No one would know the true bottom (the lowest point) of stock market unless having the ability to “Back to the Future”. Time for the bottom of stock market is ideal but may not be practical as it could be reaching the moon with underwater reflection (海底捞月), greedy for the lowest (cheapest price with most discount) with little considerations of other risk factors, may fall into water with market trap. For those without any action, there is also a fear of missing out, eventually may miss the boat of opportunity totally. So, it is a dilemma for some investors to Buy or to Wait when stock market is bearish.

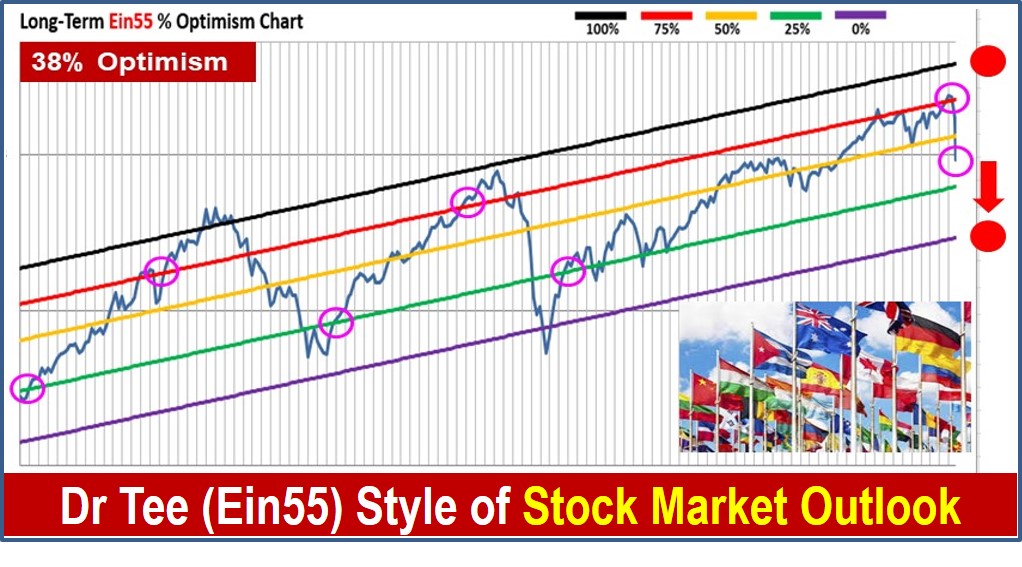

Similarly, in a Bull market (last 10 years), it is also a headache for investors to “Hold” or to “Sell”. Over the past few years, I have reminded repeatedly readers and students to take note of the high optimism risk at Level 3 (country, especially US) and Level 4 (world) stock markets, safer to apply short term trading, walking on a layer of thin ice which finally breaks over the past 1 month (those who fell but did not sell as short term trader is now trapped with over 30-50% losses). So, even one may not know the highest point, as long as know “High Enough” (>75% optimism), one could escape from the 30% loss in global stock market, which may have another 20-30% potential to fall, if it becomes global financial crisis with declining economy.

However, it is possible to apply probability investing to start progressive entries (for contrarian investor) when it is “Low Enough”. 25% Optimism will be a point of “Low Enough”, 0% Optimism is considered a rare opportunity. However, “Buy Low” is insufficient, one has to align other Ein55 styles to form personalized strategy aligned with own personality, otherwise When “Buy Low” may “Sell Lower” or “Sell Lowest” one day for those with weak holding power, especially if global financial crisis is confirmed and become worse over the next 6-12 months after the starting of global stock crisis in Mar 2020.

Trump and G20 political leaders may join forces in the next 1-3 months to launch the most generous QE ever (eg. massive printing of money of a few Trillions of dollars through asset purchase by government and other feasible economic stimulus tools). However, this is borrowing money from the future generation (20 years from now), simply planting another time bomb for future investment market (similar to QE 1-4 over the past decade, finally triggered by fear of Coronavirus and crude oil crisis).

For smart investor, one could save 10-20 years of investing time by leveraging on current opportunity. However, the lost generation who does not know investment may suffer in future. See Japan ‘s example of lost 3 decades, some elderly people could not retire as retirement was evaporated and young people need to struggle with lower pay job without bright future despite inflation is low.

I am reluctant to reveal here exactly what are the prices of “low enough” (25% optimism) or “rare opportunity” (0% optimism) for each investment here (stocks, properties, commodities, forex, bond, bitcoin, car COE, etc). Main reason is readers may not be trained, sharing may be wrongly used as “tips”, when not supported by other Ein55 styles (eg. strong fundamental stocks and technical of prices, macroeconomic analysis, personality, etc), it could be a disaster.

Current global stock market crisis could be a gift from heaven but only if one knows exactly how to position with integration of minimum 5 Ein55 Styles of LOFTP strategies (Level 1-4, Optimism 0-100%, Fundamental – Strong/Weak, Technical – Up/Down, Personal – Trade / Invest).

Register Here for free 4hr stock investment course by Dr Tee (23 Apr session is full, next one is 21 May session, only 1 class monthly, will be updated in same website): www.ein55.com

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 8000 members:

https://www.facebook.com/groups/ein55forum/