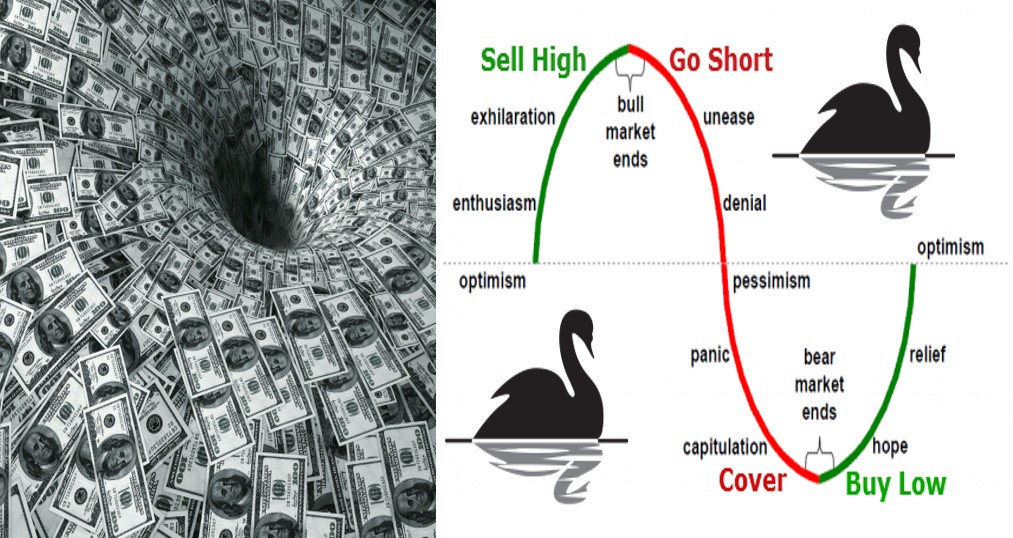

Usually before a black swan could become a black bear for stock market, there are many market signals, eg:

1) High stock market optimism > 75% at global level (fulfilled)

2) Inverted bond yield for US (partial fulfilled)

3) Strong US job data < 4% unemployment rate (fulfilled)

… many more stock market and economic indicators

The global stock market is indeed feverish but it may get excited for a period of time first before falling down. Since global stock market at country level is a giant, it would recover one day as well, therefore a no-brainer way of investing could be simply invest in stocks of major economy (eg. US S&P500 ETF, Hong Kong HSI ETF, Singapore STI ETF, etc), buy low & hold long term.

A black swan is a market surprise, therefore not predictable. However, if we guess each month for 10-20 years based on everyday global financial news, one of them could turn into a black swan or global financial crisis eventually.

Therefore, a more practical way could be to allocate our funds based on market optimism. When optimism is higher, we could gradually take more profit, converting stocks into cash. At the same time, position more with shorter term trading with lower risk (assuming no leveraging), one could react faster when a true black swan is here.

We should view the economic cycle positively as it provides an opportunity for smart investors to buy low sell high with cyclic trading.

At the same time, there are defensive growth stocks which are not affected much by global financial crisis, suitable for buy low & hold with growth investing until the business growth is not sustainable, can be as long as lifetime as some businesses could transform and continue to grow.

In shorter term timeframe, traders could also apply swing trading (cyclic trading to buy low sell high within weeks or months) or momentum trading (buy & hold for a period of time until the momentum is over)

Ein55 graduates have learned various types of cyclic vs growth/momentum stocks for long term investing vs short term trading. Use the unique market condition to create various opportunities for us, aligning to own unique personalities.

For general public, you could learn the 5 pillars of Ein55 investing/trading: LO-FTP (Levels 1-4, Optimism, FA, TA, PA) through free 4hr stock investment course by Dr Tee. You will learn how to Buy Low Sell High, as well as Buy Low & Hold. Register Here: www.ein55.com