ARA Asset Management (SGX: D1R) is one of the Top-20 giant stocks in Singapore, based on Optimism Strategies with consideration of FA (Fundamental Analysis), TA (Technical Analysis) and PA (Personal Analysis). Let’s learn how to grab the next opportunities following similar approach, taking action ahead of the potential big bunds.

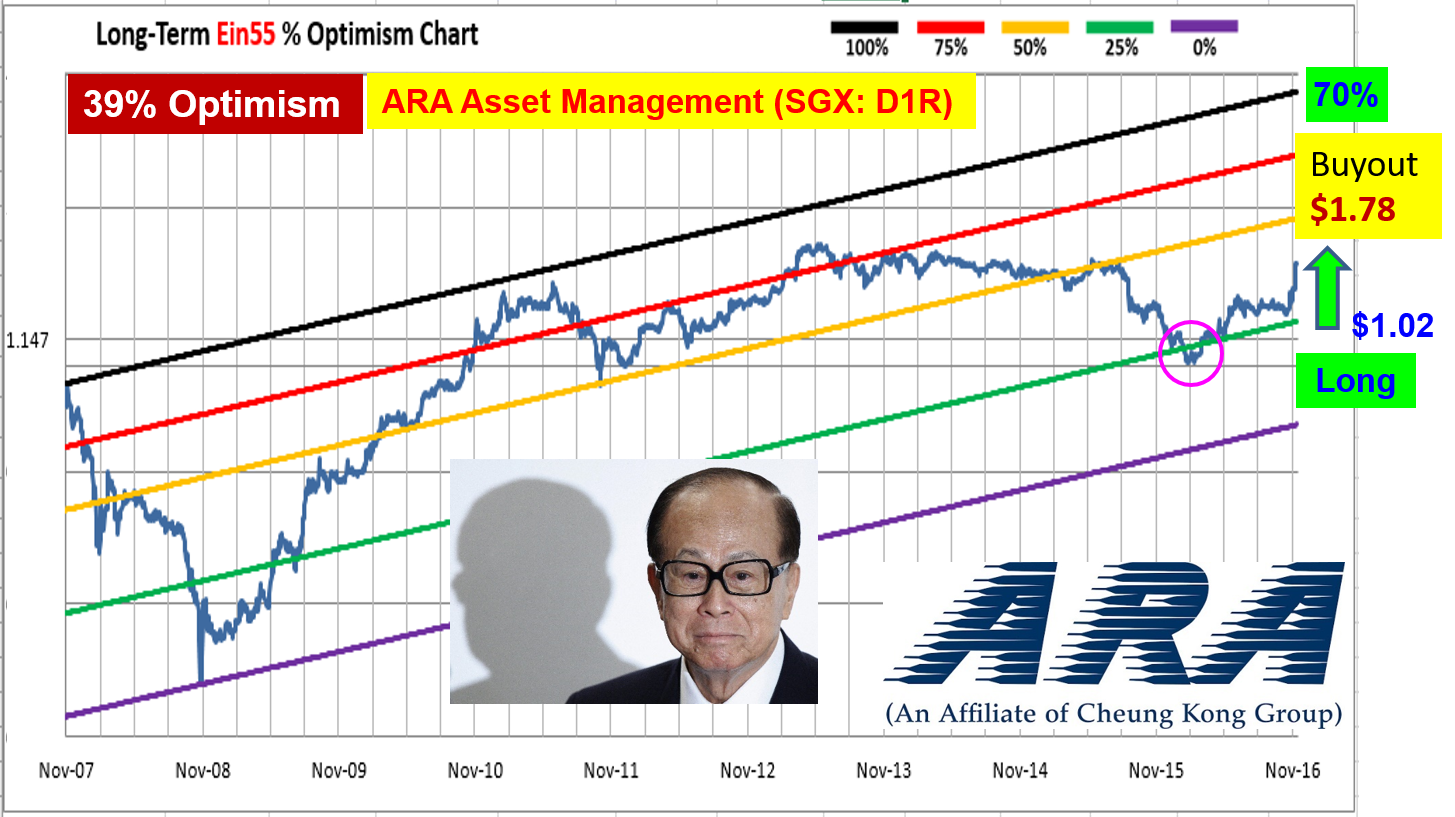

ARA is a REIT manager with consistent earning, major shareholders are John Lim (CEO), Cheung Kong (Li Ka-Shing) and Straits Trading. Due to the weak property market outlook, the stock price has been declining in the past 3 years from high optimism (over 75%) to low optimism (below 25%), creating a rare opportunity for potential investors who could identify the hidden treasure and wait patiently for the acquisition or recovery in share price.

ARA share price was falling below $1.10, considered low optimism, suitable for investor to buy low again. There is no surprise when the major shareholders have decided to offer to acquire ARA recently as they know the true value of their own business. As a result, ARA share price is approaching offer price of $1.78/share, gain of 70% over the last 1 year.

We should learn to find the other Top 20 Giant stocks in Singapore with high value, buying at discounted price at low optimism, ahead of other potential big buyers who are also looking for these cash cows. Investment clock is very critical to profit consistently from stock market.

Most people may think Singapore stock market is stagnant but actually it is a good time for big funds to acquire good business at low price. If we can understand the mindset of big funds who are value investors, taking actions before them, then there is no surprise of the big gains in short time with the acquisition. Earlier successes by Ein55 Graduates were SMRT, Sim Lian, CM Pacific and Super Group, all are value or growth stocks acquired so far.