Temasek stocks of Sembcorp Industries SGX: U96, parent stock) and Sembcorp Marine (SGX: S51, subsidiary stock) just announce 2 bundled corporate actions of rights issue for Sembcorp Marine and then demerger from Sembcorp Industries. In this article, Dr Tee will compare both Sembcorp stocks and share the possible causes and effects of such actions with deeper analysis.

Recently, Temasek stock of Singapore Airlines, SIA (SGX: C6L) just completed the rights and mandatory convertible bonds (MCB) issues to inject extra capital to save the company from Covid-19 crisis encountered in airlines sector with over 90% drop in number of flights. Temasek would become the sponsor to take up additional rights and bonds if not taken up by other shareholders.

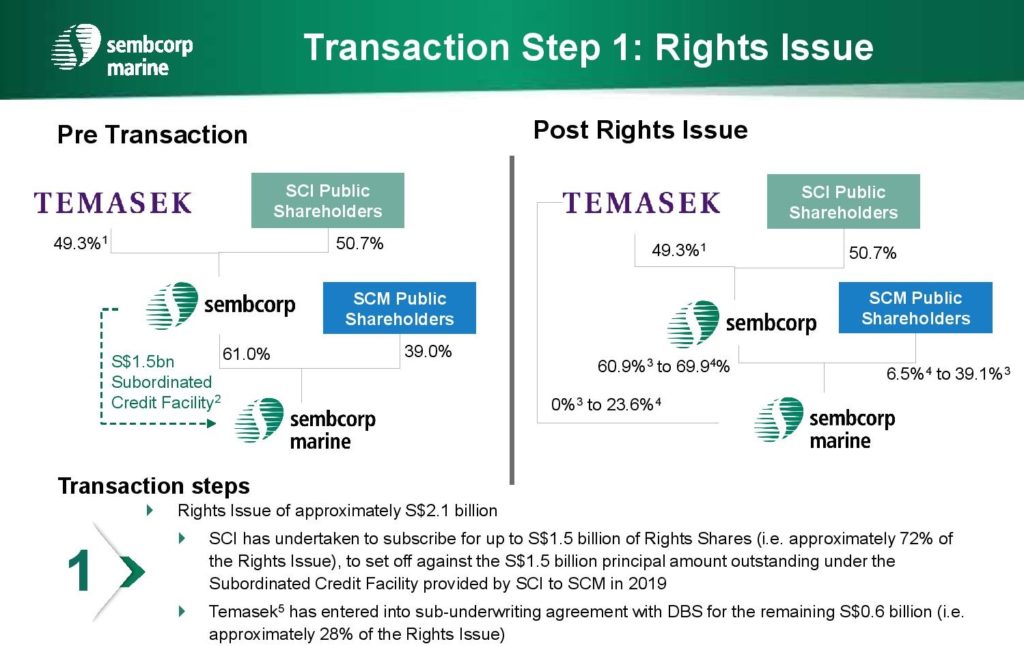

Temasek may have modified the “rescue” recipe for another company (Sembcorp) which need helps under both Covid-19 and Crude Oil Crises. Temasek owns 49.3% of Sembcorp Industries, a parent stock which subsequently owns 61% of Sembcorp Marine from oil & gas sector (see diagram).

The proposed corporate actions are bundle of 2 actions (see diagram), requiring both to pass together to be effective. Sharing here are for educational purpose, please make your own decision in investment.

1) 5-for-1 Rights Issue for Sembcorp Marine

There are a few ways to “borrow money” for a business, eg. borrowing from banks or issue bonds but this would increase the debt level (both Sembcorp Industries and Sembcorp Marine have relatively high level of debt over asset) and additional cost to business with interest of loans. Therefore, an alternative way is to “borrow” money from shareholders through rights issue as this strategy would not increase the debt level and no interest is required. However, if shareholders don’t welcome this move (may be under pressure to invest with new capital), they may reflect the negative sentiment with lower share prices which affect the market cap of company or hidden wealth of shareholders.

