Global oil & gas related stocks have experienced significant corrections over the past 1 year, many stocks including blue chips are at attractive low prices. Although investors know that crisis is an opportunity, the share price could become lower with time, therefore few people dare to grab the opportunity.

Is it time to buy or sell Oil & Gas stocks? The answer is to align the strategy with personality (short term trader vs long term investor):

1) Long Term Investor

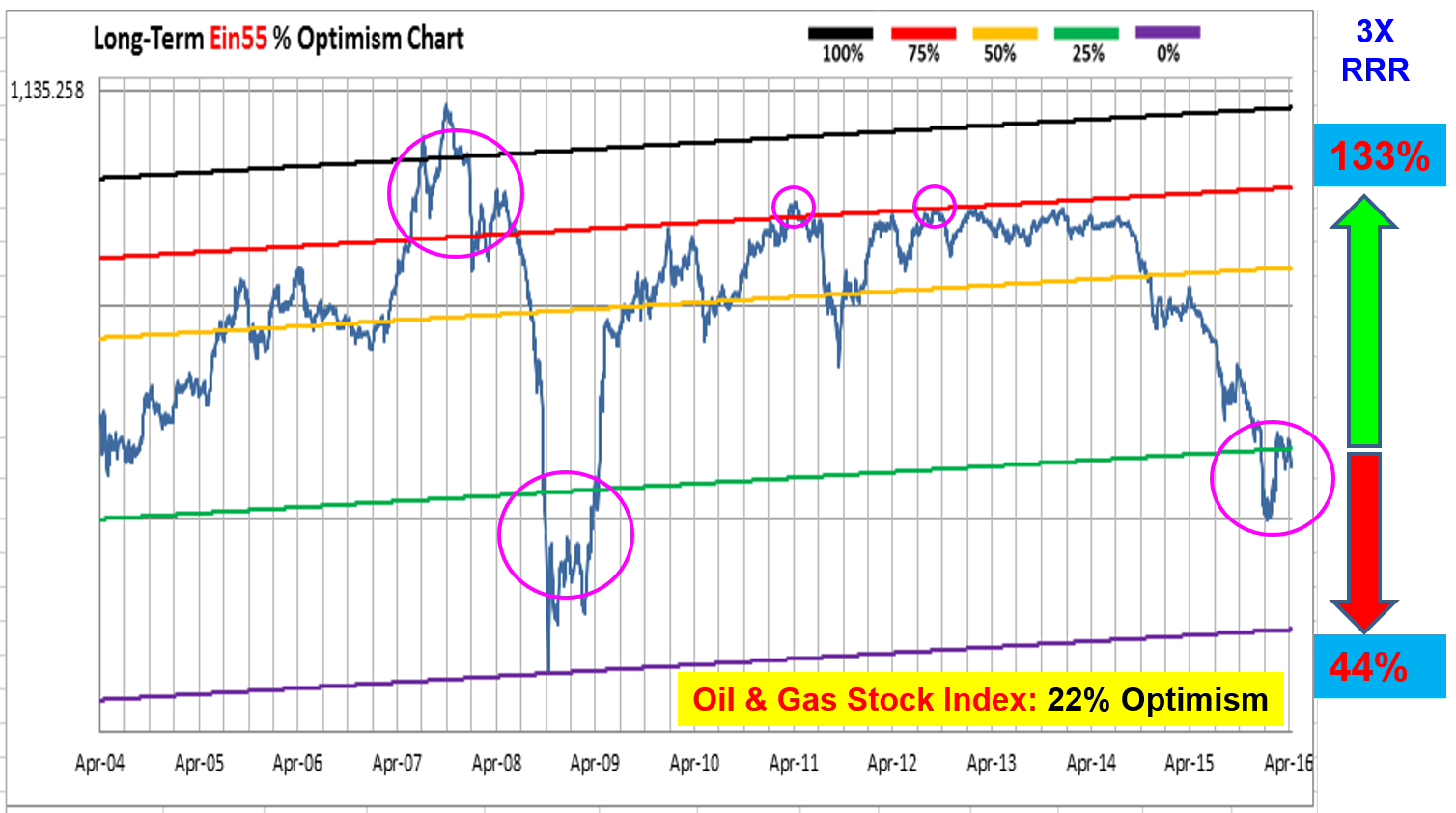

For a long term investor with at least 3 years of holding power, oil & gas crisis presents a rare opportunity for entry to buy low. As shown in the Optimism Chart below for Oil & Gas Stocks Index, long-term optimism is 22%, an attractive low price, having RRR (Reward to Risk Ratio) of 3 times. However, no one will know the true bottom, therefore the best strategy is to buy low enough (below 25%), not to depend on luck to wait for the lowest point. The investors enter with long-term low optimism require 3 additional weapons to be successful:

- Know what to buy for giant oil & gas stocks. Some weak stocks may not survive through this storm, losing business with high debt could break the camel’s back. Giants with strong fundamentals will last and revive as final winners.

- Holding power of at least 3 years to wait for the recovery of oil & gas

- Ability to control the fearful emotion during crisis, certain stocks may fall in price further due to market sentiment.

2) Short Term Trader

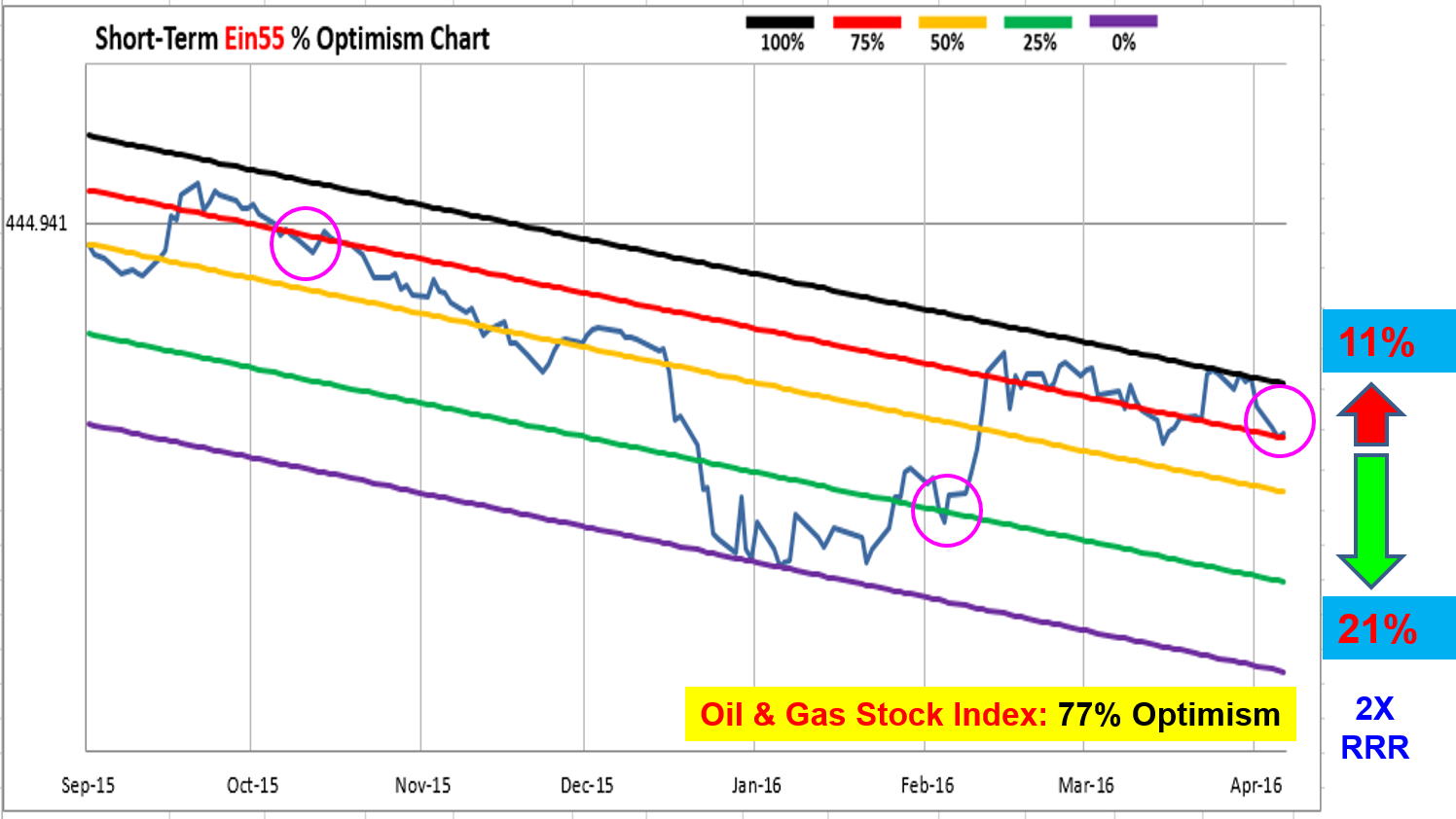

For a short term trader, the holding power is shorter (a few weeks to a few months), therefore the strategy is totally different from long term investor. A trader has to align with the short term market sentiment which is still bearish over the past 6 months. With the recent recovery of oil & gas prices, the short-term optimism is high at 77% (see chart below). For a short term trader, the upside is limited, downside is 2 times, having RRR (Reward to Risk Ratio) of 2 times if shorting strategy is applied. Of course, a short term trader could also wait for stronger breakout above 100% Optimism, if still want to long the market for a short period.

The traders who long/short the oil & gas stocks require the following strength:

- Know what to buy for trading, either for long or short, choices are different from investing.

- The ability to cut loss when direction is wrong based on risk tolerance level, knowing when to take profit, not to be too greedy. Winning or losing is a probability game in trading. Retail traders may have hard time to manage own emotions as the trades are their own capital, they could be forced to hold the stocks from short term to long term when direction is wrong, finally ending up sell low when price breaks below their psychological limit one day.

When Optimism Strategies are combined with Fundamental Analysis (value investing & growth investing), Technical Analysis (support / resistance / trends), and Personal Analysis (mind control of greed and fear), it is very powerful when one is able to take the right action (Buy, Hold, Sell, Wait or Short) at the right time aligning with own personality.

The unique Optimism Strategy developed by Dr Tee provides a special advantage to know which investment (stock, forex, property, commodity, bond, etc) to buy safely, when to buy, when to sell, including option of long term holding. So far over 10,000 audience have benefited from Dr Tee high quality free courses to the public. Take action now to invest in your financial knowledge, starting your journey towards financial freedom.

Brexit has created new stock trading and investing opportunities globally. At the same time, British Pound is severely corrected, one could apply Forex Optimism to maximize the gains in stock market. The fear factor has supported the bullish gold price and gold related stocks (eg. gold miners), analysis with Commodity Optimism is needed. Every crisis is an opportunity, provided one knows how to position.