Over the past 1 month of global stock crisis with 30% major correction to US stock market due to fear of both Coronavirus pandemic affecting the whole world and Crude Oil price war between OPEC and non-OPEC.

By right, it is nearly a mission impossible for global stock market to recover (eg. for S&P 500 to stand above 3000 points again). Trump’s most powerful opponent is not China nor Biden. It is the tiny Coronavirus which was still an underdog a few months ago when rising from China, but now becomes a deadly challenger to Trump’s second’s term US presidency.

“Water” and “Fire” are 2 extreme elements, never get along well (水火不容). Similarly, “Greed” and “Fear” are 2 human nature which affect the stock markets, eventually the global economy.

Trump is multi-billionaire businessman, understanding the importance of greed to stock market. So, unlimited Quantitative Easing (QE = printing money) combines forces with global QE by Q20 (through various ways of economic stimulus plans, including Singapore), providing liquidity (as if “water”) to investment markets and economy to fight against spreading of wild “fire” due to fear of Coronavirus, which results in weaker economy mainly due to reduced social networking, greatly affecting all sectors, especially transportation, retail, tourism, F&B, now virtually everyone when more countries are under lockdown.

QE is literally printing money or adding liquidity, naturally results in short term market rally, even if not even 1 cent is used yet. Greed could change the market overnight, changing from 5% daily drop to 5% daily rally for global stock market.

However, current “rally” in stock market is more suitable for trading (mid term) unless entry is positioned with long term value investing (consider price below the intrinsic value), able to resist the potential downside. “Greed” and “Fear” will exchange blows to stock market, until a stronger one would survive and stand for longer time.

Let’s understand the weapons of stock market “Greed” and “Fear” now.

Greed is supported by global QE. However, when global stock markets were over speculated over the past decade to high optimism > 75% (especially for US), after the Fear has come to correct to mid optimism of about 50%, it needs more silver bullets to be strong again. In the last global financial crisis (2008-2009 subprime crisis), a few trillions of dollars were pumped in during QE 1-4 during years 2009 – 2014 to revive the US economy with excitement of global stock markets.

Due to investment market and “greed inflation”, current global stock crisis would need more than 10 trillions of dollars to resolve (similar to addiction to drug, dosage is increased each time). So, Trump has found a smart way of “Unlimited QE” through the Fed to provide “unlimited greed” to the investment market, resulting in short term stock market rally.

There are 2 keys before summer (Jun-July) to determine the fate of Trump and global stock markets: Economy vs Coronavirus conditions.

Be careful of early Apr when the first set of monthly economic data is released, likely to show higher unemployment rate or lower GDP, then investors may be back to fear again. Job market is very crucial for global economy, especially for US. Until Feb 2020, unemployment rate of 3.5% is the best performance over the past 50 years, implying the downside is tremendous. For every 100 American, about 96 have jobs which salary could be used for spending (helping other businesses with stocks to grow) and investing (helping investment markets such as stock and properties to grow).

If Mar 2020 (first monthly data after Coronavirus and global stock market crisis, to be reported in early Apr) unemployment gets worse significantly, eg to 4-5% or higher, it means a downtrend economic cycle is initiated with less spending and less investing by No 1 economy, US, which contribute to over 50% of world economy and stock market values. After the retrenchment, usually it is hard to hire back in a short term and economy is slower in response, compared to stock market which could change overnight.

So, time is key now to Trump, only maximum 3 months (Mar – May) to stabilize the global stock market fear, firstly with silver bullets of unlimited QE. However, this is only half-time match, the ending would depends on whether Coronavirus could end on time by summer and even so, will it come come again every 6 months during winter, affecting the whole whole again before vaccine is developed in about 1 year.