Sembcorp Marine hopes to raise S$2.1 billion under 5-for-1 renounceable rights issue at an issue price of $0.20 per share. Based on recent average price of $0.74 for Sembcorp Marine, the theoretical ex-rights price (TERP) is

TERP = [($0.20 x 5) + ($0.74 x 1)] / 6 = $0.29/share

Since the rights are renounceable (similar to previous SIA rights), current shareholders of Sembcorp Marine may either accept the rights (requires extra cash to invest more on this stock) or they could simply sell the rights in stock market at later stage if action is approved.

Action of rights issue is a neutral corporate action, there is no right or wrong, decision partly depends on how the new capital is used (eg. paying debt, saving company or expanding the business, etc) and also whether a stock has strong business fundamental or strong sponsor. Similar to SIA, Sembcorp Marine needs additional capital to cope with the current crisis which is even worse, not limited to shorter term Covid-19 crisis (affecting most sectors) but also longer term oil & gas crisis with bearish crude oil price (affecting most oil & gas companies, including Sembcorp Marine and Keppel Corp, SGX: BN4).

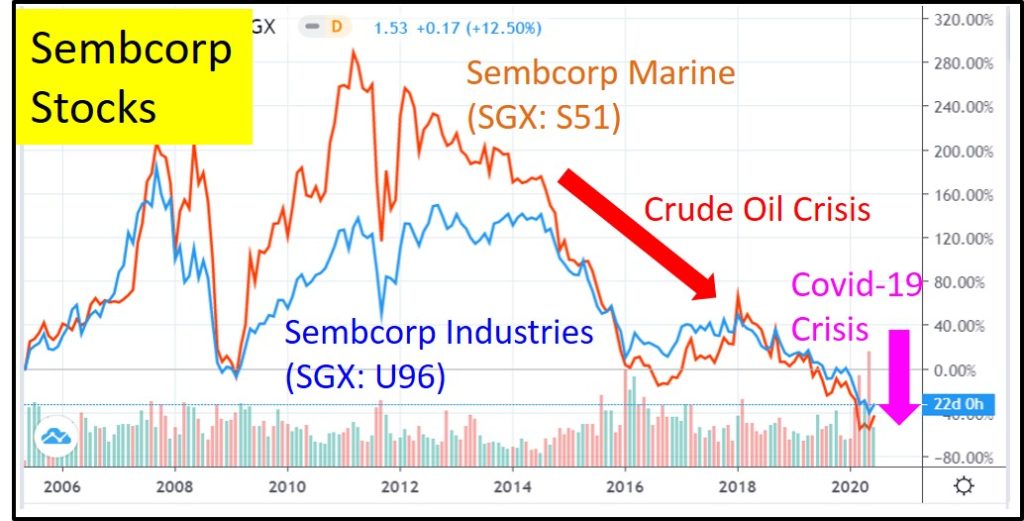

When crude oil market was bullish 10 years ago, Sembcorp Marine and Keppel Corp were still giant stocks, doing well with growing businesses. However, when crude oil price dropped from over US$100/barrel since Year 2015 to less than US$50/barrel over the past few years, businesses of Sembcorp Marine and Keppel Corp (business segment of Keppel O&M) turn to negative, becoming losses.

Sembcorp Marine revenue size is about 1/3 of Sembcorp Industries, seriously affecting the earnings of parent company, which could still remain profitable with support of other business segments (energy/utilities and urban) but it has been weaker over the past 5 years. Keppel O&M (not listed) also contributes to most losses of Keppel Corp which is mainly supported by property segment. Due to prolonged oil & gas crisis over the past 5 years, these 3 Temasek stocks have lost the titles of giant stock (based on Dr Tee criteria): Sembcorp Industries, Sembcorp Marine and Keppel Corp.

