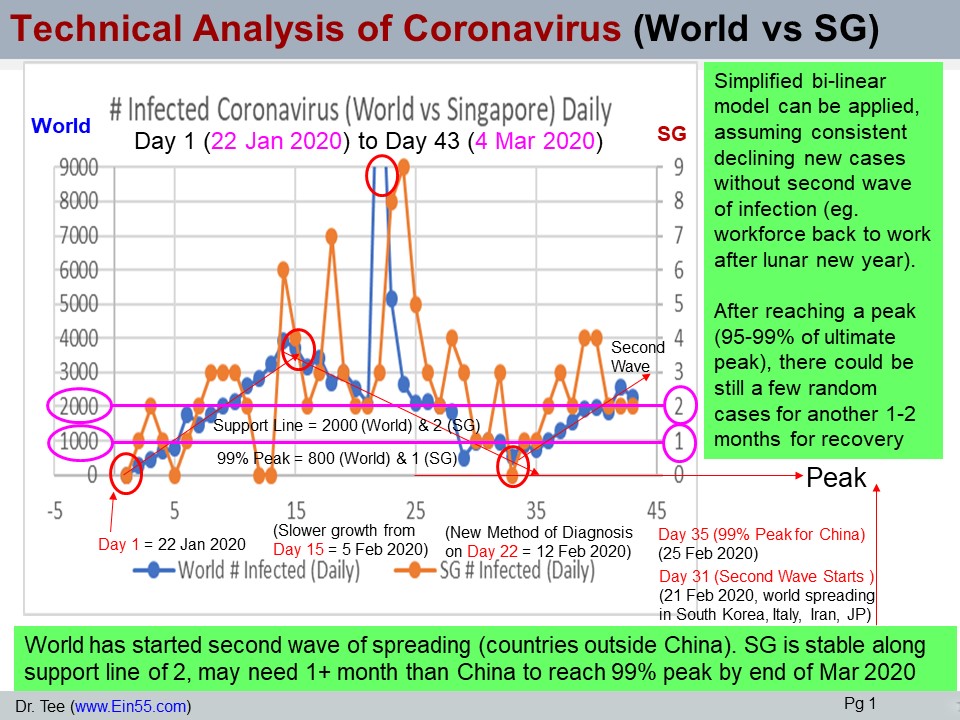

– World vs SG

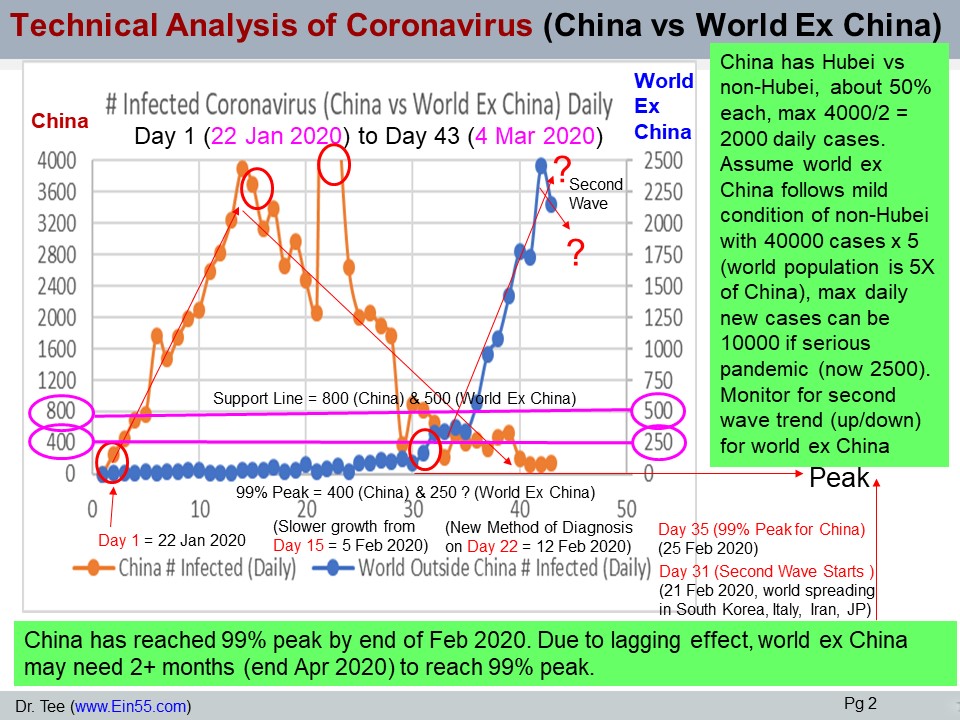

– China vs World Outside China

Here are a few main conclusions on Coronavirus with additional analysis on world outside China (due to serious outbreak in South Korea, Iran, Italy and emerging potential in the rest of the world).

1) China

China started first in Dec 2019, also the first country to reach 99% peak (daily new cases is less than 1% of total) by end of Feb 2020, aligned with earlier Technical Analysis projection with bi-linear model.

2) Singapore

Singapore is unfortunately experiencing second wave (new clusters of infection), aligning with spreading in the rest of the world outside China (especially in South Korea, Iran, Italy and Japan). Need to monitor the second peak (new max daily cases) vs the first peak (was 9 cases for Singapore), if “higher high” is achieved, Singapore may be back to growing phase as there could be cross-infection among the countries (not limited to China or a few countries).

If Singapore follows similar pattern of China (especially non-Hubei region), there is a time lagging period of 1+ month after China, Singapore may reach 99% peak by end of Mar 2020 or in Apr 2020 (if second wave in world outside China is longer and more serious than expected).

3) World Outside China

Singapore now is dependent on the World (especially Outside China), therefore good condition in China does not help Singapore much. Currently the world (outside China) is still growing, despite there is a dip yesterday in daily cases but it is insufficient to establish a clear trend (need at least 1 week of downtrend without serious new outbreak in another country). Based on population, world ex China has 5X potential than in China, therefore if it becomes pandemic, there could be 5x more cases than in China (non-Hubei which is about 50% of China cases).

