Mapletree Investment is 100% owned by Temasek, a company with strength in private property funds and managing 4 Singapore giant REITs:

1) Mapletree Logistics Trust, MLT (SGX: M44U) – Giant Logistic REIT

2) Mapletree Industrial Trust, MIT (SGX: ME8U) – Giant Industrial REIT

3) Mapletree Commercial Trust, MCT (SGX: N2IU) – Giant Commercial REIT

4) Mapletree North Asia Commercial Trust, MNACT (SGX: RW0U) – Giant Commercial REIT

Learn further on how to position in these 4 Singapore REITs after cross comparison. MLT and MCT are 30 STI component stocks while MIT is the next to consider in reserve list for STI.

1) History & Sponsor

Among the 4 Mapletree REITs, MLT is the longest history in stock market (listed in year 2005), following by IPOs of MIT (Year 2010), MCT (Year 2011) and MNACT (Year 2013). Despites all the 4 REITs are giant stocks (according to Dr Tee criteria) but 3 of them are relatively young giant stocks, only MLT has experienced the last Global Financial Crisis in Year 2008-2009 with share prices dropped by over 70%. Mapletree has 6 other private property funds which may be listed as well in future, following similar REIT model.

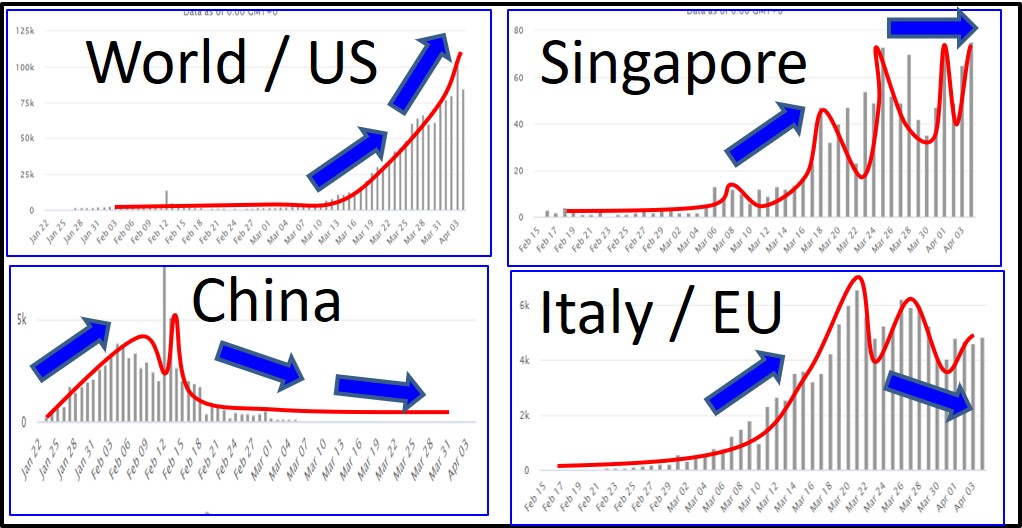

In the recent global stock crisis in Mar 2020, all these 4 REITs are corrected by about 40% (MNACT is even cut by half for share price due to additional fear when Coronavirus was first started in China in Jan 2020). Nevertheless, the scale of recent stock price correction is still not comparable with 2008-2009 subprime crisis. During a global financial crisis, it is important to have a strong sponsor, which 4 REITs have: Mapletree Investment which is 100% owned and supported by Temasek.

In short, the main risk of 4 REITs is with cyclical stock prices due to economic cycle (i.e. potential capital loss, especially during global financial crisis), not so much on business risks. When Coronavirus crisis is over or fading away, tenants would resume the business, continue to pay for the committed rentals.

2) Type of REITs

All the 4 REITs have different focuses of industries and countries, eg. MLT is on logistic REIT (Singapore / global), MIT is on industrial REIT (Singapore / global), MCT is on commercial / retail REIT (Singapore) and MNACT is on commercial REIT in North Asia (Hong Kong, China, Japan).

Geographically, each country has different economic performance but most of the REITs portfolios are in Singapore and Asia which have been growing over the past decades. REITs focus on rental collection, therefore tenant stability (ability to pay rental with agreements) are related to economic cycles of each country. REITs usually are diversified over a portfolio of clients, tenants from different industries, therefore risk is relatively lower.

The current Coronavirus crisis has limited impact, even during lockdown period, property owner (REITs) can still collect most of the rental (partially supported by local government) but distribution of dividend may not be on time for Q1/Q2 2020 as REITs may reserve some cash for planning during the uncertain Year of 2020. For longer term investor who could hold more than 1 year, this should not be an issue as dividend kept (if any) would be distributed back to shareholders at later time.

3) Business

Fundamentally, all these 4 REITs are strong, disruption of Coronavirus crisis has limited impact. The dividend yields are currently around 4+% for MLT, MIT and MCT, below the minimum expectation of 5% for dividend investing (which is achievable if an investor could take action in Mar or Apr 2020 when share prices were under 30-40% correction, this window of opportunity is closed when over half of the correction is recovered with V-shape recovery in share prices). MNACT still has 8+% dividend yield, mainly due to heavy correction in share prices (50%), recovering slower (less than 30% of total correction) than the other 3 REITs.

