Singapore Press Holdings (SGX: T39), SPH, is a well-known blue chip stock with 35 years of history of press business. It is popular especially among “grandparents” level of investors as a passive income generator through dividend payment.

In the past (over 20 years ago), there was little competition in this monopoly business, therefore SPH could gain income easily through advertisements with more circulations of hardcopy newspapers. However, in the internet era over the past 10+ years, disruptive technologies have changed the rules of the game, providing more channels of news (mostly free) through webpages, blogs, videos and social media (eg. Facebook).

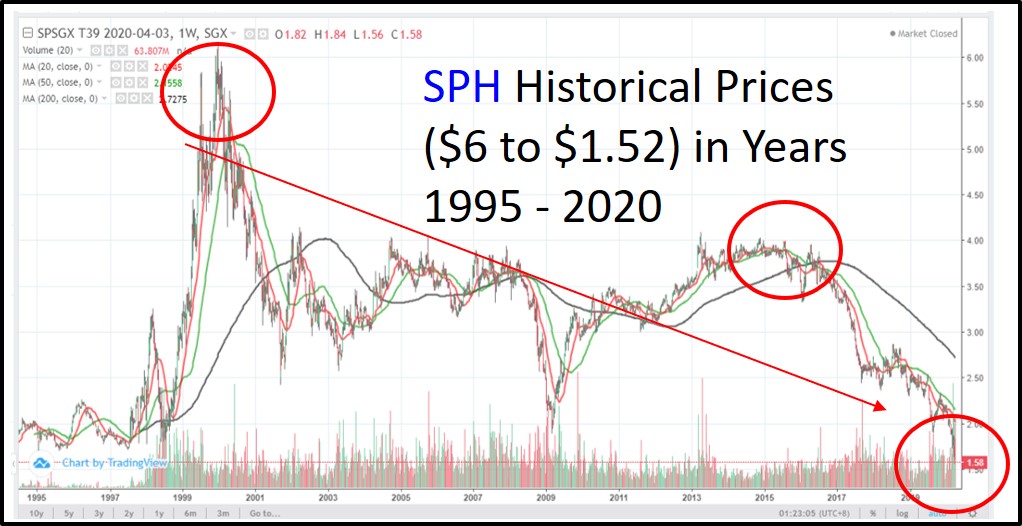

As a result, number of SPH newspapers readers have been declining over the past decade (while Facebook and other internet users are booming), resulting in gradual falling of business fundamentals (revenue, earning, cashflow, even dividend) during the same period. The share price of SPH has fallen by half from the peak price of $5+/share, supressed further by recent global stock crisis, dropping to only 1/3 of peak price, $1.52/share, the lowest point at least for the past 26 years. Dividend yield is 7.1%, seems impressive (second highest in 30 STI component stocks, just behind Capital Mall Trust) but this could be a value trap.

A blue chip stock suitable for grandparents time may not be suitable for next generation now. SPH has lost the giant stock title (based on Dr Tee criteria) since 10+ years ago. Long term investing is not simply buy any stock and hold, especially for weaker fundamental stock in a sunset industry (monopoly is not a protection) of press business, buying low in prices would become lower in long term. SPH is a classic example as company never lost money, simply making less profits each year, long term stock investors may suffer huge capital losses if never review the business condition for decade, assuming a stock paying dividend yearly must be worth holding for lifetime.

The high dividend yield (DY = Dividend / Share Price) is mainly generated by share prices falling (1/3) more than falling of dividend payment (1/2) over the past decade. A common mistake of beginner in dividend stock investing is to pursue high dividend yield or simply check company is profitable (SPH has over 5% ROE for the past decade, not a junk stock, despite it is not a giant stock). The understanding of economic moat and business climate is crucial which is disadvantaged to SPH with popularity of internet, full with free news (including when you read this article, no need to pay even 1 cent to SPH).

This negative business cycle would continue, making harder for SPH to improve the financial condition with press business segment, despite promoting digital media over the past few years and reduce the workforce to save cost. 《人无远虑,必有近忧》is a Chinese idiom of wisdom, educating that one needs to have a long term plan, otherwise there might be risks in near future.

SPH new management may know there is a natural limitation in press business (despite considering 101 ways of improvement), therefore a solution way is to diversify into other business. Since SPH with P = Press, therefore it is hard to abandon press business overnight, especially this is an important mission empowered by government to ensure true news are shared with people (instead of internet, sometimes could have fake news).

So, an easy way out is to create second revenue Pillar of SPH with P = Property. Over the past decade, SPH has successfully establish a portfolio of properties (eg. Clementi Mall, Paragon, Seletar Mall, Rail Mall, etc) and even spin off another stock, SPH Reit (SGX: SK6U), to collect rental for some of the properties. SPH Reit is a young REIT with reasonably good business performance but share price is also corrected by 40% over the past 2 months of global stock crisis. In fact, SPH property business contributes to over 50% net profit of company, about 2 times of press business, one day may become Singapore “Property” Holdings.

