Between life and money, which is more important? In this article, you will learn from Dr Tee on 11 Singapore Healthcare Giant Stocks which are efficient in making money with life as an economic moat, while some surge in prices during COVID-19 stock crisis.

1) COVID-19 “Crisis as Opportunity” Stocks

Medtecs International Corporation (SGX: 546)

UG Healthcare Corporation (SGX: 41A)

Top Glove Corporation (SGX: BVA)

Riverstone Holdings (SGX: AP4)

2) Medical Services Stocks

Q&M Dental Group (SGX: QC7)

Raffles Medical Group (SGX: BSL)

3) Healthcare Products Stocks

Tianjin Zhong Xin Pharmaceutical Group (SGX: T14)

Haw Par Corporation (SGX: H02)

4) Healthcare REITs

First Reit (SGX: AW9U)

ParkwayLife Reit (SGX: C2PU)

IHH Healthcare (SGX: Q0F)

There are about 37 Healthcare stocks in Singapore, a natural move for medical related businesses to get listed to leverage on capital from stock market for further expansion:

Accrelist Ltd (SGX: QZG), Alliance Healthcare (SGX: MIJ), Aoxin Q & M Dental (SGX: 1D4), Asia Vets Holdings (SGX: 5RE), AsiaMedic (SGX: 505), Asian Healthcare Specialists (SGX: 1J3), Beverly JCG (SGX: VFP), Biolidics (SGX: 8YY), Cordlife (SGX: P8A), First Reit (SGX: AW9U), Haw Par Corporation (SGX: H02), HC Surgical Specialists (SGX: 1B1), Healthway Medical Corporation (SGX: 5NG), Hyphens Pharma International (SGX: 1J5), IHH Healthcare (SGX: Q0F), ISEC Healthcare (SGX: 40T), IX Biopharma (SGX: 42C), Lonza Group (SGX: O6Z), Medinex (SGX: OTX), Medtecs International Corporation (SGX: 546), OUE Lippo Healthcare (SGX: 5WA), ParkwayLife Reit (SGX: C2PU), Pharmesis International (SGX: BFK), Q&M Dental Group (SGX: QC7), QT Vascular (SGX: 5I0), Raffles Medical Group (SGX: BSL), RHT Health Trust (SGX: RF1U), Riverstone Holdings (SGX: AP4), SingMedical Group (SGX: 5OT), Suntar Eco-City (SGX: BKZ), TalkMed (SGX: 5G3), Thomson Medical Group (SGX: A50), Tianjin Zhong Xin Pharmaceutical Group (SGX: T14), Top Glove Corporation (SGX: BVA), Trendlines Group (SGX: 42T), UG Healthcare Corporation (SGX: 41A), Vicplas International (SGX: 569).

From the table sorted below for 37 Singapore Healthcare stocks, only 2/3 are profitable (25 / 37 stocks were making money in businesses last year). Therefore, careful choices of giant healthcare stocks are critical, not just buying any healthcare stock with rising in share prices which may not be sustainable in longer term.

There are 1/3 stocks (13 / 37) having Price-to-Book ratio ($ / NAV = PB) < 1 with discount over asset but only 2 stocks (First Reit and Haw Par) have high quality asset related to cash or properties which will be discussed further. Buy undervalue stocks require patience, buying low may not able to Sell High in future if there is no alignment with one’s unique personality and other consideration of investment.