Mapletree REITs are more suitable for positioning as midfielders, both capital gains (mainly for trading when stock market trend is more bullish in short term to medium term) and moderate dividend yield as bonus (about 3-4% is fine). For long term investing, entry of Mapletree REITs or any giant dividend stock has to be aligned with STI or world stock market at low optimism, usually during a Global Financial Crisis.

Since Mapletree Investment strength is in property development and management, a good REIT manager would help to improve dividend yield with new property into REIT portfolio. These 4 REITs have gearing ratio less than 40%, still having potential to grow bigger, especially for MCT (only 33% gearing ratio, far below 45% maximum gearing ratio allowed by current law). MCT is more concentrated in Singapore, benefiting from government plan on “Greater Southern Waterfront”, Vivo City contributing to about 1/3 of revenue. Concentration could be viewed as a risk or an opportunity, depending on whether the focused properties are higher or lower quality.

Interestingly, 3 out of 4 REITs CEOs are female for MLT, MCT and MNACT. REITs are relatively stable businesses, delivery of committed goals are key for any CEO, whether male or female management. The best judgement of a new management performance is through positive financial report of at least 3 years.

4) Timing & Return

The best time to buy a giant REIT is usually during crisis. The only question is how low is low to buy a stock. Therefore, dividend yield >5% is a reasonable criteria for dividend stock investor. A giant REIT or dividend stock investor may also consider entry in batches (if afraid of buy low get lower in share price), entering for every 10% or X% lower in share prices.

In fact, an investor of REIT is similar to a REIT manager who consistently looks for better properties at lower prices to maximize the passive income with higher yield. It is much easier for a stock investor, just need to click a button to buy a stock to invest. However, since it is so easy, some investors may not consider properly: What to Buy, When to Buy/Sell.

=================================

There are at least 26 Temasek / GLC stocks in Singapore including these 4 Mapletree stocks, controlling shareholder with 15% or more ownership directly or indirectly (investor has to focus only on giant Temasek stocks):

Singtel (SGX: Z74), DBS Bank (SGX: D05), ST Engineering (SGX: S63), Singapore Airlines (SGX: C6L), SIA Engineering (SGX: S59), Singapore Exchange (SGX: S68), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Sembcorp Marine (SGX: S51), Olam (SGX: O32), CapitaLand (SGX: C31), CapitaLand Mall Trust (SGX: C38U), CapitaLand Commercial Trust (SGX: C61U), Ascendas Reit (SGX: A17U), Ascott Hospitality Trust (SGX: HMN), Ascendas Hospitality Trust (SGX: Q1P), CapitaLand Retail China Trust (SGX: AU8U), Ascendas-iTrust (SGX: CY6U), Keppel Corp (SGX: BN4), Keppel Reit (SGX: K71U), Keppel DC Reit (SGX: AJBU), Keppel Infrastructure Trust (SGX: A7RU), Mapletree Logistics Trust (SGX: M44U), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree NAC Trust (SGX: RW0U).

Temasek stocks portfolio also affect about 15% of STI index stocks, which has strong impact on Singapore stock market. Here are 30 STI component stocks:

DBS Bank (SGX: D05), Singtel (SGX: Z74), OCBC Bank (SGX: O39), UOB Bank (SGX: U11), Wilmar International (SGX: F34), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Thai Beverage (SGX: Y92), CapitaLand (SGX: C31), Ascendas Reit (SGX: A17U), Singapore Airlines (SGX: C6L), ST Engineering (SGX: S63), Keppel Corp (SGX: BN4), Singapore Exchange (SGX: S68), HongkongLand (SGX: H78), Genting Singapore (SGX: G13), Mapletree Logistics Trust (SGX: M44U), Jardine Cycle & Carriage (SGX: C07), Mapletree Industrial Trust (SGX: ME8U), City Development (SGX: C09), CapitaLand Mall Trust (SGX: C38U), CapitaLand Commercial Trust (SGX: C61U), Mapletree Commercial Trust (SGX: N2IU), Dairy Farm International (SGX: D01), UOL (SGX: U14), Venture Corporation (SGX: V03), YZJ Shipbldg SGD (SGX: BS6), Sembcorp Industries (SGX: U96), SATS (SGX: S58), ComfortDelGro (SGX: C52).

Dr Tee likes leaves of maple trees, still remember the first leaf collected about 3 decades ago in fall season when studying in US. When the maple tree leaves turn into red color, it is a spectacular view, making fall or autumn as the most beautiful season (northeast of US near Canada and also Japan have nice views of maple trees during the fall). Change in leaves colors (一叶知秋) is similar to stock investment, showing the investment clock with 4 seasons, an important skill to master on how to take 4 actions: Buy, Hold, Sell, Wait. When an investor knows What Giant Stocks to buy, the remaining questions are simply When to Buy/Sell and How Much to Buy/Sell (position sizing, entry/exit in batches).

There are other giant REITs in Singapore and globally which an investor may consider beyond these 4 Mapletree REITs. Drop by Dr Tee free 4hr investment course to learn how to position in global giant stocks with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Learn further from Dr Tee valuable 7hr Online Course, both English (How to Discover Giant Stocks) and Chinese (价值投资法: 探测强巨股) options, specially for learners who prefer to master stock investment strategies of over 100 global giant stocks at the comfort of home.

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 9000 members.