Global stock markets experienced mini bear last year with over 30% major correction in stocks, following by strong recovery in Year 2023, especially for US and Hong Kong giant stocks, supported by declining US inflation and ending of zero COVID policy in China / Hong Kong with full reopening of borders.

Instead of worrying about uncertain markets, a smart investor and trader may consider strong growth giant stocks (一飞冲天) with protection by strong growing business, a natural way to hedge against high inflation with interest rate hike while accumulating capital gains in a steady way with global pandemic recovery.

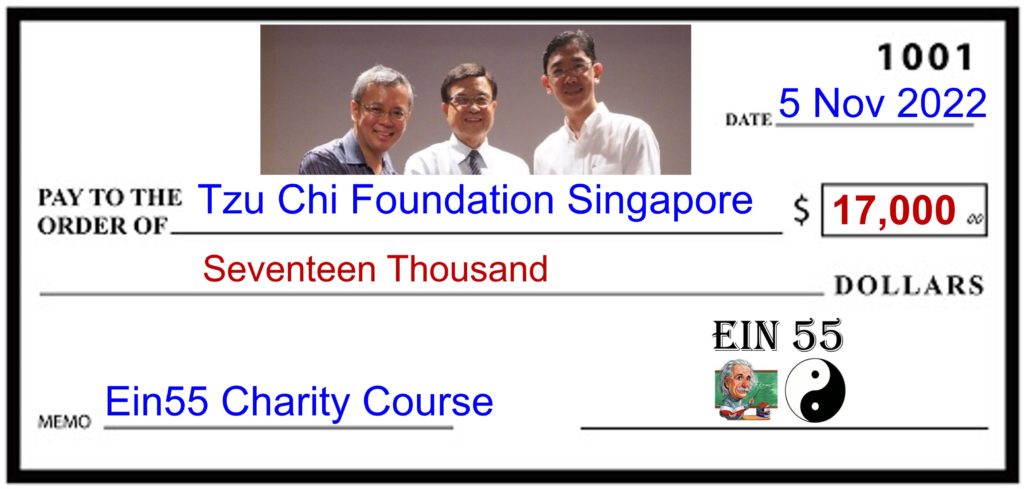

In recent 14th Ein55 Charity Course (5 Nov 2022) on Global Growth Stocks, we have raised fund of $17,000 for Tzu Chi Singapore to help needy families in Singapore. Under the spirit of charity, Dr Tee decides to share 4 defensive growth stocks in 4 countries of 4 growing sectors (pharmaceutical, agricultural, insurance and consumer discretionary) with readers as strikers in current early bullish stock markets (read each details in this article to fully understand on how to position in these giant stocks):

1) Singapore Growth Pharmaceutical Stock – TJ DaRenTang (SGX: T14)

2) Malaysia Growth Agricultural Stock – QL Resources (Bursa: 7084)

3) Hong Kong Growth Insurance Stock – Ping An Insurance (HKEx: 2318)

4) US Growth Consumer Discretionary Stock – Nike (NYSE: NKE)

The best time to invest in global growth giant stocks is always during global stock crisis (eg. Year 2020-2021 during pandemic, 2008—2009 during subprime crisis, etc), not only able to maximize the dividend yield (due to lower entry share price), also could have higher potential of capital gains (when market cycle moves from fear in low optimism to greed in high optimism). Growth stock investing is not based on stock strategy (Buy & Hold for capital gains) alone, may be integrated with cyclic investing (Buy Low Sell High), dividend investing (Buy & Hold for dividends), swing / momentum trading (Buy & Hold for short term / medium term gains), defensive investing and other Ein55 strategies.

However, not all the high growth stocks (potential value trap) are suitable for growth investing. A growing business in the past may not be sustainable during or after COVID-19 period and a growth stock may not able to continue the same rate of growth. Similarly, even a growth stock may have strong and sustainable business but if share prices is bearish due to emotional stock market or declining sector, it may not be a good choice for investors to Buy Low (prices may get lower in short term), integration with trading or alignment with promising sectors would help for a smooth entry.

Fundamental Analysis alone is not sufficient, a low PB or low PE or high dividend yield stock may be a value trap as this may be the result of lower share price with weakening businesses. Therefore, deeper analysis is required with LOFTP (Level, Optimism, Fundamental, Technical, Personal Analysis) Strategies.

