Global stock markets are bullish in Year of Bull 2021, even Singapore STI Index is above 3000 points again after 1 year of COVID-19 stock crisis. New US President, Joe Biden, is printing more money with QE, an easy way for stock market to surge with quicker recovery of economy. For investors who may miss the lower entry points last year, may consider long term growth stock investing or short term momentum trading strategies to ride the bullish wave of growth stocks with recovery of pandemic after global vaccination.

In this Dr Tee 2.5-hr video education (7 Growth Stocks for 2021 Year of Bull), you will learn Market Outlook 2021 for Singapore and Malaysia with 7 growth and momentum giant stocks recovering in 7 sectors during pandemic, having high upside potential:

1) Singapore Exchange (SGX: S68) – Finance Growth Stock

2) Thai Beverage (SGX: Y92) – F&B Growth Stock

3) Vicom Limited (SGX: WJP) – Transportation Growth Stock

4) Parkwaylife REIT (SGX: C2PU) – REIT Growth Stock

5) Raffles Medical Group (SGX: BSL) – Healthcare Growth Stock

6) Micro-Mechanics Holdings (SGX: 5DD) – Technology Momentum Stock

7) Cortina Holdings (SGX: C41) – Consumer Discretionary Momentum Stock

Here is Dr Tee Free 2.5-hr Video Course (suitable for bilingual learners: verbal presentation in Chinese, written notes in English, technical charts for everyone). Enjoy and give your comments for improvement. You may subscribe to Dr Tee Youtube channel (Ein Tee) for future Dr Tee video talks.

Dr Tee Video Course: https://youtu.be/YPVBC5rDQqg

在这Dr Tee 2.5小时教育视频(2021牛气冲天的7只成长股),您可学习:

1) 新加坡交易所 (SGX: S68) – 金融成长股

2) 泰国酿酒 (SGX: Y92) – 餐饮成长股

3) 维康 (SGX: WJP) – 交通成长股

4) 百汇生命 (SGX: C2PU) – 房地产信托成长股

5) 莱佛士医疗 (SGX: BSL) – 医疗成长股

6) 微机械 (SGX: 5DD) – 科技动量股

7) 高登 (SGX: C41) – 非必需消费品动量股

这儿是 Dr Tee 免费2.5小时华语课程 (适合双语学员:华语表达,英语讲义,图表皆通)。请欣赏鄙作,留言求进步。您可订阅 Dr Tee Youtube 频道(Ein Tee),链接未来投资视频。

Dr Tee 华语视频: https://youtu.be/YPVBC5rDQqg

===================================

Here are 7 groups of related Singapore stocks in 7 sectors but a smart investor should only focus on giant stocks.

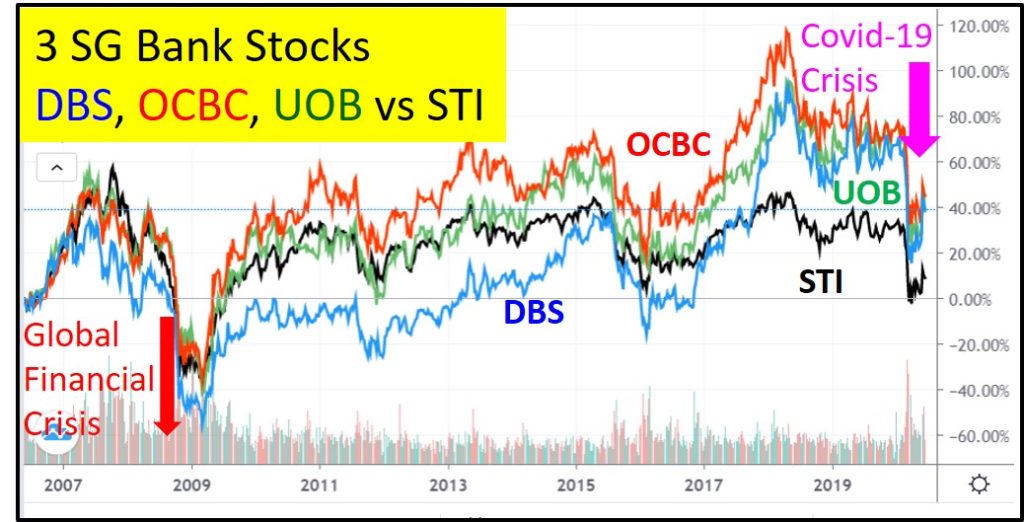

1) Banking & Finance Sector is more cyclical in nature, following economy cycles, worst time is over, could benefit from recovery of pandemic. There are 30 Banking & Finance Stocks in Singapore including Singapore Exchange (Giant Stock):

