Fresh from Oven: Download the latest 2 FREE high-quality stock investment eBooks by Dr Tee on (1) “Global Market Outlook 2023”, covering comprehensive investment topics: Stock, Property, Commodity, Forex, Bond and Political Economy & (2) “Dream Team Portfolio 2023” with Top 10 global stocks for capital gains and passive incomes. Past readers have benefited both stock investment eBooks, learning simple and useful strategies to position in current global stock markets.

Are you worried about the current global stock market with potential black swans such as high inflation, interest rate hike, Russia-Ukraine War, supply chain disruptions and endless COVID19 cases which contribute to declining stock prices? Every crisis is an opportunity for investing. You will learn useful methods step by step from 2 valuable FREE stock investment eBook by Dr Tee which work in stock market. Take action now to surprise yourself!

Dr Tee 刚完成2本投资秘籍。《环球市场展望2023》书内覆盖很多在环球主要市场 (美国、新加坡、香港、中国、欧洲) 的投资议题及提供解决方法。《10大梦幻股票2023》书则分享了各种实用投资策略于10大高潜能股票。很多读者已经从Dr Tee过去发表的股票投资书中受惠,大家可在Dr Tee 的最新报告中洞悉环球市场目前面对的风险及机遇。

Table of Contents (FREE Stock Investment eBook #1):

Global Stock Market Outlook 2023

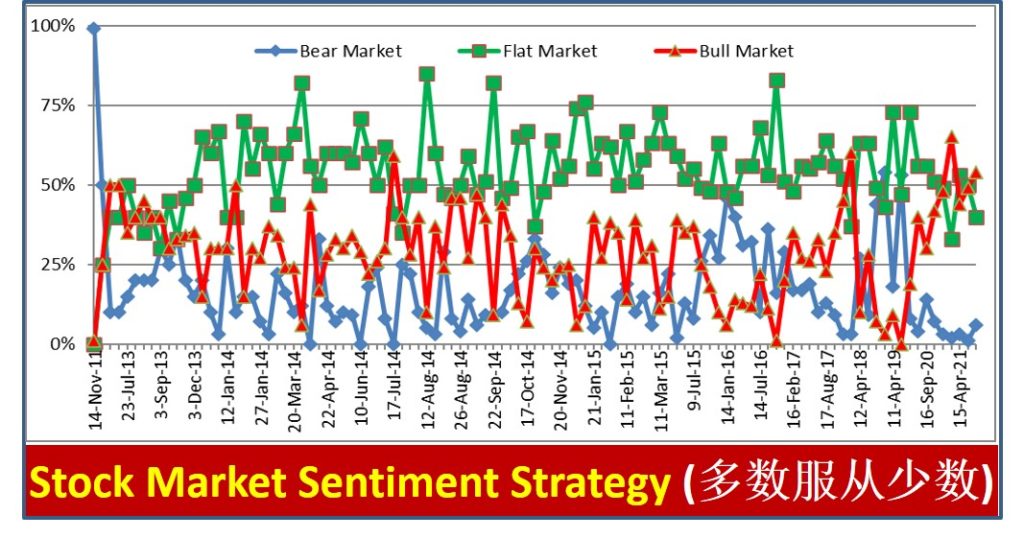

Mass Market Sentiment Survey (大众市场情绪调查)

Review of Global Stock Markets (环球股市回顾)

US Market Outlook (美国市场展望)

Regional Market Outlook (Europe, China, Hong Kong) (区域市场展望)

Singapore Market Outlook (Stock & Property) (新加坡市场展望)

Conclusions and Recommendations (总结及建议)

Table of Contents (FREE Stock Investment eBook #2):

Top 10 Global Stocks – Dream Team Portfolio 2023

Personalized Stock Investment Portfolio (个人化股票投资组合)

Ein55 Global Top 10 Stocks (10大全球高潜能股票)

Summary of Actions (投资方向总结)

Download Dr Tee 2 eBooks Here: http://eepurl.com/P8i61

===================================

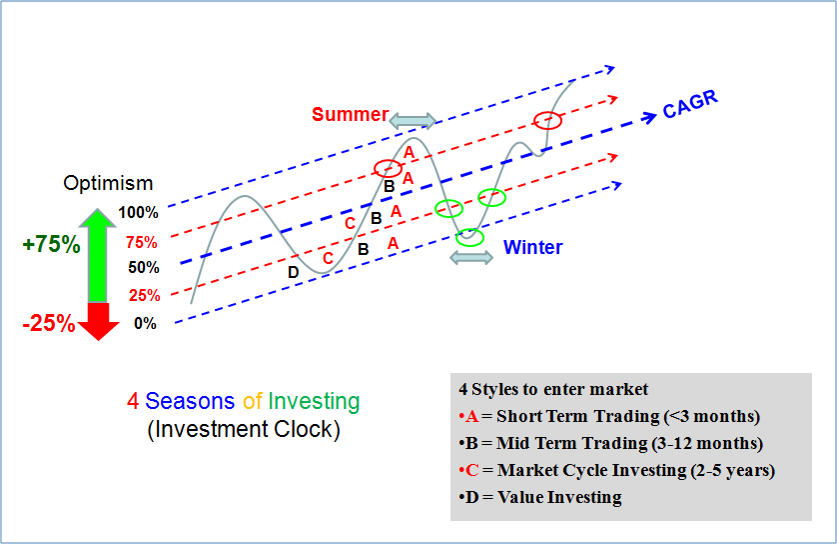

There are over 2000 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Frasers Logistics & Commercial Trust (SGX: BUOU), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Integrated Commercial Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com

View quick preview video below, Dr Tee will introduce 10 key stock investment strategies (股票投资十招) to be learned in 4hr free stock webinar:

Register Here (Dr Tee Free 4hr Stock Webinar): www.ein55.com