Despite HSBC (HKEX: 0005) is not a giant bank stock, it is definitely not a junk stock. It used to be a giant stock several decades ago but declining over the last decade in both business and stock prices. So, for life-time investing strategy, it is important to review the grandparents blue chips (another example is SPH, SGX: T29), at least once a year, if business moves in wrong direction (downtrend instead of uptrend) year after year, a painful early farewell may be required, not to wait until falling in share prices over 50%, be a lifetime investor unwillingly, resulting in more capital losses through long term investing of a declining business.

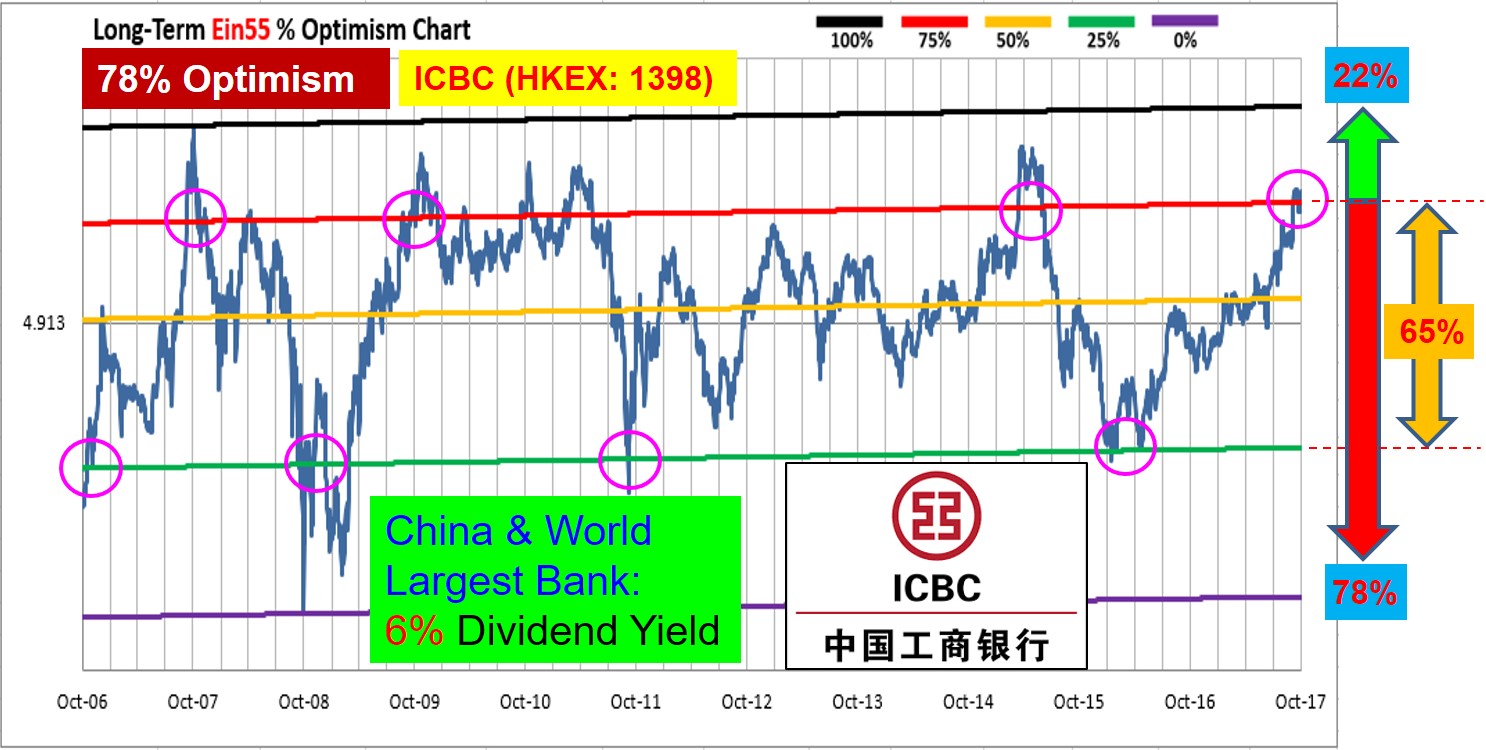

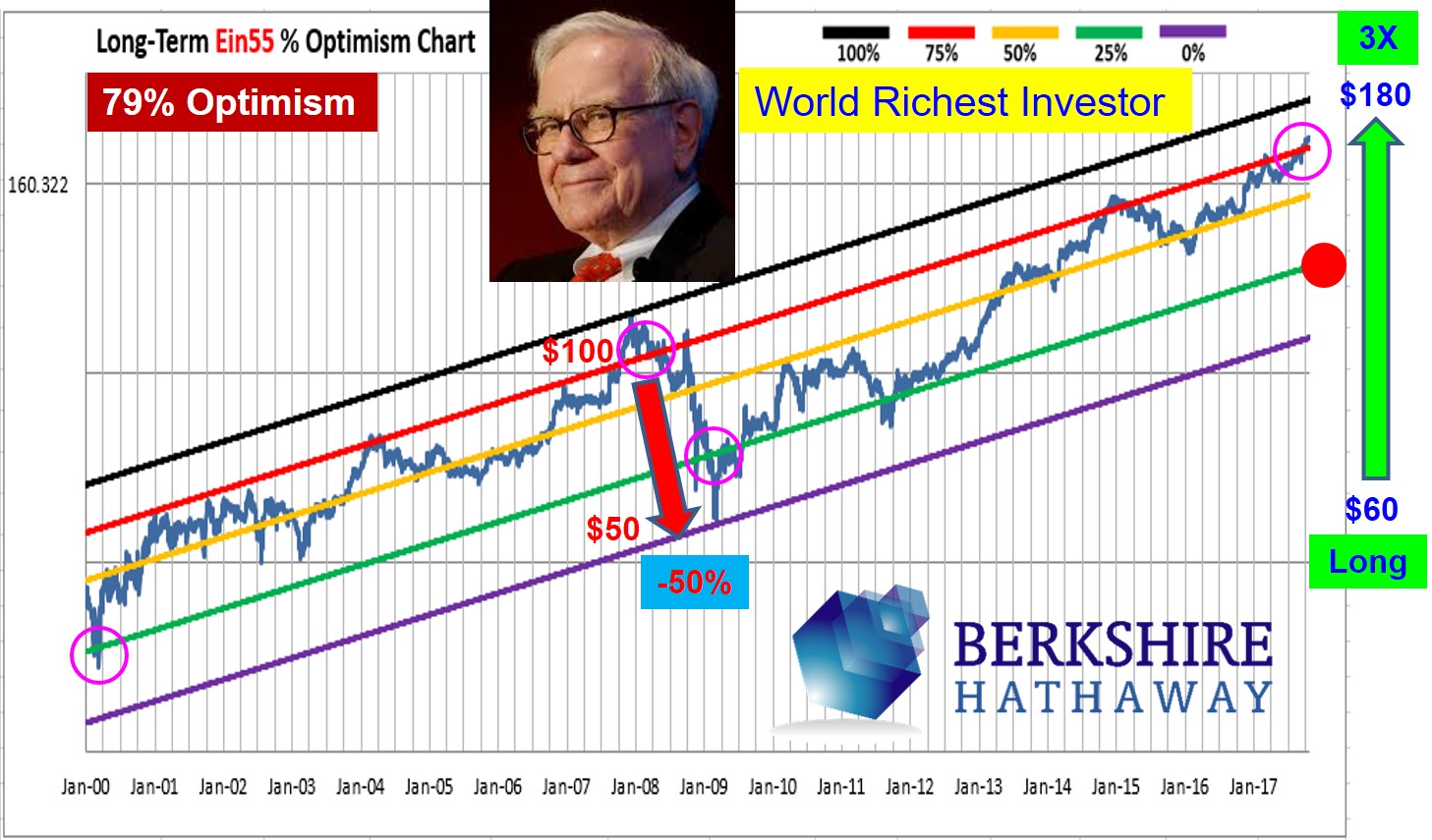

HSBC is still the largest bank in Europe and Hong Kong but we may not need to buy the largest bank. Instead, we focus in most value for money giant bank stock for investing (many in Asia countries, eg Hong Kong / China, Malaysia, etc), selecting the strongest momentum bank stock for trading (probably in US).

HSBC is not a giant bank stock (big size but not strong fundamentally). Global financial crisis has not come, weaker business already catch the cold (start to layoff staff recently), not sure if could survive in the next cold winter with intense global competition.

Investors may also compare with 3 major banks of Singapore: DBS Bank (SGX: D05), OCBC Bank (SGX: O39) and UOB Bank (SGX: U11) which require different investing strategies.

Learn from Dr Tee invest in local and global giant stocks (bank, property, REIT, F&B, healthcare, technology, oil & gas, etc) from Free 4hr stock investment course. Register Here: www.ein55.com