With oil price drops to negative recently (as if Singapore car COE drops to $1), some investors may be interested in investing in oil to buy at extremely low for tremendous potential capital gains. Before any action, readers may read through these 10 key notes carefully to identify the suitable way of investing in oil aligning to own unique personality.

1) Oil Commodity

Crude oil (WTI or Brent) is a pure commodity trading, based on buy low sell high to make money. Unlike stock, there is no business supporting the commodity prices. The hidden fundamental is with demand vs supply of economic cycles and black swans (eg. oversupply with price war of oil producers countries and low demand during Coronavirus pandemic).

2) Oil Investing

There is no simple way to invest or trade oil commodity directly, usually could be done in 3 ways, each has own limitation:

– buy physical oil (not practical as need to store the oil which incurs additional cost)

– trade oil futures (more suitable for seasoned traders for short term trading, could be speculative)

– investing oil ETF (more suitable for short-term to mid-term investors without leveraging)

3) Oil ETF

For oil ETF, investment is through oil futures contracts, rollover in each month to track either WTI (US oil) or Brent (world oil outside US). The alignment of oil ETF and oil price is acceptable within a few years (short term to mid term). For longer term oil investing, oil ETF usually would underperform actual oil market due to rollover cost (holding cost) during contango which happened about 60-70% over the past 1 decade.

For oil ETF, there are 2 stages to take note: Contango (negative rollover yield) vs Backwardation (positive rollover yield).

4) Contango for Oil ETF (Rollover Cost – loss in holding)

This is when oil futures contacts prices of later months are higher than nearby month. It happens usually in lower level of oil prices (lower optimism) with outlook of higher prices in future. There is rollover cost each month for swapping the futures contacts, could be a few % higher prices each month. Contango effect is getting more serious over the past few months during Coronavirus period, over 10% from month to month.

Investors could make money when the potential capital gains from volatile oil prices (eg. 20-50% within 1 year) is much higher than Contango rollover cost. In longer term, if oil price remains at lower prices with Contango stage, the high rollover cost would offset the capital gains from appreciation of oil price. So, an investor has to weight between these 2 conflicting factors, potential high capital gains at lower optimism vs rollover cost (holding cost).

A compromised way is to buy only when there is clear reversal of low optimism oil price (eg. applying technical analysis) when price is more bullish (with uptrend). This way, potential capital gains could offset the rollover cost of Contango. Alternatively, avoid investing during period of high Contango (much higher prices for futures contracts in later months), although usually the oil price is usually having more discount during this time. Of course, investors have the choice to wait for Backwardation period to get positive gain from rollover for holding the oil ETF.

5) Backwardation for Oil ETF (Rollover Yield – gain in holding)

This is when oil futures contacts prices of later months are lower than nearby month. It happens usually in higher level of oil prices (higher optimism) with outlook of lower prices in future. There is rollover gain each month for swapping the futures contacts, could be a few % lower prices each new month (saving cost when rollover to cheaper contracts). Examples of Backwardation were in years 2012-2013, 2019, about 1/3 of the time.

Investors could make money when capital gains in oil prices is moderate (eg. less than 10-20% within 1 year) but combined additional positive gain in rollover yield (as if passive income as dividend stock), will be reasonable. Backwardation may not stay for long term, even if it does, the potential capital loss (oil price at higher level, more potential to fall in long term) is higher if hold long term. So, an investor has to weight between these 2 conflicting factors, capital gain / loss and rollover yield.

A compromised way for Backwardation is to buy only when oil price is still uptrend (despite higher level). This way, potential capital gains from trading (despite lower potential at higher price level) is reasonable as there is some rollover yield (at least no rollover cost as in Contango).