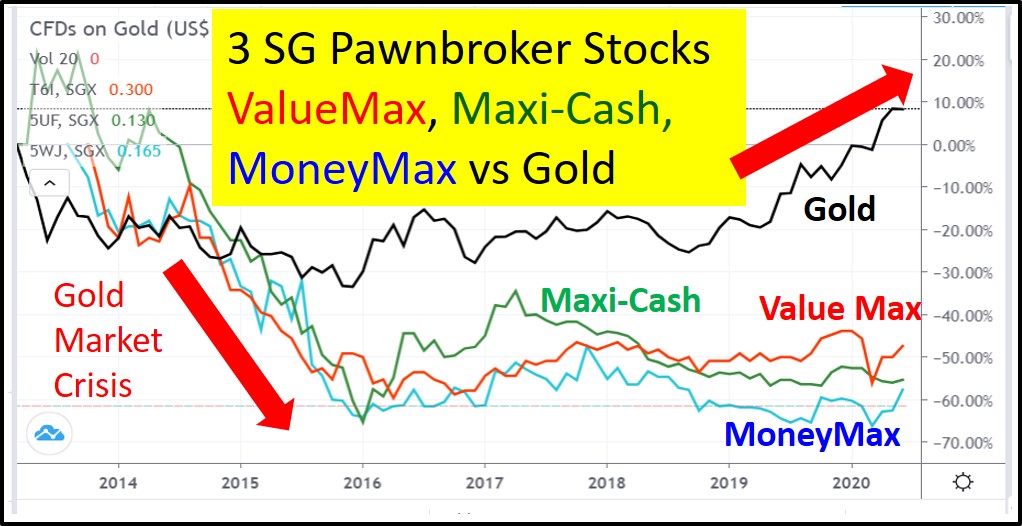

AMTD IB OV (SGX: HKB), B&M Hldg (SGX: CJN), DBS Bank (SGX: D05), Edition (SGX: 5HG), G K Goh (SGX: G41), Global Investment (SGX: B73), Great Eastern (SGX: G07), Hong Leong Finance (SGX: S41), Hotung Investment (SGX: BLS), IFAST Corporation (SGX: AIY), IFS Capital (SGX: I49), Intraco (SGX: I06), Maxi-Cash Finance (SGX: 5UF), MoneyMax Finance (SGX: 5WJ), Net Pacific Finance (SGX: 5QY), OCBC Bank (SGX: O39), Pacific Century (SGX: P15), Prudential USD (SGX: K6S), Singapore Exchange (SGX: S68), SHS (SGX: 566), Sing Investments & Finance (SGX: S35), Singapore Reinsurance (SGX: S49), Singapura Finance (SGX: S23), TIH (SGX: T55), Uni-Asia Group (SGX: CHJ), UOB Bank (SGX: U11), UOB-KAY HIAN HOLDINGS (SGX: U10), UOI (SGX: U13), ValueMax (SGX: T6I), Vibrant Group (SGX: BIP).

2) Food & Beverages Sector is more defensive in nature, affected mainly during early stage of COVID-19 during circuit breaker, could benefit from recovery of pandemic. There are 48 F&B Stocks in Singapore including Thai Beverage (Giant Stock):

