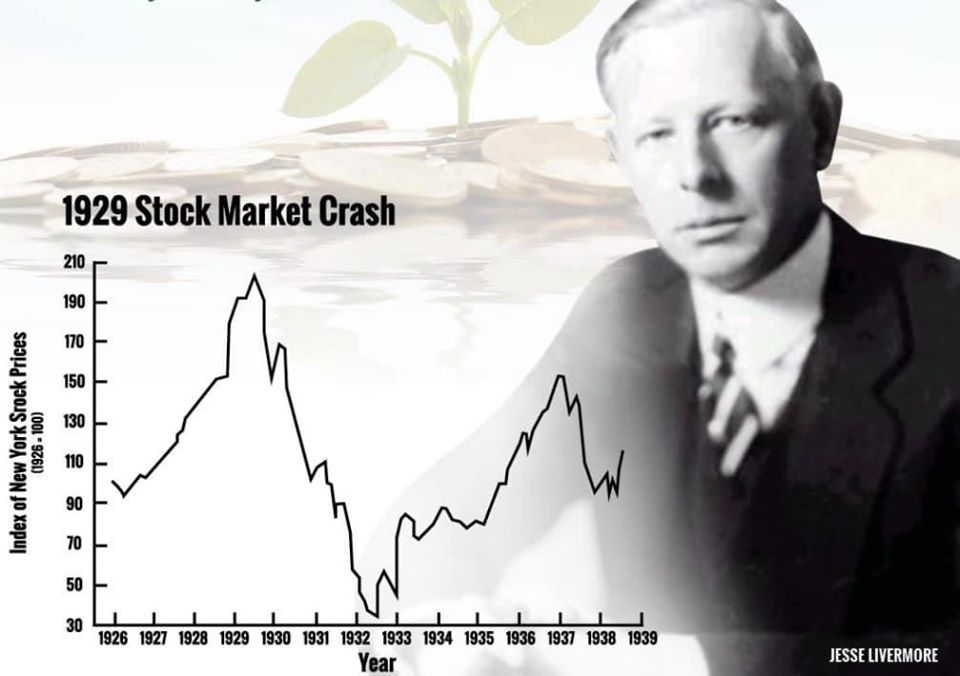

One “easy” way to make money in bear market is shorting of stocks, i.e. profiting from falling in share prices. However, shorting has hidden risk, even Jesse Livermore, the greatest trader, has lost most of his fortune, not because he does not know shorting but because he position too early and stock market 100 years ago was not as efficient as market today on placement of order (timing is crucial for shorting).

Here are a few critical points to read for those looking for “easy” money in shorting during the coming correction or potential global financial crisis.

1) S.E.T. Trading Plan

Similar to long (eg Buy Low to Sell High), trading plan is even more important to a trader for shorting, especially protecting the capital loss (eg price up 5% after shorting position, loss in shorting is significant with CFD leveraging). SET trading plan: Stop Loss (S), E (Entry), T (Target) on 3 critical prices. The plan has to consider position sizing to ensure the maximum potential loss is within own risk tolerance level.

2) Personal Analysis – Mind Control

A trader failed usually not because of no plan or making losses but because could not overcome oneself to execute the plan, eg a small loss could become bigger loss because of loss aversion. This is particularly risky for shorting.

3) Position Short Term

Long strategy could be any timeframe: short term, medium term or long term. For shorting, it is safer to start with short term, only when the downtrend continues (eg correction becomes a regional crisis or even global financial crisis in longer term), then short term would be naturally extended to longer term (position trading) until the downtrend has ended.

