Over the past 2 years of pandemic, global stock markets have been experiencing roller-coaster rides, down and up and down … mainly due to these 5 black swans with high uncertainties in cyclic manner:

1) COVID19 Pandemic

2) Supply Chain Disruption

3) Interest Rate

4) Inflation

5) Russian-Ukraine War

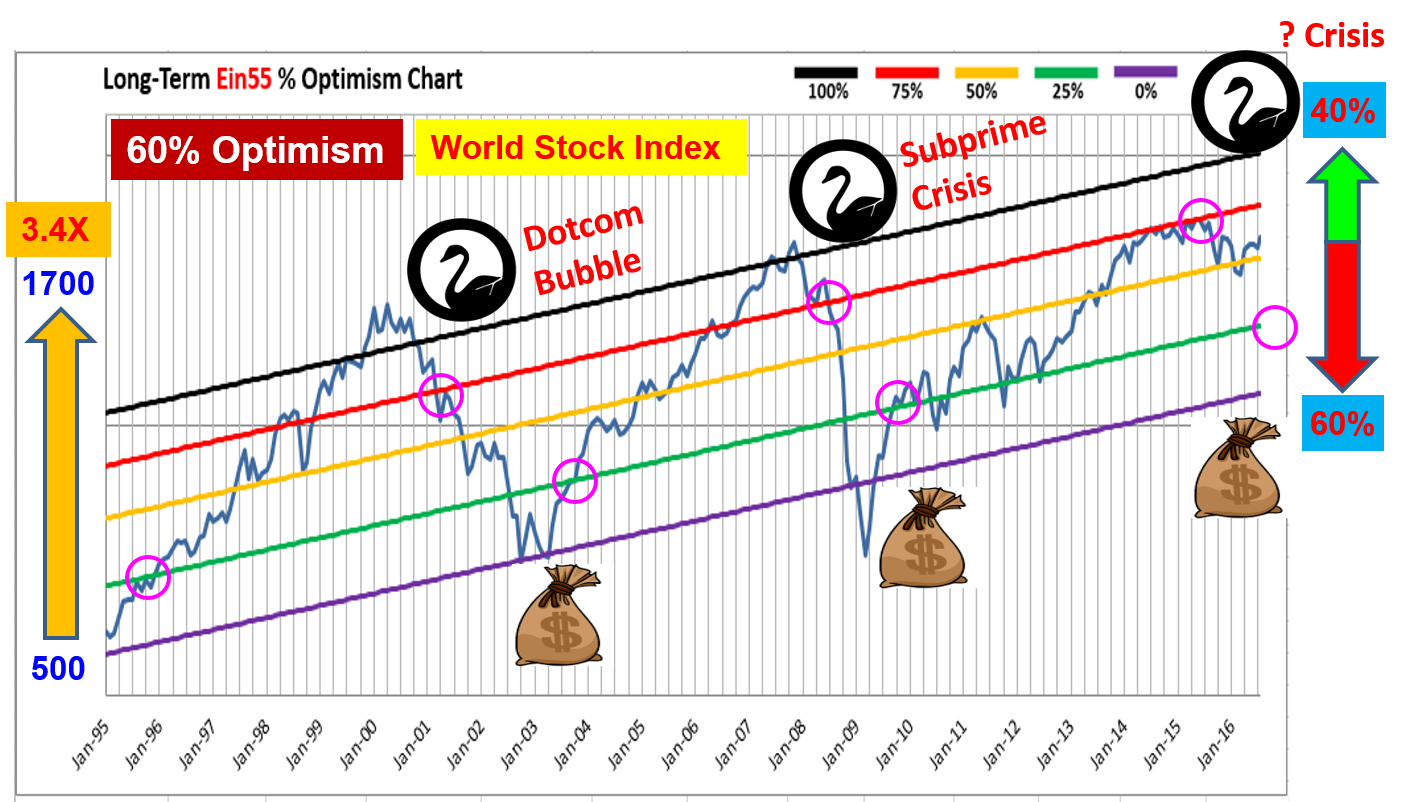

Global stock markets experienced mini dotcom bubble with over 30%-50% major correction in technology stocks, especially in US Nasdaq and Hong Kong. Both long term investors and short term traders are worried of high inflation over 8%, interest rate hike (may exceed 3% in 1 year), Russia-Ukraine War (higher commodity prices), supply chain disruptions and endless COVID19 cases (over 2 years) which contribute to declining stock prices. These 5 black swans (五内如焚) may spread the fears in technology stocks to most sectors, resulting in a global financial crisis.

