If you stayed till 2am Singapore time last night, you would have chance to trigger the first silver bullet, entry to buy WTI crude oil below US$20/barrel (only lasted for less than 1hr, heavy correction of 9% in 1 day) through USO oil ETF. This is last 18 years low for crude oil, mainly due to combination of crude oil price war and low demand of crude oil during Coronavirus pandemic, a rare crisis with 2 black swans.

I have shared this rare opportunity of crude oil crisis with low optimism, the first target US$20/barrel in earlier post a few days ago. At this price, crude oil is much cheaper than mineral water of the same volume (about US$50/barrel or US$0.30 / liter if you are more used to this unit of 1 liter bottled water price). Does it make sense?

If you miss the opportunity last night, not to worry, there could be 10 levels of opportunities (十重天机) ahead. Let’s learn together from Dr Tee on how to trigger 10 silver bullets for crude oil investment.

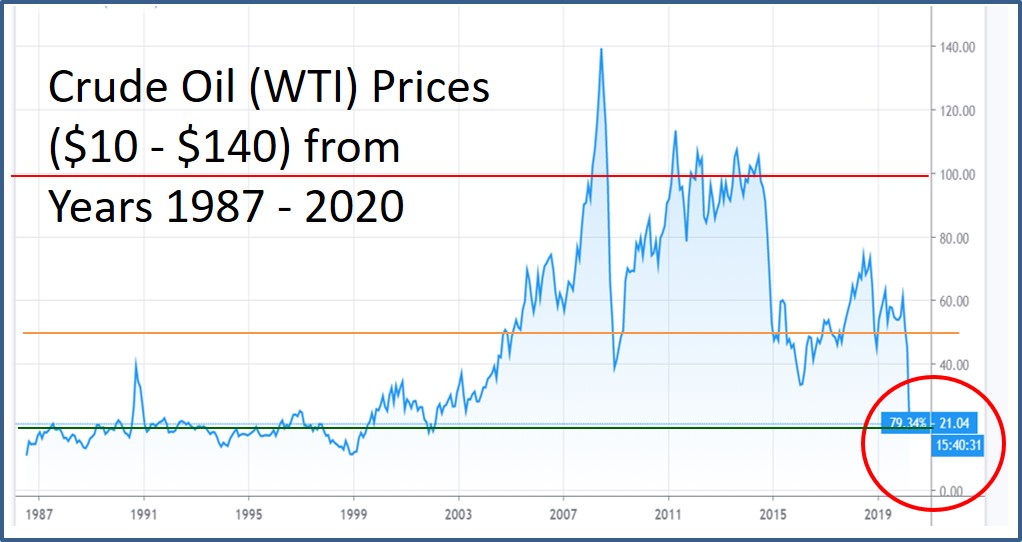

Over the past 3 decades (with multiple global financial crisis in between), crude oil (WTI) price was ranging from the lowest of about $10/barrel to $140/barrel. For simplicity, we may take $1 – $100 as possible range of crude oil price for next 10 years.

$100 = High Price (Bullish Economy / high optimism stock)

$50 = Fair Price (Average Economy / mid optimism stock)

$25 = Low Price (Bearish Economy / global stock crisis with low optimism)

Below $25/barrel with very low optimism, an investor could position in 10 opportunities for investing with 5 levels of crisis (from severe to disaster, prices may not really follows the crisis, just an illustration of how crisis causes more downside of crude oil).

Initially, prices would move in downtrend (more suitable for long term value investing with contrarian approach or even short term trader for shorting when breaking below the support), 5 possible levels of crisis (Level 1 is confirmed):

$20 = L1a = Price War Crisis (record on 31 Mar 2020)

$15 = L2a = Coronavirus Crisis (low demand 6-12 months)

$10 = L3a = Global Financial Crisis (1-2 years bearish economy)

$5 = L4a = Great Depression (Coronavirus last over 1 year without vaccine, most human in the world stay at home)

$1 (or even lower price, $X) = L5a = Nearly end of the world (no need to have crude oil or a smart scientist found a way to get free or cheaper energy source)

After reaching the bottom (no one knows, only history could tell, $X-$20, may not go through all the 5 levels), then it will recover again in a reversed way (uptrend prices):

$1 = L5b = recovering from “human crisis”