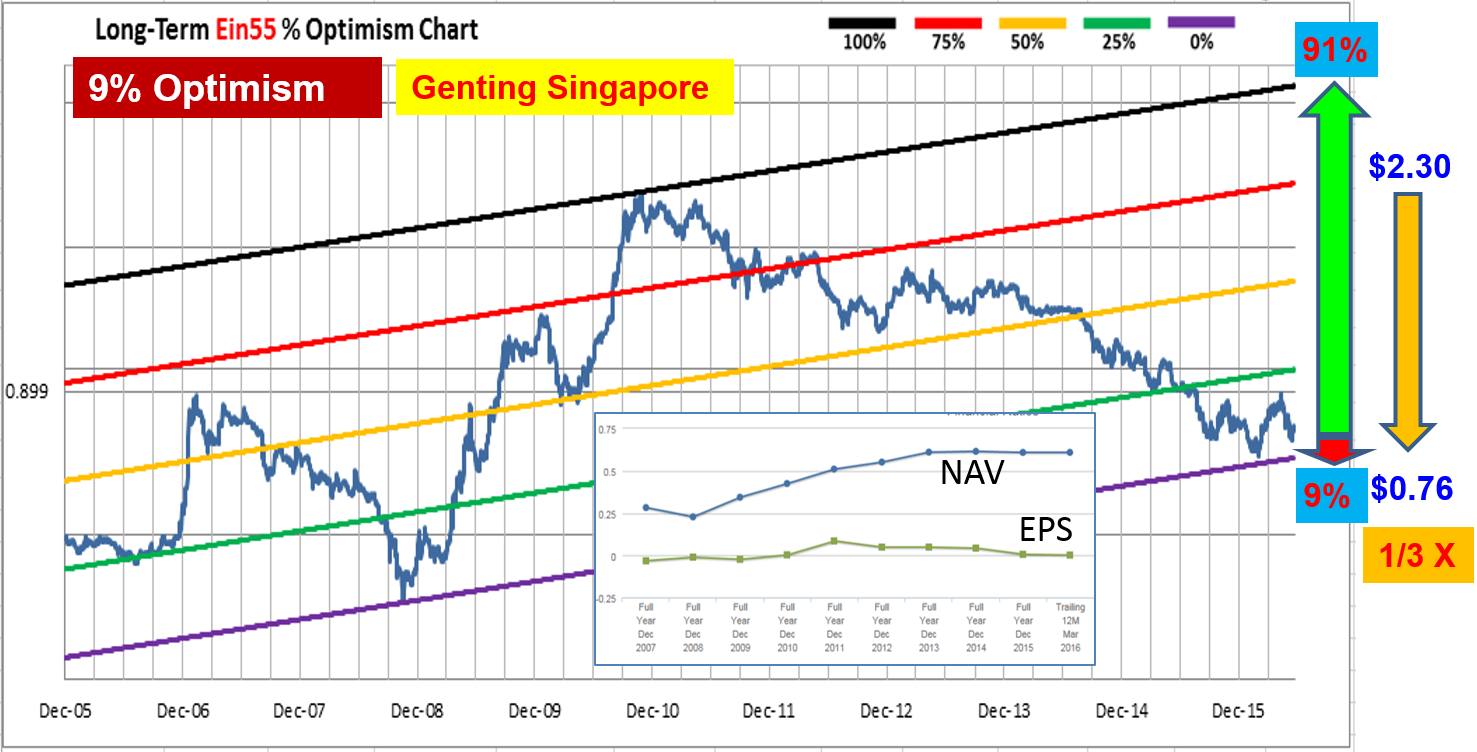

4) Weaker Fundamental

Shorting is reversed strategy, besides fear driven market fall, one may also choose stocks with weaker business fundamental (provided the counter has CFD). When both fear and weak business are combined, probability of falling is higher (to be confirmed by TA charts with Technical Analysis).

5) Level Alignment

Ideally, shorting of a stock (Level 1) can be aligned with bearish sector performance (Level 2), weaker country GDP (Level 3) or falling world economy (Level 4). However, when 4 levels are aligned, it becomes a known crisis, price may fall more than 50%. So, a trader could use TA price chart as early signal (eg downtrend), then use Level 1-4 analysis as confirmation to hold to shorting position. In between, possible to take partial profits in shorting.

———————

Trading is “easy” if one could follow own SET plan strictly. Trading is “tough” if one follows market and own emotions with daily news to trade. Shorting is not just for traders, it can be a tool for investors to hedge against own long position (avoid buy and hold with losses during global financial crisis, hedging through shorting to preserve the capital if not selling).

Long or Short? This is a choice but requires different and unique strategies aligned with trader psychology. Even if “easy” money with shorting may not be suitable for you during stock market crisis, you have the option to apply other 10 strategies (crisis investing, undervalue investing, growth investing, momentum trading, swing trading, etc) which you could learn from Dr Tee free 4 hours stock investment and trading course.

Register Here: www.ein55.com