Instead of worrying about uncertain markets, a smart investor may consider strong dividend giant stocks with protection by defensive sector business, a natural way to hedge against high inflation with interest rate hike while collecting growing passive incomes in a steady way. A wise trader would make friend with price trend, waiting for uptrend to reenter again (avoiding Buy Low get Lower). It is possible to integrate long term investing with short term trading to enjoy the best of 2 worlds.

Crisis could be Opportunities if an investor or trader knows how to take 1 of 5 critical actions (Buy / Hold / Sell / Wait / Shorting) aligning to own personality. Let’s learn further from Dr Tee on how to take action in current stock markets with 5 black swans:

1) Buy

With over 90% global stocks (especially in US & Hong Kong) turned bearish, “Buy” action for investors could be more suitable for defensive dividend giant stocks, taking calculated risks of limited downside, no need to time the market. A trader may still consider strong individual stocks from bullish sectors such as utilities, commodities, energy, etc, which still have potential to rise.

Most people wish to Buy Low Sell High but usually ending up do nothing when market is falling (fear of falling knife) and rising again (fear of “expensive” stocks).

Supply chain disruptions during pandemic becomes worse, especially for commodities (eg. agricultural products, crude oil and natural gas) during Russia-Ukraine War which is highly complicated (political, financial, humanistic, etc). While commodity stocks still enjoy higher profits in near future, it is more suitable for shorter term traders as Ein55 Optimism level of commodity stocks are generally higher, may not be suitable for long term investing.

2) Hold

A short term trader may have sold the stocks when stock markets start to turn bearish a few months ago but a long term investor may have option to hold on to certain stocks with condition that it is a giant with strong and defensive businesses.

During interest rate hike (to tame the high inflations), global bank stocks would have higher interest income due to higher Net Interest Margin (NIM). However, banks profits could be reduced if the stock correction ends up as a global financial crisis (eg. stagflation or hyper-inflation over 10%), there could be less borrowing of money by corporate. At the same time, non-interest income (eg. investment funds, insurance, credit card, etc) is highly dependent on economy condition.

The Fed of US is taking the lead to increase interest rate (from 1%) which is an art to control the high inflation (over 8%) with amount of adjustment. If the interest rate is increased too fast (eg. over 1% each time), investors may become fearful, resulting in bearish stock market which could limit hiring and expansion of business, ending as global financial crisis eventually. If the interest rate is increased too slow (eg. minimal 0.25% each time), it could not bring down the high inflation (already last 40 years high). The Fed could only do micro adjustment every few months (6 times each year) while giving “assurance” with more positive comments to cool down the inflation without spreading the fear too much.

Singapore stock market performs better than US stock market so far in Year 2022, mainly due to there are more banking and finance stocks (over 30%) than technology stock (only 1, Venture Corp) in 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand Integrated Commercial Trust (CICT) (SGX: C38U), CapitaLand (SGX: C31), City Development (SGX: C09), ComfortDelGro (SGX: C52), DBS Bank (SGX: D05), Dairy Farm International (SGX: D01), Frasers Logistics & Commercial Trust (SGX: BUOU), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Matheson Holdings JMH (SGX: J36), Jardine Cycle & Carriage (SGX: C07), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Singapore Exchange (SGX) (SGX: S68), Singapore Airlines (SIA) (SGX: C6L), ST Engineering (SGX: S63), Sembcorp Industries (SGX: U96), Singtel (SGX: Z74), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), Yangzijiang Shipbuilding (YZJ) (SGX: BS6).

