As highlighted over 1 year ago, US inflation falling from the peak below the interest rate (5+%) was a golden cross for US stock market. Indeed, US stocks become very bullish, S&P500 achieving new high >5000 points recently, ideal for short term traders. At the same time, due to economy slowdown, both China and Hong Kong stock markets are in crisis, providing a rare opportunity for long term investors.

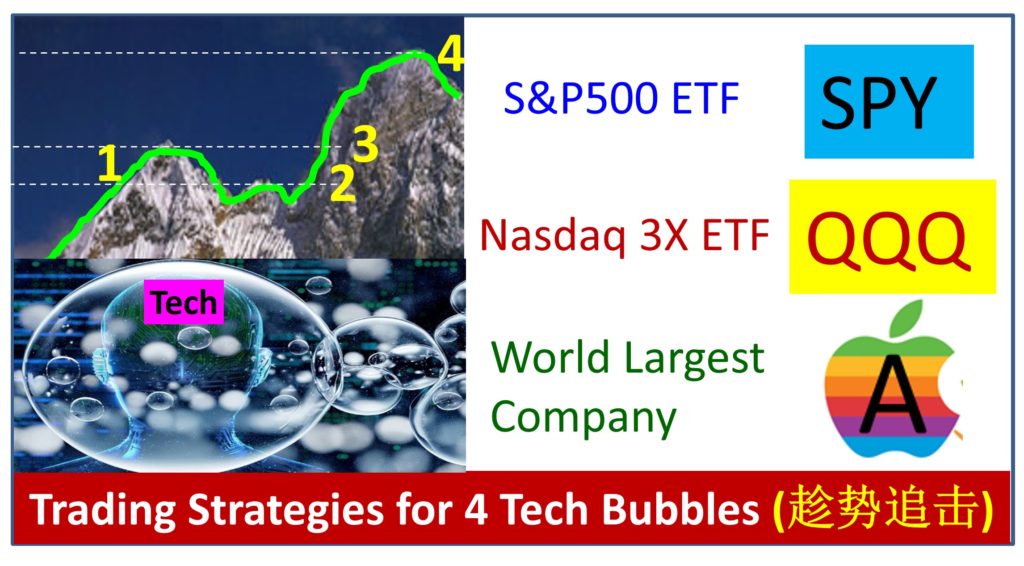

In the New Year of Dragon 2024, US inflation continues to decline (currently around 3+%) while market expecting the Fed would start to cut interest rates. Lower interest rate with strong economy would help to push up the bullish US stock market further as funds may move from bank deposits to stock market for quicker return. However, US stock market is more suitable for short term trading to Buy High Sell Higher (momentum trading / swing trading) until it reaches high Optimism level with a black swan one day. Technology giant stocks (not limited to AI) may gain more momentum with lower borrowing cost, aiming for Ver 2.0 technology bubble (Ver 1.0 was Year 2000 dotcom bubble). Bubble is friend for traders with condition that one has to know when to exit, not to hold as a long term investor when market may crash one day with >50% potential drawdown.

Usually global stock markets are aligned at country level to go up and down together, eg Japan, India, Taiwan, Indonesia, etc, are following US to higher Optimism level. However, due to political economy difference in each country, Asian stock market performs relatively weaker, especially for China and Hong Kong, suffering economy slowdown with weak investment markets (stock, bond, property, etc). This creates a golden opportunity for long term investor to Buy Low Sell High with condition that the stock portfolio is diversified over 10-20 giant stocks with strong businesses to survive and recover from stock crisis. Even for China / Hong Kong stocks at very attractive prices, entry requires consideration of 3 unique C.E.T. personalities:

1) C = Contrarian Investors (allows buying low with bearish prices),

2) E = Early Investors (entering with potential light at the end of tunnel, eg. market awaits massive stimulus plan from China),

3) T = Trend Investors (wait for stronger confirmation for bear transits into early bull).

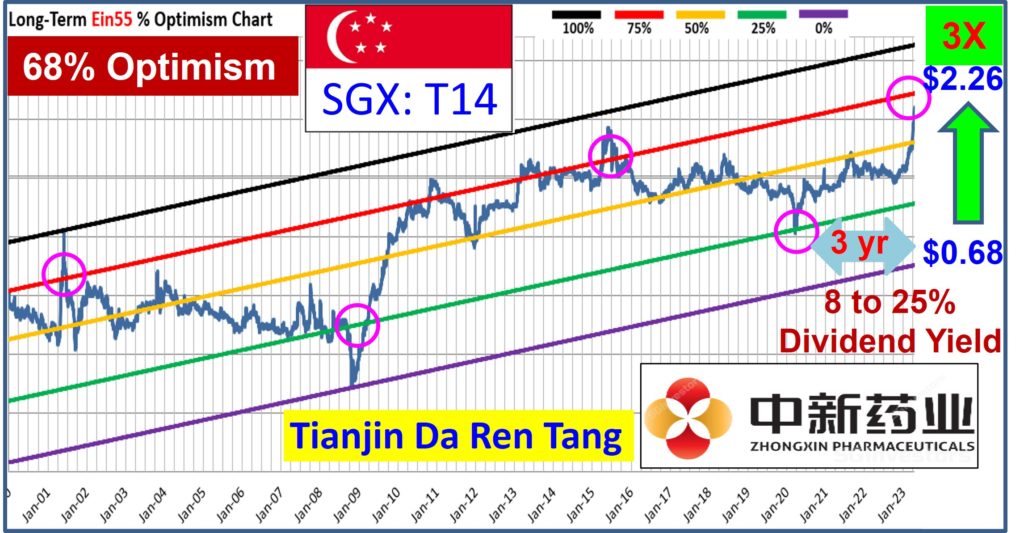

At the same time, other stock exchanges (eg. Singapore and Malaysia, etc) are at moderate Optimism levels, stagnant with mixed performance. Careful selection of giant stocks would be a better choice than investing indices / ETF.

So, your stock performance in New Year 2024 may be like a “Dragon” or “Snake”, depending on your choice (eg. US stocks for short term trading, Asian stocks for long term investing) with alignment to your unique personality (short term, mid term, long term) and style of investing (growth, cyclic, dividend, undervalue, momentum, swing, etc).

It is timely now to review own stock portfolio, making decisions (Buy / Hold / Sell / Wait / Shorting) ahead of majority.

===================================

There are over 2000 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Frasers Logistics & Commercial Trust (SGX: BUOU), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Integrated Commercial Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com

View quick preview video below, Dr Tee will introduce 10 key stock investment strategies (股票投资十招) to be learned in 4hr free stock webinar:

Register Here (Dr Tee Free 4hr Stock Webinar): www.ein55.com