Temasek invests in about 40 global stocks, the largest investment by market capitalization is in Singtel (52% shareholding), jewel in the crown. Singtel (SGX: Z74) is not just the fixed deposit of Temasek (through consistent dividend payment for decades), also cash generator for over 1 millions Singaporeans who are Singtel retail investors, the most popular stock in Singapore.

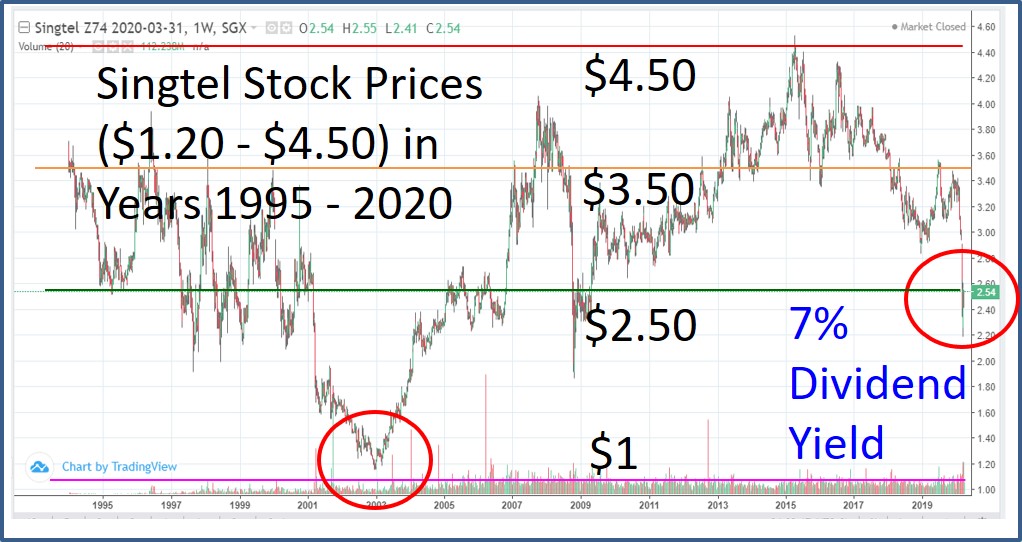

Over the past few years, due to competitive global and local Telco industry (eg. new player TPG in Singapore, uncertain regional markets), despite Singtel is more defensive than other peers, share prices has dropped by half from the peak of $4.40 to $2.28/share (about 30% price dip was over the past 2 months of global stock crisis). This is relatively stronger compare with local competitor Starhub (SGX: CC3) with share prices drop to about 1/3 of peak price. Even M1 was acquired and delisted during this period. TPG is listed in Australia (ASX: TPM), share price has also dropped by half over the past few years.

So, this is not Singtel stock crisis (Level 1 – individual stock), rather, it is Level 2 crisis (Telco sector) and even Level 3 crisis (country level – Singapore and most Asian stock markets).

Singtel is not just a Telco giant of Singapore, also a major regional Telco in Asia Pacific (Australia, India, philippines, Indonesia). It has diversification geographically, but also suffer uncertainty in each country (eg. legal cases in Thailand and India which affect its last few quarters of earnings).

Telco industry used to be a defensive sector as usually only a few licenses are given in each country for Telco operators, nearly a sure-win oligopoly business. Introduction of smart phones in 2000s, following by 3G, 4G, etc, has helped Telco industry to grow further over the past 2 decades. The yearly capex (difference of operating cashflow and free cashflow) is usually stable, therefore Singtel’s consistent earnings have contributed to stable free cashflow, eventually predictable dividend payment 2 times yearly to shareholders for decades, about 4-5% average dividend yield over the past 10 years, better than fixed deposit interest rates of 1-2% in banks.

With recent global stock crisis, Singtel share price has dropped to 11 years low, approaching the last low recorded in 2009 global financial crisis. Singtel will announce 2020 final year report (financial year ending 31 Mar 2020) in a few months time but results are predictable to be much weaker than last year due to losses in Bharti (India investment) and weaker earning over the past 2 quarters (especially with Coronavirus).

Singtel is defensive partly because it is a major Telco operator, price competition could affect its earning but few people may terminate the mobile phone lines in this internet era. During global financial crisis, perhaps some people may cut 3 meals into 1 meal to save cost but likely will still keep the phone line which is the meal of “soul’.

This implies despite Singtel has more downside in both business (especially for the coming 2020 annual report) and stock prices (especially if Coronavirus is beyond control, resulting in global financial crisis), it is unlikely the company would go bankrupt with share price dropping to $0. Singtel is a dividend giant stock, current dividend yield is nearly 7%. Assuming the earnings, cashflow and dividend available may drop by 50% (due to 1-time loss in Bharti), there is still 3.5% dividend yield.

