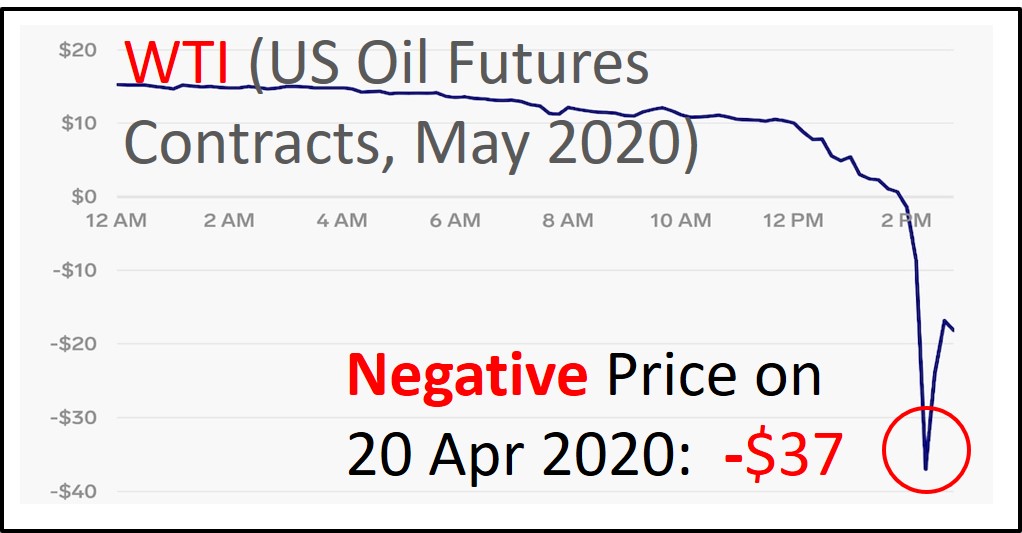

US oil (WTI) May 2020 futures contract price crashed yesterday (20 Apr 2020 is the last day before May 2020 US oil future contract expires) to negative $37. Global investors may be confused, why it is possible for oil price to drop to negative, does it mean oil investment fund will go bankrupt? Global consumers may be excited, does it mean petrol from gas station is free from now? Here are the details to uncover this myth.

An oil futures contract is an agreement to buy or sell a certain number of barrels set amount of oil at a predetermined price, on a predetermined date. There are 2 main oil futures contracts: WTI (mainly US oil prices) and Brent (overseas oil prices, outside US). Oil investors would choose futures contracts over spot contracts which requires delivery / storage of physical crude oil in barrels which is not practical.

An alternative is investing through oil ETFs (eg. USO, UCO, DBO, BON, etc) without actually owning a futures contract by investor (maximum risk is limited to investment on ETF), aiming to follow the oil price movement for capital gains. However, these oil ETFs are not suitable for holding long term (eg. more than 3 years) as there is high rollover cost for futures contracts, a strategy by oil ETF fund manager to keep the oil investment without need to physically store the oil. When futures contracts prices for later months are higher than nearby month, it is called “Contango”, would incur additional cost, when adding up over long term, could be significant to reduce the potential capital gains in actual oil price appreciation. Reversed process is called “Backwardation” which oil ETF would have positive rollover yield due to lower futures contract prices for later months.

In general, when oil price is volatile in short term (eg. up and down 20%-50%), these rollover cost or return may not be obvious. However, in May 2020 futures contract, there is a serious contango with low demand for oil price (due to global lockdown for Coronavirus, especially in US which affects WTI oil price) with over-supply of oil (global oil producers’ action to limit the production is not fast nor strong enough). Due to nearly full storage of oil in US, a buyer would have problem with high storage cost if buying in May. With tremendous sell by oil ETF for May 2020 futures contracts (rollover to buy later months futures contracts), oil price drops below $0 to negative $37, technically sellers are paying to buyers to collect the oil which is abnormal, never happened before.

This abnormality of negative oil price is a historical event, a combination both black swans of Coronavirus (low oil demand) and crude oil price war (high oil supply), breaking down near the worst time of US with severe Coronavirus condition in Apr 2020. The nearby or front month futures contract now is Jun 2020, WTI oil price is back to a more normal of $21/barrel (usually within $5 difference with Brent oil price which is around $25). So, global consumers may be disappointed as gas station won’t give free petrol unless this negative price is over a longer period of time.

The same negative oil price may or may not happen before expiry date of June 2020 futures contract as oil investors have 1 more month to observe the changes in oil price demand and supply, especially the Coronavirus condition which affects the US economy when it be restarted. The production cut of global oil produces from May 2020 although limited, may help to a certain extent.

