10000 points tonight is an important milestone for Nasdaq (mainly technology stocks) as in Year 2000 Dotcom Bubble, it also fell down from “new” peak of 5000 points to about 1/3 of value. After 20 years later, the key difference is this time the driver is V-shape recovery after over 30% major correction which shows the power of “unlimited QE”.

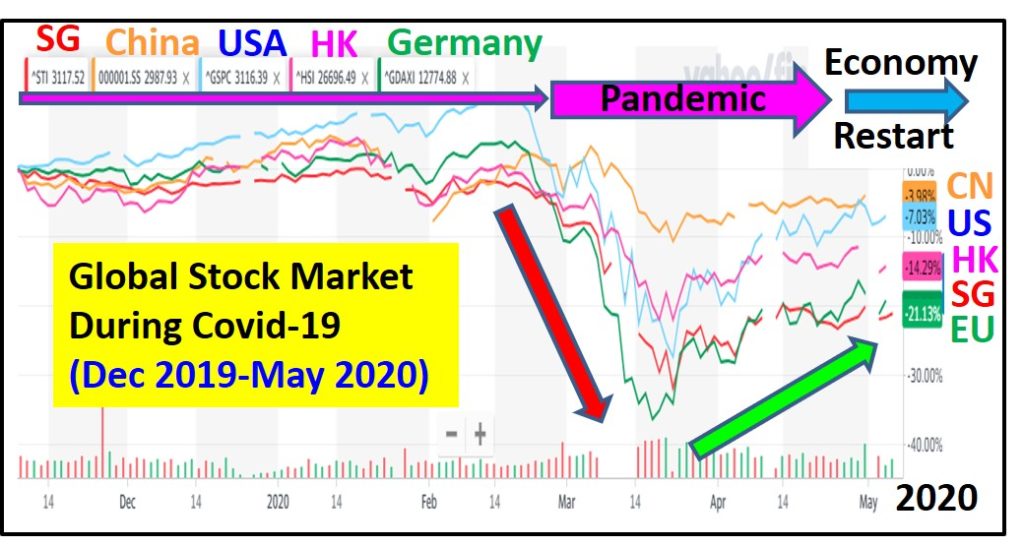

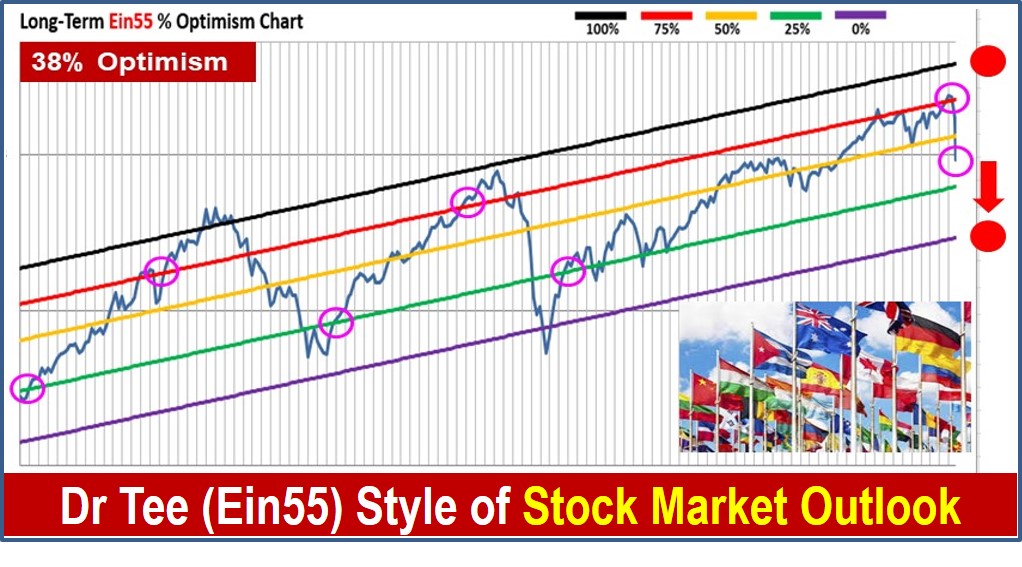

US is more suitable for shorter term trading, especially momentum trading with support of greedy mass market. Trend-following may be required for some traders as optimism is back to high level for both NYSE and NASDAQ stock markets in US. Global stock markets (STI, KLCI, HSI, SSEC, DAX, etc) also recover well but not as bullish as US.