Therefore, as a stock investor, decision of whether to take up rights issue is similar to additional investment, whether Sembcorp Marine worth investing. Currently crude oil market is still at low optimism but it is on recovery phase. It might take a few years for customers (oil producers) of Sembcorp Marine and also Keppel Corp (Keppel O&M) to become profitable and increase the capital investment. So, the cold winter of business might be much longer for Sembcorp Marine and Keppel O&M which could be a stopper for recovery of share prices despite at low optimism level.

Besides accepting / selling rights issue, current shareholders also have the option to sell the stock before corporate actions (but price may correct down if mass market views the action negatively). If the action is “Sell”, a shareholder may not suffer permanent loss if knowing how to “Change Horse”, use the remaining capital (after selling) to “Buy” an oil & gas giant stock or even a non-crisis giant stock on the same day. During oil & gas crisis period of last few years, a few oil & gas companies actually profit from the crisis, eg. those related to oil storage.

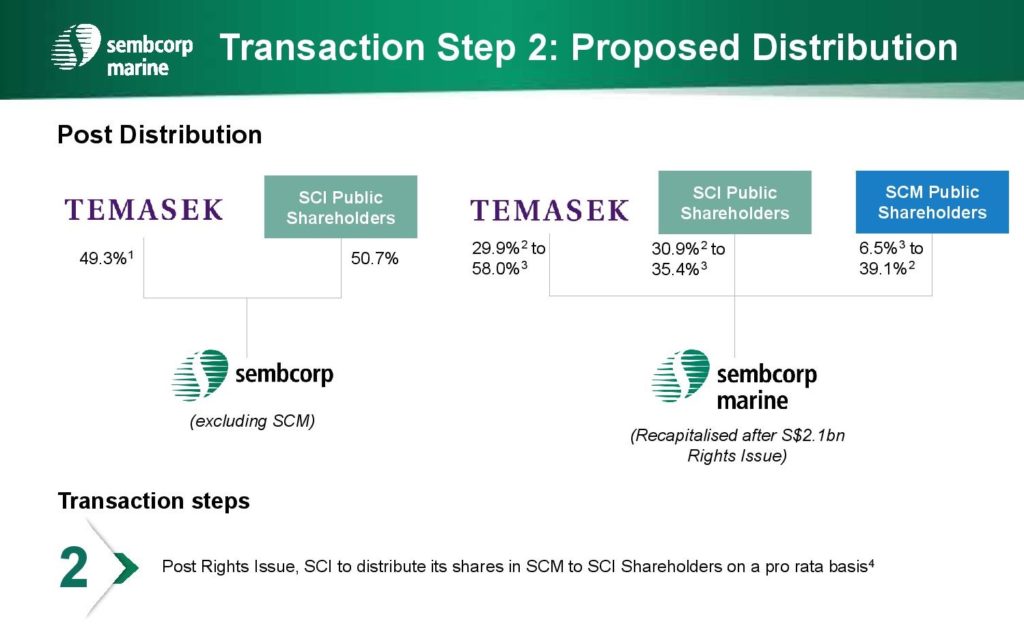

2) Demerger of Sembcorp Industries and Sembcorp Marine

Although Sembcorp Marine is only a subsidiary of Sembcorp Industries with 1/3 revenue but it contributed to most of the losses of parent company. From the chart below, it is shown that over the past 14 years (since 2006), both Sembcorp Industries and Sembcorp Marine behave more like siblings (难兄难弟), instead of parent-subsidiary relationship, having very close long term stock price trends (key difference is Sembcorp Marine is more volatile than Sembcorp Industries).

This implies 1/3 business connection of 2 Sembcorp stocks have contributed to nearly 90% strong correlation in share prices. Therefore, the proposal of demerger of 2 stocks would help Sembcorp Industries more in longer term. Sembcorp Industries shareholders would get compensation through dividend stocks of between 427 and 491 Sembcorp Marine shares for every 100 Sembcorp Industries shares owned. After demerging, since there is no connection in business, Sembcorp Industries would become more profitable (growing earnings contributed by energy/utilities and urban business segments) without affected by possible losses of Sembcorp Marine. Currently, Sembcorp Marine is as if a negative asset (contributing to losses) to Sembcorp Industries, therefore if parent company could sell away with some compensation, this would help Sembcorp Industries become a giant stock again.

