New Year 2017 will be an exciting year for global stock market with Donald Trump as the new US president, recovery of emerging markets and crude oil market, rising interest rate and a bullish US economy. Let’s learn how to position in stock market with 2 winning strategies: 1) Buy Low Sell High, 2) Buy High Sell Higher.

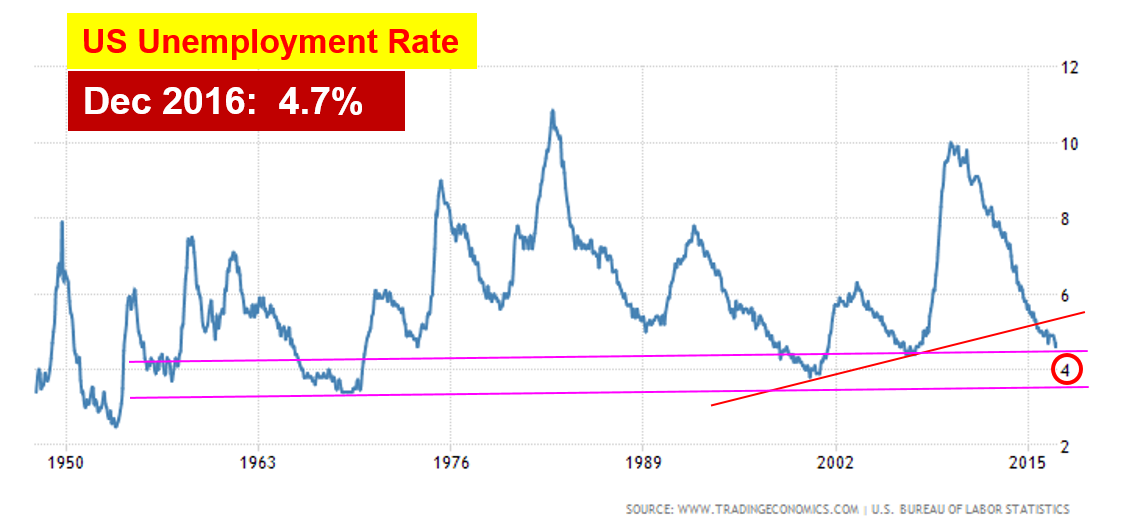

US contributes to 40% of global stock value, therefore it should be a key focus to understand the stock market outlook in year 2017. US economy has been consistently bullish, supporting the stock market. US unemployment rate has declined by half from 10% to 4.7% in Dec 2016. Based on the historical unemployment rates of US since year 1950 (see chart below), we could observe that US economy is entering the last phase of bull run as the unemployment rate is falling below 5%, moving towards the critical 4% value, reflecting the peak of US economy.

Lower unemployment rate implies more new jobs are created, therefore more spending power, which helps the business to grow with higher sales, eventually reflecting as higher stock prices due to stronger fundamental in financial statements. US stock market has been bullish in the past few years, following the trend of US economy, likely will continue in the New Year 2017.