Similarly, there are more value stocks in Malaysia 30 KLCI index component stocks:

CIMB (Bursa: 1023) CIMB GROUP HOLDINGS BERHAD, DIALOG (Bursa: 7277) DIALOG GROUP BERHAD, DIGI (Bursa: 6947) DIGI.COM BERHAD, GENM (Bursa: 4715) GENTING MALAYSIA BERHAD, GENTING (Bursa: 3182) GENTING BERHAD, HAPSENG (Bursa: 3034) HAP SENG CONSOLIDATED BERHAD, HARTA (Bursa: 5168) HARTALEGA HOLDINGS BERHAD, HLBANK (Bursa: 5819) HONG LEONG BANK BERHAD, HLFG (Bursa: 1082) HONG LEONG FINANCIAL GROUP BERHAD, IHH (Bursa: 5225) IHH HEALTHCARE BERHAD, IOICORP (1961) IOI CORPORATION BERHAD, KLCC (Bursa: 5235SS) KLCC PROPERTY HOLDINGS BERHAD, KLK (Bursa: 2445) KUALA LUMPUR KEPONG BERHAD, MAXIS (Bursa: 6012) MAXIS BERHAD, MAYBANK (Bursa: 1155) MALAYAN BANKING BERHAD, MISC (Bursa: 3816) MISC BERHAD, NESTLE (Bursa: 4707) NESTLE MALAYSIA BERHAD, PBBANK (Bursa: 1295) PUBLIC BANK BERHAD, PCHEM (Bursa: 5183) PETRONAS CHEMICALS GROUP BERHAD, PETDAG (Bursa: 5681) PETRONAS DAGANGAN BHD, PETGAS (Bursa: 6033) PETRONAS GAS BERHAD, PMETAL (Bursa: 8869) PRESS METAL ALUMINIUM HOLDINGS BERHAD, PPB (Bursa: 4065) PPB GROUP BERHAD, RHBBANK (Bursa: 1066) RHB BANK BERHAD, SIME (Bursa: 4197) SIME DARBY BERHAD, SIMEPLT (Bursa: 5285) SIME DARBY PLANTATION BERHAD, TENAGA (Bursa: 5347) TENAGA NASIONAL BHD, TM (Bursa: 4863) TELEKOM MALAYSIA BERHAD, TOPGLOV (Bursa: 7113) TOP GLOVE CORPORATION BHD.

3) Sell

Some investors may feel that it is too late to sell stocks after over 30% – 50% correction in stocks, especially in technology sector. In fact, short term traders and long term investors have different risk tolerance levels, criteria to sell could be different as well. For traders, it is important to follow a consistent trading system to buy and sell (eg. every few weeks or months), mainly based on Technical Analysis with trend-following. For investors, more considerations on longer term stock performance including business conditions (not just based on stock prices), selling of stocks is an option, not a must.

Some investors may also worry after selling a stock (especially a giant stock), hard to buy back again at the same prices, therefore prefer to hold. If an investor could integrate trading mindset into investing, even if the current bearish stock market is only a major correction (eg. rebound when high inflation is tamed), it is never too late to buy back the same stocks (or stronger stocks) at the same selling price or even higher price (difference of selling and buying price is a premium of insurance to ensure a more bullish market).

Sell a stock (whether to take profits or minimizing losses) is not a mistake, even the stock may recover higher eventually. When business or fundamental analysis is core (value investing), stock price analysis (allowing Buy Low or Sell High) would help to enhance the probability of success with higher potential return. Partial consideration of only fundamental or technical is incomplete, there could be market traps in each method.

4) Wait

For investors or traders with no stock currently, some may want to wait for opportunities to buy low. Cash is king only when used at the right time in investment one day. Cash deposit in banks forever could be wasted if too much cash (beyond emergency fund for family) with little return (current bank interest rate is still far below inflation, therefore cash is shrinking in value with time).

For investors who could not any take action in stocks due to low risk tolerance level, may consider to invest in bank stocks (eg. getting 1% interest from cash deposit in OCBC vs over 4% dividend in OCBC stock), risk as stock investors could be lower (especially for lower price-to-book ratio stock) than cash depositor ($75k compensation if a Singapore bank go bankrupt).

“Wait” is an important action but window of opportunity may be widely opened while market is still chaotic or full with negative comments. It is easy to say “Be greedy when others are fearful” but it is possible to Buy Low get Lower as it is almost impossible to buy at the lowest point (similarly to sell at the highest point).

So, probability investing (eg. LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) is a solution, taking action (from Wait to Buy) when signal has appeared for own personality. As of now, mini bear (over 20% correction in indices) is confirmed but big bear (over 50% price correction) is still uncertain.

Waiting is meaningful only if an investor or trader could take action at certain point of time to buy stock again (eg. a portfolio of 10-20 giant stocks with strong businesses and recovery in share prices).