After demerger, Temasek would become direct sponsors (major shareholder) for both companies which would become siblings or even cousins in Temasek family of stocks. The future losses of Sembcorp Marine would be sustained partially by Temasek, not by Sembcorp Industries anymore. In fact, energy/utilities (gas / power / water / waste / renewable energy) business of Sembcorp Industries are defensive in nature, would support the future share prices of “new” Sembcorp stock without “Marine” business segment. The smaller “Urban” segment (land and property development) is only 3% of company revenue but contributes to about 25% of company profits, a highly potential segment to grow further when “burden” of Marine is put aside.

To be fair to Sembcorp Marine, it is a stock with high potential but currently more suitable as crisis stock investing, implying if the potential losses in next few years could be sustainable (partly with help of rights issue), when crude oil price may be back to high optimism as 10 years ago, then Sembcorp Marine could outperform Sembcorp Industries.

Therefore, after demerging, both Sembcorp stocks would be clearer in personalities with more unique businesses. Sembcorp Industries would be mainly suitable for gradual growth, defensive investor. Sembcorp would be more for crisis stock investor who view high volatility (both potential high losses and high gains) as main driver for capital gains. Of course, a stock investor also has the option not to consider either Sembcorp stocks by selling them or not considering at all.

=====================================

Current Sembcorp Industries and Sembcorp Marine shareholders have to make a few decisions in the next few months. With support of Sembcorp Industry as major shareholder, likely the rights issue of Sembcorp Marine could be approved. However, this action is conditional based on the approval by both Sembcorp Marine and Sembcorp Industries for the other action, acceptance of demerger of 2 companies, which both Sembcorp Industries and Temasek would abstain from voting.

In short, the bundled corporation actions ultimately depend on minority shareholders for approval, therefore it is fair from democracy point of view. After excluding Temasek and Sembcorp Industries which are 50-60% ownership in both stocks, remaining minority shareholders are scattered (some are big funds), a simple majority >50% votes is required for both companies to approve the entire package.

Therefore, it may be similar to an election process, hard to predict the outcome unless there is alliance or rally among the minority shareholders. When 1 “party” feels in disadvantaged position, it may not approve, then whole deal would fail.

There are at least 26 Temasek / GLC stocks in Singapore including Sembcorp Industries and Sembcorp Marine, controlling shareholder with 15% or more ownership directly or indirectly:

Singtel (SGX: Z74), DBS Bank (SGX: D05), ST Engineering (SGX: S63), SIA (SGX: C6L), SIA Engineering (SGX: S59), SGX (SGX: S68), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Sembcorp Marine (SGX: S51), Olam (SGX: O32), CapitaLand (SGX: C31), CapitaLand Mall Trust (SGX: C38U), CapitaLand Commercial Trust (SGX: C61U), Ascendas Reit (SGX: A17U), Ascott HTrust (SGX: HMN), Ascendas-hTrust (SGX: Q1P), CapitaR China Trust (SGX: Au8U), Ascendas-iTrust (SGX: CY6U), Keppel Corp (SGX: BN4), Keppel Reit (SGX: K71U), Keppel DC Reit (SGX: AJBU), Keppel Infrastructure Trust (SGX: A7RU), Mapletree Logistics Trust (SGX: M44U), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree NAC Trust (SGX: RW0U).