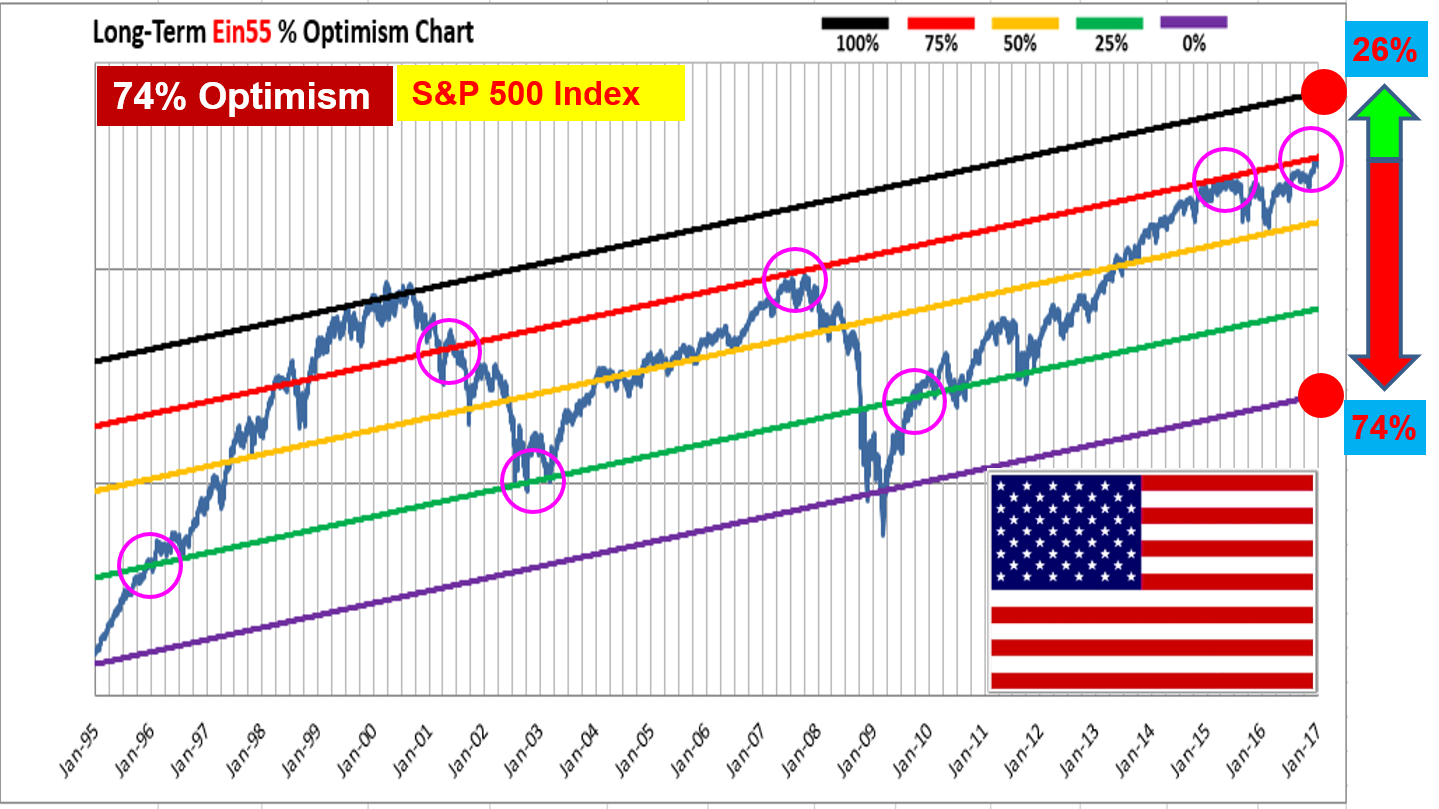

US S&P500 stock index has achieved new historical high on 6 Jan 2017 with 2276 points. Based on Dr Tee (Ein55) Optimism Strategy, US stock market is close to danger zone with 74% Optimism in long term (see chart below), implying the probability of bear market risk is 74% while the upside potential is limited, only 26%.

There have been mixed feelings in the stock market. Some people have stopped investing, worrying about the peak of US stock market but unknowingly the stock prices become higher and higher with time, they may regret of missing the train, hoping to have the last ride.

There are actually many mechanisms to make money in stocks. Here are 2 winning strategies for the New Year 2017, to be aligned with one’s unique personality:

