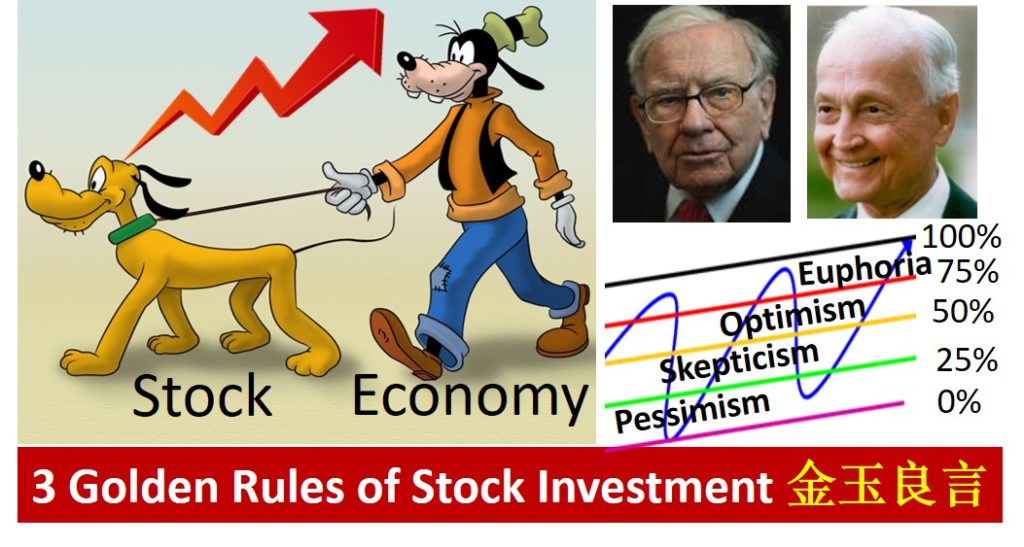

“Bull markets are born on PESSIMISM, grow on SKEPTICISM, mature on OPTIMISM and die on EUPHORIA.”, this is the Best Golden Rule of Sir John Templeton, founder of famous Templeton Funds, indicating management of human emotions is key for success in investment.

This is aligned with another famous saying by Warren Buffett: “Be Greedy when others are fearful. Be fearful when others are greedy“, which could be summarized simply as the universal law of “Buy Low Sell High“.

Everyone would agree the above 3 Golden Rules to make money in investment, but they are qualitative in nature (eg. how low is low, how high is high). In the practical investment world, how to do it exactly, would need a quantitative method such as Dr Tee “Ein55 Optimism” to Buy Low (when Optimism < 25%) and Sell High (when Optimism > 75%).

Pandemic year 2020 was “pessimistic” (Ein55 Optimism < 25%) based on Dr Tee criteria, therefore “Bull market was born’. Year 2021 is pandemic recovery with different views between bullish and bearish viewers, therefore stock market “grow on skepticism” (moderate Ein55 Optimism 40%-60%, near to fair value). One day, stock market may “mature on optimism” or “die on euphoria” when the stock market is over-heated (Ein55 Optimism > 75%-100%).

This is a natural emotional cycle which commonly reflected as stock market or economic cycle every 5 to 10+ years. Mastery of market cycle could help an investor maximizing the capital gains during a bull run and minimizing the market risks during a global financial crisis.

However, market cycle investing (eg. with Ein55 Optimism Method) has to be integrated with other dimensions of investment, eg. Fundamental Analysis (FA at business level), Economic Analysis (FA at country level), Technical Analysis (TA of share prices), Level Analysis (LA of Level 1 – stock, Level 2 – sector, Level 3 – country, Level 4 – world), Personal Analysis (PA to know own unique personality to define suitable style of investing or trading), etc.

If not, “Buy Low” may “Get Lower”, especially if an investor blindly invests in a weak fundamental stock with bearish price trend during a global financial crisis. Interested learners may refer to earlier hundreds of educational articles by Dr Tee on applications of LOFTP Analysis strategies on various global giant stocks.

========================

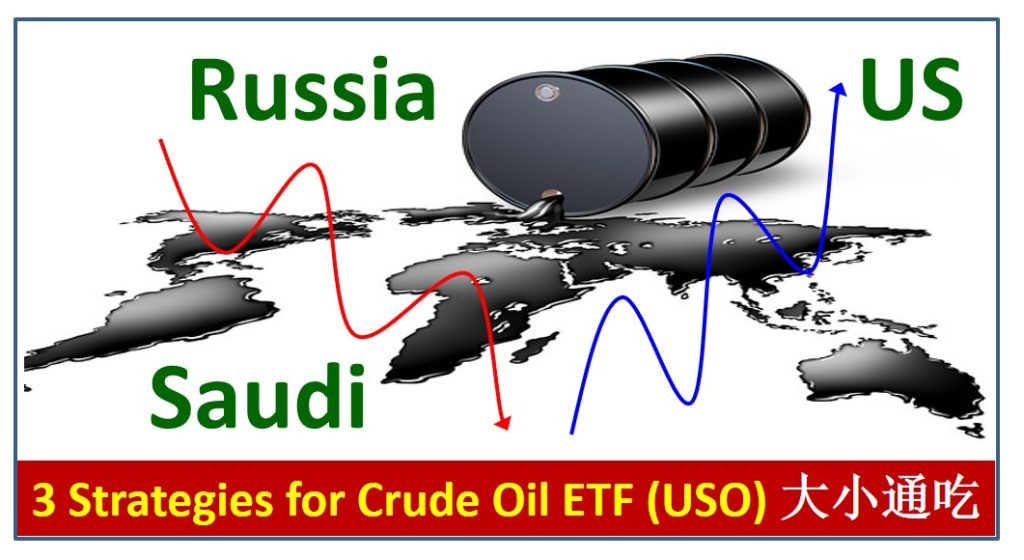

Tonight (2 July 2021) is key for US stock market to reflect emotions for non-farm payroll (jobs excluding farming, local gov and non-profit work) of June 2021, last trading day before 4th of July, US Independence Day celebration.