Besides, SPH also diversifies the businesses to healthcare (eg. Orange Valley Nursing Home), education (eg. Mindchamps) and even Telco (M1 through partnership with Keppel Corp, another blue chip stock which also depends on property business to last through cold winter of oil & gas crisis). However, unlike property business which may be more passive in nature (investment decision), other businesses in different sectors could be out of circle of expertise for SPH, results of diversification have to be proven over time (so far property business is proven to be in right path).

For long term stock investors of SPH who have been making losses (more than 50% capital loss, even if collecting dividend yearly), may be in a dilemma of whether to cut loss (painful) or give SPH a chance to grow in property (proven) and other new businesses (still uncertain) beyond press business. One possible option is to apply “Change Horse” strategy as shared in earlier article, which is to sell a weaker fundamental stock, using the remaining capital to buy another giant stock with strong business fundamental (eg. existing competitors of SPH, internet related giant stocks which have growing businesses with more readers each month) on the same day, as if stock is never sold, just name is changed.

If not, at least SPH stock investor may consider to change P of SPH from Press to Property through SPH Reit (swapping between parent and subsidiary stocks) which focuses on property rental (may not be a giant REIT but performance is better than SPH as a whole). In this way, decade of downtrend in SPH business may be changed to potential decade of uptrend in SPH Reit business (with condition REIT manager is making the right decisions, eg. buying new property at lower price during crisis, etc).

The story of SPH has many hidden learning lessons. Firstly, there are few blue chip stocks which investors could buy and hold for lifetime as disruptive technologies (eg. another grandparents blue chip stock, Comfortdelgro with new challenger in taxi business but condition is more stable than SPH) may change the rule of game or there could be unexpected business crisis at certain point of time (eg. SARS and Coronavirus crisis to airlines sector but this is a short term risk). A smart investor has to regularly monitor the business at least with half-yearly annual reports. Buy a stock means one is in partnership with company doing business together, sharing the pains (if losses or less profits) and fortunes (if more profits which could justify more dividend payment).

Besides, SPH press business is a mirror of some individual who could not control own active job (eg. could be a worker in a declining semiconductor sector or a staff who does not have pay increment for years, etc) as they have been working for decades, not able to change the profession easily. So, if one could learn to convert the active income (salary from a job who may not have a bright future prospect) into 10-20 giant stocks, then literary one has 10-20 “jobs” which could generate money at the same time. The best is these additional incomes don’t need active “work”, therefore it is called passive income with dividend yearly or even quarterly, when holding long enough, potential capital gains due to growing business (with condition focusing in a portfolio of giant stocks, ideally buying low during global stock crisis). If these 10-20 giant stocks could pass the yearly certification process as a giant stock, then an investor may have option to hold for long term or even for lifetime or passing to the next generation as family wealth (this is common for those rich families with investment funds but individual may pass a few giant stocks to the next generation).

Dr Tee is still a long term supporter of SPH newspaper (not stock, but a reader), could not change the habit of reading daily newspaper for several decades. Personally, I hope SPH could continue to be strong in property and new business, so that the press business is sustainable.

So, until SPH becomes a giant stock again (to be proven, see if could pass Dr Tee criteria one day), an investor has the choice to invest in over 1500 global giant stocks, supported by growing business.

In Year 2020, SPH is officially removed from 30 STI index component stocks (investor has to focus only on giant stocks for investing, not just buying grandparents blue chips stocks):

DBS Bank (SGX: D05), Singtel (SGX: Z74), OCBC Bank (SGX: O39), UOB Bank (SGX: U11), Wilmar International (SGX: F34), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Thai Beverage (SGX: Y92), CapitaLand (SGX: C31), Ascendas Reit (SGX: A17U), Singapore Airlines (SGX: C6L), ST Engineering (SGX: S63), Keppel Corp (SGX: BN4), Singapore Exchange (SGX: S68), Hongkong Land (SGX: H78), Genting Singapore (SGX: G13), Mapletree Logistics Trust (SGX: M44U), Jardine Cycle & Carriage (SGX: C07), Mapletree Industrial Trust (SGX: ME8U), City Development (SGX: C09), CapitaLand Mall Trust (SGX: C38U), CapitaLand Commercial Trust (SGX: C61U), Mapletree Commercial Trust (SGX: N2IU), Dairy Farm International (SGX: D01), UOL (SGX: U14), Venture Corporation (SGX: V03), YZJ Shipbldg SGD (SGX: BS6), Sembcorp Industries (SGX: U96), SATS (SGX: S58), ComfortDelGro (SGX: C52).

==================================

Drop by Dr Tee free 4hr investment course to learn how to position in global giant stocks with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Learn further from Dr Tee valuable 7hr Online Course, both English (How to Discover Giant Stocks) and Chinese (价值投资法: 探测强巨股) options, specially for learners who prefer to master stock investment strategies of over 100 global giant stocks at the comfort of home.

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 9000 member.