Temasek stocks portfolio also affect about 15% of STI index stocks, which has strong impact on Singapore stock market. Here are 30 STI component stocks:

DBS Bank (SGX: D05), Singtel (SGX: Z74), OCBC Bank (SGX: O39), UOB Bank (SGX: U11), Wilmar International (SGX: F34), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Thai Beverage (SGX: Y92), CapitaLand (SGX: C31), Ascendas Reit (SGX: A17U), Singapore Airlines (SGX: C6L), ST Engineering (SGX: S63), Keppel Corp (SGX: BN4), Singapore Exchange (SGX: S68), HongkongLand (SGX: H78), Genting Singapore (SGX: G13), Mapletree Logistics Trust (SGX: M44U), Jardine Cycle & Carriage (SGX: C07), Mapletree Industrial Trust (SGX: ME8U), City Development (SGX: C09), CapitaLand Mall Trust (SGX: C38U), CapitaLand Commercial Trust (SGX: C61U), Mapletree Commercial Trust (SGX: N2IU), Dairy Farm International (SGX: D01), UOL (SGX: U14), Venture Corporation (SGX: V03), YZJ Shipbldg SGD (SGX: BS6), Sembcorp Industries (SGX: U96), SATS (SGX: S58), ComfortDelGro (SGX: C52).

The results of SIA rights issue and subsequently the Sembcorp resolutions, could give some direction of what possible actions to take for other Temasek stocks which may need help in business. Among the 30 STI component stocks with Temasek control (over 15% share ownership), these 4 Temasek stocks would need more help: Singapore Airlines, Sembcorp Industries (linked to Sembcorp Marine which was STI component stock before) and Keppel Corp.

So, regardless the outcome of Sembcorp actions, Temasek may also consider other options in future, eg. demerger of Keppel O&M from Keppel Corp, merging with Sembcorp Marine for cost saving of 2 oil & gas companies. For all the actions, there is a positive common point, which they all have a strong sponsor, Temasek. It is a bonus to have a strong sponsor but a business still needs good management with right strategies for each of the business sector. These performances would be reflected in both yearly financial reports and daily stock prices, especially for longer term trends. So, it may not be difficult for a stock investor to make a sound decision (Buy, Hold, Sell, Wait, Shorting), aligning the right Temasek stock with own personality, supported by growing business.

=====================================

On surface, this topic seems to be just on corporate actions of 2 Sembcorp stocks. When understanding further, it requires understanding of 2 current financial crisis, Crude Oil crisis and Covid-19 crisis, when they may end or fade away. When going to another deeper level, it may also involve political economy and global stock market, especially potential impact of US-China trade war. So, a stock investor should master at least 5 key LO-FTP strategies (Levels 1-4, Optimism, Fundamental, Technical, Personal Analysis).

There are 30 STI index component stocks including Sembcorp Industries (investor has to focus only on giant stocks for investing):

DBS Bank (SGX: D05), Singtel (SGX: Z74), OCBC Bank (SGX: O39), UOB Bank (SGX: U11), Wilmar International (SGX: F34), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Thai Beverage (SGX: Y92), CapitaLand (SGX: C31), Ascendas Reit (SGX: A17U), Singapore Airlines (SGX: C6L), ST Engineering (SGX: S63), Keppel Corp (SGX: BN4), Singapore Exchange (SGX: S68), Hongkong Land (SGX: H78), Genting Singapore (SGX: G13), Mapletree Logistics Trust (SGX: M44U), Jardine Cycle & Carriage (SGX: C07), Mapletree Industrial Trust (SGX: ME8U), City Development (SGX: C09), CapitaLand Mall Trust (SGX: C38U), CapitaLand Commercial Trust (SGX: C61U), Mapletree Commercial Trust (SGX: N2IU), Dairy Farm International (SGX: D01), UOL (SGX: U14), Venture Corporation (SGX: V03), YZJ Shipbldg SGD (SGX: BS6), Sembcorp Industries (SGX: U96), SATS (SGX: S58), ComfortDelGro (SGX: C52).

Drop by Dr Tee free 4hr investment course to learn how to position in global giant stocks with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Learn further from Dr Tee valuable 7hr Online Course, both English (How to Discover Giant Stocks) and Chinese (价值投资法: 探测强巨股) options, specially for learners who prefer to master stock investment strategies of over 100 global giant stocks at the comfort of home.

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 9000 members.