abroad Malaysia could follow entire funeral ceremony remotely in an interactive way, praying and talking to my father who rest peacefully, knowing all his children would get united again regardless of obstacles. Except I could not hold my father hands anymore.

I remember a unique subject studied in university time in US several decades ago: “On Death & Dying”. The funeral services are not just for the deceased, also for those who are alive to heal their wounds in heart. It is a way to accept and adjust to new norm in life without the loved one (switching connection from physical to spiritual).

Looking back, I believe my father may have special plan in choice of timing to depart us (knowing that I would try different ways to get there to see him for the last time). Perhaps this was his intention not to trouble 3 of children abroad, not to take any risk in travelling. If so, I may need to thank the authority with hard rules for helping my father to achieve his final wish to help family again.

Father, please Rest in Peace. The best way to repay your kindness in lifelong support is to maximize values of my own life which I promise won’t disappoint you!

Dr Tee’s Grandparents Story

In fact, Dr Tee parents also learned from their parents who have similar personality of working hard, despite low income but knowing how to invest to improve on quality of life. Dr Tee grandparents were very poor (not having any formal education, could only do lower income work) when first came from China to Malaysia nearly 100 years ago.

After many years of working and saving little by little, Dr Tee grandparents grabbed the rare opportunity of Japanese occupation time (1940s) to use life saving in “banana money” to buy a small piece of land with rubber plantations at very low price (a form of crisis investing during World War II), holding for 80 years till today with about 2000 times capital gains.

Many people lose money in saving cash when Japanese “banana money” became zero value overnight but Dr Tee grandparents converted the cash (paper value) into land (high quality asset), therefore reversing the family poverty destiny, converting crisis into opportunity. With the first foundation (plantation could generate incomes), they continue to improve family financial condition with more purchases of land with hard earned savings (but similar crisis of low land price was only once a lifetime).

Dr Tee grandparents success (hardwork with special help of crisis investing in property) has changed the future of Tee family (from poor to middle class). This inspired Dr Tee parents to follow similar track of working hard and invest when young (but extending from properties to stocks). Crisis investing of high quality assets at low price is a high probability of winning if one has holding power.

Similarly, the success of last 2 generations has motivated Dr Tee to study hard (aiming for highest educational level of PhD), then work hard to achieve the career goals (climbing ladder till VP in corporate world, then CEO of own company after becoming financial free) and extending investment from long term investing to short term trading, developing an universal way of “Buy Low Sell High” with Ein55 styles of investing for stocks, properties, bonds, commodities and forex.

Dr Tee owes the current success (both personal life and investment) to contribution of 3 generations of Tee family over the past 100 years. The same principles of life (work hard with simple life) are not just passed to 4th generation but also shared with over 3000 Dr Tee graduates and over 300,000 public audience over the past 10 years.

Even if you not Tee family member, could you duplicate this simple secret of success in life with “Sure-Win” strategy? Answer is yes but not everyone could do it. A person must be willing to have a determination of working hard (or study hard in early age) for life, spending little on oneself, converting saving into higher growth investment with a portfolio of giant stocks or properties, investing more during financial crisis time, then holding for high growth over lifetime.

If you could read every word of this article until this here, you have the potential to be the first generation of your family to inspire future generations for another 100 years (百年树人)!

=================================================

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar.

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Mall Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com