5) Shorting

“Shorting” is a higher probability of action in a bearish stock market with over 90% stocks correcting to lower prices, profiting from lower prices. However, it is more suitable for shorter trading and S.E.T. (Stop Loss / Entry / Target Prices) plan is required for trading because shorting could have infinite loss when a trader short sell a stock with rising price (sky is the limit for upward potential, eg. Tesla or iFAST have over 10X in share prices over the past few years).

Shorting may be conducted with CFD (Contract for Difference) platform but only selected stocks are available (many weak fundamental stocks may not be available in CFD). CFD may not be suitable for beginners, especially those who don’t have a trading plan. Alternatively, an investor may considered inversed ETF (higher prices or more profits when actual index is falling) which could be traded under most stock exchanges.

Shorting is mainly reversed strategy (aiming for lower prices) of usual long strategy (aiming for higher prices), riding the bearish share prices, breaking each critical support to start the shorting. It may be against the personalities of some investors, therefore it is possible to “Wait”, no need to “Short” during a bear market.

=====================================

While 5 black swans above could be uncertain in nature (therefore it is called “black” swan) but they are actually secondary factors. The primary factors of stock market prices up and down are actually Greed and Fear, which could be reflected under LOFTP (Level / Optimism / Fundamental / Technical / Personal). Despite we could not have a crystal ball to see the future stock market, probability investing aligning to own personality would enhance the winning chances.

===================================

There are over 2000 giant stocks in the world based on Dr Tee criteria, choice of 10 Dream Team giant stocks have to align with one’s unique personality, eg. for shorter term trading (eg. momentum or swing trading) or longer term investing (cyclic investing, undervalue investing or growth investing). Readers should not just “copy and paste” any stock (What to Buy, When to Buy/Sell) as successful action taking requires deeper consideration (LOFTP strategies – Level / Optimism / Fundamental / Technical / Personal Analysis) which you could learn further from Dr Tee Free 4-hr Webinar.

Drop by Dr Tee free 4hr webinar (learning at comfort of home with Zoom) to learn how to position in global giant stocks during COVID-19 stock crisis with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Zoom will be started 30 min before event, bonus talk (Q&A on any investment topics from readers) for early birds. There are many topics we will cover in this 4hr webinar, Dr Tee can have more time for Q&A if you could stay later after the webinar, you could ask on any global and local stocks including but not limited to 30 STI component stocks:

Ascendas Reit (SGX: A17U), CapitaLand (SGX: C31), CapitaLand Integrated Commercial Trust (SGX: C38U), City Development (SGX: C09), ComfortDelGro (SGX: C52), Dairy Farm International (SGX: D01), DBS Bank (SGX: D05), Frasers Logistics & Commercial Trust (SGX: BUOU), Genting Singapore (SGX: G13), Hongkong Land (SGX: H78), Jardine Cycle & Carriage (SGX: C07), Jardine Matheson Holdings JMH (SGX: J36), Keppel Corp (SGX: BN4), Keppel DC Reit (SGX: AJBU), Mapletree Commercial Trust (SGX: N2IU), Mapletree Industrial Trust (SGX: ME8U), Mapletree Logistics Trust (SGX: M44U), OCBC Bank (SGX: O39), SATS (SGX: S58), Sembcorp Industries (SGX: U96), Singapore Airlines (SGX: C6L), Singapore Exchange (SGX: S68), Singtel (SGX: Z74), ST Engineering (SGX: S63), Thai Beverage (SGX: Y92), UOB Bank (SGX: U11), UOL (SGX: U14), Venture Corporation (SGX: V03), Wilmar International (SGX: F34), YZJ Shipbldg SGD (SGX: BS6).

Dr Tee will cover over 20 case studies, Singapore giant stocks, eg. CapitaLand Integrated Commercial Trust (SGX: C38U), Singapore Exchange (SGX: S68), Keppel Corp (SGX: BN4), Top Glove (SGX: BVA), Jardine Matheson Holdings JMH (SGX: J36), Vicom (SGX: WJP) and many others, Malaysia giant stocks, Hong Kong giant stocks and US giant stocks, both long term investing and short term trading.

There are limited tickets left for this 4hr free webinar, please ensure 100% you could join when register: www.ein55.com

View quick preview video below, Dr Tee will introduce 10 key stock investment strategies (股票投资十招) to be learned in 4hr free stock webinar:

Register Here (Dr Tee Free 4hr Stock Webinar): www.ein55.com