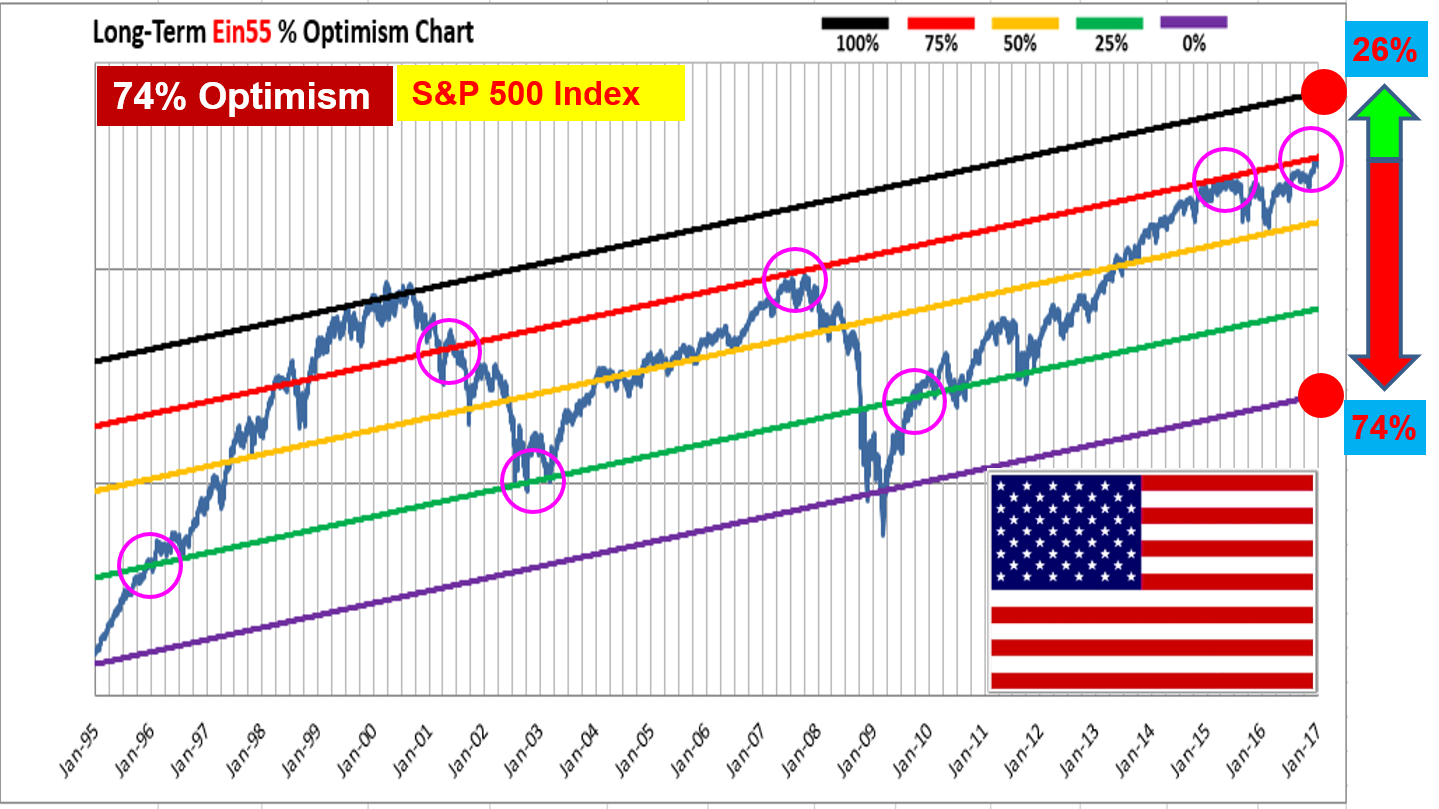

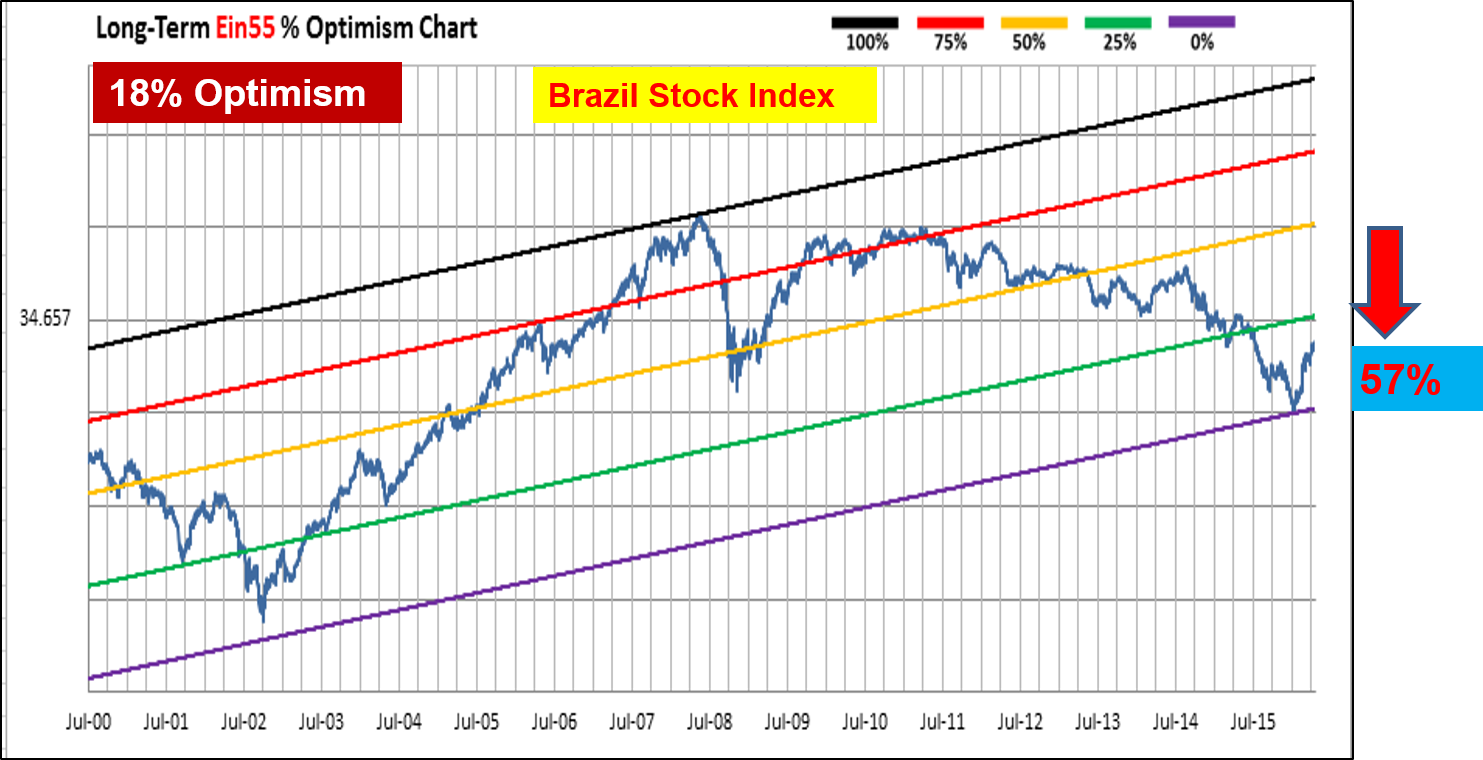

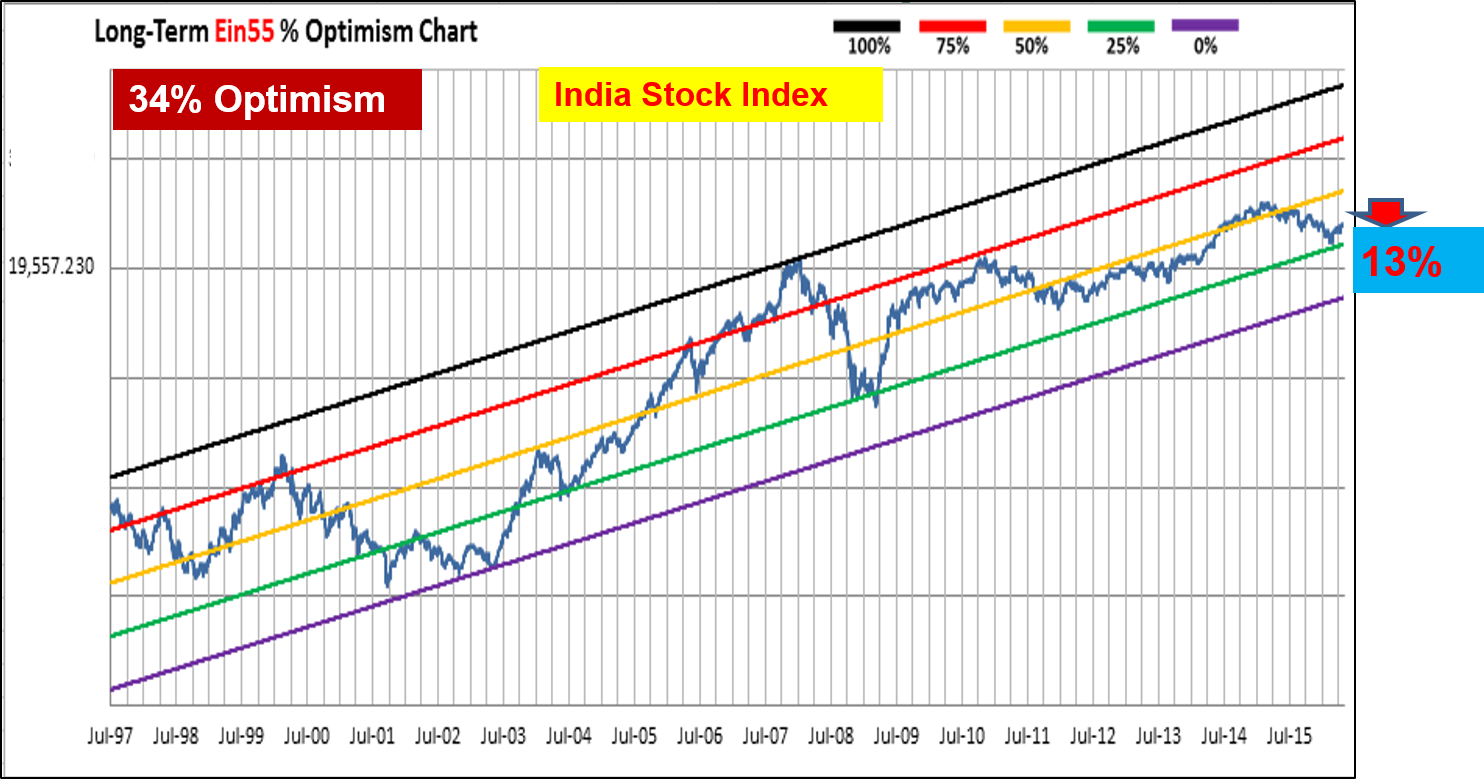

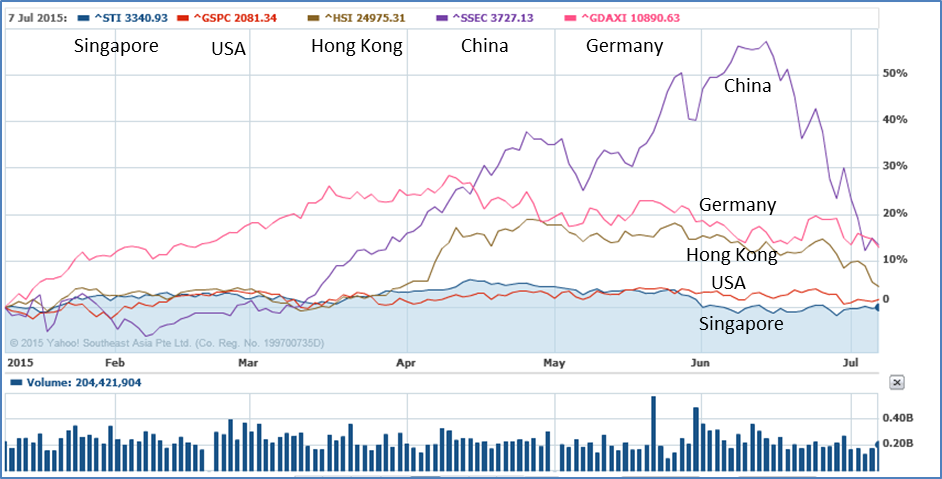

Although both were/are at historical peak stock prices with high optimism, there is a key difference between bullish stock markets of China SSEC (Year 2015) and US S&P and DJI (Jan 2017). The chart below shows that the rate of index growth is much faster for China SSEC, therefore the high optimism was not sustainable, going up and coming down within months. US stock market is a gradual warming process, although feverish, it is more sustainable.

We may have heard the story of a frog swims comfortably in warm water, could be killed unknowingly when the water is heated up gradually. A frog could adjust the body resistance to temperature change, but there is a limit for the tolerance, eventually it will get killed if the water temperature is too high because it is so used to the environment, does not know how to jump out of the danger.