Abterra (SGX: L5I), Acma (SGX: AYV), Amara Holdings (SGX: A34), Bonvests Holdings (SGX: B28), ChasWood Resources (SGX: 5TW), China Fishery (SGX: B0Z), China Kangda Food (SGX: P74), Dairy Farm International (SGX: D01), Del Monte Pacific (SGX: D03), Delfi (SGX: P34), Dukang (SGX: BKV), Envictus (SGX: BQD), Food Empire Holdings (SGX: F03), Fraser and Neave F&N (SGX: F99), Hosen Group (SGX: 5EV), Japan Foods Holding (SGX: 5OI), Japfa (SGX: UD2), JB Foods (SGX: BEW), Jumbo Group (SGX: 42R), Katrina Group (SGX: 1A0), Khong Guan (SGX: K03), Kimly (SGX: 1D0), Koufu (SGX: VL6), Luzhou Bio-Chem (SGX: L46), Mewah International (SGX: MV4), Neo (SGX: 5UJ), No Signboard Holdings (SGX: 1G6), Old Chang Kee (SGX: 5ML), OneApex (SGX: 5SY), Pacific Andes (SGX: P11), Pavillon (SGX: 596), QAF (SGX: Q01), Sakae (SGX: 5DO), SATS (SGX: S58), Sheng Siong (SGX: OV8), Shopper360 (SGX: 1F0), Sino Grandness (SGX: T4B), Soup Restaurant (SGX: 5KI), ST Group Food (SGX: DRX), SunMoon Food (SGX: AAJ), Thai Beverage (SGX: Y92), Tung Lok Restaurants (SGX: 540), United Food (SGX: AZR), Wilmar International (SGX: F34), Yamada Green Resources (SGX: BJV), Yeo Hiap Seng (SGX: Y03), Zhongxin Fruit (SGX: 5EG).

3) Transportation Sector has been in serious crisis during COVID-19 due to social distancing, need more time than other sectors to recover from pandemic. There are 24 Transportation Stocks in Singapore including Vicom (Giant Stock):

Baker Technology (SGX: BTP), CH Offshore (SGX: C13), COSCO Shipping International Singpore (SGX: F83), Chuan Hup Holdings (SGX: C33), ComfortDelGro Corporation (SGX: C52), Ezra Holdings (SGX: 5DN), First Ship Lease Trust (SGX: D8DU), Grand Banks Yachts (SGX: G50), Jardine Cycle & Carriage (SGX: C07), Keppel Corporation (SGX: BN4), MS Holdings (SGX: 40U), MTQ Corporation (SGX: M05), Pan-United Corporation (SGX: P52), Penguin International (SGX: BTM), SBS Transit (SGX: S61), Singapore Airlines (SGX: C6L), Samudera Shipping Line (SGX: S56), Sembcorp Marine (SGX: S51), Seroja Investments (SGX: IW5), Singapore Shipping Corporation (SGX: S19), Tan Chong International (SGX: T15), VICOM Limited (SGX: WJP), Vibrant Group (SGX: BIP).

4) REIT Sector is more defensive than other sectors, rental income is not much affected by COVID-19, could benefit from recovery of pandemic. There are 52 REITs and Business Trusts Stocks in Singapore including Parkwaylife REIT (Giant Stock):

AIMS APAC Reit (SGX: O5RU), ARA Hospitality Trust USD (SGX: XZL), ARA LOGOS Logistics Trust (SGX: K2LU), Ascendas Reit (SGX: A17U), Ascendas India Trust (SGX: CY6U), Ascott Trust (SGX: HMN), Asian Pay Tv Trust (SGX: S7OU), BHG Retail Reit (SGX: BMGU), CapitaLand Commercial Trust (SGX: C61U), CapitaLand Mall Trust (SGX: C38U), CapitaLand Retail China Tr (SGX: AU8U), CDL Hospitality Trust (SGX: J85), Cromwell Reit EUR (SGX: CNNU), Cromwell Reit SGD (SGX: CSFU), Dasin Retail Trust (SGX: CEDU), Eagle Hospitality Trust USD (SGX: LIW), EC World Reit (SGX: BWCU), Elite Commercial Reit (SGX: MXNU), ESR-REIT (SGX: J91U), Far East Hospitality Trust (SGX: Q5T), First Reit (SGX: AW9U), Frasers Centrepoint Trust (SGX: J69U), Frasers Hospitality Trust (SGX: ACV), Frasers Logistics & Commercial Trust (SGX: BUOU), FSL Trust (SGX: D8DU), HPH Trust SGD (SGX: P7VU), HPH Trust USD (SGX: NS8U), IREIT Global (SGX: UD1U), Keppel Infrastructure Trust (SGX: A7RU), Keppel Pacific Oak US REIT (SGX: CMOU), Keppel DC Reit (SGX: AJBU), Keppel Reit (SGX: K71U), Lendlease Reit (SGX: JYEU), Lippo Malls Trust (SGX: D5IU), Manulife Reit (SGX: BTOU), Mapletree Commmercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), Mapletree North Asia Commercial Trust (SGX: RW0U), NetLink NBN Trust (SGX: CJLU), OUE Commercial Reit (SGX: TS0U), ParkwayLife Reit (SGX: C2PU), Prime US Reit (SGX: OXMU), RHT HealthTrust (SGX: RF1U), Sabana Reit (SGX: M1GU), Sasseur Reit (SGX: CRPU), Soilbuild Business Space Reit (SGX: SV3U), SPH Reit (SGX: SK6U), Starhill Global Reit (SGX: P40U), Suntec Reit (SGX: T82U), United Hampshire US Reit (SGX: ODBU).

