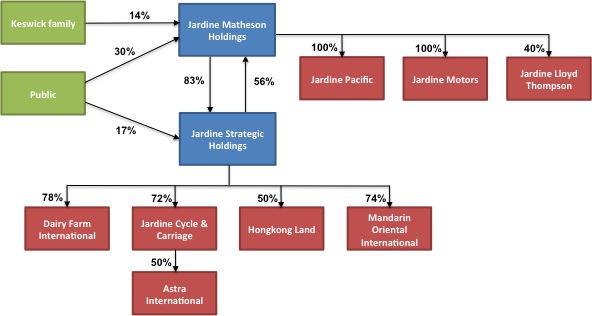

Based on Ein55 Giant Detector, out of about 800 stocks, there are only 6 dividend giant stocks in Singapore. Unfortunately, 1 of the dividend giant stocks, Challenger Technologies (SGX: 573), is being acquired recently, will be delisted from Singapore stock market.

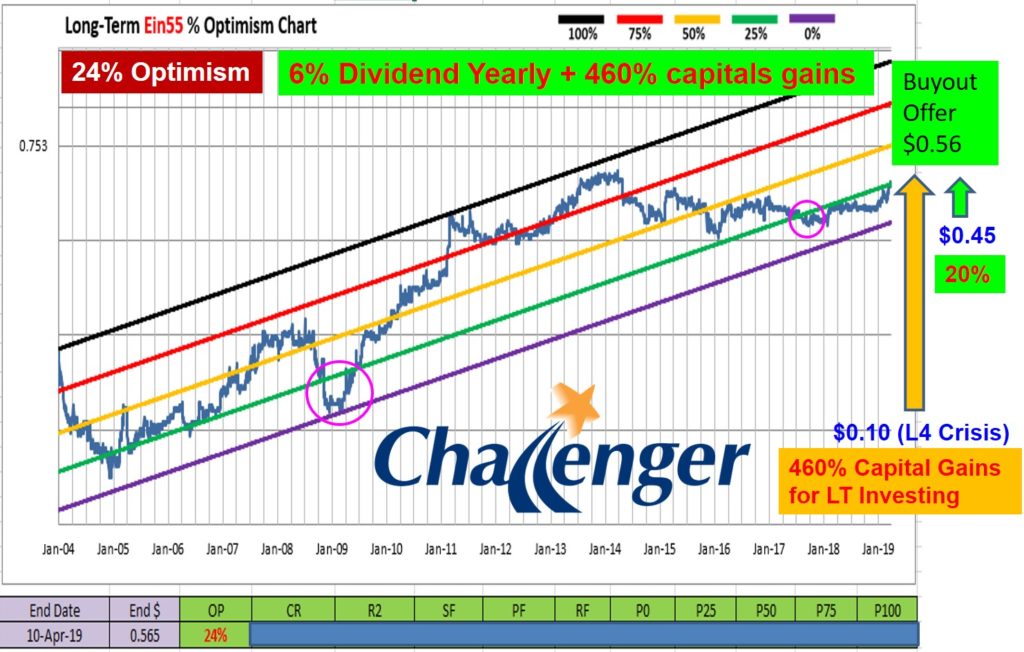

Challenger Technologies is not a REIT nor blue chip stock, but it has strong earning growth with stable positive operating cashflow, able to pay consistent dividend each year (more than 5% dividend yield) over the past 10 years. Due to weak stock market sentiment, Challenger Technologies has been trading at low Optimism level (<25%) over the past 2 years, providing a golden opportunity for major shareholder (Loo family in partnership with Digileap Capital) to acquire at low price of $0.56/share, which is a premium of about 20% compared with average low optimism price of $0.48/share (when homework on Challenger Technologies was assigned to Ein55 coaching class in Feb 2017) over the past 2 years. The timing of acquisition is ideal as Challenger Technologies has low trading volume with little public float, even with offer price of $0.56/share, it is still consider undervalue.

Over the past 10 years, Challenger Technologies has grown more than 5 times in share prices (from initial low of $0.10/share to more than $0.50/share), an ideal growth stock for buy and hold for tremendous capital gains, as well as collecting more than 5% dividend yield yearly as bonus (13% dividend yield if bought in year 2008 during global financial crisis). Most investors may position dividend as the No 1 objective for dividend stock investing. In fact, the hidden treasure of dividend stock is with the enormous capital gains (rise in share prices over the years) as other investors have to pay higher prices each year to exchange for this money-making machine which pay $5 for every $100 investment. Challenger Technologies is an excellent example of dividend giant stock which is suitable for both passive income and also capital gains.

Investors have been given at least 2 years to consider Challenger Technologies but the response has been weak, partly because the stock is not a typical trading stock with high volatility. In total, there are 86 giant dividend stocks in the world major stock markets. After delisting of Challenger Technologies, there are still another 5 dividend giant stocks from Singapore waiting for us, do not miss these limited opportunities, especially when they are trading at low optimism price with high dividend yield (>10%) one day during the global financial crisis while business is still strong to make money consistently each year.

Interested readers may sign up for free 4hr stock investment course by Dr Tee to learn the right way of dividend stock investing, as well as timing for entry and exit, through 10 personalized investing strategies. Register Here: www.ein55.com

Share price is a 3-dimensional movement, governed by Ein55 Law of Stock Market Motion:

Share price is a 3-dimensional movement, governed by Ein55 Law of Stock Market Motion: