It is possible for disruptive technology (eg. virtual bank, cryptocurrencies, etc) to change the banking & finance but it won’t be overnight, many major conventional banks are still top choices for longer term or even lifetime investing (need to compare price vs value before entry). SPH has shown weakness since 10 years ago (declining number of newspaper readers and earning), there is enough time to exit from stock investing if one day conventional banks are affected. These blue chips are likely to prepare in advance as well, see how Comfortdelgro adapts to dynamic pricing to fight against Grab Taxi.

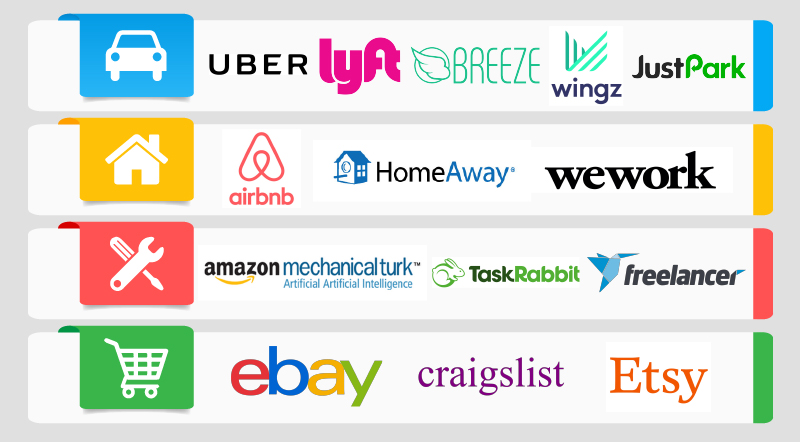

Technology stocks are generally not suitable for longer term passive investing (unless monitor both share prices and businesses regularly) as new disruptive technology could change the entire sector, a business could be out-dated if not keep up with R&D. See the changes of mobile phone leaders over the past few decades from Motorola to Nokia to Samsung / Apple / Huawei … how long the BAT-FAANG (Baidu, Alibaba, Tencent, Facebook, Amazon, Apple, Netflix, Google) could continue to dominate the market?

Every generation (about 25 years) has its own unique sector for longer term investing due to business moat during this period. In general, property / bank / utility stocks have longer lasting business and economic moat but careful choice of stocks are critical and understanding the sector cycle to compare share price vs business value, applying strategies of Buy Low Sell High, or Buy & Hold (until value is diminishing one day).

In short, monitor the quarterly or yearly business performance, especially for longer term or lifetime investing, don’t just buy stock and hold for lifetime. How to extend decade of past performance to project into lifetime investing, assuming no challenger for next few decades? Eg, we could see the trend of declining soft drink (carbonated) over the decades, Coke has to make changes or diversify into other products, may not be the same good stock for long term investing as decades ago when Buffett was younger. Similarly, number of smokers (% population) are declining, therefore tobacco / cigarette stock may not be suitable for longer term holding.

Sign up free 4hr stock investment course by Dr Tee to learn various giant stocks of current generation for longer term investing or shorter term trading. Register Here.