| No | Ticker | PB = Price /NAV | ROE (%) |

| 1 | Accrelist Ltd (SGX: QZG) | 0.31 | 0.0 |

| 2 | Alliance Healthcare (SGX: MIJ) | 1.89 | 12.6 |

| 3 | Aoxin Q & M Dental (SGX: 1D4) | 1.17 | -0.1 |

| 4 | Asia Vets Holdings (SGX: 5RE) | 0.57 | 3.9 |

| 5 | AsiaMedic (SGX: 505) | 2.53 | -0.1 |

| 6 | Asian Healthcare Specialists (SGX: 1J3) | 2.51 | 12.3 |

| 7 | Beverly JCG (SGX: VFP) | 6.67 | -0.7 |

| 8 | Biolidics (SGX: 8YY) | 8.33 | -0.4 |

| 9 | Cordlife (SGX: P8A) | 0.74 | 5.0 |

| 10 | First Reit (SGX: AW9U) | 0.45 | 5.7 |

| 11 | Haw Par Corporation (SGX: H02) | 0.78 | 5.8 |

| 12 | HC Surgical Specialists (SGX: 1B1) | 2.78 | 21.5 |

| 13 | Healthway Medical Corporation (SGX: 5NG) | 0.82 | 0.0 |

| 14 | Hyphens Pharma International (SGX: 1J5) | 2.72 | 14.8 |

| 15 | IHH Healthcare (SGX: Q0F) | 2.15 | 1.9 |

| 16 | ISEC Healthcare (SGX: 40T) | 2.60 | 11.7 |

| 17 | IX Biopharma (SGX: 42C) | 16.88 | -1.0 |

| 18 | Lonza Group (SGX: O6Z) | 0.63 | 9.9 |

| 19 | Medinex (SGX: OTX) | 2.02 | 25.5 |

| 20 | Medtecs International Corporation (SGX: 546) | 5.33 | 1.8 |

| 21 | OUE Lippo Healthcare (SGX: 5WA) | 0.64 | 1.3 |

| 22 | ParkwayLife Reit (SGX: C2PU) | 1.98 | 10.4 |

| 23 | Pharmesis International (SGX: BFK) | 0.53 | -0.3 |

| 24 | Q&M Dental Group (SGX: QC7) | 3.20 | 14.7 |

| 25 | QT Vascular (SGX: 5I0) | 4.78 | -2.5 |

| 26 | Raffles Medical Group (SGX: BSL) | 1.69 | 7.2 |

| 27 | RHT Health Trust (SGX: RF1U) | 0.92 | -0.1 |

| 28 | Riverstone Holdings (SGX: AP4) | 9.39 | 16.52 |

| 29 | SingMedical Group (SGX: 5OT) | 0.82 | 9.4 |

| 30 | Suntar Eco-City (SGX: BKZ) | 2.49 | 0.0 |

| 31 | TalkMed (SGX: 5G3) | 6.48 | 43.0 |

| 32 | Thomson Medical Group (SGX: A50) | 2.87 | -0.2 |

| 33 | Tianjin Zhong Xin Pharmaceutical Group (SGX: T14) | 0.83 | 11.6 |

| 34 | Top Glove Corporation (SGX: BVA) | 20.89 | 15.3 |

| 35 | Trendlines Group (SGX: 42T) | 0.53 | 0.0 |

| 36 | UG Healthcare Corporation (SGX: 41A) | 6.75 | 25.7 |

| 37 | Vicplas International (SGX: 569) | 4.36 | 7.0 |

Interestingly, none of the 37 Singapore Healthcare stocks are 30 STI component stocks but a few could be related (eg. Haw Par is related to UOB Bank and UOL):

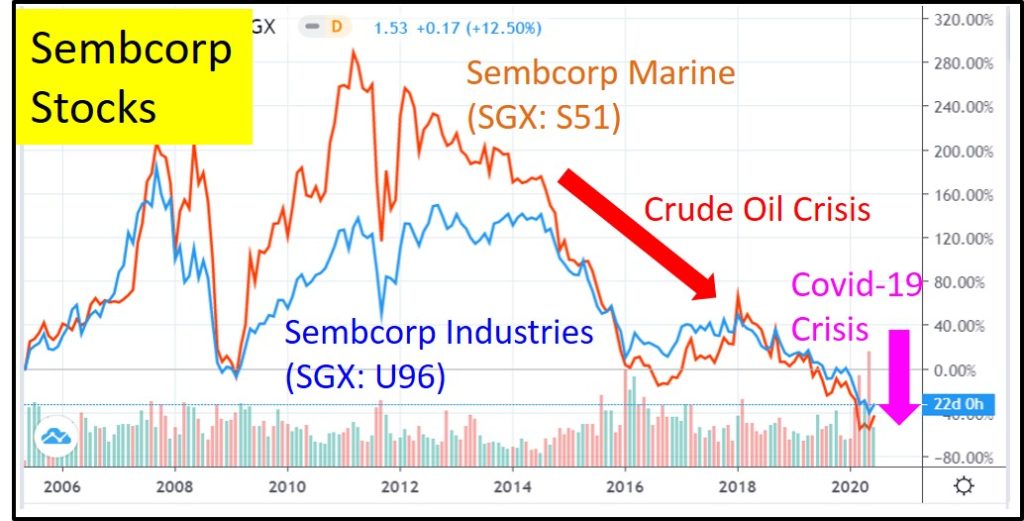

DBS Bank (SGX: D05), Singtel (SGX: Z74), OCBC Bank (SGX: O39), UOB Bank (SGX: U11), Wilmar International (SGX: F34), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Thai Beverage (SGX: Y92), CapitaLand (SGX: C31), Ascendas Reit (SGX: A17U), Singapore Airlines (SGX: C6L), ST Engineering (SGX: S63), Keppel Corp (SGX: BN4), Singapore Exchange (SGX: S68), Hongkong Land (SGX: H78), Genting Singapore (SGX: G13), Mapletree Logistics Trust (SGX: M44U), Jardine Cycle & Carriage (SGX: C07), Mapletree Industrial Trust (SGX: ME8U), City Development (SGX: C09), CapitaLand Mall Trust (SGX: C38U), CapitaLand Commercial Trust (SGX: C61U), Mapletree Commercial Trust (SGX: N2IU), Dairy Farm International (SGX: D01), UOL (SGX: U14), Venture Corporation (SGX: V03), YZJ Shipbldg SGD (SGX: BS6), Sembcorp Industries (SGX: U96), SATS (SGX: S58), ComfortDelGro (SGX: C52).