===================

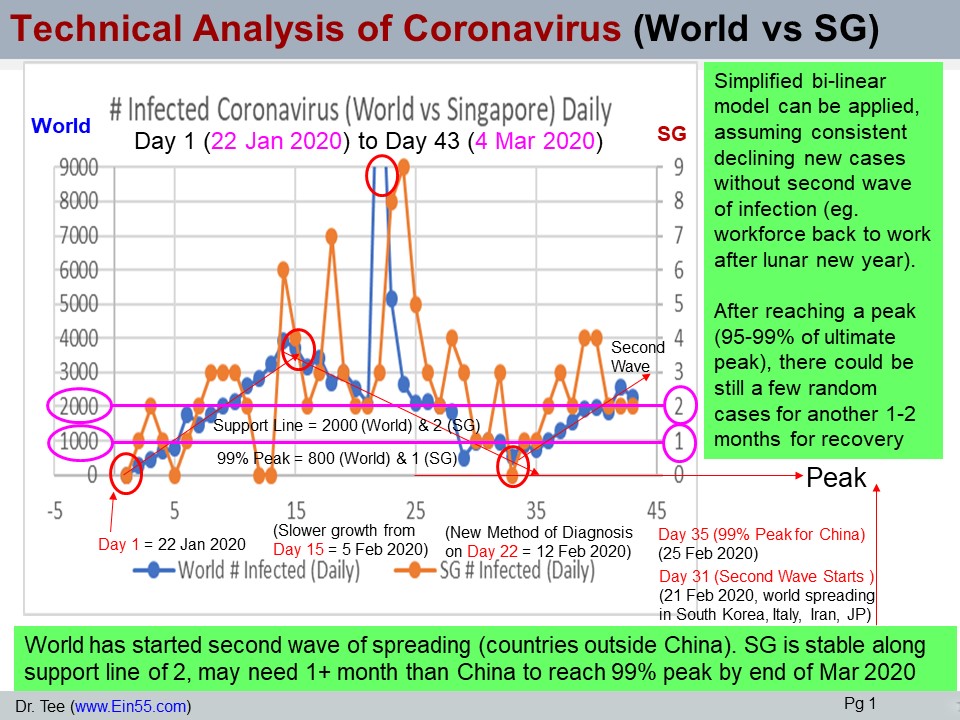

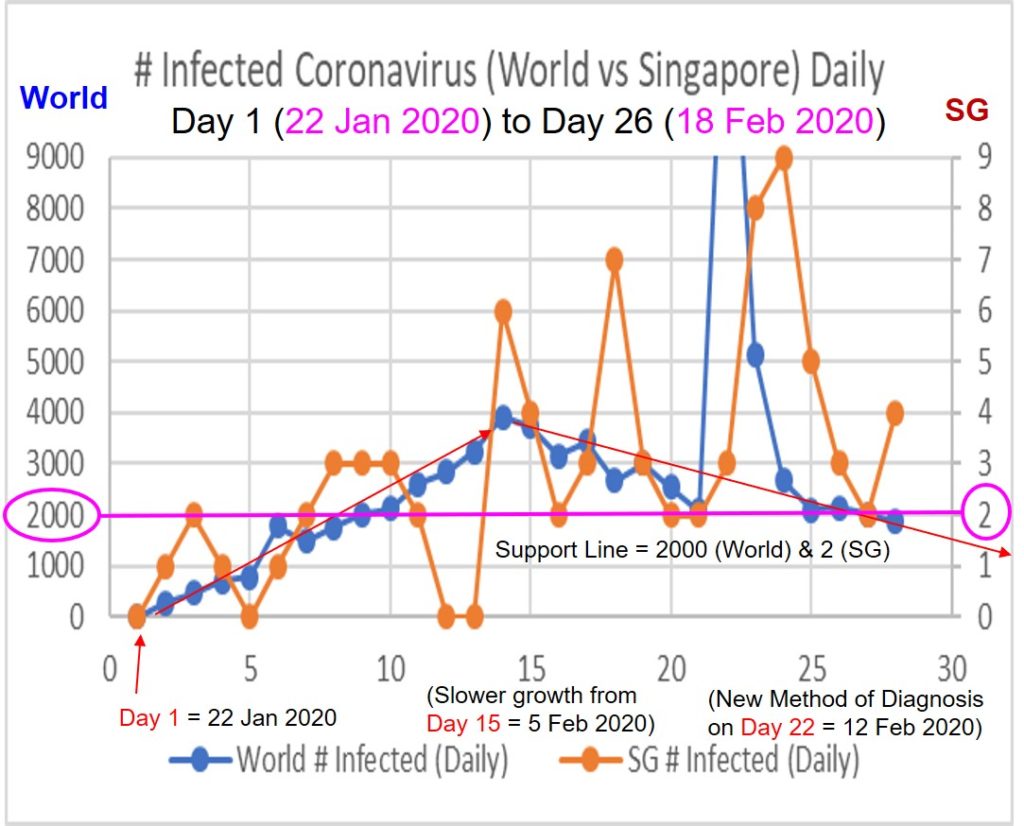

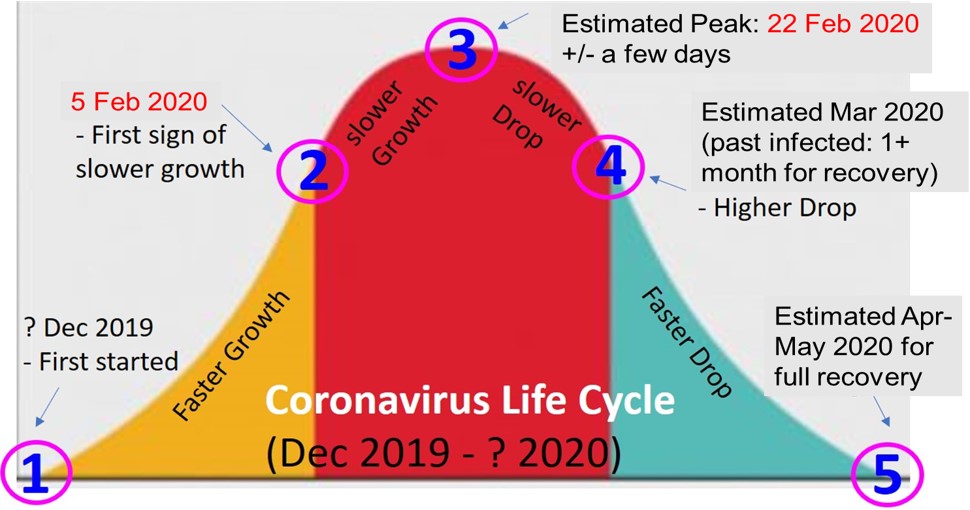

Good news is Trump has a fair chance to win as Coronavirus dislikes warm temperature. Here is an update of Coronavirus condition in major countries (see my previous video on how to analyze):