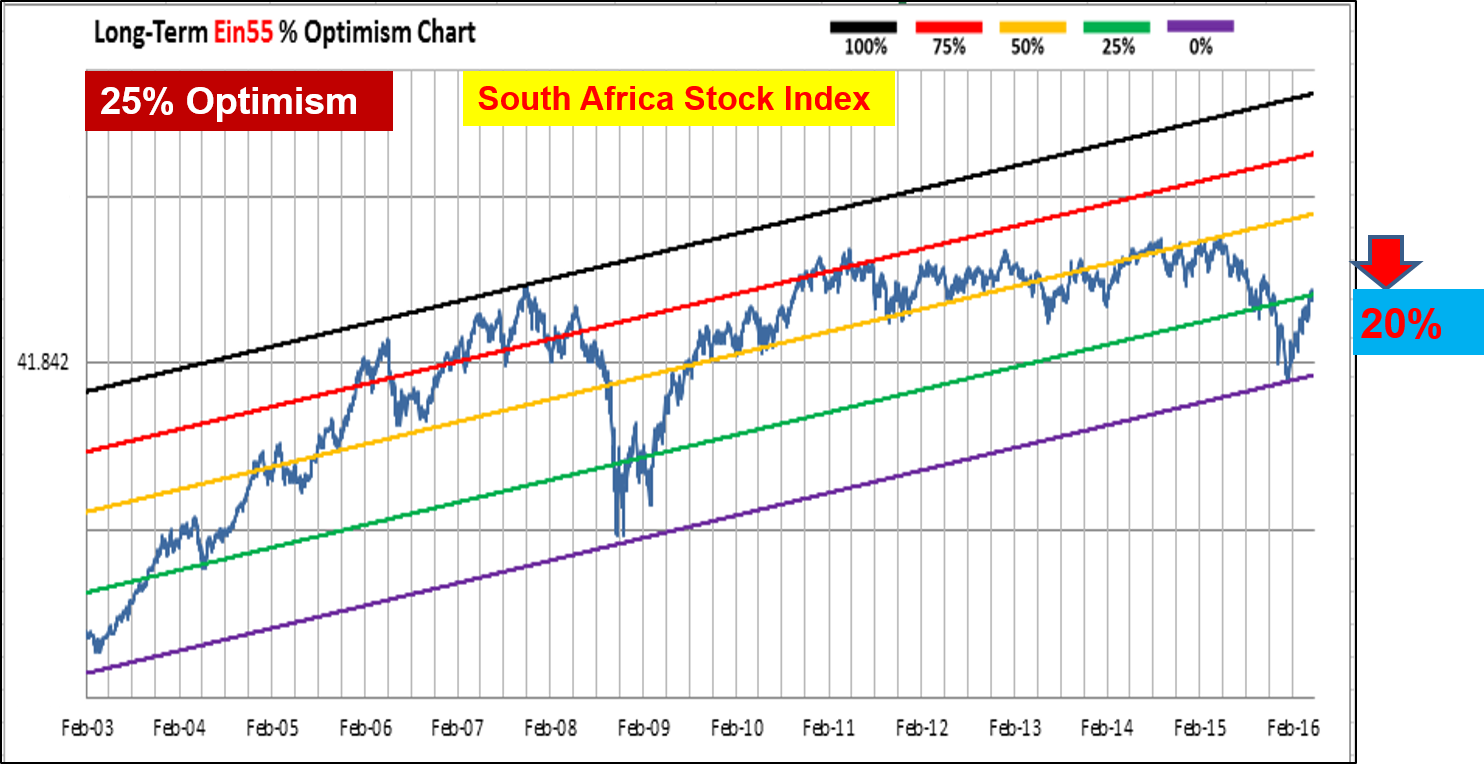

Sounds familiar to those in the stock market? If a stock trader or investor behaves like a frog, adjusting to the cooling water (i.e. stock market correction) and warm water (i.e. stock market rally), mild bearish or mild bullish market, but eventually when stock market hits extreme high optimism, one may not know how to escape when the market melts down, not able to react fast enough as they may not feel the risks when stock market prices grow up gradually.

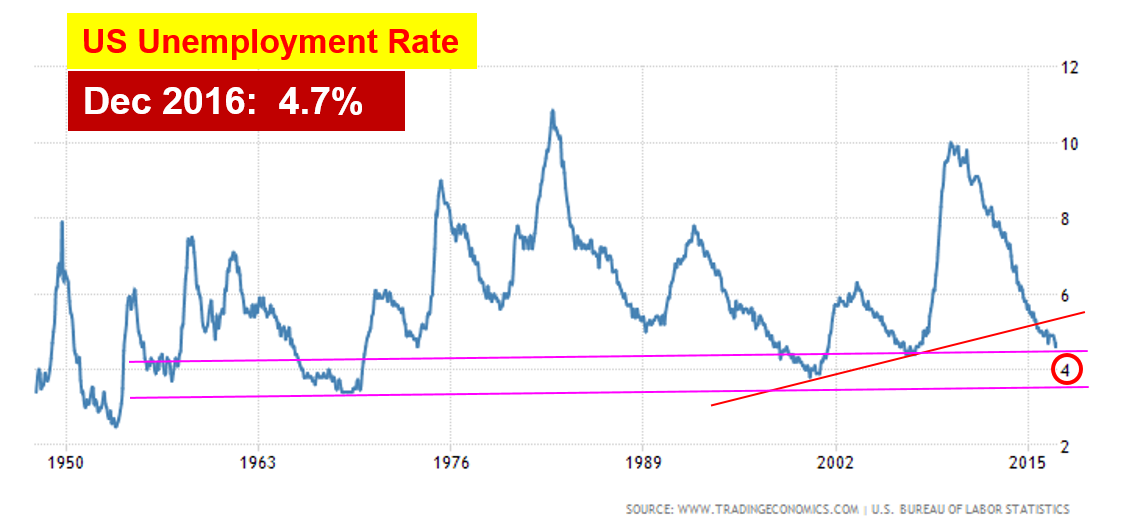

The US stock market has been bullish recently, leading the global stock markets in the same direction, ideal for short term traders to buy high sell higher. Dow Jones Index is above the critical 20,000 points, which could be the next future support over the time, while S&P 500 is near to the next milestone of 2300 points. As long as the water temperature of stock market is heated gradually, best with some cooling in between, the “frogs” could still be safe for a prolonged period of time until a Black Swan swims in one day, then the unprepared traders or even investors, could be caught by surprise, may not know this will be a real crisis.

You could call this as a new Ein55 style but since Dr Tee already has established 55 Investment Styles, I won’t give a new number, eg. #56. You may know the reason if you have attended my free courses to the public before. This investing concept was already integrated into Optimism Strategies, it is just I did not label with a style in the past. We need to monitor the rate of change in Optimism which is different from Technical Analysis which focuses only on stock prices. Ein55 Investment styles are usually generalized concepts with interesting stories, helping learners to apply the methods easily in daily life experience of investment markets.