US non-farm payroll is another way to measure job market, has been on increasing trend during pandemic recovery. The key is how far the increment from the consensus (eg. 720k more jobs expected before the official report today). The Fed focuses mainly on job market and inflation to adjust its economic policies. More jobs created could add fuel to spending, thus stimulate the economy further, supporting the stock market indirectly in longer run.

If the actual number is too good (people may worry higher interest rate to cope with higher inflation due to potential over-heated economy) or too weak (people may worry economy is still weak) may give surprised market responses, best compromised results could be mild growth (slightly lower or higher than expectation) within the tolerances of both bull and bear viewers.

US Non-farm payroll for month of June 2021 with additional new jobs (850k) is higher than expected (720k) but unemployment rate (5.9%) is slightly higher than May 2021 (5.8%). So, gradual growth of economy or even mixed performance is probably the most ideal market condition for mass market, both bullish viewers (who worry about lagging economy) and bearish viewers (who worry about higher inflation or interest rate) are able to accept it.

Based on the market opening so far today (2 July 2021) with mild bullish US stock market, US job market has mixed performance which is ideal to balance between bull and bear viewer, supporting both S&P500 and Nasdaq indices to another new historical high tonight. Dow Jones (mainly 30 blue chip stocks) may also achieve a new high over the next few weeks.

At the same time, Asian stock markets (Singapore STI, Malaysia KLCI, Hong Kong HSI, China SSEC, etc) are stagnant recently after the rally in Q1 2021. Asian stock markets smaller in sizes, mainly follow US or global trends for stock market or economy. Pandemic recovery is getting faster with global vaccination, the likely stronger economy would help to support the growth of global stock markets in the next few years.

Last year, economy and stock market was diverged, stock market (forward looking, expecting pandemic would end sooner or later) was recovering ahead of economy. This year, economy starts to catch up with stock market (becoming slower growth as early investors have make over 50% gains in the last 1 year). Moving forward, economy and stock market would be more “normal” to move in similar pace, eg. moderate growth yearly until the next Global Financial Crisis comes unexpectedly to reset the market again.

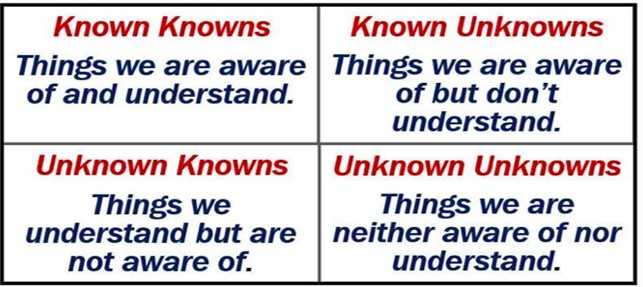

Knowledge of macroeconomy would help both investors and traders to see the bigger picture as the stock market (dog) would follow the economy (master) but may not be in a predictable way, sometimes could be ahead or behind the master. A smart investor needs to digest what is known and what is unknown but likely to happen in future (eg. black swan which may induce the global financial crisis), taking calculated risks with a portfolio of 10-20 global giant stocks.

===================================

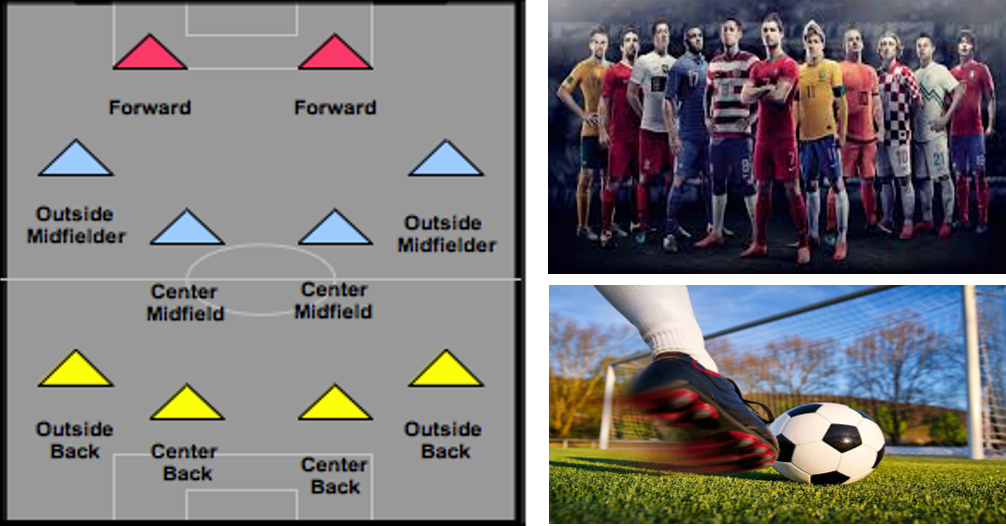

There are over 2000 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Frasers Logistics & Commercial Trust (SGX: BUOU), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Integrated Commercial Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com

View quick preview video below, Dr Tee will introduce 10 key stock investment strategies (股票投资十招) to be learned in 4hr free stock webinar:

Register Here (Dr Tee Free 4hr Stock Webinar): www.ein55.com