5) Healthcare Sector has different responses to COVID-19 (benefited or affected), both could benefit from recovery of pandemic but stock performance would vary. There are 37 Healthcare Stocks in Singapore including Raffles Medical (Giant Stock):

Accrelist Ltd (SGX: QZG), Alliance Healthcare (SGX: MIJ), Aoxin Q & M Dental (SGX: 1D4), Asia Vets Holdings (SGX: 5RE), AsiaMedic (SGX: 505), Asian Healthcare Specialists (SGX: 1J3), Beverly JCG (SGX: VFP), Biolidics (SGX: 8YY), Cordlife (SGX: P8A), First Reit (SGX: AW9U), Haw Par Corporation (SGX: H02), HC Surgical Specialists (SGX: 1B1), Healthway Medical Corporation (SGX: 5NG), Hyphens Pharma International (SGX: 1J5), IHH Healthcare (SGX: Q0F), ISEC Healthcare (SGX: 40T), IX Biopharma (SGX: 42C), Lonza Group (SGX: O6Z), Medinex (SGX: OTX), Medtecs International Corporation (SGX: 546), OUE Lippo Healthcare (SGX: 5WA), ParkwayLife Reit (SGX: C2PU), Pharmesis International (SGX: BFK), Q&M Dental Group (SGX: QC7), QT Vascular (SGX: 5I0), Raffles Medical Group (SGX: BSL), RHT Health Trust (SGX: RF1U), Riverstone Holdings (SGX: AP4), SingMedical Group (SGX: 5OT), Suntar Eco-City (SGX: BKZ), TalkMed (SGX: 5G3), Thomson Medical Group (SGX: A50), Tianjin Zhong Xin Pharmaceutical Group (SGX: T14), Top Glove Corporation (SGX: BVA), Trendlines Group (SGX: 42T), UG Healthcare Corporation (SGX: 41A), Vicplas International (SGX: 569).

6) Technology Sector has benefited from COVID-19, especially for online related stocks, future stock market responses would vary, depending on type of technology. There are 88 Technology Stocks in Singapore including Micro-Mechanics (Giant Stock):

