To make money in stock trading or investing can be as simple as 3 steps:

1) Buy giant stocks (eg. using Giant Detector)

2) Buy Low at price below the value (eg. using Optimism Strategies)

3) Either Sell High or Hold for capital gains (duration depends on personality)

To lose money in stock trading or investing can also be as simple as 3 steps:

1) Buy weak fundamental stocks

2) Buy High at price above the value

3) Either Sell Low or Hold for capital loss

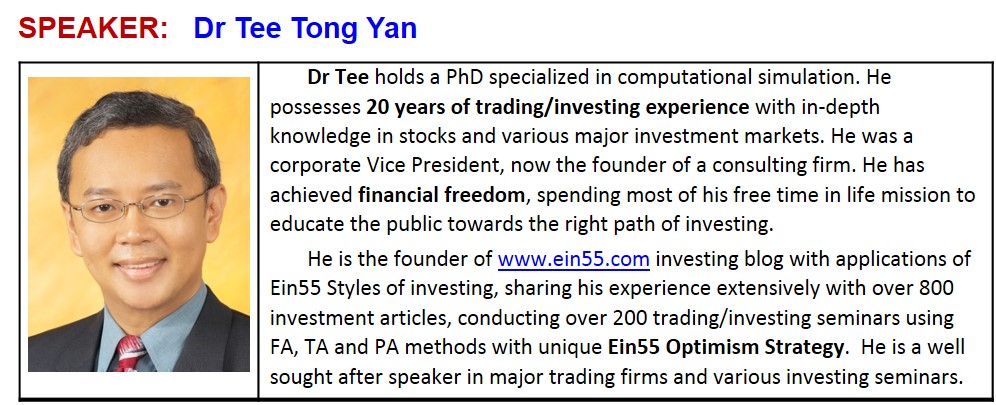

Most traders and investors assume “Methods” are the most important, actively searching for “secrets to make money”. In fact, based on 5 steps of Ein55 trading or investing analysis of LO-FTP, most important step should be reversed in order (PTF-OL) to evaluate PA first:

1) PA (Personal Analysis) – Determine own personality to align the with right strategy (eg. short term trading or long term investing)

2) TA (Technical Analysis)- Following trend of stock prices in trading or investing

3) FA (Fundamental Analysis)- Extra protection with a portfolio of stocks with strong business fundamental

4) OA (Optimism Analysis)- Buy Low Sell High to increase winning probability

5) LA (Level Analysis)- Align Level 1 (individual stock) with Level 2 (sector / industry), Level 3 (country stock market) and Level 4 (world stock market), let big fish (big funds) protect the small fish (individual stocks).

Since making money or lose money in stocks are easy, it is important for us to learn and apply the right way aligned with own personality. Interested readers may sign up for free 4hr stock investment course by Dr Tee to learn 5 steps of stock trading or investing with LO-FTP analyses. Register Here: www.ein55.com