Poor Noble Group (SGX: N21), just about to recover, Iceberg is back with new report. Similar to Ezra and Cosco, it is a crisis stock with declining business and stock price.

It is not suitable to apply conventional method to analyze Noblle Group. Technically it is like a new company now, most of the good assets are sold to save the company by paying the debt. It may not have the same power to recover to the past glory.

Since it is a trader stock, fundamental will be relatively not so critical as in a bullish market, even weak fundamental stock could rise many times under speculation. It is more suitable for short term trading, using short term TA signals. 23 cents support was broken downward, combining with Iceberg (negative PA), tough on Noble. It is still above the intermediate support of 20 cents. There is no need to guess for trading, prices with support and resistance will show us the probability.

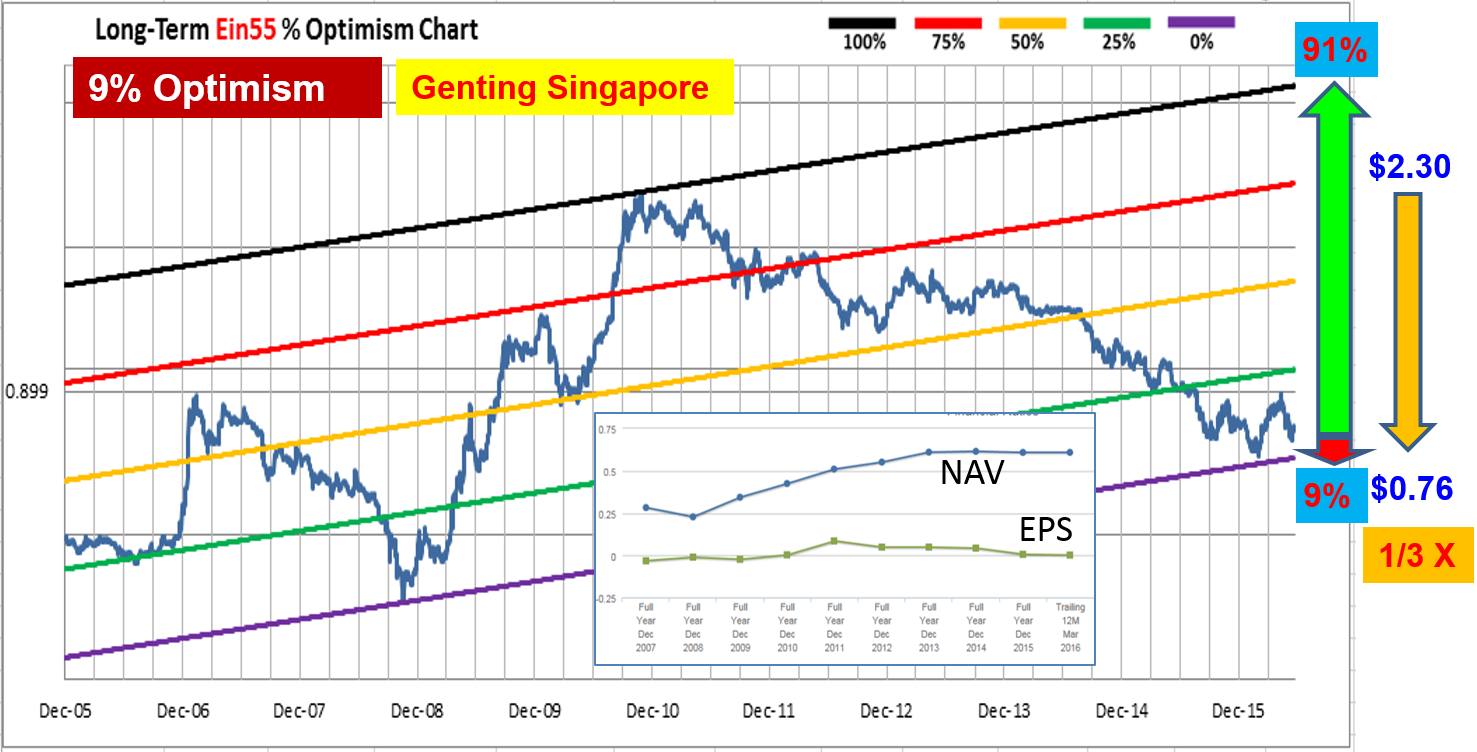

NAV (Net Asset Value) criteria may not be suitable for Noble Group as it becomes asset light business, the asset quality is also a question mark. Good assets are properties and cash, many company have these quality assets, some with discounted share price.

Iceberg may be shorting all the way on Noble to low optimism with profits. If Iceberg is profit driven, similar to hedge fund, they could change to long position to “accept” Noble now, so that they could profit from recovery of Noble. Since Iceberg is still consistent in their negative views, it deserves some respect as they have principles. At low optimism, even for lousy business, very little profit potential to short a stock. With recovery of commodity market, Noble could have survived the greatest business crisis.

In ancient time, a warrior could cut off own arm to save one life when bitten by poisonous snake. Noble has cut his arm of core asset to save from 2 “snakes” with multiple bites from Iceberg and Muddy Water, starving in a cold winter (commodity crisis). It deserves a chance to recover.

壮士断腕、可悲可泣。