Accrelist Limited (SGX: QZG), Acma Limited (SGX: AYV), Advanced Systems Automation (SGX: 5TY), Adventus Holdings (SGX: 5EF), AEI Corporation (SGX: AWG), AEM Holdings (SGX: AWX), Allied Technologies Limited (SGX: A13), Amplefield Limited (SGX: AOF), Asian Micro Holdings (SGX: 585), ASTI Holdings (SGX: 575), Avi Tech Electronics (SGX: BKY), Ban Leong Technologies (SGX: B26), CDW Holding (SGX: BXE), CEI Limited (SGX: AVV), CFM Holdings (SGX: 5EB), Chuan Hup Holdings (SGX: C33), CPH Limited (SGX: 539), Creative Technology (SGX: C76), Datapulse Technology (SGX: BKW), Dragon Group International (SGX: MT1), Dutech Holdings (SGX: CZ4), Duty Free International (SGX: 5SO), Ellipsiz Limited (SGX: BIX), Excelpoint Technology (SGX: BDF), Frencken Group (SGX: E28), Global Invacom Group (SGX: QS9), Global Testing Corporation (SGX: AYN), GP Industries (SGX: G20), Grand Venture Technology (SGX: JLB), HGH Holdings (SGX: 5GZ), Hu An Cable Holdings (SGX: KI3), ICP Limited (SGX: 5I4), Jadason Enterprises (SGX: J03), JEP Holdings (SGX: 1J4), Karin Technology Holdings (SGX: K29), Ley Choon Group (SGX: Q0X), Libra Group (SGX: 5TR), Manufacturing Integration Technology (SGX: M11), Maruwa Yen1k (SGX: M12), MeGroup Limited (SGX: SJY), Micro-Mechanics Holdings (SGX: 5DD), Plastoform Holdings (SGX: AYD), Polaris Limited (SGX: 5BI), Powermatic Data Systems (SGX: BCY), Renaissance United (SGX: I11), Serial System (SGX: S69), SEVAK Limited (SGX: BAI), Shinvest Holding (SGX: BJW), Sunright Limited (SGX: S71), Sunrise Shares Holdings (SGX: 581), SUTL Enterprise (SGX: BHU), Thakral Corporation (SGX: AWI), The Place Holdings (SGX: E27), Trek 2000 International (SGX: 5AB), TT International (SGX: T09), UMS Holdings (SGX: 558), Valuetronics Holdings (SGX: BN2), Venture Corporation (SGX: V03), Willas-Array Electronics Holdings (SGX: BDR), World Precision Machinery (SGX: B49), Alpha Energy Holdings (SGX: 5TS), Alset International (SGX: 40V), Artivision Technologies (SGX: 5NK), Asiatravel.com Holdings (SGX: 5AM), A-Smart Holdings (SGX: BQC), Azeus Systems Holdings (SGX: BBW), Boustead Singapore Limited (SGX: F9D), Captii (SGX: AWV), Challenger Technologies (SGX: 573), CSE Global (SGX: 544), DISA (SGX: 532), International Press Softcom (SGX: 571), ISDN Holdings (SGX: I07), Keppel DC Reit (SGX: AJBU), Koyo International (SGX: 5OC), M Development (SGX: N14), Mapletree Industrial Trust (SGX: ME8U), New Silkroutes Group (SGX: BMT), New Wave Holdings (SGX: 5FX), PEC (SGX: IX2), Plato Capital (SGX: YYN), Procurri Corporation (SGX: BVQ), Rich Capital Holdings (SGX: 5G4), Silverlake Axis (SGX: 5CP), SinoCloud Group (SGX: 5EK), Stratech Group (SGX: BRR), Synagie Corp (SGX: V2Y), YuuZoo Networks Group Corp (SGX: AFC).

7) Consumer Sector has different responses in COVID-19 crisis, Consumer Staple Sector benefited in early stage of COVID-19 while Consumer Discretionary Sector has more potential in recovery stage of pandemic. There are 40 Consumer Stocks in Singapore including Cortina (Giant Stock):

Aspial Corporation (SGX: A30), BHG Retail Reit (SGX: BMGU), Camsing Healthcare (SGX: BAC), CapitaLand Retail China Trust (SGX: AU8U), Challenger Technologies (SGX: 573), China Sports (SGX: FQ8), Choo Chiang Holdings (SGX: 42E), Cortina Holdings (SGX: C41), Dairy Farm International Holdings (SGX: D01), Duty Free International (SGX: 5SO), Epicentre Holdings (SGX: 5MQ), EuroSports Global (SGX: 5G1), FJ Benjamin Holdings (SGX: F10), Gallant Venture (SGX: 5IG), Hafary Holdings (SGX: 5VS), Hatten Land (SGX: PH0), Isetan Singapore (SGX: I15), Jardine Cycle & Carriage (SGX: C07), Jardine Strategic Holdings (SGX: J37), Koda Limited (SGX: BJZ), Koufu Group (SGX: VL6), LifeBrandz Limited (SGX: 1D3), Lorenzo International (SGX: 5IE), Mercurius Capital Investment (SGX: 5RF).

===================================

There are over 1500 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Mall Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com