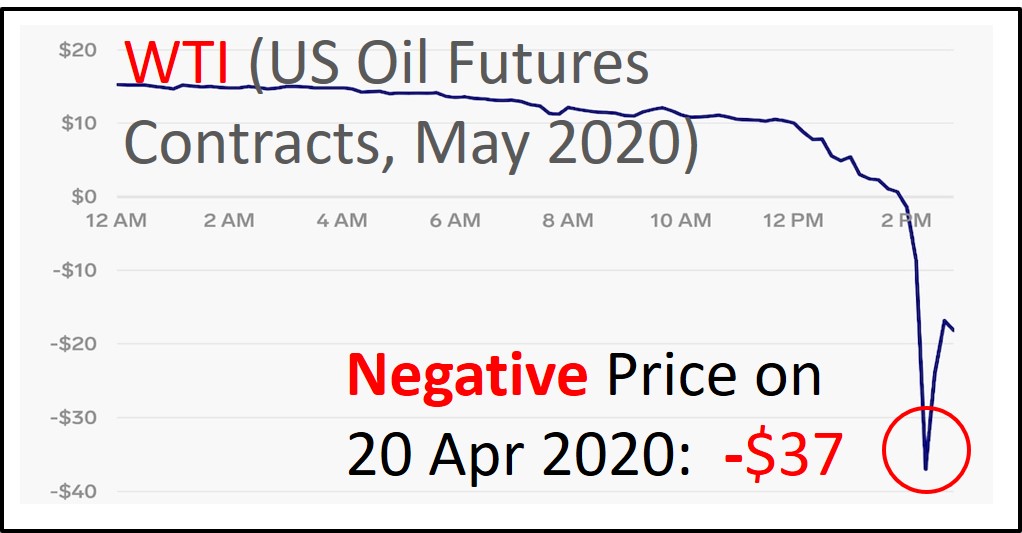

6) Negative Oil Price

Technically, it is possible for oil investors to apply multiple entries during low optimism (balance potential high capital gains with high rollover cost during Contango), eg

$20, $15, $10, $5, $1 per barrel. This way, there is no need to predict the bottom of oil price.

This is true with assumption that oil would not drop to $0 which is true for physical oil (similar to petrol in gas station, could be lower price but never could be $0). However, due to human greed (political economy with price wars in oil producer company) and fear (Coronavirus with over 50% people in the world staying at home during lockdown with low energy consumption), together with nearly full storage of oil capacity, oil price dropped to negative $40/barrel. This is as if a buyer could get a barrel of oil, not only free, but additional $40 reward for buying.

This is against human nature but negative oil price actually happened on 20 Apr 2020 as Apr-May 2020 are likely the peak of Coronavrus pandemic in the world (especially US with which US oil consumption would be the lowest during this period). The negative oil price may happen again for June 2020 oil futures contract if there is no significant improvement in oil market sentiment.

Negative oil price is as if a complex number (i) in mathematics which is not real but could have its effect. So, for very conservative oil investors, instead of $0, need to consider negative $40 as new bottom in multiple entries:

$20, $0, negative $20, negative $40 per barrel.

In addition, the investors at such crisis time also need to suffer the potential high Contango (over 10-30% monthly rollover cost). Therefore, oil investing is more speculative than it should (if one could go to gas station to buy 1 barrel of oil at $1, selling back at $10 after 1 year later). In the physical world, buying oil requires transportation, storage and other costs, not as simple as buying 1 ounce of gold (another commodity but different condition as crude oil) which can be kept safely at home for long term investing.

7) USO ETF (WTI)

USO ETF is a way to invest WTI (US Oil) which one has to consider al the points 4-6 above with Contango, Backwardation and even negative oil price. Since an investor could not buy oil directly, the multiple entries have to be based on USO prices, eg:

Assuming the USO price is $/unit, multiple entries could be around:

$4, $3, $2, $1, $0.10 per unit of USO

Which is corresponding to oil prices of

$20, $15, $10, $5, $1 per barrel

Since oil price could fall into negative, therefore prices targets based on USO is more exact than based on oil price (especially when it falls momentarily to negative, no reference in USO price). With time, USO would approach similar scale as above (eg. USO $2 when oil price is around $10/barrel, USO $4 when oil price is around $20/barrel) with exception of sudden drop to negative price (which would recover the next few days).

For investors who could take higher risk of high contango during Coronavirus crisis need to take note that negative oil price may not mean super low price for USO ETF as the physical world could not take negative fund which means bankruptcy. An investor may wait until oil price to stabilize first (over Coronavirus period), even if oil price could be higher, safer for positioning.

Of course, one has the option to totally ignore oil investing through future contracts or oil ETF (see other options in later points). Oil could drop to negative number or near to $0 but oil ETF could not stay at near $0 for too long as there is rollover cost. To minimize high volatility in nearby month futures contract, USO ETF may need to rollover to 2 months later, not just on nearby month, to minimize the risk of negative price. However, it means USO and oil price will not be so closely correlated during those blind spots of time.

8) Potential of Oil Market

Similar to global stock market, oil market also depends on black swan, Coronavirus, whether it could end on time by summer, in US and also for the whole world. If so, people could step out from the home, could travel (cars, trains, cruise, flights, etc), could work (manufacturing plants) and many other activities that need more energy. Based on the Coronavirus analysis so far, there is a high possibility that the pandemic may end or fade away by summer. However,

Oil produces may not let the oil market (the largest commodity market in the world) to fall to low for a long period of time as it means these countries would suffer losses at national level.

US – largest oil producer (production cost is about $50/barrel), mainly shale oil companies would go bankrupt if oil is below $20/barrel, not to mention at negative price or near to $0. Trump may use the low oil price to top up the national oil reserves and support US oil price at the same time but it subjects to congress approval. If shale oil companies go bankrupt, US economy would be serious affected.