For healthcare business with strong economic moat, eg. having special knowhow or patents in medical solutions, limited suppliers of critical medical appliances, etc, would naturally be the preferred choice for stock investing. Most people would choice life over money (eg. during COVID-19 health crisis, 生死关头) but if one could integrate both life and money through giant stocks, the probability of success in investing would be high.

Here, let’s focus on 11 Singapore healthcare giant stocks over 4 main categories:

1) COVID-19 “Crisis as Opportunity” Stocks

There are 4 “lucky” stocks helped by COVID-19 crisis as they are crucial medical appliance suppliers, sales and profits surge during pandemic:

– Medtecs International Corporation (SGX: 546) – personal protective apparel

– UG Healthcare Corporation (SGX: 41A) – gloves

– Top Glove Corporation (SGX: BVA) – gloves

– Riverstone Holdings (SGX: AP4) – gloves

Their share prices have been speculated to over 5-10 times during COVID-19 stock “crisis” (which is an opportunity). This is a form of positive speculation (strong business fundamental with share price speculated to very high optimism level), especially for Top Glove and Riverstone which have strong business performances even before COVID-19 crisis. However, for Medtecs and UG Healthcare, both only have moderate good businesses before COVID-19 crisis, the sudden high growth in business would not be sustainable when fear of COVID-19 has subsided in 6-12 months. Stock such as Biolidics (SGX: 8YY) has even weaker business fundamental (losses in the past) but share prices surged due to speculation, traders may suffer huge loss if investing in long term for stock which may not have sustainable business beyond COVID-19.

Therefore, these 4 COVID-19 healthcare stocks are more suitable for shorter term trading as optimism level has been speculated to very high. Trend-following trading strategy may be applied to “Buy High Sell Higher” but when price trend is reversed, a trader would need to exit, even if it is a loss due to sudden correction. If not, do not speculate, even these companies make a lot of money during pandemic. Stock market is forward looking, their strong business fundamental are already considered in rising prices. One day, when they could not perform as strong as now with lower demand (despite still profitable), the share prices would be corrected significantly, especially for Medtecs and UG Healthcare.

2) Medical Services Stocks

These are the 2 “unlucky” stocks which save lives or reduce pains but due to nature of businesses which require interaction with patients (how to cure without seeing the patients), business performances are affected, including share prices at lower optimism levels.

– Raffles Medical Group (SGX: BSL) – Hospitals

– Q&M Dental Group (SGX: QC7) – Dental Clinics

Both stocks have been growing the business through expansion locally and abroad. Raffles Medical has extended businesses to China cities (eg. Shanghai, Chongqing, etc), even before COVID-19 crisis, the share prices have been corrected due to ambitious expansion which would take a few years to breakeven in investment for new hospitals. During pandemic, Raffles Medical loses overseas patients due to international travelling restrictions. Similarly, Q&M Dental has expanded to be the largest dental service provider in Singapore, business has been affected during COVID-19 due to close interaction required between dentists and patients.

However, COVID-19 could only slowdown, not stopping patients from seeking medical help (saving life or tooth pains), therefore when fear of COVID-19 has subsided, both giant stocks would perform normally again, accumulation of demand (non-urgent cases, eg. medical or dental check-up) would surge and balance out in longer term business.

Since both giant stocks are at lower optimism level, they are more suitable for longer term cyclic investors with “Buy Low Sell High” strategy while collecting moderate dividends during the recovery phase (as if fixed deposit investing in a medical bank).

3) Healthcare Products Stocks

These 2 stocks have healthcare products which have no strong correlation to COVID-19. So, they could still perform normally in businesses during pandemic:

– Tianjin Zhong Xin Pharmaceutical Group (SGX: T14) – Traditional Chinese Medicine (TCM)

– Haw Par Corporation (SGX: H02) – Tiger Balm and Others

Tianjin Zhong Xin is a highly cyclic growth stock (dual listing in both Singapore Stock Exchange – T14 and Shanghai Stock Exchange – 600329) with very strong business fundamental. It is more suitable for longer term cyclic investor, optimism is just recovering from low level. Share prices in Singapore and Shanghai stock exchanges are aligned in general direction but sometimes one market could perform better than another (eg. China stock market is relatively more bullish than Singapore in current market condition). Tianjin Zhong Xin is an all-rounded stock, also paying high dividend yield of 5-6% (depending on the share prices, higher if one could investing during crisis). It is not suitable for shorter term trader or investor with weak holding power, buy low may get lower during bearish stock market, despite business fundamental is strong.

