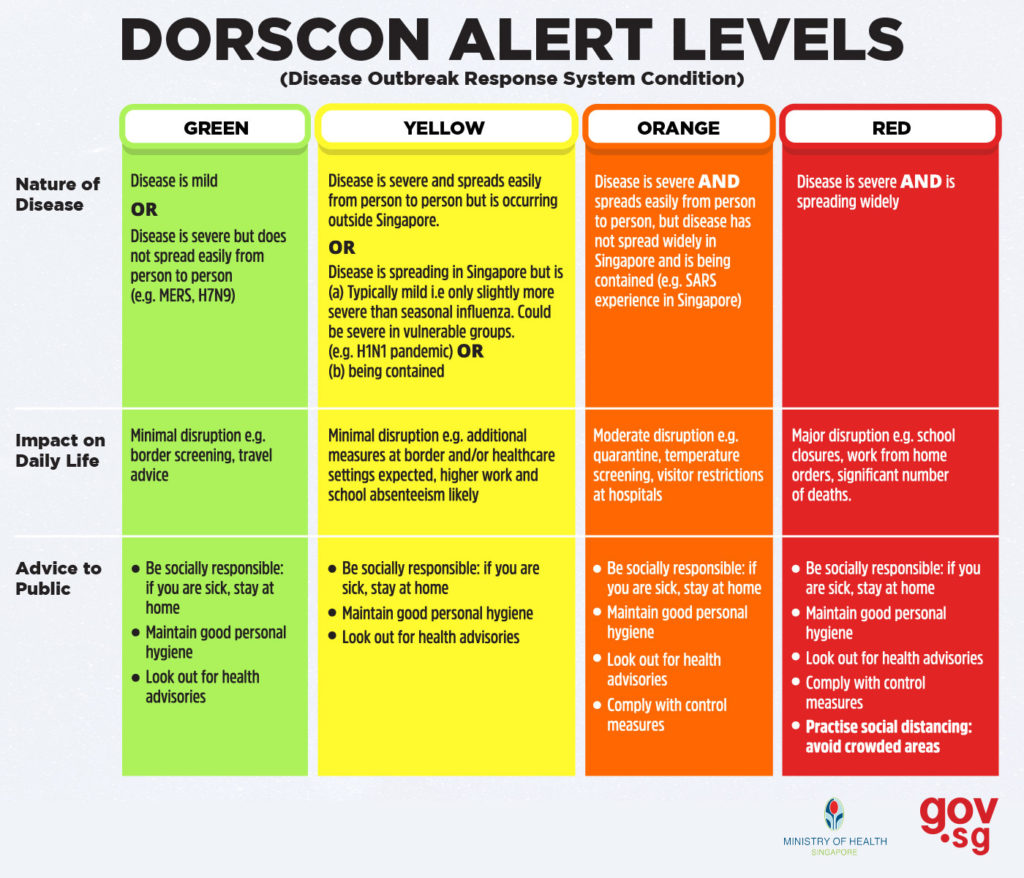

Dorscon disease outbreak alert system (4 colors: Green, Yellow, Orange, Red) was established in Singapore after SARS 2003. Some people may worry the current situation may be changed from Orange to Red Alert for Coronavirus (if so, schools have to be shutdown temporary).

There is grey area (no clear quantitative criteria) in Dorscon for 2 main criteria (# infected vs # death) to be Red Alert:

1) spread widely

– how many # infected daily is considered widely

2) Significant # death

– how to define significant?

Even for SARS in Singapore, it was later benchmark as Orange Alert, having 33 death out of 238 infected cases in Singapore. Since Dorscon absolute criteria may not be known. We may do a relative criteria based on benchmark with known case of SARS in 2003 at Orange Alert.

For Coronavirus, although actual fatality rate could be much lower than 2% (due to many cases in Hubei may not be diagnosed in earlier stage), we may assume 2% as the worst case scenario.

We could do a reversed calculation to estimate when Coronavirus may be as severe as SARS based on Dorscon criteria of Orange Alert before transition to Red Alert. There are 3 possible conditions as criteria:

1) Same # infected as SARS of 238 cases. Currently Coronavirus has 58 # infected in Singapore till 13 Feb 2020. Coronavirus is about 25% level of SARS for Singapore. Since worldwide data shows Coronavirus has more potential than SARS, then this # infected may have potential to grow in Singapore.

2) Same # death as SARS of 33 cases. Currently Coronavirus has 0 death, still a long distance before in par with SARS (which is rated as Orange alert).

3) Since # death in Singapore for Coronavirus is 0, we may also apply same # death as SARS of 33, assuming 2% fatality rate (worst case) for Coronavirus, we could derive a critical # infected = 33/0.02 = 1650 # infected in Singapore before Coronavirus is comparable with SARS. Criteria 2 and 3 are related, see whichever reached first.

Conclusions:

SARS Orange alert criteria is in fact quite high. If we use the same criteria as SARS, then Coronavirus has to have either 238 or 1650 infected cases and/or 33 death in Singapore before declaring the same level of health crisis as SARS (which is still Orange Alert). Based on 3 possible conditions, the easiest criteria (assuming either wide spreading or significant number of death, not both) to meet is probably No 1 based on same # infected of 238. For Conditions No 2 & 3, will be more difficult to achieve, if applying this criteria, likely Coronavirus would remain just Orange Alert.

Assuming SARS is the upper limit of Orange Alert, then Coronavirus currently is probably the lower limit or Orange Alert. The Red Alert has to be reserved for true health crisis, otherwise there is no proper level to reflect the right action for such emergency then.

============================

Dorscon standard is just a reference, main objective is to show the relative risk in health, individual could then use it to make decision on how much risk to take.

Similarly, we may apply 4-color Dorscon concept in stock investment, dividing into 4 levels of investing opportunities, each level has its own risk vs opportunity based on business fundamental vs optimism level:

4 Levels of Ein55 Investment Opportunities

1) Green

– Strong business fundamental

– Low Optimism level (<25%)

2) Yellow

– Strong business fundamental

– Moderate Optimism level (25-75%)

3) Orange

– Moderate business fundamental

– Moderate Optimism level (25-75%)

4) Red

– Moderate business fundamental

– High Optimism level (>75%)

For either long term investing or short term trading, a stock requires minimum of moderate business fundamental. Buying weak fundamental stocks with bullish price trend is speculative, more suitable for very short term trader (eg. during the Coronavirus crisis time, some weak stocks start to rise).

When Optimism level is higher (from Green to Red Opportunity), positioning style is safer from investing to trading. Current global stock market is around Red Opportunity but traders may still consider short term trading in US with high optimism. For Singapore (moderate optimism level), it will be either Yellow or Orange Opportunities, depending on type of stocks.

Learn from Dr Tee free 4hr investment course on balance between risk and opportunities with comprehensive LOFTP Strategies (Level / Optimism / Fundamental / Technical / Personal Analysis). Register Here: www.ein55.com