Saudi (with OPEC) – second largest oil producer (production cost is about $5/barrel), despite it is the only country which could last the longest with lower price, high national expenses with high dependency on oil revenue, the oil price could not stay at low level below $20 for a few years. Currently lower oil price is partially supported by high US dollar strength (higher revenue when converted to local currency) but when USD is weaker, it would become double blows to Saudi and also entire OPEC.

Russia (with OPEC+) – third largest oil producer (production cost is about $20/barrel), it is already a loss for current oil price, when Russia economy remains weak, this will be a high pressure. This is also true for all other oil producers countries.

These top 3 oil producers countries control about half of the world oil production and having influence over other smaller oil producers countries. The production cut starting in May 2020 is below market expectation, therefore more cut may be required to fight against the immediate risk of storage capacity issue (which will be full in May 2020 for most places in the world, no place to keep for new oil produced).

Price is moved by demand vs supply. Oil producers countries could control the supply but another 50% is dependent on demand which mainly depends on Coronavirus. Therefore, commodity has a natural market cycle of low and high, only uncertainty is duration and timing of low and high is a variable.

So, oil commodity investing may not be suitable for those without holding power, not to mention there is no suitable investing tool as oil ETF would incur high rollover cost during Contango period. A safer compromise is not to buy oil at the lowest point with the most uncertain period with the highest rollover cost. Instead, wait for some light at the end of tunnel with higher oil price, lower rollover cost, higher uptrend price which is an insurance premium for extra safety.

9) XLE (Energy ETF)

An alternative to oil commodity investing is to investing in a portfolio of oil & gas stocks through XLE (SPDR Energy ETF) or similar energy ETF with energy related stocks. Many of the composition stocks are oil & gas companies (integrated, upstream, midstream, downstream) which has certain correlation to oil prices. The up and down in oil prices would affect the businesses of these XLE sector companies, therefore an investor could benefit indirectly the low oil price when investing these oil & gas companies through XLE.

XLE ETF provides diversification, suitable for lower capital investor for crisis sector investing. Even it is possible for a few companies may eventually go bankrupt (eg. if oil price below $10/barrel for a few years), energy fund is based on business, unlike USO ETF which has high rollover cost, XLE is more suitable for holding longer term. When oil price is at higher optimism level or just moderate optimism one day (assuming Coronavirus disappear), XLE would also benefit with capital gains in share prices, which are reflected in sector ETF. However, it is more suitable for longer term investors when investing at low optimism level (十年寒窗).

The bonus for XLE investor is to collect 3-10% dividend yield (which may not be stable, depending on the entry prices), as if Backwardation period USO oil ETF with positive rollover yield. Contango is as if negative dividend yield, more holding cost with longer term investing.

XLE investing requires alignment with optimism (entry at low optimism, exit at high optimism, collecting 5-10% dividend yield during waiting period). Management cost is relatively lower than USO but it won’t benefit from sudden surge in oil prices for short term, instead, profiting through the businesses with stocks in oil sector which benefits from higher oil price over mid to long term.

10) Oil & Gas Giant Stocks

For smart oil investor, one may not just invest in oil through ETF (rollover cost) or XLE (stable but requires holding power). One could become own fund manager to invest in oil & gas giant stocks (44 global giants based on Dr Tee giant criteria). Even when oil prices have been at lower optimism over the past 5 years of crisis, these giant stocks are strong in business fundamental, still can make money each year with consistent growth.

Some of these companies, for example, are in midstream segment of oil storage or delivery business, not affected much by oil prices. When oil is full storage capacity due to low demand, these companies could charge a higher price. They are also good candidates for longer term investing, investing at lower optimism, collecting dividend (over 5-10% yield) as passive income while holding during winter time, eventually better with growth investing with higher optimism when oil and share prices appreciate one day. At higher optimism, an investor has a choice to either sell for profits or even hold for longer term investing (if the stock is defensive in nature).

Crisis investing is not easy as it is not simply Buy Low or “Be Greedy when Others are Fearful”. It requires understanding the risks and opportunities of each option, then an investor may choose the right tool (eg. oil ETF, XLE energy ETF or oil & gas giant stock) with strategy aligned with own personality, either for short term trading or long term investing.

==================================

Drop by Dr Tee free 4hr investment course to learn how to position in global giant stocks of growing sectors with 3 value investing strategies (undervalue, growth, dividend stocks), knowing What to Buy, When to Buy/Sell.

Learn further from Dr Tee valuable 7hr Online Course, both English (How to Discover Giant Stocks) and Chinese (价值投资法: 探测强巨股) options, specially for learners who prefer to master stock investment strategies of over 100 global giant stocks at the comfort of home.

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 9000 members.