In this Dr Tee 1.5hr video education (Free Ride on 10 Singapore Bull Market Stocks), you will learn:

1) Singapore and Malaysia Stock Market Outlook 2021/Q3

2) Long Term Investing on 3 Singapore Giant Stocks:

– The Hour Glass (SGX: AGS)

– Thai Beverage (SGX: Y92)

– Raffles Medical Group (SGX: BSL)

3) Short Term Trading on 3 Singapore Giant Stocks:

– PropNex (SGX: OYY)

– Union Gas Holdings (SGX: 1F2)

– Cortina Holdings (SGX: C41)

4) Bonus Stock Diagnosis for Audience Q&A on 4 Singapore Giant Stocks:

– Yangzijiang Shipbuilding Holdings (SGX: BS6)

– Tuan Sing Holdings (SGX: T24)

– OCBC Bank (SGX: O39)

– Wilmar International (SGX: F34)

Learners of earlier Dr Tee videos could have profited with over 50% rally in share price if have taken actions during pandemic on similar giant stocks such as The Hour Glass, Cortina, Union Gas, OCBC, etc. No one could change the past but you could still change the future if taking action to learn now!

Here is Dr Tee Free 1.5-hr Video Course (suitable for bilingual learners: verbal presentation in Chinese, written notes in English, technical charts for everyone). Enjoy and give your comments for improvement. You may subscribe to Dr Tee Youtube channel (Ein Tee) for future Dr Tee video talks.

Dr Tee Video Course: https://youtu.be/WCciuIn88uI

在这Dr Tee 1.5小时教育视频(10只新加坡牛市股票顺风车),您可学习:

1) 新加坡与马来西亚2021/Q3股市展望。

2) 三只长期投资的新加坡强股

– 欧佳时 The Hour Glass (SGX: AGS)

– 泰国酿酒 Thai Beverage (SGX: Y92)

– 莱佛士医疗 Raffles Medical Group (SGX: BSL)

3) 三只短期交易的新加坡强股

– 博纳产业 PropNex (SGX: OYY)

– 优联燃气 Union Gas Holdings (SGX: 1F2)

– 高登 Cortina Holdings (SGX: C41)

4) 现场观众问答环节,四只新加坡强股分析:

– 揚子江船業 Yangzijiang Shipbuilding Holdings (SGX: BS6)

– 传慎控股 Tuan Sing Holdings (SGX: T24)

– 华侨银行 OCBC Bank (SGX: O39)

– 丰益国际 Wilmar International (SGX: F34)

错过Dr Tee之前教导,猛涨过50%的强股 (欧佳时、高登、优联燃气、华侨银行)?往者不可谏,来者犹可追,现在开始学习投资!

这儿是 Dr Tee 免费1.5小时华语课程 (适合双语学员:华语表达,英语讲义,图表皆通)。请欣赏鄙作,留言求进步。您可订阅 Dr Tee Youtube 频道(Ein Tee),链接未来投资视频。

Dr Tee 华语视频: https://youtu.be/WCciuIn88uI

===================================

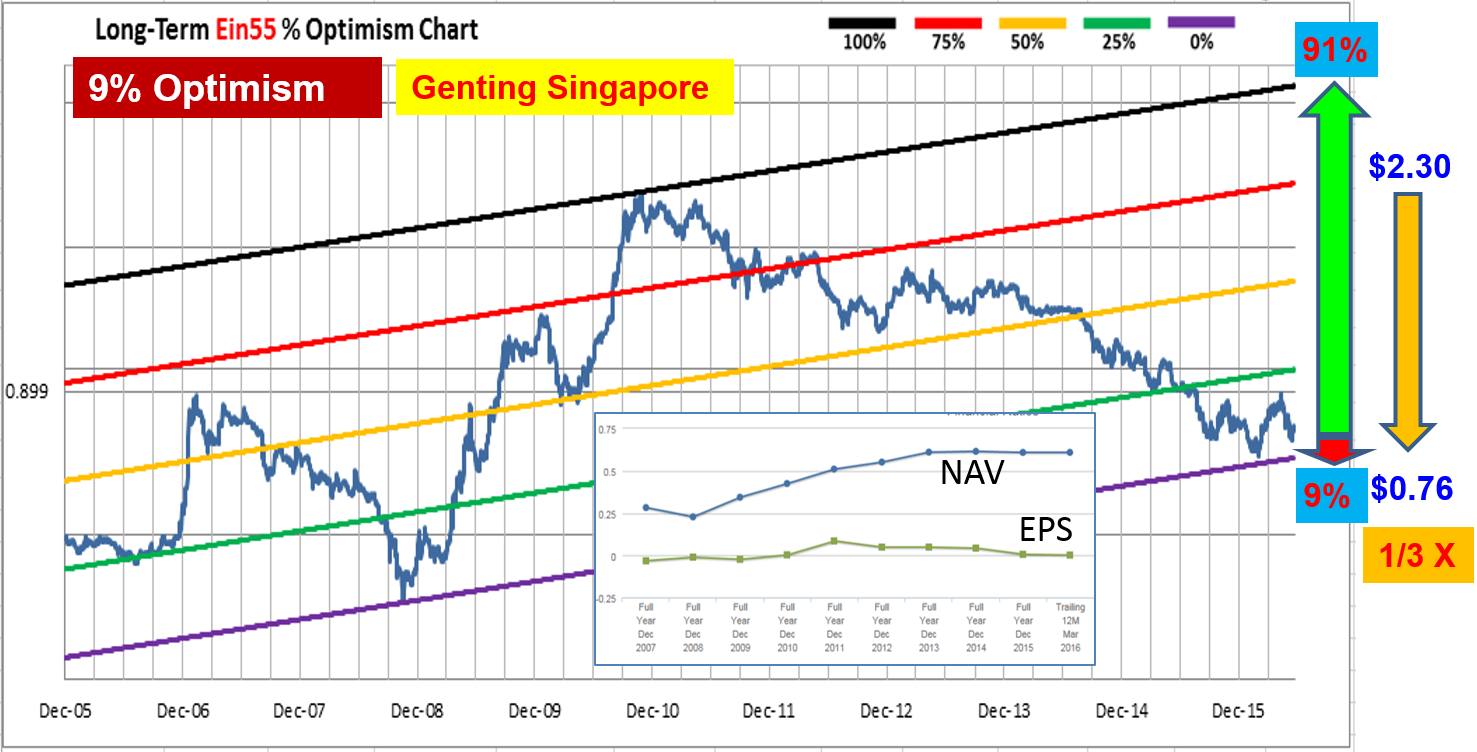

There are over 2000 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Frasers Logistics & Commercial Trust (SGX: BUOU), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Integrated Commercial Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com

View quick preview video below, Dr Tee will introduce 10 key stock investment strategies (股票投资十招) to be learned in 4hr free stock webinar:

Register Here (Dr Tee Free 4hr Stock Webinar): www.ein55.com