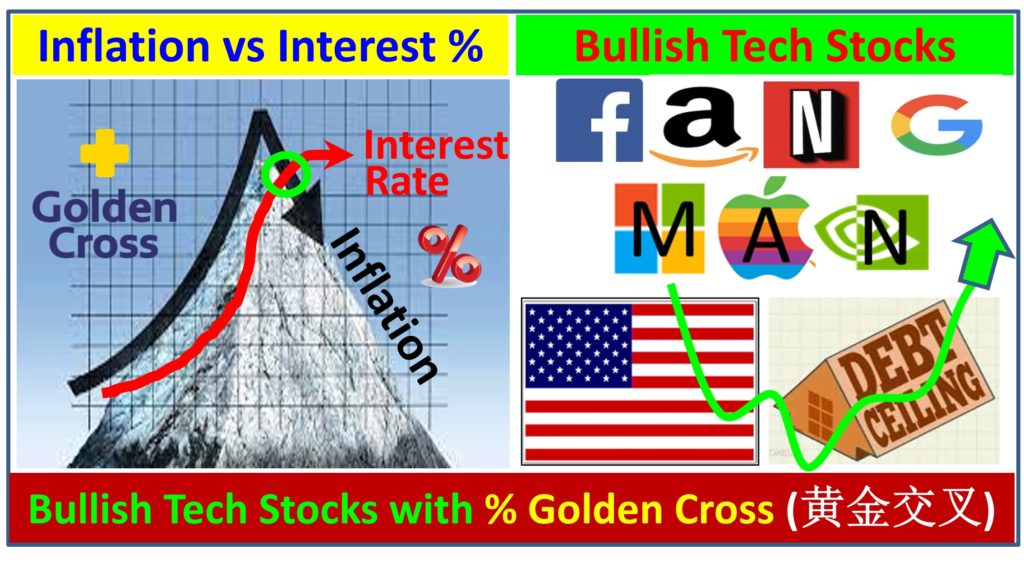

US stock market is recovering gradually over the past 6 months with clearance of debt ceiling issue recently, greed is overtaking fear. In particular, US large-cap technology stocks have been bullish, supported by golden cross of inflation (4% currently) below interest rate (5.25% currently), confirming the declining trend of inflation from the peak of 9.1%.

Technology stocks are sensitive to interest rate hike (which is dependent on inflation), therefore the tech sector was severely corrected over 30-50% in Year 2022, seeing light at the end of tunnel 6 months ago when inflation starts to fall. The Fed has been using higher inflation rate (eg. 6-9%) as an excuse to increase interest rate but the fact is inflation is a lagging indicator which is CPI (Consumer Price Index) % change over the past 1 year. Monthly CPI has been slowing down, therefore yearly CPI change (i.e. inflation rate) is declining naturally, the trend likely will continue till Q3/2023 with inflation rate below 3%. With inflation at moderate level of 4%, The Fed decides to pause on interest rate hike (remain at 5.25%) but keeping options of 2 further hikes by end of this year when needed.

Consistent lower inflation provides an excellent mid-term trading opportunity, especially for large-cap US technology stocks, here are familiar companies (FANG-MAN):

F – Facebook / Meta (NASDAQ: Meta)

A – Amazon (Nasdaq: AMZN)

N – Netflix (Nasdaq: NFLX)

G – Google / Alphabet (Nasdaq: GOOGL / GOOG)

M – Microsoft (Nasdaq: MSFT)

A – Apple (Nasdaq: AAPL)

N – NVidia (Nasdaq: NVDA)

These 7 tech stocks contribute to over 25% of US S&P 500 Index, 5 of them are over $1 Trillion market (Apple, Microsoft, Amazon, Google, NVdia), even Apple alone (nearly $3 Trillions) is bigger than 30 STI component stocks combined. However, strong recovery of S&P 500 and Nasdaq indices may give a false impression that most stocks are doing well. In fact, many non-technology small / mid cap stocks are still relatively weak, these 7 FANG-MAN stocks have relatively bigger weightage, therefore investors / traders selectively buy up technology stocks, help to push up the index as a whole.

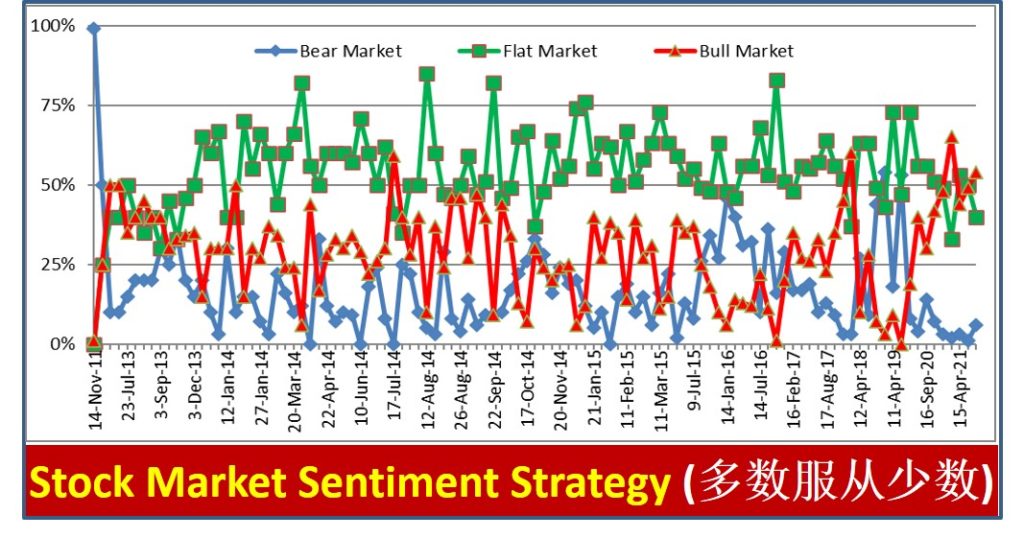

Alignment with the right sector and country (Level Analysis) is key for stock trading, therefore it is not surprise to see technology stocks with uptrend prices (higher highs, higher lows), ideal for trading or even investing. However, due to moderate higher Ein55 Optimism level, current stock market recovery (especially for technology stocks) is more suitable for short term / mid term trading. A smart investor may apply trend-following trading system to ride the trend but need to be careful when it enters high Ein55 Optimism level (eg. >75%) as any unexpected black swan could result in the next global financial crisis, knowing when to exit (take profits) is critical as the next move.

US economy currently is relatively strong with low unemployment rate (3.7% currently), weaker USD would help in financial reports for many S&P 500 companies with overseas businesses (when converting income to USD). So, average inflation level (2-4%) is healthy for a growing economy, too high results in overheated spending, too low ends up in lagging economy (eg. lost 3 decades in Japan). Based on similar experience of last high inflation in 1970-1980, there was upside potential of over 50% for US indices when inflation was declining from the peak. Stock market usually is 6-12 months ahead of economy or business fundamentals, therefore forward-looking views may be needed for success in trading.

There is information overflow each day with good/bad financial news, therefore each investor needs to have own independent thinking (not to blindly follow Dr Doom or Dr Boom), following an investing / trading strategy aligning with own personality (short term / mid term / long term / lifetime).

===================================

There are over 2000 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Frasers Logistics & Commercial Trust (SGX: BUOU), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Integrated Commercial Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com

View quick preview video below, Dr Tee will introduce 10 key stock investment strategies (股票投资十招) to be learned in 4hr free stock webinar:

Register Here (Dr Tee Free 4hr Stock Webinar): www.ein55.com