US is part of “World Outside China” category, relatively still not so serious at the moment (considering the population of US). However, trend of the rest of the world is growing with Coronavirus, even if “second wave” is trending down, there could be 3rd or 4th wave in any city or country as there is time lagging effect for Coronavirus to spread from 1 country to another country (eg. from China Wuhan to Singapore in 1-2 months, then to the rest of the world in 1-3 months).

It is still a good news to see China condition improves significantly over the past 1 month (with condition that we trust the data reported) as the rest of the world including Singapore would follow similar pattern in near future, just take extra few more months to end or at least control the health crisis (reaching 99% peak with less than 1% new daily cases).

===================

Thinking positively, world outside China (including Singapore) could follow the footstep of China, both for Coronavirus (uptrend and then downtrend) and stock market (correction for a few days during first week of fear, then up again). G7 includes US are taking pro-active actions to stimulate economy to prolong the current bull market (started since year 2009). For example, US Federal Reserve has started to cut interest rate further by 0.5%, despite US economy is still strong.

There is no need to worry as we could only control what’s within our capacity. This is true for Coronavirus, also valid for stock investment (eg. what stocks to buy, when to buy/sell is within one control but exactly when and what crisis may come is beyond the radar). We just need to take the right actions, then depend on the probability to give us the unfair advantage (eg. low chance to be infected, high probability of winning in stocks).

While taking precautionary measures for Coronavirus, learn to take calculated risk to invest in global giant stocks at discounted prices with this rare health crisis which is only a correction in global stock market at the moment. The main focus is on the next global financial crisis which could be the best opportunity for an investor.

Learn from Dr Tee free 4hr stock investment course to convert the crisis into opportunity. Register Here: www.ein55.com