In this Dr Tee 2-hr video education (Mystery of Divergence in Stock and Economy ), you will learn:

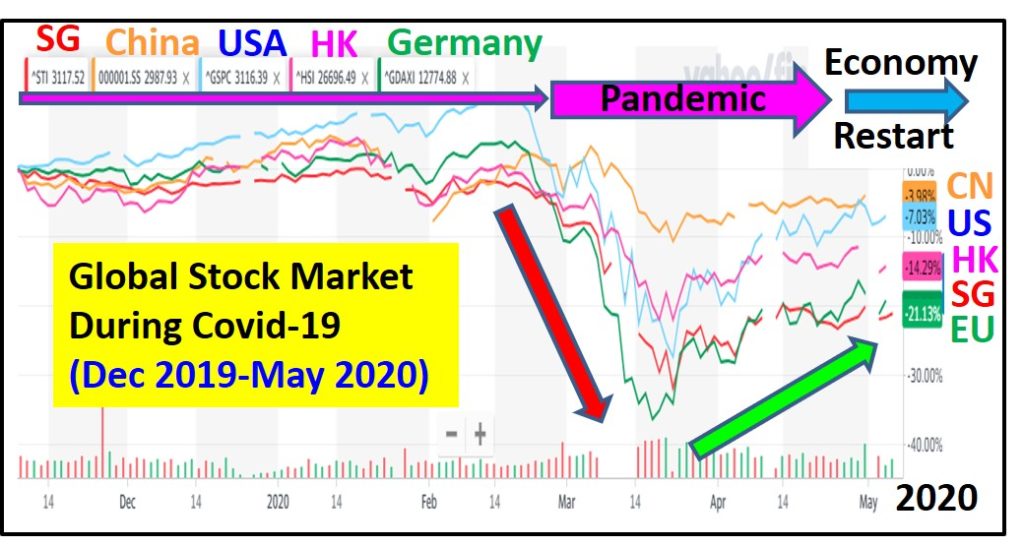

1) How to position with different direction in global stock and economy.

2) Master 3 key economic indicators for global economy (US, Singapore, China, Europe).

3) Mixed signals in investment clock of global stock markets, comparing US, Singapore, Hong Kong & China.

4) Technical Analysis of Coronavirus by country with stage of virus life cycle and estimated ending period.

5) Defensive Investing Strategies during Stock Crisis.

Here is English Version of Dr Tee Video Course (Chinese version is also available as Dr Tee is bilingual). Enjoy and give your comments for improvement. You may subscribe to Dr Tee Youtube channel (Ein Tee) for future Dr Tee video talks. Collect 3 extra bonuses here.

English Video: https://youtu.be/Gs3tsbncBS4

在这Dr Tee 90分钟教育视频(股票与经济:背道而驰之谜),您可学习:

1) 学习定位全球股票与经济各奔东西。

2) 掌握三大经济指标,把脉环球经济(美国、新加坡、中国、欧洲)。

3) 各国新冠病毒技术分析:疫情周期,预估结束点。

4) 投资时钟的交叉讯号(短期、中期、长期):全球、美国、新加坡、香港、中国。

5) 危机入市的防御性投资策略。

这儿是 Dr Tee 华语视频 (英语视频也已完成,Dr Tee 双语皆行)。请欣赏鄙作,留言求进步。您可订阅 Dr Tee Youtube 频道(Ein Tee),链接未来投资视频。这里得额外三红利。

Chinese Video (华语视频): https://youtu.be/uaPHWaRFuEM

This defensive investing strategy may be applied to 30 Singapore STI index component stocks (investor has to focus only on giant stocks for investing):

DBS Bank (SGX: D05), Singtel (SGX: Z74), OCBC Bank (SGX: O39), UOB Bank (SGX: U11), Wilmar International (SGX: F34), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Thai Beverage (SGX: Y92), CapitaLand (SGX: C31), Ascendas Reit (SGX: A17U), Singapore Airlines (SGX: C6L), ST Engineering (SGX: S63), Keppel Corp (SGX: BN4), Singapore Exchange (SGX: S68), Hongkong Land (SGX: H78), Genting Singapore (SGX: G13), Mapletree Logistics Trust (SGX: M44U), Jardine Cycle & Carriage (SGX: C07), Mapletree Industrial Trust (SGX: ME8U), City Development (SGX: C09), CapitaLand Mall Trust (SGX: C38U), CapitaLand Commercial Trust (SGX: C61U), Mapletree Commercial Trust (SGX: N2IU), Dairy Farm International (SGX: D01), UOL (SGX: U14), Venture Corporation (SGX: V03), YZJ Shipbldg SGD (SGX: BS6), Sembcorp Industries (SGX: U96), SATS (SGX: S58), ComfortDelGro (SGX: C52).

This powerful strategy can be extended to global giant stocks including 30 Malaysia Bursa KLCI index component stocks (investor has to focus only on giant stocks for investing):

CIMB (Bursa: 1023) CIMB GROUP HOLDINGS BERHAD, DIALOG (Bursa: 7277) DIALOG GROUP BERHAD, DIGI (Bursa: 6947) DIGI.COM BERHAD, GENM (Bursa: 4715) GENTING MALAYSIA BERHAD, GENTING (Bursa: 3182) GENTING BERHAD, HAPSENG (Bursa: 3034) HAP SENG CONSOLIDATED BERHAD, HARTA (Bursa: 5168) HARTALEGA HOLDINGS BERHAD, HLBANK (Bursa: 5819) HONG LEONG BANK BERHAD, HLFG (Bursa: 1082) HONG LEONG FINANCIAL GROUP BERHAD, IHH (Bursa: 5225) IHH HEALTHCARE BERHAD, IOICORP (1961) IOI CORPORATION BERHAD, KLCC (Bursa: 5235SS) KLCC PROPERTY HOLDINGS BERHAD, KLK (Bursa: 2445) KUALA LUMPUR KEPONG BERHAD, MAXIS (Bursa: 6012) MAXIS BERHAD, MAYBANK (Bursa: 1155) MALAYAN BANKING BERHAD, MISC (Bursa: 3816) MISC BERHAD, NESTLE (Bursa: 4707) NESTLE MALAYSIA BERHAD, PBBANK (Bursa: 1295) PUBLIC BANK BERHAD, PCHEM (Bursa: 5183) PETRONAS CHEMICALS GROUP BERHAD, PETDAG (Bursa: 5681) PETRONAS DAGANGAN BHD, PETGAS (Bursa: 6033) PETRONAS GAS BERHAD, PMETAL (Bursa: 8869) PRESS METAL ALUMINIUM HOLDINGS BERHAD, PPB (Bursa: 4065) PPB GROUP BERHAD, RHBBANK (Bursa: 1066) RHB BANK BERHAD, SIME (Bursa: 4197) SIME DARBY BERHAD, SIMEPLT (Bursa: 5285) SIME DARBY PLANTATION BERHAD, TENAGA (Bursa: 5347) TENAGA NASIONAL BHD, TM (Bursa: 4863) TELEKOM MALAYSIA BERHAD, TOPGLOV (7113) TOP GLOVE CORPORATION BHD.

===================================

There are over 1500 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar.

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Mall Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com