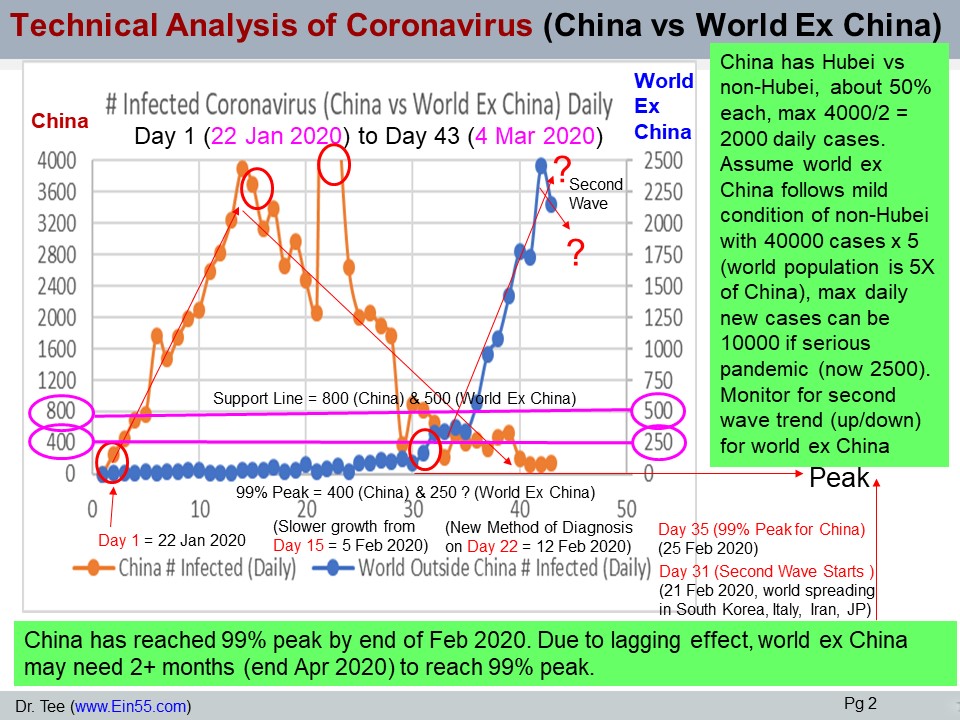

1) China – 4 months Coronavirus period is confirmed, ending in Mar 2020. China people including Wuhan / Hubei have reopened the door of economy, busy making money again. This is the result after painful experience of lockdown of whole China for 2 months, with good practices continue to prevent future viruses.