The global Coronavirus condition is improving with 5 days consistent downtrend in number of new daily cases. US has also shown a gradual downtrend in new daily Coronavirus cases over last 1 week which is an weak positive signal, if better results are seen by end of Apr 2020, more states in US would restart the economy. Most Americans drive, so when lockdown is stopped, US oil price (WTI) would recover naturally with more energy consumption. Trump may also consider to buy more unwanted US oil at low or negative prices to top up the national oil reserves. Europe countries have significantly lower number of new daily Coronavirus cases, lockdown may gradually be loosened, combined with more manufacturing activities in China, global demand for oil price would gradually pickup by summer. Singapore has a surge in number of Coronavirus cases over the past 1 week but mainly this is within foreign labour dormitories, risk of community infection is in fact lower with stricter partial lockdown.

Global consumers likely could continue to enjoy cheaper petrol prices but not free oil as the negative oil price is a rare product of 2 black swans of Coronavirus crisis and oil price war crisis. If oil prices are below $20/barrel over a longer period of time (eg. a few years), weaker oil producers countries would start to go bankrupt (see past example of Venezuela, even oil price was above $50 a few years ago), following by US shale oil producers (production cost is around $50/barrel), then Russia (production cost is around $20/barrel), finally only Saudi (despite production cost is $5/barrel, there is high national expenses, need much higher oil price to sustain the normal lifestyles).

So, what are the options for global oil investors? Oil ETF such as USO has reasonable correlation to WTI, eg. when oil price surged from $20 to $28 a few weeks ago, USO also went up by similar magnitude of 40% in short term. With yesterday negative oil price, USO is only partially affected as most contracts are already rollover to later months, USO is corrected by around 10%. USO has some flexibility to rollover future contracts to 2 months later, instead of to nearby month (more volatile, negative oil price may have chance to happen again by 20 May 2020 before June 2020 futures contracts expire) but this would affect the tracking of WTI short term oil price (in exchange for smoother price movement). USO is not suitable for holding long time due to Contango effect, so for oil investors who see significant appreciation (eg. 20-50%) in future oil price in short to mid term (less than 1 year), may consider to take progressive profits as rollover cost is inherent to oil ETFs (similar to holding cost), hard to find other better way to invest in oil prices.

Oil investors may also consider indirect way of investing through energy ETF (eg. XLE, SPDR energy sector ETF) which invests in oil & gas stocks with reasonable correlation to oil prices but won’t be easily affected by such abnormality of negative oil price (XLE was only down by 3% yesterday with negative oil price).

A better oil investment option could be to focus in global oil & gas giant stocks (44 of them based on Dr Tee giant criteria), many are midstream oil 7 gas stocks, eg. storage or delivery of oil which is a more defensive business segment. Storage of oil is a consistent profitable business, some companies are strong in business despite oil & gas crisis over the past 5 years. Oil delivery business could be temporary affected due to lower demand of oil. These midstream oil & gas stocks could even pay consistent dividend, suitable for holding during low optimism of stock prices, waiting for recovery of oil price for potential capital gains indirectly.

Of course, one may do futures trading directly without oil ETF or oil & gas stocks. However, futures trading is speculative in nature for shorter term, may not be suitable for retail traders. Even Singapore oil trading company, Hin Leong, could go bankrupt after losing US$800M in oil futures trading. As a result, 3 major banks (DBS, OCBC, UOB) in Singapore would need to set aside provisions for this non-performing loan (NPL) but risks to these banks are lower than 5 years ago when more weak oil & gas companies were in trouble (eg. Swiber, Marco Polo Marine, etc).

Sharing above is for educational purpose. Readers have to make own decision after independent thinking, especially on risk tolerance level, always having the option not to consider any investment in crisis sectors with business seriously affected.

There are other sectors which business are relatively strong, eg. technology (especially internet related), consumer staples, healthcare, property, etc, many global giant stocks (over 1500) could be considered. Due to the uncertainty in Coronavirus condition (despite downtrends in last 5 days for world condition), stock investors may need to plan for capital allocation (investment in batches) with a portfolio of giant stocks supported by strong fundamental business, so that one could invest with a peace of mind, no need to worry of abnormality such as negative oil price.

==================================

Drop by Dr Tee free 4hr investment course to learn how to position in global giant stocks of growing sectors with 3 value investing strategies (undervalue, growth, dividend stocks), knowing What to Buy, When to Buy/Sell.

Learn further from Dr Tee valuable 7hr Online Course, both English (How to Discover Giant Stocks) and Chinese (价值投资法: 探测强巨股) options, specially for learners who prefer to master stock investment strategies of over 100 global giant stocks at the comfort of home.

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 9000 members.