1) Buy Low Sell High

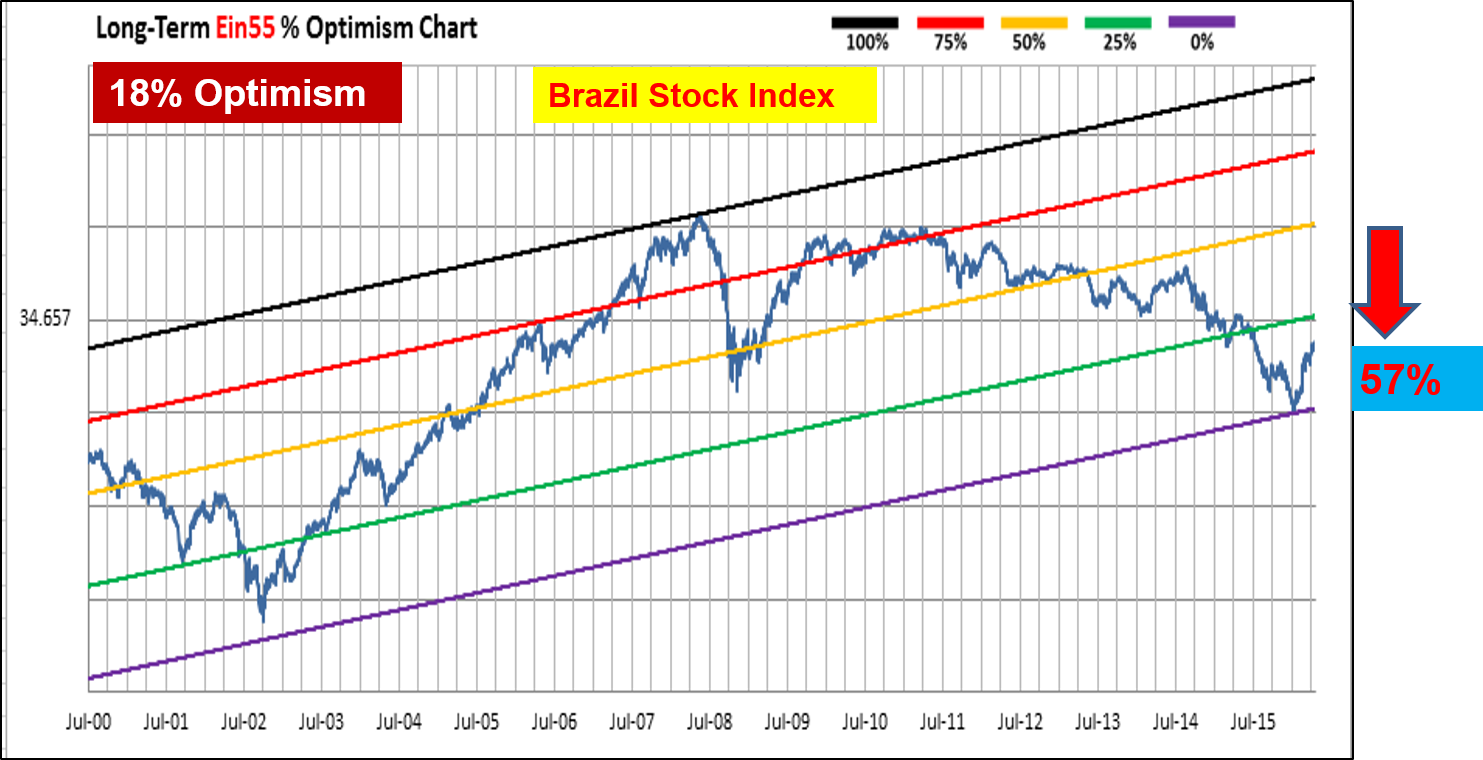

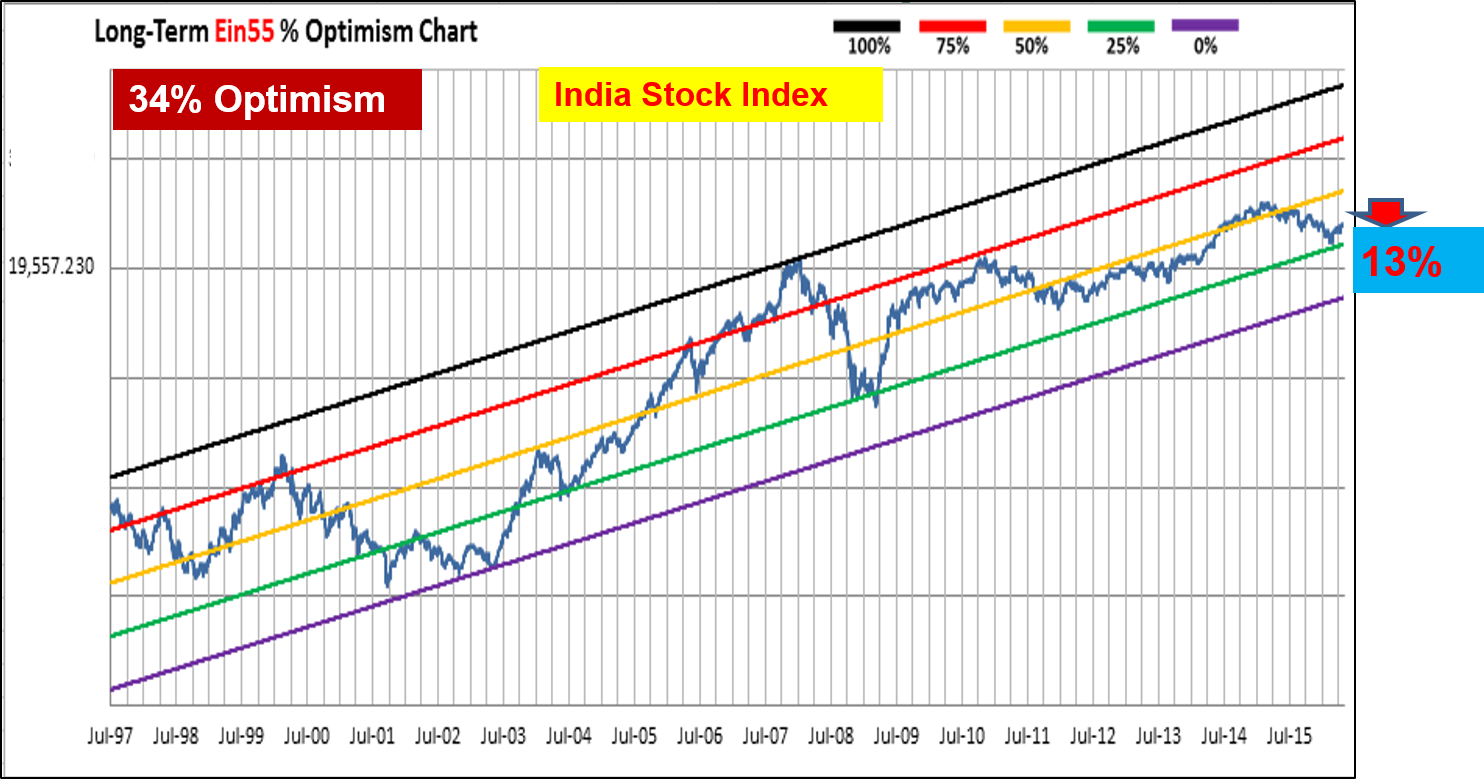

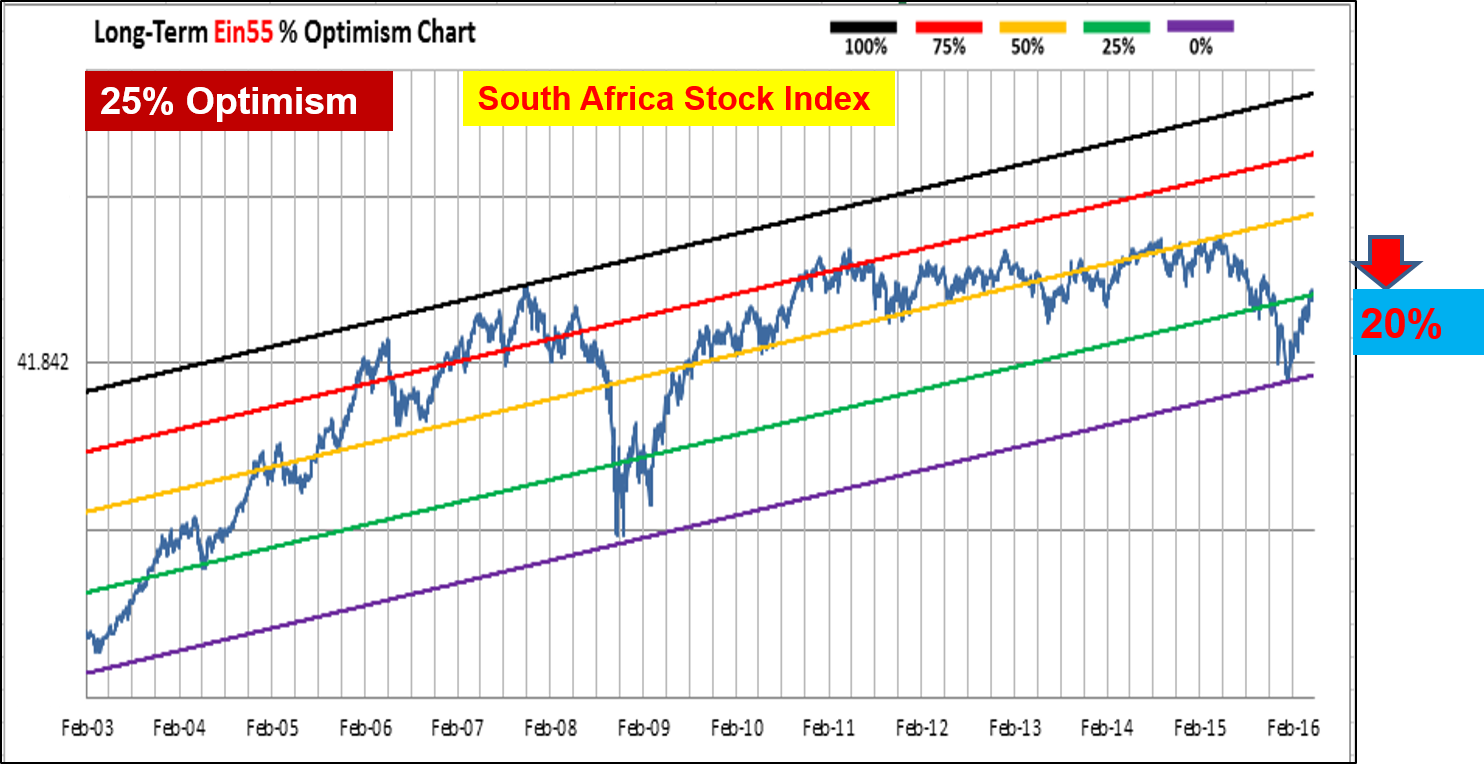

This strategy is suitable for long term investors who hope to invest safely, buying good fundamental stock at low price, selling high in future or holding for long term. Since US and global stock market are approaching higher optimism level, the chances of global financial crisis is high, any unexpected global event in near future could trigger the bear market.

An investor will need to be very patient, ignoring the temptation of the bullish market, taking profit while others are greedy (Optimism >75%), standby enough capital to prepare to buy low when Optimism of global stock market is below 25% again. Control of emotions is critical to buy low when others are fearful one day.

2) Buy High Sell Higher

Not everyone is an investor, having the patience to wait. Some people are more suitable for short term trading, which they could follow momentum trading to buy high and sell higher in near future. A stock price could be at high price but the trend is bullish, therefore the price is sustainable for short term, having the potential to go up even higher with time.

This strategy is more suitable for short term trading in the last phase of bull market, following the trends of stock prices, supported by news, speculations, business, economy, etc. When the trend has stopped, the traders have to stop as well or applying reversed trend in trading. Control of emotions are very critical as daily news could affect the traders’ psychology. The ability to take profit or cut loss is important as the elements of probability are stronger here.

There are other variations of the strategies, eg. an investor could buy low for strong fundamental stocks, sell high for short to medium terms. This way, an investor could also enjoy the last phase of the bull run in stock market with integration of trading strategies.