An investor who is interested in Singtel may apply progressive entries at low optimism level, eg 5 times x 20%. Assuming $2.50/share is the first trigger at low optimism. and investor may consider (just a sample investing plan, not a personal financial advice, please make your own decision):

$2.50 or $X – First Entry (Level 1-3 crisis)

$1.50 or $Y – Second Entry (Level 4 crisis)

$0.50 or $Z – Third Entry (Great Depression, when people cut from 3 meals to 1 meal, still cannot survive, Telco is no longer important)

Assuming 3 levels of crisis happen, average price will be $1.50/share over 3 entries. Investor may also consider these prices after it drops to bottom and recover again (uptrend), no need to suffer with falling prices in bear market. The strategy is personality dependent, counter-trend (contrarian investor) and/or follow-trend (trader mindset).

Singtel may remain at low optimism (below $2.50/share) for several years, investors could collect >3% dividend yield (pessimistic assumption) during the winter period of crisis. This way of averaging method (investors may define own $X, $Y, $Z prices above, the sample prices given above are just for example purpose).

The strategies above may be applied for any dividend giant stock. There are about 100 global dividend giant stocks (you may learn the strategies from Dr Tee in 6 days comprehensive course or note down a few sample stocks in free 4hr workshop for the public), some are much stronger and more stable than Singtel. In fact, Singtel is slower in growth, more suitable for dividend investing (as if fixed deposit in stock market) at low optimism but may not suitable for growth to achieve higher capital gains.

There are many ways to make money in stocks, may not be investing, could be trading (higher probability is shorting for current stock market but risk is high due to high market volatility). It is possible for short term trader to short at bearish Telco stocks (may not be Singtel) to profit from the falling prices, especially when breaking below a critical price support, driven by fear of declining business and global events (Coronavirus, etc). So, it is possible for different persons to take different actions (Buy, Hold, Sell, Wait, Shorting) and all could make money in stocks if strategies aligned with personalities and market conditions.

There are at least 26 Temasek / GLC stocks in Singapore including Singtel, controlling shareholder with 15% or more ownership directly or indirectly (investor needs to focus only on giant Temasek stocks):

Singtel (SGX: Z74), DBS Bank (SGX: D05), ST Engineering (SGX: S63), Singapore Airlines (SGX: C6L), SIA Engineering (SGX: S59), Singapore Exchange (SGX: S68), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Sembcorp Marine (SGX: S51), Olam (SGX: O32), CapitaLand (SGX: C31), CapitaLand Mall Trust (SGX: C38U), CapitaLand Commercial Trust (SGX: C61U), Ascendas Reit (SGX: A17U), Ascott Hospitality Trust (SGX: HMN), Ascendas Hospitality Trust (SGX: Q1P), CapitaLand Retail China Trust (SGX: AU8U), Ascendas-iTrust (SGX: CY6U), Keppel Corp (SGX: BN4), Keppel Reit (SGX: K71U), Keppel DC Reit (SGX: AJBU), Keppel Infrastructure Trust (SGX: A7RU), Mapletree Logistics Trust (SGX: M44U), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree NAC Trust (SGX: RW0U).

Temasek stocks portfolio also affect about 15% of STI index stocks, which has strong impact on Singapore stock market. Here are 30 STI component stocks:

DBS Bank (SGX: D05), Singtel (SGX: Z74), OCBC Bank (SGX: O39), UOB Bank (SGX: U11), Wilmar International (SGX: F34), Jardine Matheson Holdings JMH (SGX: J36), Jardine Strategic Holdings JSH (SGX: J37), Thai Beverage (SGX: Y92), CapitaLand (SGX: C31), Ascendas Reit (SGX: A17U), Singapore Airlines (SGX: C6L), ST Engineering (SGX: S63), Keppel Corp (SGX: BN4), Singapore Exchange (SGX: S68), HongkongLand (SGX: H78), Genting Singapore (SGX: G13), Mapletree Logistics Trust (SGX: M44U), Jardine Cycle & Carriage (SGX: C07), Mapletree Industrial Trust (SGX: ME8U), City Development (SGX: C09), CapitaLand Mall Trust (SGX: C38U), CapitaLand Commercial Trust (SGX: C61U), Mapletree Commercial Trust (SGX: N2IU), Dairy Farm International (SGX: D01), UOL (SGX: U14), Venture Corporation (SGX: V03), YZJ Shipbldg SGD (SGX: BS6), Sembcorp Industries (SGX: U96), SATS (SGX: S58), ComfortDelGro (SGX: C52).

Temasek has 40 stocks in the global portfolio, about half are giant stocks (based on Dr Tee criteria). Singtel is Temasek’s largest investment but not Temasek’s best giant stock. An investor may invest in the Top 3 Temasek giant stocks, buying lower than Temasek (hopefully with help of global stock crisis), selling higher than Temasek (if timing is right). Even the stock with business may be in trouble (eg. Olam previously, SIA currently), Temasek is a strong sponsor, likely will help if having significant investment.

==================================

Learn from Dr Tee 4hr Free investment course on global dividend giant stocks to collect passive income during low optimism in stock crisis, then enjoying capital gains with growing share prices when crisis is over.

Learn further from Dr Tee valuable 7hr Online Course, both English (How to Discover Giant Stocks) and Chinese (价值投资法: 探测强巨股) options, specially for learners who prefer to master stock investment strategies of over 100 global giant stocks at the comfort of home.

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 9000 members.