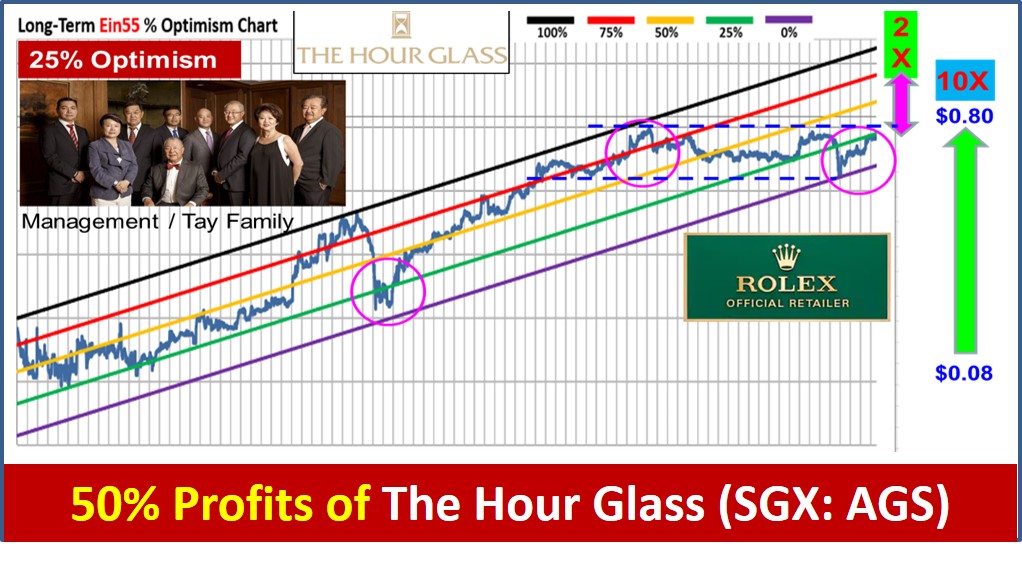

Congratulations to readers who have taken action on The Hour Glass (luxury watches stock, SGX: AGS) as Dr Tee has shared this giant stock in several educational posts over the past 1 year. The profit is nearly 50% from $0.80 (breakout) to $1.18 today.

In the earlier educational article on 100 Singapore Dividend Stocks (Mar 2021), Dr Tee shared the intrinsic value of The Hour Glass is about $1.20, now the price has surged to $1.18. It could have more upside but requires market greed to drive it to higher optimism. This is value investing, buy the right stock and right price, just wait patiently for the fruit in 2 targets: intrinsic value and also possible higher optimism price target.

As shown in Optimism Chart, The Hour Glass was still low optimism a few months ago, having 2X upside potential. It is a growth, dividend and cyclic stock, 3-in-1 stock. More importantly, this is a giant stock with very strong business fundamental.

For those who missed the 80 cents price breakout (low optimism, despite nearly highest price at that time) in Feb 2021 with rally to 90+ cents, there is a second chance recently. After the special gift from government on fear of Phase2 COVID measures on 14 May 2021 (Hour Glass dropped to 90 cents), Hour Glass has surged 20% last week and 10% this week, partly supported by good earnings results for financial year ending Mar 2021 (8% better results in last 1 year of pandemic compared to before pandemic), declaring 2X higher interim dividend than last year.

Dividend is like honey to attract bees (traders and investors) to work, helping to support the rising prices (capital gains). However, the plant (stock) needs to produce aromatic flower (growing business) first, else the honey supply may end one day. The best integration of strategy could be dividend + growth investing, having the best of 2 worlds, collecting passive income slowly while enjoying the capital gains with compounding of time. Patient investors could make big money but it requires strong determination.

Major shareholder Dr Henry Tay may know the investment marketing strategy, giving extra 2 cents per share dividend but share price has gained extra 28 cents. Timing of action is crucial, especially for stocks with Financial Reports ending in Mar 201, better results in Q2 would help to support the share prices (except for tech stocks at high optimism under sector rotation). So, a giant stock at low optimism is key. Hour Glass still has upside potential but it is no longer a low hanging fruit (low optimism giant stock) as shared over the past 1 year.

We may not need to own a Rolex watch even if we could afford. Instead, saving for the capital, an investor could indirectly own many luxury watches (Rolex, Patek Philippe, Hublot, etc) through investing in The Hour Glass stock as a business partner. Dr Henry Tay of The Hour Glass is even smarter, also invest in stock of main competitor, Cortina Holdings (SGX: C41), having strong control of luxury watches market in Singapore. In a bullish stock market with growing economy, consumer discretionary stock (including luxury watches) would have higher upside in both businesses and share prices. Alignment of individual stock (Level 1) to sector (Level 2), country (Level 3) and global (Level 4) economy and stock markets is crucial.

Readers may learn further, there are still many low optimism giant stocks waiting. Learn further in the next free 4hr Free Webinar by Dr Tee on other giant stocks (as good as The Hour Glass) which could still wait for you.

===================================

There are over 1500 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Mall Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com