It may be hard to compare Apple (eg. US stock market) with Orange (eg. Asian stock market) but they are still connected as both are fruits (global stock market), therefore when demand for Apple is higher, likely demand for Orange may be higher as well.

At the same time, within each fruit, an investor should look for better Apple or better Orange as it may be confusing to apply the Orange criteria (eg. sweatness) on selection of Apple (eg. crunchy).

In short, you don’t have to like Apple or Orange but need to ensure their prices would be higher in future based on the timeframe of your interest.

Trading may not be suitable for everyone. Those who prefer to buy and forget may be more suitable for investing. There are a few who could invest and trade at the same time but applying 2 different strategies, even if the stock is the same.

When there is a reversal (eg. bear to bull), some would be happy (those who take actions to buy), some may feel sad (those who wait but now uncertain whether decision is right).

In fact, there is no need to worry as there is no right nor wrong in stock market. A trader or investor needs to have a trading plan or investing strategy as an “anchor” to position oneself (aligned with own personality), else will be drifted each day by the wave of stock market, confused with up or down until giddy, may make a “wrong” decision by following others who shout louder.

Covid-19 conditions (both # daily infected cases and death cases) are getting much better for major economies (US, China, Japan, Europe) and also in Singapore. If you follow Dr Tee articles and video education (www.ein55.com/blog) over the past 4 months since the pandemic started in Feb 2020, summer 2020 was a key factor and global Covid-19 trends have been reported to fade away by then.

With restart of economies in most global countries from June 2020, economy starts to show V-shape recovery. Oil price at low optimism starts to recover strongly after the negative oil price a few weeks ago, preparing for higher demand by the world after lockdown is over.

US job market is improving for May 2020, S&P 500 rises to another high of nearly 3200 points, could break historical high of 3300+ points if this momentum continues in June. Asia stock markets also recover gradually with less fear.

Warren Buffett is not wrong (selling Airlines stocks and bank stocks) as his actions are aligned with his own personality (sell when outlook is uncertain or beyond his knowledge) and this is only his partial stock portfolio, still holding lots of other stocks. So, even if stock market is truly recovering, Warren Buffett and Berkshire would benefit (rising in stock prices is a proof).

Those investors who follow Warren Buffett blindly (copy his actions and even extend to sell all stocks) are wrong as they don’t align the strategies with their own personalities, some even greedy to wait to buy all stocks at the lowest point (which no one knows), may end up missing the opportunity boat or given option to buy at much higher prices (旁观者迷).

There are 2 ways of analysis: relative and absolute way. Therefore, even for a bearish stock market or economy, some may view “less negative” as positive. This is similar to a weak business which should lose $1M yearly but when losing “only” $100k, it is considered positive.

Ideally economy should be strong to support stock market. However, during Covid-19 crisis, relative method may be applied.

Stock market is forward looking, therefore some traders prefer to look at price alone which could reflect most of the key market factors including emotions. A smart investor may combine business fundamental and trading together. The biggest enemy is usually ourselves, whether we are comfortable with the strategy, either short term trading or long term investing.

Analysts who have been bearish would keep quiet for a few weeks, then more posts will come out when there is correction over 10% again. Now, there will be more posts on bullish stock market. Readers would hear different views each time, eventually not able to take action at all if simply follow others.

There are always 2 views of market: bull or bear, that’s why for each transaction, there is always a pair of buyer and seller. Don’t follow analysts blindly. Instead, leverage on the views, do additional filtering, aligning with own personality.

No expert would know what may happen for tomorrow’s share price but in longer term, business with sustainable growth would have higher chance to make profits in business to support the rising price.

Since no one could see the future, a stock investor may need to apply probability investing during this uncertain period: position in 10-20 giant stocks (strikers / mid-fielders / defenders) with strategies (eg. momentum / growth / dividend / undervalue, etc) aligned with own personalities (eg. short term trading or long term / life investing), minimizing risks with multiple entries / exits.

It is fun to “watch” and cheer in the football game but at the end, observers may waste the time and money if not able to take even the first action nor having a clear strategy.

Running out of ideas of What Stocks to Buy? Read hundreds of articles by Dr Tee over the past few months of global stock crisis.

Drop by Dr Tee free 4hr investment course to learn how to position in global giant stocks with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Learn further from Dr Tee valuable 7hr Online Course, both English (How to Discover Giant Stocks) and Chinese (价值投资法: 探测强巨股) options, specially for learners who prefer to master stock investment strategies of over 100 global giant stocks at the comfort of home.

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 9000 members.