$5 = L4b = recovering from Great Depression

$10 = L3b = recovering from Global Financial Crisis

$15 = L2b = recovering from Coronavirus Crisis

$20 = L1b = recovering from price war

Subsequently, crude oil may move higher to normal range of prices, between $20 – $100+/barrel, averaging around $50/barrel. For those who are patient with strong holding power of over 3 years, there is a good chance of capital gains in future if one believes the 5 levels of crisis above are possible but low chance. Even if price war continues, at $20/barrel, Russia would start to lose money as its production cost is $20/barrel. Saudi could last longer as production cost is only $5/barrel but high national expenses won’t allow oil price to remain at low level for too long and other OPEC / non-OPEC countries may go bankrupt at this price. US, China and big funds in the world may also use the opportunity of low oil price (below $20/barrel) to buy for storage as strategic energy weapon, or simply sell higher price in future.

Some traders may take action to short when $20 support is clearly broken down. Some investors (contrarian type) may take action to gradually buy at historical 18 years low price (perhaps next target will be $15, $10, $5, $1, etc).

Question is will crude oil drops to $0 and will human forever stay at home more than 1 year with Coronavirus?

If not, it means crude oil is a commodity giant, every crisis at low optimism is an opportunity. There are 3 different strategies, counter-trend and/or follow-trend. Assuming, all 5 levels of crisis (although unlike, actual case could be between L1-L5), then one may apply multiple entries, eg (10 times x 10% capital), (5 times x 20%), (2 times x 50%) or simply 1 x 100% (1 bullet, could be due to limited capital).

1) Counter-trend (eg. 5 x 20% in downtrend L1a-L5a)

1.1) Fixed quantity method (eg. 100 units for each price)

Average price

= ($20 + $15 + $10 + $5 + $1) / 5

= $10.20

It means there is no need to guess the levels of crisis, simple average down could get about $10/barrel easily. This is 50% discount compared with someone with 1 entry at $20 with 100% capital.

1.2) Fixed capital method (eg. $100 per entry)

Total units = ($100/$20) + ($100/$15) + ($100/$10) + ($100 / $5) + ($100 / $1) = 142

Average price = ($100 x 5) / 142 = $3.50

This average method allows more units purchased at lower prices, therefore achieving a even lower average entry price.

2) Follow-trend (eg. 5 x 20% in uptrend L1b-L5b)

Average price will be same as counter-trend, depending on which levels are experienced.

3) Counter-trend + Follow trend (eg. 10 x 10% in downtrend L1a-L5a + uptrend L5b-L1b).

Results will be same as above but with more entries (more diversification), depending on which levels are experienced.

Assume, only L1a-L3a ($20 – $10) with 3 levels of crisis, one could still get $13 as average price with fixed capital method over 3 entries. This method is different from dollar cost averaging which buys all the time (low and high prices). This method requires low optimism to trigger multiple entries, high optimism to trigger multiple exits (future topic when market is bullish again to sell one day).

Learn further from Dr Tee for both trading (eg. shorting crude oil in bearish market to make money) and investing (eg. buying crude oil in bearish market with value investing). Contrarian investing has risk of buy low get lower, therefore needs to be supported by giant investment (eg. crude oil, gold, property and over 1500 global giant stocks with strong business fundamental). An investor may also integrate trading into investing, only enter during uptrend phase but there is a risk of missing out (eg. price may touch $20 and rebound forever). So, align the strategy with own personality, either trading or shorting, there are many ways to profit from current crude oil crisis and global stock crisis.

Ideally, buying giant dividend stocks (about 100+ in the world) at low optimism prices with high dividend yield is even better than crude oil investing because one could collect over 5% dividend return in next few years (better than fixed deposit in bank with 1+% interest rate) while waiting for winter time is over, applying similar methods of entries but first silver bullet to trigger (first entry) will depend on unique optimism level of each stock, this is 1 of 55 investing styles developed by Dr Tee.

What is the chances of winning in crude oil for entries below $20/barrel if one has holding power of over 3 years (typical global financial crisis is 1-2 years)?

==================================

Drop by Dr Tee free 4hr investment course to learn how to position in global giant stocks with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Learn further from Dr Tee valuable 7hr Online Course, both English (How to Discover Giant Stocks) and Chinese (价值投资法: 探测强巨股) options, specially for learners who prefer to master stock investment strategies of over 100 global giant stocks at the comfort of home.

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 9000 member.