2) Korea – was the second most severe country, Coronavirus would end in Apr after follow the lockdown model of China. This is the first proof outside China that Coronavirus could be controlled within about 4 months period with active intervention to minimize the death cases.

3) Italy is the most severe cases, considering the death number (actual infected cases could be more than China as mild cases were not diagnosed). Even so, after lockdown for a few weeks, last 5 days were showing downtrend in new daily cases, good chance to reach a peak by mid of Apr, ending in May.

4) Iran has been stable at high cases (growth is limited), social distancing could be a challenge, therefore infection may continue until more people to be infected before community immunity may be established to stop the spreading.

5) US/Europe is under high growth of Coronavirus, especially for US (major city like New York City with crowded population is high risk), over 13k cases each day, likely will exceed both China and Italy to have the highest number of infection. However, due to strong medical resources, US death rate is lower than China and Italy. However, US/Europe may have high growth in cases in Apr, fading in May, only then may end in Jun.

This is also true for countries like Germany and Singapore, so high infected number may not be a threat, more importantly spread over a longer period to ensure medical solution could be given.

6) Singapore and Southeast asia countries continue to follow the global trends (mainly US/Europe) with high growth. With total / partial lockdown, significant reduction would be observed in number of new daily cases as most new cases are imported cases due to return of residents infected from overseas.

7) Both Africa and India (second world largest population) may be slow in spreading of cases but Coronavirus treats everyone fairly. So, early intervention in India with strict measures would help to lower the death rate by slowing down the growth rate, similar strategy as in Singapore. Many people die in China Hubei and Italy, not due to high number of cases, but mainly due to lack of medical resources during the peak period.

In summary, there is fair chance for current on-going Coronavirus to end in summer (Jun-July). The turning point from high to slower growth rate (decline in new daily cases) is key for US as this is the first signal to see light at the end of tunnel, which would affect both stock and economy in US and whole world.

So, Trump could only help 50% with unlimited QE. The remaining 50% would need the opponent Coronavirus to fall itself. The results will be clear in summer but signals will be clearer each week from now to summer and stock market would reflect such probability of winning or losing through the stock prices.

====================

In general, don’t focus on daily changes in share prices. Rather, one has to establish an overall strategy: long term investing, mid term trading or short term trading. Both long or shorting is possible but need to align with own personality.

In the current uncertain market with lower optimism in Asia stock market and mid optimism for US, it is relatively safe to apply long term value investing but entries have to be in batches (eg. 10% x 10 times, 20% x 5 times, 33% x 3 times, 50% x 2 times), averaging down and up with low optimism strategies across Level 1 (individual stocks), Level 2 (sectors), Level 3 (country) and Level 4 (world) over a portfolio of 10-20 global giant stocks.

If trading is applied, S.E.T. (Stop Loss / Entry / Target Prices) trading plan must be followed strictly but a challenge for retail traders in volatile market with +/- 5% in daily stock market.

If Coronavirus may end in summer, global stock market has reasonable chance to recover with support of global QE. If not, it may fall into depression with global financial crisis, especially if the same virus may come back again every winter, every 6 months to haunt the world. By then, vaccine in about 1 year of now would be key to prevent the global financial crisis falling into the great depression as it is serious when there is little social network (eg. shopping) for more than 1 year.

Dr Tee has cancelled all investment workshops in Feb-Apr 2020 during global stock crisis to follow the government rules with less gathering. This is a regret for some students as it is the best time in 10+ years to learn and apply crisis stock investing. So, I could only share through more regular articles and video education but it has limitation compared to a more comprehensive 4 hours workshop.

The next available free 4hr investment public workshop (with meet-up) by Dr Tee will be on 21 May 2020, you may register here before it is full: www.ein55.com

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 8000 members:

https://www.facebook.com/groups/ein55forum/