Let’s learn these 4 giant growth stocks from 4 promising sectors (pharmaceutical, agricultural, insurance and consumer discretionary) as defenders in 4 countries (Singapore, Malaysia, Hong Kong and US), understanding the business nature, investment clock and unique strategy.

1) Singapore Growth Pharmaceutical Stock – TJ DaRenTang (SGX: T14)

During and even after COVID-19 period, TJ DaRenTang (Tianjin ZhongXin) consistently achieves outstanding growing pharmaceutical business (about 70% in TCM, Traditional Chinese Medicine). It has many patents and unique / popular products which a strong moat for future growth.

The stock is dual-listing, 1/3 in SGX (T14) and 2/3 in China SSEC (600329). Comparing using the same currency USD, China-listed stock is 4X higher price than Singapore-listed stock, resulting in Singapore stock (T14) is more valuable (from investing perspective) with 6% dividend yield with current stock price.

TJ DaRenTang is still at moderate low Ein55 Optimism (<50%) but recovering well from correction in China pandemic 2022, aiming for Ein55 intrinsic value of about $1.50/share or over $2.50/share when market emotion may be greedy again. The stock is well balanced, suitable for dividend investing (Buy & Hold for dividend), growth investing (Buy & Hold for capital gains) and trading (uptrend in short term), but not for cyclic investing (near to fair price).

Since the stock was shared on 5 Nov 2022 (about $1) during charity course, the share price has surged about 30% over the past 3 months.

2) Malaysia Growth Agricultural Stock – QL Resources (Bursa: 7084)

QL Resources is a major producer for eggs / chicken, during high inflation period in 2021-2022, unlike most commodity stocks, it suffered major correction in business due to price cap by Malaysia government for eggs / chicken. As a result, the past high growth is slowed down, then starts to grow again over the past few quarters with support of other growing divisions (marine products, palm oil and Family Mart operations).

QL Resources is still at low Ein55 Optimism (<25%) but recovering well from the worst time of eggs business, aiming for Ein55 intrinsic value of about $7.50/share or over $9/share when market emotion may be greedy again. The stock is more suitable for growth investing (Buy & Hold for capital gains) and trading (uptrend in short term).

Since the stock was shared on 5 Nov 2022 (breaking above critical $5 resistance) during charity course, the share price has climbed up about 20% over the past 3 months.

3) Hong Kong Growth Insurance Stock – Ping An Insurance (HKEx: 2318)

Over the past 3 years of pandemic, Ping An Insurance (business in China) has declined by about 1/3 but the price corrected by 2/3, aligning with the fear of Hong Kong stock market (Hang Seng Index was halved from the peak), providing a rare investing opportunity.

Ping An is undervalue, despite higher gearing ratio, core business in insurance is still defensive in nature. The parent company (Ping An) is much stronger than other subsidiaries (businesses not as good).

Ping An is still at low Ein55 Optimism (<25%) but recovering well from correction in last 3 years of pandemic, aiming for Ein55 intrinsic value of about $100/share or over $150/share when market emotion may be greedy again. The stock is all-rounded, suitable for dividend investing (Buy & Hold for dividend, 5% dividend yield currently), growth investing (Buy & Hold for capital gains), trading (uptrend in short term) and cyclic investing (Buy Low Sell High).

Since the stock was shared on 5 Nov 2022 (about $35) during charity course, the share price is nearly doubled over the past 3 months. There is still significant upside potential, mainly due to over-correction in share price over the past 3 years.

4) US Growth Consumer Discretionary Stock – Nike (NYSE: NKE)

Nike has the largest global market share for sports shoes and related products (following by Adidas and Puma). It has many popular products which a strong moat for future growth under consumer discretionary market.

Nike is still at moderate low Ein55 Optimism (<50%) but recovering well from US stock crisis in 2022, aiming for Ein55 intrinsic value of about $150/share or over $180/share when market emotion may be greedy again. The stock is more suitable for growth investing (Buy & Hold for capital gains) and trading (uptrend in short term).

Since the stock was shared on 5 Nov 2022 (about $96, later breaking above critical $100 resistance) during charity course, the share price has surged about 35% over the past 3 months.

===================================

There are over 2000 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Frasers Logistics & Commercial Trust (SGX: BUOU), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Integrated Commercial Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com

View quick preview video below, Dr Tee will introduce 10 key stock investment strategies (股票投资十招) to be learned in 4hr free stock webinar:

Register Here (Dr Tee Free 4hr Stock Webinar): www.ein55.com