Haw Par is not a pure healthcare stock as majority of revenue and income are actually on investment of 2 other stocks of Mr Wee Cho Yeow (Top 10 richest person in Singapore, UOB Chairman) stocks: UOB Bank and UOL. Therefore, investing in Haw Par is an indirect investment of UOB and UOL stocks. With the current lower optimism prices of Haw Par stock with ownership of equivalent values of UOB and UOL shares, the main “business” of Tiger Balm and other products are virtually “free” for undervalue stock investors. However, patience is required for undervalue investing (owning high quality asset of cash from UOB Bank and properties from UOL). Haw Par has strong support of Singapore Giant stocks, UOB and UOL, all under Mr Wee Cho Yeow. If Mr Wee continues to be the Top 10 richest person in Singapore, implying these 3 giant stocks are doing well in both businesses and stock market.

4) Healthcare REITs

These 3 stocks are special integration of healthcare with property sectors as Healthcare REITs:

– First Reit (SGX: AW9U) – Healthcare REIT with hospitals mainly in Indonesia

– ParkwayLife Reit (SGX: C2PU) – Healthcare REIT with hospitals mainly in Singapore

– IHH Healthcare (SGX: Q0F) – Sponsor of ParkwayLife REIT

Both healthcare and property are promising sectors in general for stock investing, therefore healthcare REITs (rental collection from hospitals as tenants) are defensive in nature as they could pay consistent dividend with long term tenant agreement (eg. 15 years), slow growth but steady. Therefore, they may be considered for longer term investing, crisis usually is a good opportunity to own healthcare REITs to generate consistent passive incomes.

However, stock has price component which may give surprises to investors, for example First REIT share prices have been corrected to less than 1/3 of peak prices over the past few years due to various concerns, mainly due to poor sponsor and customers (who owns Siloam Hospitals), Lippo Karawaci group which has cashflow issue due to ambitious property expansion in Indonesia.

This concern of sponsor has resulted instability to other Lippo Group related stocks, eg. OUE Group. Second sponsor of First Reit is OUE Lippo Healthcare, also not a giant stock, could not help much to restore the confidence of investors, worrying potential rights issues (nightmare for dividend investors, paying passive incomes, instead of collecting dividends). Despite First REIT is a giant REIT (even as of today) but this is a supported giant stock, mainly dependent on sponsor, main customer and major shareholder (multiple roles in 1). The immediate risk is cut of dividend payment (rental relief during COVID1-9 requested by sponsor) and also possible future rental payment for new agreements in Rupiah (about 25% of portfolio) in Year 2021, which could reduce overall dividend yield by 1/8 (Rupiah has depreciated more than 50% against SGD over the past 10 years in earlier agreement). Based on current crisis price of $0.44/share (lower than IPO price), dividend yield is nearly 20% but actual payment could be only 10% due to rental relief. Before a stock investor may enjoy 20% dividend yield, First Reit has dropped more than 20% share prices with capital loss in just a few months.

So, First REIT is an indirect crisis stock, not due to the Reit itself (a giant stock) but more dependent on performance of weak sponsor. Current Price-to-Book is less than 0.5, rare for a Reit, even if sponsor goes bankcrupt, First Reit investor could still recover the share prices with selling of Reit properties. The main concern is the REIT likely could operate normally (especially Siloam Hospitals and Lippo Group would perform better after fading of COVID-19 crisis) but short term to midterm bearish share prices could affect the confidence of investors who collect high dividend yield but also suffer huge capital losses.

Parkwaylife Reit is an opposite of First Reit, having a strong sponsor, IHH Healthcare (also a giant stock), therefore enjoying the stability with gradual growth under triple net lease. Parkwaylife owns local properties which rent out to customer (Parkway Pantai) who owns profitable hospitals, eg. Mount Elizabeth Hospital, Gleneagles Hospital, Parkway East Hospital, etc. When sponsor and customer and major shareholder (3 roles in 1) are strong, it provides stability to long term rental payment and therefore, dividend payment to stock investor of Parkwaylife Reit.

Despite Parkwaylife is suitable for longer term or event lifetime investing (if there is no major change in sponsor financial condition), it is crucial to buy below fair price, ideally during stock crisis such as COVID-19. This would help to maximize the dividend yield. So, an investor may apply “Buy Low and Hold” strategy. Value is what you get and Price is what you pay. Integration of value and price are crucial for investing success.

===================================

Choice of 11 healthcare giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar.

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Mall Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com